Applying for Medicare Part D with Medicare’s plan finder

- Go to the Medicare Plan Finder page: Create an account if you'll want to save your search and come back to it later.

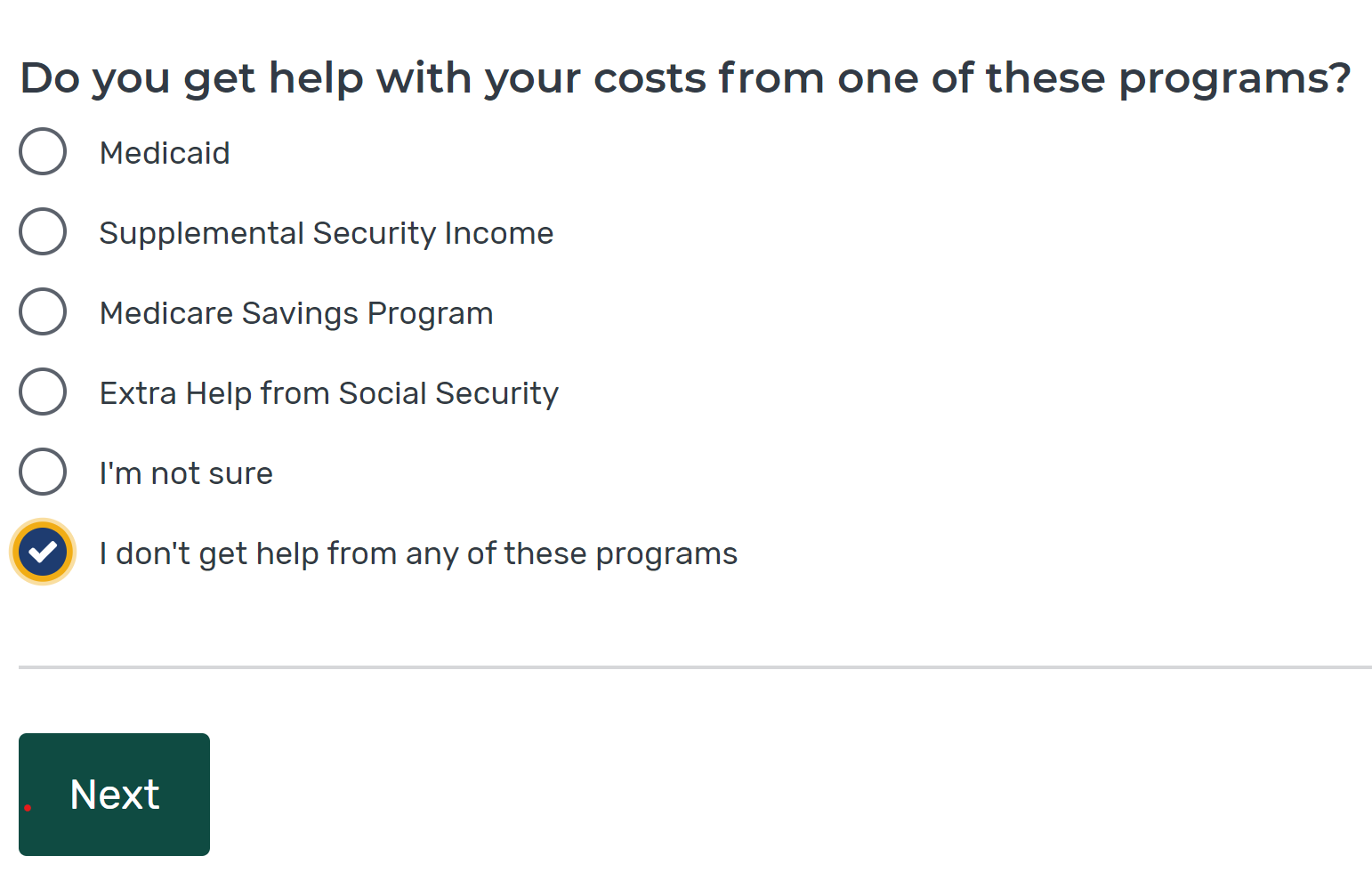

- Enter your information: Select "Drug Plan (Part D). Then enter your zip code and answer any other questions that pop up.

- Enter all your drugs, dosages, and frequencies just as you listed them:...

Full Answer

Who is eligible for Medicare Part D?

Medicare Part D is an outpatient prescription drug benefit available to people who have Medicare (Part A and/or Part B). While technically Part D is optional coverage, Medicare “encourages” you to enroll in Part D by assessing a late penalty if you don ...

How much does Medicare Part D cost?

Your actual drug coverage costs will vary depending on:

- Your prescriptions and whether they’re on your plan’s list of covered drugs ( formulary A list of prescription drugs covered by a prescription drug plan or another insurance plan offering ...

- What “tier” the drug is in.

- Which drug benefit phase you’re in (like whether you’ve met your deductible, or if you’re in the catastrophic coverage phase).

How much does a part D cost?

You pay your portion of the monthly premium if you receive Part D coverage as part of Medicare. The cost varies, but the nationwide base is about $33 per month in 2022. Each plan will also have a copayment and coinsurance amount.

What drugs does Medicare Part B and Part D cover?

Transplant / immunosuppressive drugs. Medicare covers transplant drug therapy if Medicare helped pay for your organ transplant. Part D covers transplant drugs that Part B doesn't cover. If you have ESRD and Original Medicare, you may join a Medicare drug plan.

Can I add Part D to my Medicare at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

Can I get Medicare Part D alone?

You could enroll in a stand-alone Medicare Part D plan , or you could get drug coverage as part of a Medicare Advantage plan . There are also a few different ways you can enroll: Use Medicare's plan finder tool to enroll online. Call the plan you want to enroll in.

How much does Medicare Part D cost?

In 2019, Medicare Part D covered more than 3,500 prescription drug products, with total spending of $183 billion, not accounting for rebates.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

How long does it take to get Medicare Part D after applying?

When you first get Medicare (Initial Enrollment Periods for Part C & Part D)If you joinYour coverage beginsDuring the month you turn 65The first day of the month after you ask to join the planDuring one of the 3 months after you turn 65The first day of the month after you ask to join the plan1 more row

What is the 2021 Part D premium?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.

Who has the cheapest Part D drug plan?

Recommended for those who Although costs vary by ZIP Code, the average nationwide monthly premium for the SmartRx plan is only $7.08, making it the most affordable Medicare Part D plan this carrier offers.

Is Medicare Part D deducted from Social Security?

If you are getting Medicare Part C (additional health coverage through a private insurer) or Part D (prescriptions), you have the option to have the premium deducted from your Social Security benefit or to pay the plan provider directly.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

How do I choose a Part D plan?

Before you enroll in a Part D prescription drug plan, find out which plans are available in your area and whether they cover your prescriptions. Compare their overall cost and look for a plan that: Features the lowest overall cost.

What is the cost of Medicare Part D for 2022?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

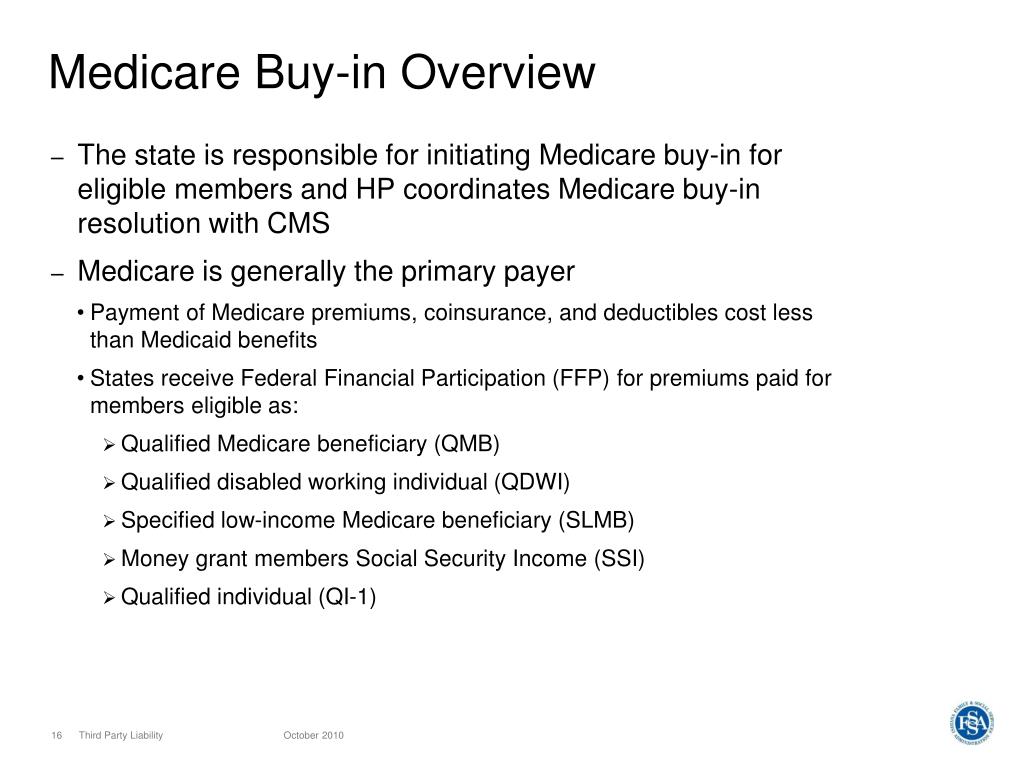

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

How to enroll in Medicare?

Enroll on the Medicare Plan Finder or on the plan's website. Complete a paper enrollment form. Call the plan. Call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. When you join a Medicare drug plan, you'll give your Medicare Number and the date your Part A and/or Part B coverage started.

What are the different types of Medicare plans?

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a: 1 Private Fee-for-Service Plan 2 Medical Savings Account Plan 3 Cost Plan 4 Certain employer-sponsored Medicare health plans

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or other. Medicare Health Plan. Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan.

Do you have to have Part A and Part B to get Medicare?

You get all of your Part A, Part B, and drug coverage, through these plans. Remember, you must have Part A and Part B to join a Medicare Advantage Plan , and not all of these plans offer drug coverage. Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you’re interested in ...

Does Medicare change drug coverage?

The drug coverage you already have may change because of Medicare drug coverage, so consider all your coverage options. If you have (or are eligible for) other types of drug coverage, read all the materials you get from your insurer or plan provider.

What is Medicare Part D?

Part D is Medicare’s insurance program for prescription drugs. For most of its history, Medicare did not offer a prescription drug benefit. Congress added the coverage, which began in 2006. AARP Membership: Join or Renew for Just $16 a Year.

How much is Medicare Part D premium 2020?

The Centers for Medicare & Medicaid Services (CMS) estimates that the average monthly Part D basic premium for 2020 will be $32.74. But premiums vary widely, depending on the drugs covered and the copays. Some plans have no premiums. If you are enrolled in a Medicare Advantage plan, part of your premium may include prescription drugs.

What happens if my Medicare plan is no longer available?

If your plan is no longer available, you will receive a letter from the insurer about the termination. You will then need to pick another plan. However, Medicare officials and experts strongly suggest that you review other available Part D plans — even if you are satisfied with your current plan.

What is the Medicare call center number?

Medicare has a call center that’s open seven days a week, 24 hours a day. The toll-free number is 800-MEDICARE (800-633-4227). You may also contact SHIP. You can find contact information for SHIP in your state at Medicare.gov.

How much can I deduct from my insurance in 2020?

The federal government sets a limit on deductibles every year. For 2020, a plan can’t impose a deductible higher than $435. But deductible amounts vary widely by plan, and many plans don’t impose a deductible.

When do you sign up for Medicare Part A and B?

Your IEP begins three months before the month you turn 65 and lasts until three months after. For example, if you will turn 65 on June 15, your IEP is from March 1 to Sept. 30.

Does Medicare pay for cough syrup?

Getty Images. Medicare Part D does not pay for over-the-counter medications like cough syrup or antacids. It also doesn't cover some prescription drugs, such as Viagra when it is used for erectile dysfunction.

What do you need to know before enrolling in a Part D plan?

The most important preparation you can do before finding a Part D plan is recording information about your medications.

When is the best time to sign up for Part D?

If you don’t have creditable drug coverage or health insurance from a current employer, the best time to sign up for Part D is during your 7-month initial enrollment period (IEP) to avoid penalties. Under your IEP, you have a 7-month window that opens 3 months before you turn 65 and closes at the end of the 3rd month following your birthday month.

How does dosage affect Part D?

Your dosage can affect your final cost or enact certain plan restrictions depending on the Part D plan. The frequency of the medication. The number of pills you take also affects the cost, so double check how often you take your medication and write it down. Once you have these recorded, you’ll be able to compare plans, apples-to-apples.

Is Medicare Part D a good program?

Although Medicare is not without its faults, one thing is clear: Medicare Part D has been a successful program. With nearly 70% of all beneficiaries enrolled in Part D, this optional add-on to Original Medicare is a popular way to lower drug costs. 1. But before diving into the deep end of Part D plans, you’ll want to perform due diligence ...

What is a Medigap policy?

Medigap policy with creditable drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage.

Can you get your Medicare coverage back if you have a Medigap policy?

If your Medigap policy covers prescription drugs, you'll need to tell your Medigap insurance company if you join a Medicare Prescription Drug Plan. The Medigap insurance company will remove the prescription drug coverage from your Medigap policy and adjust your premium. Once the drug coverage is removed, you can't get that coverage back, even though you didn't change Medigap policies.

Does Medigap have to send a notice?

Your Medigap company must send you a notice each year telling you if the prescription drug coverage in your Medigap policy is creditable. Keep these notices in case you decide later to join a Medicare drug plan.

Do you have to pay late enrollment penalty for Medigap?

You'll probably have to pay a late enrollment penalty if you have a Medigap policy that doesn't include creditable prescription drug coverage and you decide to join a Medicare Prescription Drug Plan later. This means you'll pay a higher monthly premium than if you joined when you were first eligible.