Other Ways to Apply You can call us at 1-800-772-1213 (TTY 1-800-325-0778) to apply over the phone. You can also request a paper application, or you can schedule an appointment to apply at your local Social Security office.

Full Answer

How do I apply for the Medicare low-income subsidy?

To apply for the Medicare low-income subsidy, simply fill out an Application for Extra Help with Medicare Prescription Drug Plan Costs form with Social Security. You can apply and submit this form by: Applying online at www.socialsecurity.gov/extrahelp. Applying in person at your local Social Security office.

What is Medicare Part D Extra Help and deemed subsidy eligible?

A. Extra Help and deemed subsidy eligibles. The Medicare Part D Extra Help program helps Medicare beneficiaries with limited income and resources pay for prescription drug coverage. Eligible beneficiaries receive subsidized premiums, deductibles, and copayments.

What is the low-income subsidy program?

The Low-Income Subsidy Program is a federal health care program. Its administered by the Social Security Administration for Medicare consumers with limited income. The program helps Medicare beneficiaries with Medicare Part D costs.

Does Medicare Part D cover prescription drug subsidies?

The Medicare Part D program assumes responsibility for prescription drug coverage for full Medicaid recipients with Medicare. Certain beneficiaries are automatically deemed subsidy-eligible and should not complete an application for Extra Help.

How does Medicare Part D Extra Help work?

Extra Help is a program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. If you qualify for Extra Help, you won't pay a late enrollment penalty when you join a Medicare drug plan.

Is Medicare Part D subsidized?

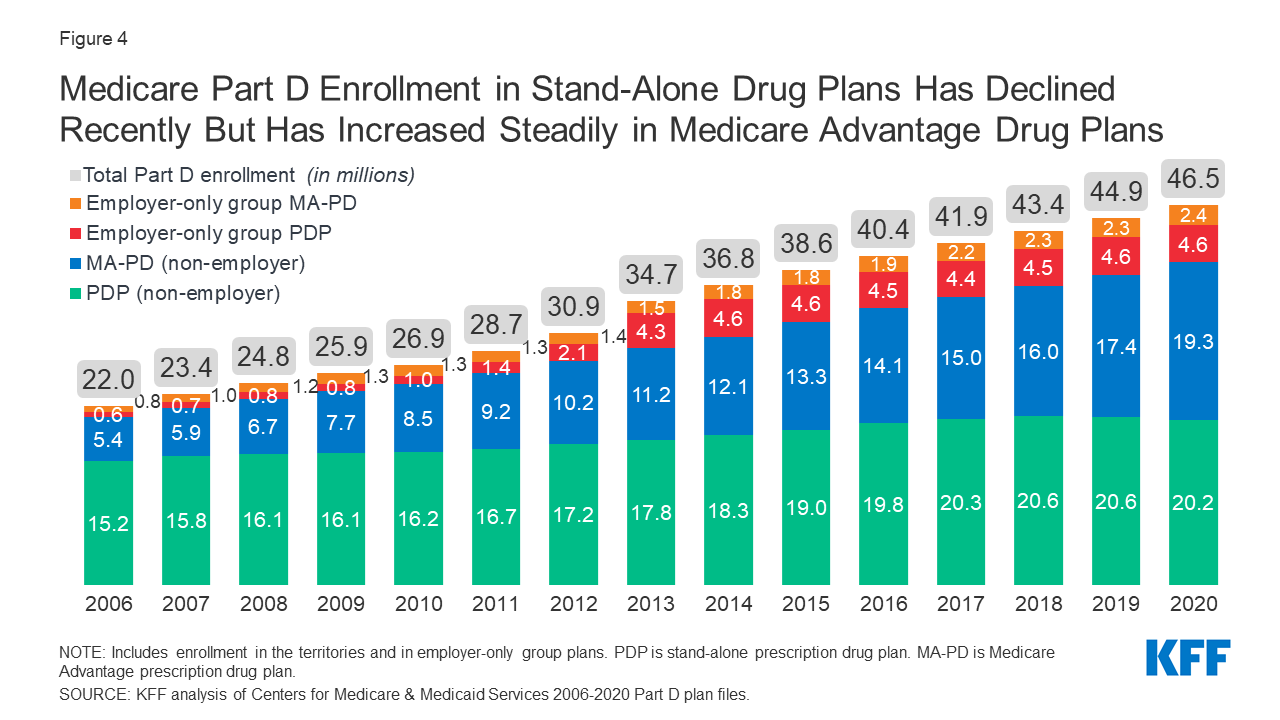

Part D Financing Medicare subsidizes the remaining 74.5%, based on bids submitted by plans for their expected benefit payments. Higher-income Part D enrollees pay a larger share of standard Part D costs, ranging from 35% to 85%, depending on income.

Does everyone have to pay for Medicare Part D?

You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums. If you don't pay the Part D IRMAA and get disenrolled, you may also lose your retirement coverage and you may not be able to get it back.

What is the lowest income to qualify for Medicare?

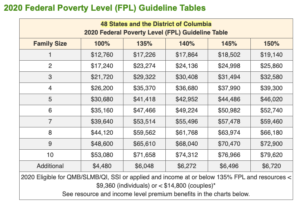

Qualifying Individual (QDWI) program an individual monthly income of $4,379 or less. an individual resources limit of $4,000. a married couple monthly income of $5,892 or less.

What is the income limit for extra help in 2021?

To qualify for Extra Help, your annual income must be limited to $20,385 for an individual or $27,465 for a married couple living together.

What is the maximum out of pocket for Medicare Part D?

Medicare Part D, the outpatient prescription drug benefit for Medicare beneficiaries, provides coverage above a catastrophic threshold for high out-of-pocket drug costs, but there is no cap on total out-of-pocket drug costs that beneficiaries pay each year.

What is the cost for Medicare Part D for 2021?

The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

Who has the cheapest Part D drug plan?

Recommended for those who Although costs vary by ZIP Code, the average nationwide monthly premium for the SmartRx plan is only $7.08, making it the most affordable Medicare Part D plan this carrier offers.

How much money can you have in the bank if your on Medicare?

4. How to Qualify. To find out if you qualify for one of Medi-Cal's programs, look at your countable asset levels. As of July 1, 2022, you may have up to $130,000 in assets as an individual, up to $195,000 in assets as a couple, and an additional $65,000 for each family member.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

Key Takeaways

Medicare’s Part D Low Income Subsidy (also called LIS/Extra Help) helps cover the Part D prescription drug plan costs.

What does Full Help cover?

Full Help covers those with lower incomes/fewer resources. Both the deductible and the plan premium for Part D are waived; for the premium to be waived, enrollment in a “benchmark” plan is required (meaning the plan is below the LIS premium amount).

What does Partial Help cover?

Partial Help covers those with slightly higher incomes/resources. The premium is either waived or an incomed-based sliding scale is used to determine benefits.

Expert Help to Understand Medicare Plan Options

Did you know that Medicare isn’t free, which means you need to consider plan coverage and prices before you enroll? Or that if you don’t enroll on time during your initial enrollment period, you could face a penalty? Navigating your Medicare selection needs and priorities may feel overwhelming.

What do you need to qualify for Medicare Extra Help?

To qualify for the Medicare Extra Help Program, you also need to have limited financial resources. Resources include the value of the things you own, such as real estate (excluding your primary residence), bank accounts, investments, Individual Retirement Accounts (IRAs) and cash.

What is the maximum amount of money you can get with Medicare in 2021?

In 2021, the income limits for Extra Help with Medicare are: $19,320 for individuals. $26,130 for married couples living together. If your income is above these thresholds, you may still qualify for some extra help. For instance, if you or your spouse support other family members who live with you, you may qualify even with a higher annual income.

What is Medicare Extra Help?

The Medicare Extra Help Program, also called the Part D Low-Income Subsidy, helps Medicare beneficiaries with low income and resources pay for the cost of their prescription drugs and prescription drug coverage. To qualify for Extra Help, you must be on Medicare and living in the U.S. with income and financial resources below a certain annual ...

How much is the Extra Help 2021?

When you receive Extra Help, your drug plan ensures you never pay more than the Low Income Subsidy coverage cost limit. In 2021, this is no more than $3.70 for each generic or $9.20 for each brand-name covered drug, Saks says.

What do not count as income for extra help?

The following payments do not count as income when determining the income limits for Extra Help: Scholarships and education grants. Supplemental Nutrition Assistance Program benefits, also known as food stamps. Housing assistance.

Do you have to provide proof of income to SSA?

If you receive rental income, pensions, income from an annuity or alimony payments, these must be provided as well. While the SSA doesn’t require you to give proof corroborating the information you provide on the application, it will compare your answers with data from other government agencies.

Can I get help with my 2021 income?

Likewise, if you have earnings from work or live in Alaska or Hawaii, you might be able to receive help with income above the 2021 limits.

Can you get extra help if your income is over the limit?

Even if your income or assets are above the eligibility limits, you could still qualify for Extra Help because certain types of income and assets may not be counted, in addition to the $20 mentioned above.

Can you get extra help with Part D if you have a late enrollment?

You should use Fall Open Enrollment during this time to make prescription drug coverage changes.) Eliminates any Part D late enrollment penalty you may have incurred if you delayed Part D enrollment. Depending on your income and assets, you may qualify for either full or partial Extra Help.

Is Extra Help a replacement for Medicare?

Remember that Extra Help is not a replacement for Part D or a plan on its own: You must still have a Part D plan to receive Medicare prescription drug coverage and Extra Help assistance. If you do not choose a plan, you will in most cases be automatically enrolled in one.

Can you get extra help if you have SSI?

If you are enrolled in Medicaid, Supplemental Security Income (SSI), or a Medicare Savings Program (MSP), you automatically qualify for Extra Help regardless of whether you meet Extra Help’s eligibility requirements.

What is Medicare Part D?

The Medicare Part D program assume s responsibility for prescription drug coverage for full Medicaid recipients with Medicare. Certain beneficiaries are automatically deemed subsidy-eligible and should not complete an application for Extra Help. These beneficiaries have Medicare Parts A or B, or both, and are:

What is a QMB in Medicare?

These beneficiaries have Medicare Parts A or B, or both, and are: covered under one of the Medicare Savings Programs as a Qualified Medicare Beneficiary (QMB), Specified Low-Income Medicare Beneficiary (SLMB), or Qualified Individual (QI).

Can a subsidy determination be effective before Medicare?

A subsidy determination cannot be effective before Medicare entitlement begins or before enrollment with a PDP/MA-PD becomes effective. SSA periodically redetermines eligibility for Extra Help beneficiaries to determine continued eligibility for a full or partial subsidy.

4 kinds of Medicare Savings Programs

Select a program name below for details about each Medicare Savings Program. If you have income from working, you still may qualify for these 4 programs even if your income is higher than the income limits listed for each program.

How do I apply for Medicare Savings Programs?

If you answer yes to these 3 questions, call your State Medicaid Program to see if you qualify for a Medicare Savings Program in your state:.

What to do if you disagree with Medicare decision?

If you disagree with the decision we made about your eligibility for Extra Help, complete an Appeal of Determination for Extra Help with Medicare Prescription Drug Plan Costs. We also provide Instructions for Completing the Appeal.

Can you get help with Medicare?

With the Medicare Savings Programs (MSP), you can get help, from your state, paying your Medicare premiums. In some cases, MSPs may also pay Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) deductibles, coinsurance, and copayments if you meet certain conditions. If you qualify for certain MSPs, you automatically qualify ...

Can Medicare beneficiaries get extra help?

Table of Contents. Medicare beneficiaries can qualify for Extra Help paying for their monthly premiums, annual deductibles, and co-payments related to Medicare Part D (prescription drug coverage).