- Get in touch with GoHealth

- Apply for Medicare in FL online with Social Security Administration

- Apply for Medicare in Florida over the phone by calling Social Security at 1-800-772-1213 (TTY: 1-800-325-0778)

- Find a local Social Security office and apply in person

What are the requirements for Medicare in Florida?

Medicare Eligibility in Florida : Know Your Options If you’re 65 and already receiving Social Security benefits, you’ll be automatically enrolled in what’s known as “Original Medicare.” It’s divided into two parts: Part A, which covers hospital stays; and Part B, which covers doctor visits and outpatient services.

What are the Florida Medicaid plans?

- Hearing services and vision services

- Flu vaccine, shingles vaccine, pneumonia vaccine

- Over-the-counter medication and supplies

- Home health care and primary care visits for non-pregnant adults

- Outpatient hospital services and physician home visits

- Medically related food and lodging and meals after you’ve been discharged from the hospital

- Waived copayments

How do I enroll in Medicare?

How do I enroll in Medicare? You apply for Medicare with the Social Security Administration. Contact the Social Security Administration in the way that is most convenient for you. Call Social Security at a toll-free number (800) 772-1213 to schedule an appointment with your local Social Security office - in person or over phone.

What is Medicare Advantage in Florida?

The Pros and Cons of Florida Medicare Advantage Plans vs Original Medicare

- Doctor Choice:

- Medicare Advantage: Must use healthcare providers within the plan's network.

- Original Medicare: Use any Medicare-approved provider you choose.

- Copays, Coinsurance Coinsurance is a percentage of the total you are required to pay for a medical service. ...

When can I apply for Medicare in Florida?

65 or olderMedicare is health insurance for people 65 or older. You're first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease (ESRD), or ALS (also called Lou Gehrig's disease).

What do I need in order to apply for Medicare?

What documents do I need to enroll in Medicare?your Social Security number.your date and place of birth.your citizenship status.the name and Social Security number of your current spouse and any former spouses.the date and place of any marriages or divorces you've had.More items...

Who is eligible for Medicare in the state of Florida?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

What is the income limit for Medicare in Florida?

Income limits: The income limit is $2,349 a month if single and $4,698 a month if married (and both spouses are applying).

How long does it take to be approved for Medicare?

between 30-60 daysMedicare applications generally take between 30-60 days to obtain approval.

Can you enroll in Medicare online?

You can apply online (at Social Security) - select “Already Enrolled in Medicare” from the menu. Or, fax or mail your forms to your local Social Security office.

Is Medicare free in Florida?

How Much Does Medicare Cost in Florida? The cost of Original Medicare in Florida will be the same as the rest of the nation. With qualifying work history, most people are eligible for premium-free Part A coverage. Part B premiums for most people are $148.50 in 2021, but those with higher incomes will pay more.

Does everyone automatically get Medicare at 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What is the Medicare in Florida called?

Simply Healthcare Plans, Inc. is a Medicare-contracted coordinated care plan that has a Medicaid contract with the State of Florida Agency for Health Care Administration to provide benefits or arrange for benefits to be provided to enrollees.

How much money can you have in the bank if your on Medicare?

4. How to Qualify. To find out if you qualify for one of Medi-Cal's programs, look at your countable asset levels. As of July 1, 2022, you may have up to $130,000 in assets as an individual, up to $195,000 in assets as a couple, and an additional $65,000 for each family member.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

Can you be denied Medicare?

In all but four states, insurance companies can deny private Medigap insurance policies to seniors after their initial enrollment in Medicare because of a pre-existing medical condition, such as diabetes or heart disease, except under limited, qualifying circumstances, a Kaiser Family Foundation analysis finds.

Who Is Eligible for Medicare?

You are age 65 or older and a U.S. citizen or a permanent U.S. resident who has lived in the U.S. continuously for five years prior to applying.

When Can You Enroll in Medicare?

There are multiple opportunities to enroll in Medicare. There are certain rules around applying, when your coverage will begin and what types of Medicare plans you can sign up for, so make sure you understand your options.

Initial Enrollment Period (IEP)

Your first opportunity to sign up for Medicare is called the Initial Enrollment Period (IEP). Your IEP starts the three months before the month you turn 65, the month you turn 65 and lasts for the three months after you turn 65.

Annual Enrollment Period (AEP)

Every year, from October 15 through December 7, you can switch, drop or join the Medicare Advantage, Medicare Supplement or Medicare Prescription Drug Plan of your choosing. This period is referred to as the Annual Enrollment Period (AEP). During AEP, you can also enroll in Original Medicare.

Open Enrollment Period (OEP)

If you are enrolled in a Medicare Advantage (MA) plan, you are allowed to make a one-time change to another MA plan or to Original Medicare during the Open Enrollment Period. The OEP runs from January 1 through March 31. If you enroll in Original Medicare, you may also purchase a Medicare Supplement and/or a Prescription Drug Plan.

Key Takeaways

Medicare in Florida is not free, but you may have options to help with costs like copays A copayment is the fixed amount you pay directly to your provider for medical services or prescription drugs covered in your plan.

Is there Medicare in Florida?

Medicare in Florida is available to all legal U.S. citizens ages 65 and older. Some younger adults living with disabilities, ESRD, or Lou Gehrig’s disease may be eligible for Medicare before 65. Medicare Advantage plans are available in Florida but vary by carrier and location.

Is Medicare free in Florida?

If you’re age 65 and have contributed Medicare and Social Security payroll taxes for at least 10 years, your Part A plan has a no-cost premium. All Medicare Part B plans require the beneficiaries to pay a monthly premium.

How do I apply for Medicare in Florida?

You can apply for Medicare in Florida online, by phone, or in person at a Social Security office. A GoHealth licensed insurance agent can help you compare Medicare Advantage plans and enroll in FL.

What are the best Medicare Advantage plans in Florida?

To find the best Medicare Advantage plan in FL, consider your health needs and find a plan that meets your needs. You may begin by researching five star rated Medicare Advantage plans, but a five star rating is not a guarantee that the plan is the best for your needs. Comparing benefits can be tricky, so can finding the “best” plan.

Medicare in FL by the numbers

Thousands of older adults enroll in Medicare every day across the United States. The latest CMS data shows that 4,257,270 people are enrolled in Medicare in Florida. The total number of beneficiaries enrolled in Medicare Advantage in Florida is 2,056,734. The previous year, 1,922,951 enrolled in Medicare Advantage.

Florida Medicare Resources & Contacts

Beneficiaries spend an average of $11,562.29 each year on Medicare in Florida. To be certain you are not leaving anything on the table, let us help. A GoHealth licensed insurance agent can assess your coverage or explain which Florida-based resources, like these, may be able to help:

How much Medicare does Florida pay?

In general, you can expect to pay up to $471 per month for Part A coverage and around $149 per month for Part B. As an alternative to Original Medicare, Florida has 67 Medicare Advantage Plans ...

How many Medicare Advantage Plans are there in Florida?

As an alternative to Original Medicare, Florida has 67 Medicare Advantage Plans if you're seeking more robust coverage. Read on to learn more about the different types of Medicare plans in Florida and the state agencies and organizations that can help you evaluate and plan for your health care needs. Jump to section:

How to save money on Medicare Supplement?

Many with Original Medicare save money by adding a Medicare Supplement Insurance policy . Opting for a plan that includes prescription drug coverage or adding this coverage to your policy may help you save money over time.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also called Medigap, covers some of your cost-sharing responsibilities to reduce your overall expenses. These policies are provided by private health insurance companies and have monthly premiums that you pay in addition to your Medicare premium.

What is the Florida Senior Legal Helpline?

The firm also operates the Florida Senior Legal Helpline, which is available to seniors throughout the state and answers Medicare questions. The helpline is operational on weekdays from 9 a.m. to 4:30 p.m. and is reached at 888-895-7873. Contact Information: Website | 800-625-2257.

What can a counselor do for Medicare?

They can help you organize and settle medical bills , spot billing errors, dispute denied claims, and understand your Original Medicare benefits . Counselors can also help you identify the available Medicare Advantage Plans in your region and compare their prices and coverage options.

What is original Medicare?

Original Medicare is managed by the federal government and available to those aged 65 and over or who have certain disabilities. With this plan, you get a great deal of flexibility regarding health care services. You can go to any health care provider, hospital, or facility in the nation that’s registered with Medicare. You don’t need to choose a primary care doctor, and in most cases, you can schedule an appointment to see a specialist without a referral. Original Medicare is made up of two parts: Part A, which covers hospital bills, and Part B, which covers medical expenses such as doctors’ services, medical supplies, and preventative care.

What is Medicaid application in Florida?

The Medicaid application and associated paperwork helps officials determine who is eligible for Medicaid coverage. Prospective applicants wondering where to apply for Medicaid in FL may be surprised about the methods and locations available for signing up for government assistance.

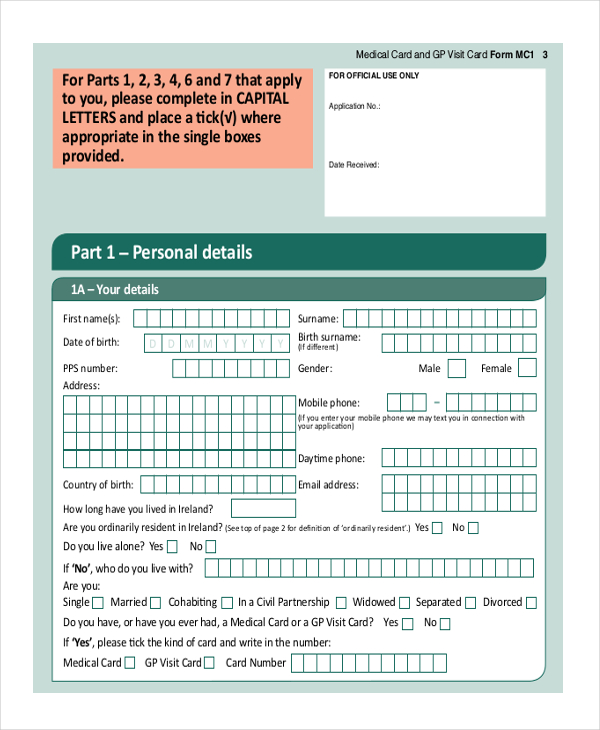

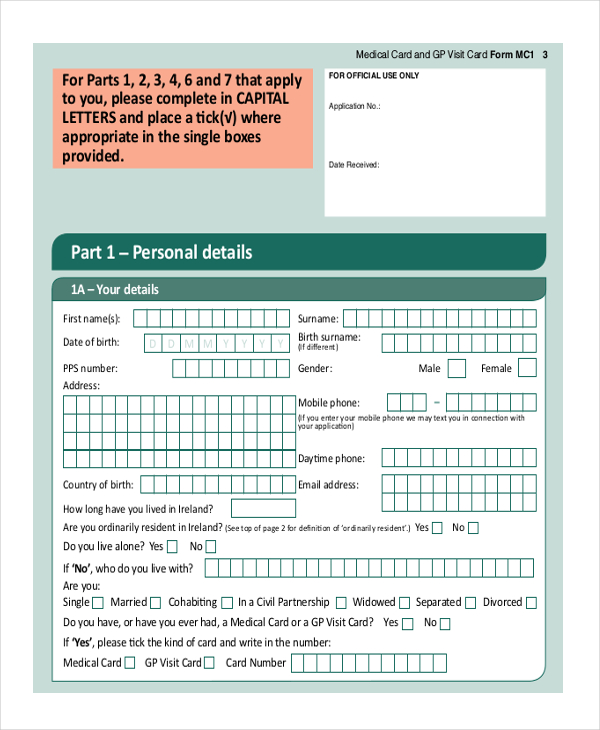

How to prove financial eligibility for medicaid in Florida?

To prove financial eligibility to enroll in Medicaid, applicant’s income will need to be verified with items like a W-2 form or paystubs. The Florida Medicaid application form requires you to give a lot of details about yourself and your family. Regardless of how and where you apply to Medicaid, you will need to provide the following information: ...

How often do you have to reapply for medicaid?

Recipients will have to reapply for Medicaid every 12 months or another predetermined time period. To sign up for Medicaid online, petitioners must create an online account. This account allows you to apply for Medicaid benefits and to check your eligibility for the program. A paper Medicaid application form is available for applicants who prefer ...

What happens if you are denied Medicaid in Florida?

If you are denied Medicaid enrollment, you have the right to file an appeal with the Florida Medicaid program, which will require program officials to review your application. The appeal process does not promise acceptance into the program, but does give you a second opportunity to be enrolled.

What information is needed for Florida Medicaid?

Your income and employer’s information. Your existing health coverage or any health coverage available through your employer. If you are married or have children, the Florida Medicaid form will need similar information about your spouse or dependents.

Do you have to list your parents on Medicaid?

Likewise, adults older than 21 years of age will also not have to list any adult relatives including their parents on their Medicaid form if they are filing taxes separately. However, family members filing taxes with the applicant will need to be listed on the form.

Do you have to include your spouse's health information when applying for medicaid in Florida?

However, unmarried partners who sign up for Florida Medicaid will not have to include details about the other if he or she does not want health care.

How to contact Medicare in Florida?

Free volunteer Medicare counseling is available by contacting the Florida SHINE at 1-800-963-5337. This is a State Health Insurance Assistance Program (SHIP) offered in conjunction with the State Department of Elder Affairs.

How long does it take to recover Medicaid in Florida?

There is a 5-year lookback period for asset transfers in Florida. Florida has chosen to pursue estate recovery for all Medicaid costs received starting at age 55. The state where you reside has a significant impact on the care you receive and how much you pay as a Medicare beneficiary.

How much can a spouse keep on Medicaid in Florida?

If only one spouse needs Medicaid, the other spouse can keep up to $128,640. In Florida, the asset limit for nursing home enrollees increases – to $5,000 if single and $6,000 if married – if an applicant’s income is below $961 a month if single and $1,261 a month if married, meaning they also qualify for Medicaid ABD.

What is Medicare Savings Program in Florida?

A Medicare Savings Program (MSP) can help Florida Medicare beneficiaries who struggle to afford the cost of Medicare coverage. The MSPs help some Floridians pay for Medicare Part B premiums, Medicare Part A and B cost-sharing, and – in some cases – Part A premiums. Qualified Medicare Beneficiary ...

What is Medicaid ABD in Florida?

This program is called Medicaid for the Aged and Disabled (MEDS-AD) in Florida. In Florida, Medicaid ABD covers dental services in emergencies.

What is estate recovery in Florida?

Medicaid agencies must have estate recovery programs that try to recoup Medicaid’s payments for long-term care related benefits received starting at age 55. States have the option to also recover the cost of all Medicaid benefits. This is called estate recovery.

Does Medicaid cover dental insurance in Florida?

In Florida, Medicaid ABD covers dental services in emergencies. According to this website, Medicaid may also cover non-emergency dental benefits for some enrollees. Medicaid ABD also covers eyeglasses (one pair of lenses every 12 months, and frames every 24 months), contact lenses, eyeglasses repairs, and will pay for prosthetic eyes.

How to become a Medicare provider?

Become a Medicare Provider or Supplier 1 You’re a DMEPOS supplier. DMEPOS suppliers should follow the instructions on the Enroll as a DMEPOS Supplier page. 2 You’re an institutional provider. If you’re enrolling a hospital, critical care facility, skilled nursing facility, home health agency, hospice, or other similar institution, you should use the Medicare Enrollment Guide for Institutional Providers.

How long does it take to change your Medicare billing?

To avoid having your Medicare billing privileges revoked, be sure to report the following changes within 30 days: a change in ownership. an adverse legal action. a change in practice location. You must report all other changes within 90 days. If you applied online, you can keep your information up to date in PECOS.

How to get an NPI?

If you already have an NPI, skip this step and proceed to Step 2. NPIs are issued through the National Plan & Provider Enumeration System (NPPES). You can apply for an NPI on the NPPES website.

Can you bill Medicare for your services?

You’re a health care provider who wants to bill Medicare for your services and also have the ability to order and certify. You don’t want to bill Medicare for your services, but you do want enroll in Medicare solely to order and certify.

What age can you get Medicaid in Florida?

Qualified hospitals (QH) may make presumptive eligibility determinations for: pregnant women, infants and children under age 19, parents and other caretaker relatives of children, and individuals under age 26 receiving Medicaid when they aged out of Florida foster care.

Can you be eligible for full medicaid?

Individuals who are not eligible for "full" Medicaid because their income or assets are over the Medicaid program limits may qualify for the Medically Needy program. Individuals enrolled in Medically Needy must have a certain amount of medical bills each month before Medicaid can be approved.