You must meet one of the following requirements to avoid the Medicare Levy Surcharge:

- your taxable income for MLS purposes is below the income threshold (see above),

- your taxable income for MLS purposes is over the income threshold and you have approved hospital insurance (see below)...

- you are normally exempt from the Medicare levy because you are a prescribed person...

Can you avoid the Medicare levy surcharge before 30 June?

Don't be fooled by marketing material advising you take out health cover before 30 June to avoid the surcharge. The way the rules work, if your income exceeds the threshold and you don't have appropriate private cover for the whole year, you'll pay the Medicare levy surcharge up to the date you took out the policy.

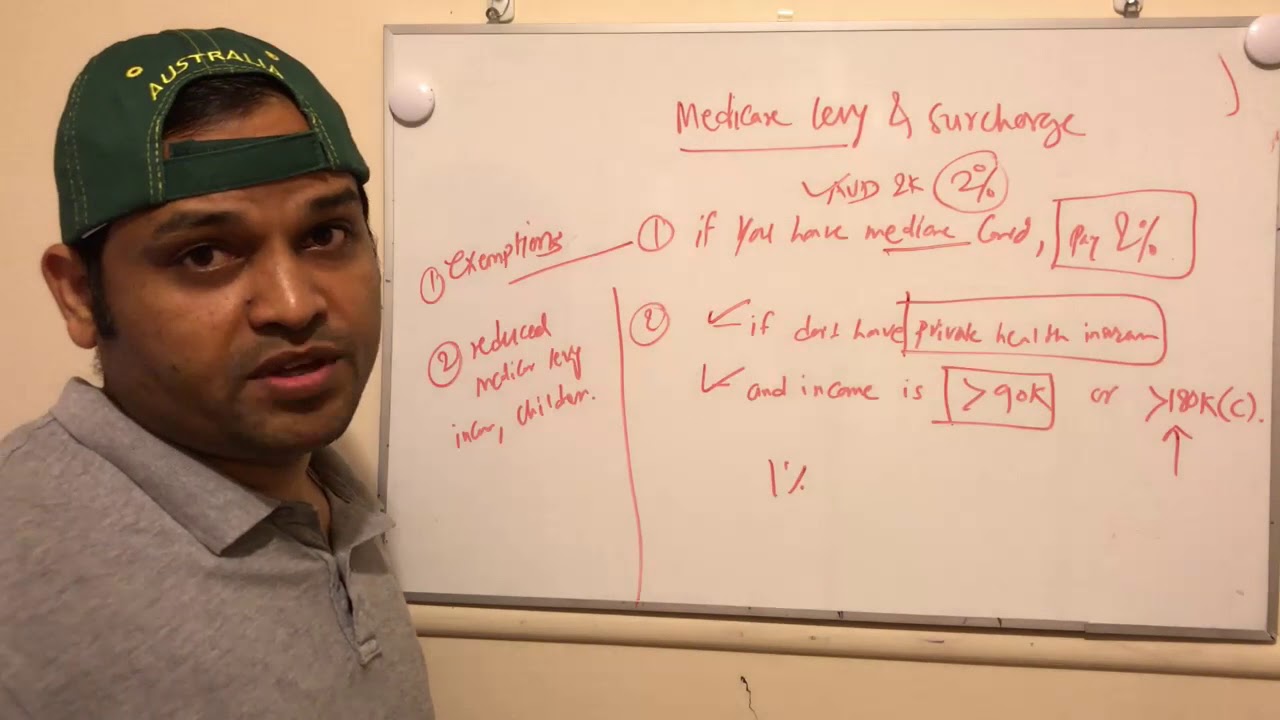

Who is affected by the Medicare levy surcharge?

If you're earning over $90,000 as a single or over $180,000 as a couple, family or single-parent family, you could be affected by the Medicare Levy Surcharge if you don't hold private hospital cover for the full financial year.

How can I avoid the hospital cover surcharge?

Any nib Hospital cover with an excess of $750 or less for singles, and $1500 or less for couples, families and single-parent families will help you avoid the surcharge. Avoid the MLS with a Hospital cover that suits you.

Do I have to pay Medicare levy?

If you have to pay Medicare levy, you may have to pay the Medicare levy surcharge (MLS) if you, your spouse and your dependent children do not have an appropriate level of private patient hospital cover and you earn above a certain income.

How do I get around the medicare levy surcharge?

How to avoid the Medicare Levy Surcharge. In order to avoid the surcharge, you must have the appropriate level of cover. For singles, that means a policy with an excess of $500 or less. For couples or families, it means an excess of $1,000 or less.

How do I avoid Medicare levy in Australia?

There are just two main ways to avoid paying the levy and they do not apply to many Australians:You're a low income earner. Some low income earners (depends on your annual income) do not have to pay the levy or receive a reduction on the levy rate.You have a Medicare Entitlement Statement.

Do I pay Medicare levy surcharge if I have private health insurance?

The Medicare levy is in addition to the tax you pay. You may have to pay the Medicare levy surcharge if you, your spouse and dependant children don't have an appropriate level of private health insurance.

Why do I pay Medicare levy when I have private health?

The surcharge aims to encourage individuals to take out private hospital cover, and where possible, to use the private system to reduce the demand on the public Medicare system. The surcharge is calculated at the rate of 1% to 1.5% of your income for Medicare Levy Surcharge purposes.

What's the difference between medicare levy and medicare levy surcharge?

Generally, the Medicare Levy (2% of your taxable income) must be paid by all Australian residents receiving free health care (Medicare), unless you...

Am I eligible for medicare levy exemption?

According to the Australia Taxation Office (ATO), some foreign residents and low-income earners generally do not have to pay the whole or part of t...

How does health insurance help to avoid medicare levy surcharge?

You can avoid paying the MLS if you purchase a hospital policy from a registered private health insurance company in Australia. For a plan to be su...

How do I avoid the Medicare levy surcharge?

To avoid paying the Medicare levy surcharge, you’ll generally need to apply for an eligible Hospital policy before the first of July. To find the r...

How does the Medicare levy surcharge work?

If you earn more than $90,000 per year and you do not have an hospital plan in place, then you’ll generally be required to pay an additional levy....

Do I have to pay Medicare levy surcharge if I have private health insurance?

No, typically if you’ve purchased and maintained an eligible Hospital policy you won’t need to pay the Medicare levy surcharge. However, if you can...

Who is exempt from paying the Medicare levy?

Generally, you’ll be exempt from paying the levy if you earn less than the average threshold limit, are a foreign resident or meet specific medical...

What happens if you suspend Medicare?

A: If you suspend your cover and are still earning above the Government's Medicare Levy Surcharge threshold, you may be hit with the surcharge for that period of time .

How much is Medicare tax if you don't have private hospital cover?

If this sounds like you, you could be up for $900 or more in extra tax if you don’t have the right level of Hospital cover!

Can you avoid surcharges on hospital cover?

A: That’s the start of the new financial year so, if you take out hospital cover part-way through a financial year, you will only avoid the surcharge for the period you held suitable hospital cover for.

How to avoid the Medicare Levy Surcharge?

If you are currently or are likely to pay the MLS, join any ING Health Insurance Hospital cover before 1 July and maintain it for the full financial year to avoid paying the MLS.

Who does the Medicare Levy Surcharge apply to?

The Medicare Levy Surcharge (MLS) is a tax applied to people who earn above $90,000 as a single and $180,000 as a single parent, couple or family and don't have an appropriate level of Hospital cover.

How much is the Medicare Levy Surcharge?

As we have stated, the amount of MLS you’ll pay is dependent on how much you earn, either on your own if you’re single, or as a family.

What happens if you are subject to Medicare levy?

If you are subject to the Medicare Levy Surcharge, everyone in your family will need coverage for you to avoid paying the levy.

What is a surcharge on health insurance?

The surcharge is payable for each day you don’t have private health insurance within a financial year. That means if you don’t purchase a policy before the start of the new financial year on 1 July, but buy one later in the year, you’ll pay a charge for each day you weren’t covered.

How much was the levy in 2014?

By 2014 the levy had doubled to 2%, with the government picking up the slack through general expenditure.

How much money do you have to make to pay MLS?

If you’re earning more than $90,000, or are in a couple with a combined income of more than $180,000, you are liable to pay the MLS if you don’t have a suitable level of private healthcare cover.

Do you have to pay for a general practitioner?

When most of us visit our General Practitioner, collect a prescription from a pharmacy, or receive specialist care, we don’t have to pay anything. This carries benefits for individuals and employers alike.

Is Medicare funding a challenge?

As with all healthcare systems, funding Medicare since its inception has proved to be a challenge. The initial Medicare levy of 1% was insufficient as demand, improved treatment, and increased life expectancy have put pressure on the system.

What is the Medicare levy surcharge?

The MLS is designed to encourage people to take out private patient hospital cover and use the private hospital system. This will reduce demand on the public Medicare system.

How much is a single person liable for MLS?

you may be liable for MLS for the number of days you were single – if your own income for MLS purposes was more than the single surcharge threshold of $90,000. you may be liable for MLS for the number of days you had a spouse or dependent children – if your own income for MLS purposes was more than the family surcharge threshold of $180,000 ...

What is the income threshold for MLS?

The base income threshold (under which you are not liable to pay the MLS) is: $90,000 for singles. $180,000 (plus $1,500 for each dependent child after the first one) for families. However, if you had a spouse for the full year, you do not have to pay the MLS if: your family income exceeds the $180,000 ...

Who is liable for MLS?

If circumstances for yourself, your spouse or your dependent children change at any time during the year, you may become liable to pay the MLS.

Can you use your spouse's income for MLS?

If you have a spouse, we will use your combined income for MLS purposes.

Can you reduce your income for MLS?

If you meet the following conditions, you can reduce income for ML S purposes by any taxed element of the super lump sum, other than a death benefit, that does not exceed your (or your spouse's) low rate cap: you (or your spouse) received a super lump sum.

Is a super contribution deductible?

if you have a spouse, their share of the net income of a trust on which the trustee must pay tax (under section 98 of the Income Tax Assessment Act 1936) and which has not been included in their taxable income.

Why are you exempt from Medicare levy?

you are normally exempt from the Medicare levy because you are a prescribed person and you do not have any dependents. Your income level is not considered in this case,

What is Medicare surcharge?

The Medicare Levy Surcharge (MLS) is a levy paid by Australian tax payers who do not have private hospital cover and who earn above a certain income. The surcharge aims to encourage individuals to take out private hospital cover, and where possible, to use the private system to reduce the demand on the public Medicare system.

What is the deductible for MLS?

your taxable income for MLS purposes is over the income threshold and you have approved hospital insurance (see below) for you and all of your dependents with a registered health insurer. From 1 April 2019, the total yearly front-end deductible or excess on the policy can be no greater than $750 for singles and $1,500 for families/couples. (Prior to 1 April 2019, the maximum deductible or excess was $500 for singles or $1,000 for families/couples.)

What is the surcharge for 2021?

The surcharge levels applicable to 30 June 2021* are: Single parents and couples (including de facto couples) are subject to family tiers. For families with children, the thresholds are increased by $1,500 for each child after the first. *The income thresholds are indexed and will remain the same to 30 June 2023.

What is the taxable income for MLS?

a single person with an annual taxable income for MLS purposes greater than $90,000; or. a family or couple with a combined taxable income for MLS purposes greater than $180,000. The family income threshold increases by $1,500 for each dependent child after the first; and do not have an approved hospital cover with a registered health insurer.

What is the maximum amount of hospital insurance?

From 1 April 2019, the maximum permitted excesses for private hospital insurance is $750 for singles and $1,500 for couples/families (i.e. if multiple hospital claims are made in a single year, the excess paid by you cannot exceed $750/$1,500). The following types of health insurance do not provide an exemption:

Do you have to pay MLS surcharges?

If you have held hospital cover for part of the year, then you will have a partial exemption from the MLS. You will have to pay the surcharge to account for the days that which you did not hold hospital cover.

How to avoid Medicare levies?

How to avoid the Medicare Levy Surcharge? If you earn above $90,000 as an individual or above $180,000 as a couple or family, there is a simple way to avoid the surcharge. Take out private hospital cover. It’s that simple.

What is Medicare levie surcharge?

The Medicare Levy Surcharge is designed to encourage more Australians to take out private hospital insurance.

How is Medicare surcharge calculated?

How is the Medicare Levy Surcharge Calculated? The Medicare Levy Surcharge is calculated as a simple percentage of your annual income. In general, the more you earn the higher the medicare levy surcharge. The income tiers for individuals are: $90,000 – $105,000 – the surcharge is 1% of your income. $105,001 – $140,000 – the surcharge is 1.25% ...

How much does Medicare pay in Australia?

Simple Summary. Almost everyone who works in Australia pays the Medicare Levy at 2% of their income (if they earn more than $28,501). Only people who earn over $90,000 (singles) or $180,000 (couples) also pay the Medicare Levy Surcharge IF they don’t have private health cover. Popular Articles.

Why do we pay surcharges?

Like the Medicare Levy, the surcharge is to help pay for the public health system and to encourage those people who can afford it to take out private health cover. This means they can avoid paying the surcharge, but also if they do get sick, those taxpayers go to a private hospital and reduce the pressure on public medical services.

How many times will my tax return be checked before lodgement?

Your return will be reviewed and checked two times at Etax before lodgement – giving you the confidence it was done right.

How much does private hospital cover cost?

Read more here about deciding on private health cover. For individuals, very basic private hospital cover can cost between $80 and $170 a month, depending on the tier (level).

How to avoid Medicare surcharge?

How to avoid the Medicare Levy Surcharge. In order to avoid the surcharge, you must have the appropriate level of cover. For singles, that means a policy with an excess of $500 or less. For couples or families, it means an excess of $1,000 or less.

Who is liable to pay the surcharge?

If your income exceeds the relevant income threshold and you do not have an appropriate level of private patient hospital cover for the full year , you will be liable to pay the surcharge. The income threshold that the surcharge kicks-in at changes depending on whether you are single or have dependants:

What is Medicare levy in Australia?

What is the Medicare Levy Surcharge? Australia's tax system encourages high-income earners to take out private health insurance. It ds this by charging a tax supplement (on top of the normal 2% Medicare levy) on high-income earners who don't have private health cover. This is called the Medicare Levy Surcharge (MLS).

What happens if you don't have private insurance?

The way the rules work, if your income exceeds the threshold and you don't have appropriate private cover for the whole year, you'll pay the Medicare levy surcharge up to the date you took out the policy.

What is Medicare levy?

Separate to the Medicare Levy, the Medicare Levy surcharge (MLS) is an additional tax of between 1 to 1.5% levied on those earning above the threshold who do not maintain a sufficient level of Private Hospital cover.

What happens if you don't have private health insurance?

If you don’t have (and maintain) private hospital cover by the time you turn 30, you may have to pay a Lifetime Health Cover loading. Also, if you don’t have private health insurance and your annual taxable income is over $90,000 (for singles) and $180,000 (for families), then you may also have to pay the Medicare Levy Surcharge. Message us through myBupa, or call us on 134 135 to find out more.

How much is MLS tax?

The rate at which the MLS is paid ranges from 1 to 1.5% of your taxable income, total reportable fringe benefits, and any amount in which a family trust distribution tax has been paid. When considering Private Health Cover its good to be aware that the Medicare Levy Surcharge (MLS) often exceeds the cost of you taking out private hospital cover.

When will Medicare tax rebates be effective?

You can read more about the Medicare Levy Surcharge on the ATO website . Rebate percentages are effective for payments made from 1 April 2019 and are indexed annually. The income tiers will remain the same until 30 June 2023. For more information, visit ato.gov.au.

Does a hospital policy cover accidents?

Some policies out there cover you for little more than accidents in a private hospital. Our policies are designed to cover the common procedures you’re likely to need when you’re younger.

Does private hospital cover Medicare?

Maintaining a sufficient level of Private hospital cover will help you avoid paying the Medicare Levy Surcharge. All of our Hospital and bundled Hospital and Extras covers will allow you to avoid paying the surcharge. However, if you don't have Private Hospital cover, you may have to pay an extra 1-1.5% on top of your levy.