NO The GHP is primary. Submit your claim to the GHP. If payment made, denied or YES applied to deductible, bill Medicare conditionally using Process J.

Full Answer

What happens if Medicare pays primary when the GHP has primary?

Apr 04, 2022 · Once new MSP situations are discovered, the CRC identifies claims Medicare mistakenly paid primary and initiates recovery activities. For additional information on this topic, please visit the Coordination of Benefits page. If Medicare paid primary when the GHP had primary payment responsibility, the CRC will seek repayment.

Can a group health plan make a payment before Medicare?

Apr 04, 2022 · The GHP User Guide provides an overview of the related Section 111 legislation, MSP rules, entities that are required to report, and the GHP reporting process followed by detailed instructions and requirements. File specifications are located in its appendices. The first section of the GHP User Guide provides a list of updates made since the ...

What is the difference between Medicare and GHP?

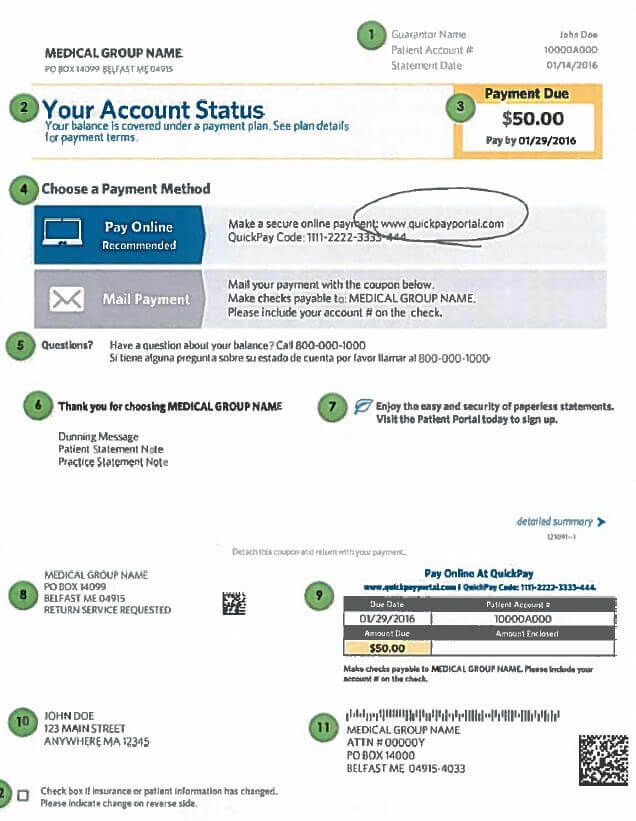

If you get a "Medicare Premium Bill" from Medicare, there are 4 ways to pay your premium, including 2 ways to pay online: Log into (or create) your secure Medicare account — Select “Pay my premium” to make a payment by credit card, debit, card, or from your checking or savings account. Our service is free. Contact your bank to set up an ...

What is Medicare GHP recovery?

CMS is responsible for protecting the Medicare program's fiscal integrity and ensuring that it pays only for those services that are its responsibility. Medicare Secondary Payer (MSP) provisions make Medicare a secondary payer to certain non-group health plans (NGHPs), which include liability insurers (including self-insured entities), no-fault insurers, and workers' compensation …

What is GHP coverage Medicare?

How do I bill Medicare as a secondary payer?

How do I submit Medicare secondary claims?

What is Medicare conditional billing?

Will Medicare pay as secondary if primary denies?

How do I know if my Medicare is primary or secondary?

Does Medicare automatically send claims to secondary insurance?

How do I bill a MSP claim?

- Complete the claim form CMS-1500 or electronic equivalent in the usual manner.

- Report all claim coding usually required for the services including charges for all Medicare-covered services, not just the balance remaining after the primary payer's payment.

How do I submit a medical claim to Medicare?

Do I have to pay back conditional payments?

How does Medicare reimbursement work?

When would Medicare make a conditional payment to a beneficiary?

Section 111 GHP Alerts

Frequently, CMS will publish new guidance in the form of an alert on the GHP Alerts page. These alerts are incorporated into subsequent versions of the GHP User Guide and supersede information published in the GHP User Guide.

Section 111 Coordination of Benefits Secure Website User Guide

The Section 111 Coordination of Benefits Secure Website (COBSW) is used by GHP RREs to register for Section 111 reporting, monitor file submissions, and submit online queries of Medicare entitlement. The user guide for this Web portal can be viewed and downloaded after logging in to the Section 111 COBSW.

Is Medicare a secondary payer?

Medicare Secondary Payer (MSP) provisions make Medicare a secondary payer to certain non-group health plans (NGHPs), which include liability insurers (including self-insured entities), no-fault insurers, and workers' compensation entities. CMS has the right to recover Medicare payments made that should have been the responsibility of another payer.

What is MSPRP in insurance?

The MSPRP is a web-based tool designed to assist in the resolution of liability insurance, no-fault insurance, and workers’ compensation Medicare recovery cases. The MSPRP gives users (attorneys, insurers, beneficiaries, and recovery agents) the ability to access and update certain case specific information online and monitor the recovery process online. For additional information regarding the MSPRP, click the Medicare Secondary Payer Recovery Portal link.

What is the role of CMS in Medicare?

CMS is responsible for protecting the Medicare program's fiscal integrity and ensuring that it pays only for those services that are its responsibility. Medicare Secondary Payer (MSP) provisions make Medicare a secondary payer to certain non-group health plans (NGHPs), which include liability insurers (including self-insured entities), ...

What is BCRC in Medicare?

The Benefits Coordination & Recovery Center (BCRC) is responsible for ensuring that Medicare gets repaid by the beneficiary for any conditional payments it makes related to a liability, no-fault, or workers’ compensation case. A conditional payment is a payment Medicare makes for services another payer may be responsible for.

What is conditional payment?

A conditional payment is a payment Medicare makes for services another payer may be responsible for. The payment is "conditional" because it must be repaid to Medicare when a beneficiary receives a settlement, judgment, award, or other payment from an NGHP.

What is the BCRC?

Benefits Coordination & Recovery Center (BCRC) Responsibilities. The Benefits Coordination & Recovery Center (BCRC) is responsible for ensuring that Medicare gets repaid by the beneficiary for any conditional payments it makes related to a liability, no-fault, or workers’ compensation case. A conditional payment is a payment Medicare makes ...

What is Medicare Secondary Payer?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare. When Medicare began in 1966, it was the primary payer for all claims except for those covered by Workers' Compensation, ...

When did Medicare start?

When Medicare began in 1966 , it was the primary payer for all claims except for those covered by Workers' Compensation, Federal Black Lung benefits, and Veteran’s Administration (VA) benefits.

Is Medicare the primary payer?

Medicare remains the primary payer for beneficiaries who are not covered by other types of health insurance or coverage. Medicare is also the primary payer in certain instances, provided several conditions are met.

What is ESRD in Medicare?

End-Stage Renal Disease (ESRD): Individual has ESRD, is covered by a GHP and is in the first 30 months of eligibility or entitlement to Medicare. GHP pays Primary, Medicare pays secondary during 30-month coordination period for ESRD. Individual has ESRD, is covered by a Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA plan) ...

How long does ESRD last on Medicare?

Individual has ESRD, is covered by a GHP and is in the first 30 months of eligibility or entitlement to Medicare. GHP pays Primary, Medicare pays secondary during 30-month coordination period for ESRD.

Why is Medicare conditional?

Medicare makes this conditional payment so that the beneficiary won’t have to use his own money to pay the bill. The payment is “conditional” because it must be repaid to Medicare when a settlement, judgment, award or other payment is made. Federal law takes precedence over state laws and private contracts.

What is the purpose of MSP?

The MSP provisions have protected Medicare Trust Funds by ensuring that Medicare does not pay for items and services that certain health insurance or coverage is primarily responsible for paying. The MSP provisions apply to situations when Medicare is not the beneficiary’s primary health insurance coverage.

Section 111 GHP Alerts

Frequently, CMS will publish new guidance in the form of an alert on the GHP Alerts page. These alerts are incorporated into subsequent versions of the GHP User Guide and supersede information published in the GHP User Guide.

Section 111 Coordination of Benefits Secure Website User Guide

The Section 111 Coordination of Benefits Secure Website (COBSW) is used by GHP RREs to register for Section 111 reporting, monitor file submissions, and submit online queries of Medicare entitlement. The user guide for this Web portal can be viewed and downloaded after logging in to the Section 111 COBSW.

What is provider based billing?

What does "provider-based" or "hospital-based outpatient" mean?#N#"Provider-based" or "hospital-based outpatient" refers to the billing process for services rendered in a hospital outpatient clinic or location. This is the national model of practice for large, integrated delivery systems involved in patient care.#N#How does this affect billing?#N#Under this model, patients may potentially receive two (2) charges on their combined patient bill for services provided within a clinic. One charge represents the facility or hospital charge and one charge represents the professional or physician fee.#N#Why does Geisinger do "provider-based" billing?#N#Since Geisinger employs many physicians, following this same type of billing process for outpatient care rendered at our hospitals ensures more appropriate payment for services provided by hospital staff and physicians and distinguishes facilities that function as departments of hospitals from those which are freestanding.#N#Does this mean patients will pay more for services?#N#Depending on their particular insurance coverage, it's possible patients may pay more for certain outpatient services and procedures at our provider-based/hospital outpatient locations than at one of our other sites. We recommend patients review their insurance benefits or contact their insurance provider to determine what their policy will pay and what out-of-pocket expenses may incur. Please note some lab tests drawn at a freestanding clinic may be sent to a hospital or other facility for processing and also show a "hospital outpatient lab charge".#N#What are Geisinger's "provider-based" or "hospital-based outpatient" locations?#N#Click for a list of Geisinger hospital-based locations (PDF). Other locations will be included as Geisinger expands services to meet patient needs.#N#Does this affect patient co-pays or deductibles?#N#Depending on each patient's specific insurance benefits, additional patient out-of-pocket expenses may be incurred by the "provider-based" model.#N#Where can patients call with their questions or concerns?#N#Geisinger's Patient Service Call Center toll-free at 800-640-4206#N#What can patients do if they are having difficulty paying for healthcare services?#N#Geisinger offers discounting and charity policies to help qualifying patients. Detailed information is available by calling Geisinger's Patient Service Call Center toll-free at 800-640-4206.#N#In summary: Receiving care at Geisinger's "provider-based" locations may result in a facility charge as well as a professional or physician charge for outpatient services and/or procedures. These charges will be reflected on the patient statement you receive for services provided. Depending on a patient's specific insurance coverage, it is possible that some patients may pay more for these services and procedures than they would at one of our other sites. Geisinger is not unique in this regard as this is the case in many integrated healthcare delivery systems across the country.#N#Patients are advised to review their insurance benefits or contact their insurance provider to determine what their policy will cover and identify any out-of-pocket expenses. For more information, contact our Patient Service Call Center at 800-640-4206 if you have further questions regarding "provider-based" or "hospital-based outpatient" billing.

How to contact Geisinger?

Insurance inquiries: If you have questions regarding your Geisinger billing statement, contact the Patient Service Call Center at 800-640-4206 during our normal business hours and one of our staff will assist you.