How to Avoid Medicare’s IRMAA Premium Surcharge

- Medicare increases monthly premiums for Part B and Part D coverage if your income is higher than certain limits.

- To avoid these surcharges, you’ll need to reduce your modified adjusted gross income.

- Talk with a CPA or financial adviser to determine which income-lowering strategy is best for your situation.

How can I avoid getting an irmaa?

Mar 10, 2022 · This surcharge impacts those who earn too much income and how to avoid IRMAA is very simply. How to avoid IRMAA: The easiest answer to avoid IRMAA is to just not generate the wrong type of income while in Medicare. Granted, this may be easier said than done, especially for those who heed financial advice, but it can be done.

How to avoid the Medicare irmaa surcharge?

Jan 29, 2022 · If you are not eligible for an appeal, consider analyzing your retirement plan and withdrawal strategy to see if you can limit your income. For example, you can withdrawal money from Roth or taxable brokerage accounts during the year instead of IRAs. This will help reduce income that counts towards the IRMAA limit.

What is a Medicare irmaa?

Dec 21, 2021 · To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213). Even if you are married, file jointly, and only had one …

How does Medicare’s income-related monthly adjustment amount (irmaa) affect you?

Jan 01, 2021 · To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213). Even if you are married, file jointly, and only had one …

What income level triggers Irmaa?

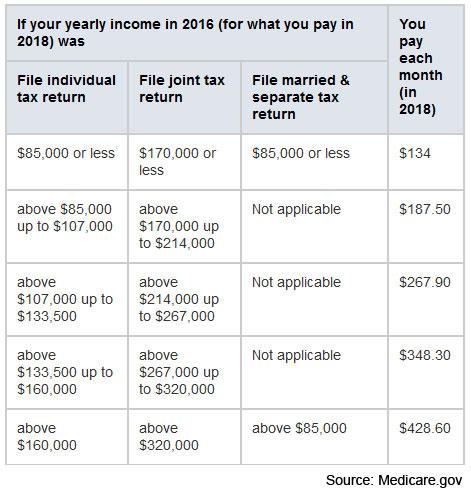

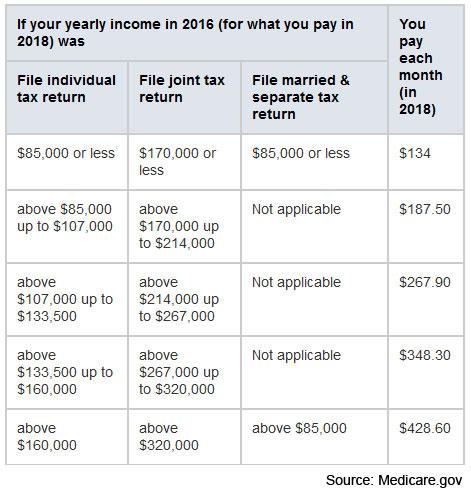

Most people pay the standard Part B premium amount. The 2022 Medicare IRMAA surcharge kicks in when modified adjusted gross income exceeds $91,000 for single taxpayers or $182,000 for married couples filing jointly.

How do I stop paying Irmaa?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).Dec 21, 2021

Does everyone pay Irmaa?

Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

Is Irmaa calculated every year?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually.

How do I lower my Magi?

You can reduce your MAGI by earning less money, but a lot of people prefer to look for deductions instead. Consider the available deductions on your tax return that are above the line that shows your AGI (this used to be Line 37 on the regular 1040; it's now Line 11).

Does Roth conversion affect Irmaa?

If your income is on the threshold of qualifying for IRMAA treatment, a Roth Conversion could force you to start paying premiums as a percentage of your higher income. There is a two-year look-back that determines IRMAA. So, even if you perform a Roth Conversion in 2019, you may not see the impact until 2021.

Is Irmaa based on AGI or magi?

IRMAA charges are based on your income. The SSA calculates the IRMAA amount using your modified adjusted gross income (MAGI) according to your tax returns from 2 years ago.Dec 14, 2020

WHAT IS THE MAGI for 2021?

You can expect to pay more for your Medicare Part B premiums if your MAGI is over a certain amount of money. For 2021, the threshold for these income-related monthly adjustments will kick in for those individuals with a MAGI of $88,000 and for married couples filing jointly with a MAGI of $176,000.Oct 22, 2021

Do I have to pay Irmaa Part D if I don't have Part D Medicare?

If Social Security notifies you about paying a higher amount for your Part D coverage, you're required by law to pay the Part D-Income Related Monthly Adjustment Amount (Part D IRMAA). If you don't pay the Part D IRMAA, you'll lose your Part D coverage.

Does Social Security affect Irmaa?

Once the IRMAA calculations are done, CMS notifies the Social Security Administration (SSA) so we can make IRMAA determinations. CMS also calculates premium surcharges for late enrollment or reenrollment based on the base beneficiary premium.Dec 21, 2021

Is Social Security included in Irmaa?

Essentially, IRMAA is a way of increasing the Medicare Part B and now Part D payments drawn from your monthly Social Security checks. Currently, most individuals pay about 25 percent of their Medicare costs at a standard rate of $144.60 a month, social security paying the remaining 75 percent.Feb 12, 2020

What will Irmaa be in 2023?

2023 IRMAA Brackets (Projected)PROJECTED 2023 IRMAA BRACKETS FOR MEDICARE PART BAbove $149,000 – $178,000Above $298,000 – $356,000Standard Premium x 2.6Above $178,000 – $500,000Above $356,000 – $750,000Standard Premium x 3.2Greater than $500,000Greater than $750,000Standard Premium x 3.45 more rows•Mar 28, 2022

What is the Medicare premium for 2019?

Individuals who reported MAGIs under $85,000 and married couples filing jointly who reported MAGIs under $170,000 on their 2019 returns are paying the current Medicare part B premium of $148.50 a month. Individuals and couples reporting higher MAGIs in 2019 are currently experiencing an IRMAA surcharge on both Part B and Part D.

What is Roth conversion?

A Roth conversion, in which all or part of the balance of an existing traditional IRA is converted to a Roth IRA, is another way to avoid getting bumped into higher IRMAA brackets.

What is IRMAA in Medicare?

IRMAA is an added fee to your monthly Medicare premium that is based on your income from previous years. It is common for retirees with large IRAs or have IRAs that make up a majority of their retirement savings, those with large pensions, or those who have high expenses in a single year.

How much will Medicare pay in 2021?

For example, in 2021, if a married couple on Medicare had income of $176,000, each person will pay $148.50 per month for Medicare Part B. If they have income of $176,001, they will each pay $207.70 per month.

Can you add videos to your watch history?

Videos you watch may be added to the TV's watch history and influence TV recommendations. To avoid this, cancel and sign in to YouTube on your computer. An error occurred while retrieving sharing information. Please try again later.

What is MAGI income?

MAGI may include one-time only income, such as capital gains, the sale of property, withdrawals from an Individual Retirement Account (IRA) or conversion from a traditional IRA to a Roth IRA. One-time income will affect your Medicare premium for only one year. ….

How much is Medicare Part B in 2021?

Sadly, the public policy target ends up hurting these people anyway. In 2021, the standard Medicare Part B premium is $148.50 per month. However, if your modified adjusted gross income ( MAGI) from 2 years ago is above a certain amount, you are faced with an Income Related ...

What happens if you divorce your spouse?

You divorced, or your marriage was annulled, You became a widow or widower, You or your spouse stopped working or reduced work hours, You or your spouse lost income-producing property due to a disaster or other event beyond your control,

Who is Megan Russell?

Megan Russell has worked with Marotta Wealth Management most of her life. She loves to find ways to make the complexities of financial planning accessible to everyone. She is the author of over 700 financial articles. Her most popular post is " The Complete Guide to Your Washing Machine " while one of her favorites is " Funding a 3-Year-Old’s Roth IRA ."

What is Medicare Part D IRMAA?

Can I Avoid Medicare Part D IRMAA? Medicare Part D IRMAA stands for Income-Related Monthly Adjustment Amounts that affects higher income beneficiaries. Basically, the government is making you pay more for being successful.

Who Gets Affected by the Part D IRMAA?

After addressing the question, ‘What is Medicare Part D IRMAA?’, the next question is who gets affected or who gets to pay the Part D IRMAA.

How Do You Know if You Have Part D IRMAA?

Aside from the income bracket indicated above, policy holders who have Part D IRMAA will be notified by the Social Security Administration if they are part of this adjustment or not. This is determined every year in line with the Modified Adjusted Gross Income as indicated by your two-year income tax return report.

How Do You Pay Your Part D IRMAA?

Generally, most people have their Part D IRMAA deducted from their Social Security benefits. However, if you aren’t a recipient of Social Security benefits or the amount of your benefit is not enough to pay for Part D IRMAA, the CMS will directly bill you.

How can I avoid IRMAA?

Can I Avoid Medicare Part D IRMAA? If Medicare has your income correct then you cannot avoid IRMMA. What you CAN do is adjust your insurance plan premium to offset the extra cost you have to pay with IRMMA.