To calculate your MAGI:

- Add up your gross income from all sources.

- Check the list of “adjustments” to your gross income and subtract those for which you qualify from your gross income. ...

- The resulting number is your AGI.

Full Answer

How do you calculate the Magi?

· How do I calculate my modified adjusted gross income? Step 1: Calculate your gross income. Your gross income (GI) is the simplest form of income. It includes all the money you earned without any tax ... Step 2: Calculate your adjusted gross income. Step 3. Calculate your modified adjusted gross ...

How is Medicare Magi calculated?

Modified Adjusted Gross Income (MAGI) Part B monthly premium amount Prescription drug coverage monthly premium amount; Individuals with a MAGI of less than or equal to $91,000: 2022 standard premium = $170.10: Your plan premium: Individuals with a MAGI above $91,000 and less than $409,000: Standard premium + $374.20: Your plan premium + $71.30: …

Is non-taxble Social Security included in Magi?

· For example, if you will be paying Medicare premiums in 2021, the SSA will determine if an IRMAA surcharge applies by reviewing your 2019 tax return. Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI).

What is the maximum premium for Medicare Part B?

· How Do I Find My MAGI? Any IRA deductions that you took. Any deductions you took for student loan interest or tuition. Passive income or loss 14. Excluded foreign income. …

What Is Adjusted Gross Income?

Generally, your adjusted gross income is your household's income minus various adjustments. Adjusted gross income is calculated before the itemized...

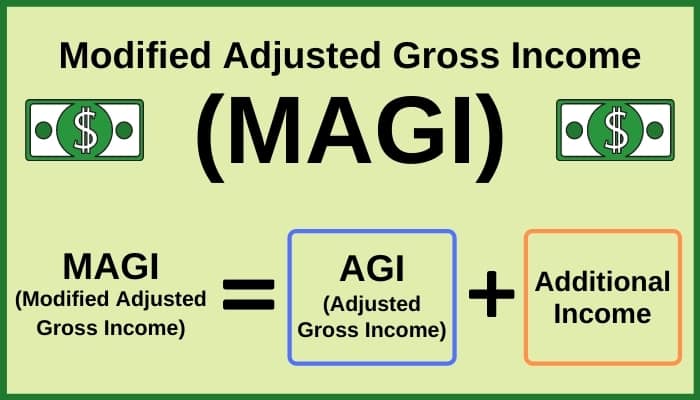

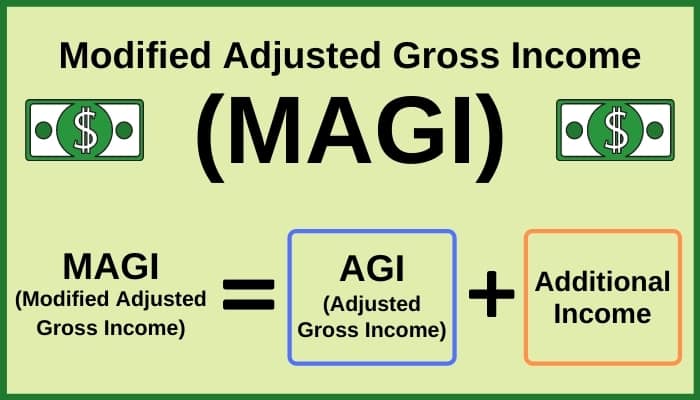

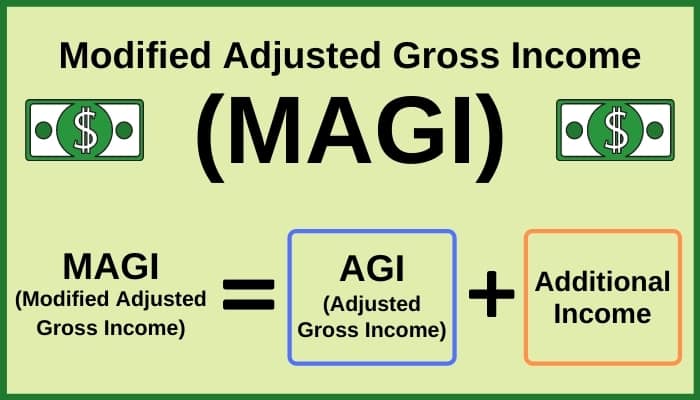

What Is Modified Adjusted Gross Income?

Generally, your modified adjusted gross income (MAGI) is the total of your household's adjusted gross income plus any tax-exempt interest income yo...

How to Calculate Your Gross Income

Your gross income (GI) is the money you earned through wages, interests, dividends, rental and royalty income, capital gains, business income, farm...

How to Calculate Your Adjusted Gross Income

Once you have gross income, you "adjust" it to calculate your AGI. You make adjustments by subtracting qualified deductions from your gross income....

How to Calculate Your Modified Adjusted Gross Income

Once you have adjusted gross income, you "modify" it to calculate your MAGI. For most people, MAGI is the same as AGI.Specifically, Internal Revenu...

What happens if your MAGI is greater than $88,000?

If you file your taxes using a different status, and your MAGI is greater than $88,000, you’ll pay higher premiums (see the chart below, Modified Adjusted Gross Income (MAGI), for an idea of what you can expect to pay).

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

How to determine 2021 income adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

How to appeal a monthly adjustment?

The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

How Much Are My Premiums?

The Social Security Administration (SSA) determines whether an Income-Related Monthly Adjustment Amount (IRMAA) applies to your Medicare Part B and D premiums based on your Modified Adjusted Gross Income (MAGI) from two years prior.

My Income has Changed: What can I do?

The SSA states that if life-changing events altered your income in a way that would impact your IRMAA surcharge, you can complete form SSA-44 ( Medicare Income-Related Monthly Adjustment Amount-Life-Changing Event ). After entering your name and social security number, follow these step-by-step directions on how to complete the form:

Summary

Dealing with Medicare-related items can be difficult. If you receive a determination letter that you feel does not reflect your current financial standing, utilize the tools afforded by the government to mitigate your premium expenditures.

Schedule a Consultation

We have helped our clients answer these questions and more. If you want a clear understanding of your financial future, and need help making changes to reach your goals, schedule a consultation and we can get started.

The IRS uses MAGI to determine IRA eligibility and more

David Fisher is a communications and content specialist with expertise in journalism, multimedia content production, and corporate communications strategy. David Fisher has a BA in history from the University of Montana, with concentrations in economics, journalism, and geology.

How Do I Find My Adjusted Gross Income?

Your AGI and your MAGI are likely to be fairly close in value to one another. Your AGI is the total amount of income you make in a year, minus certain expenses that you are allowed to deduct.

How Do I Find My MAGI?

You won't find your modified adjusted gross income on your tax return, but it is easy to figure out on your own.

How Does the IRS Use Your MAGI?

Your MAGI is what determines whether you can make tax-deductible contributions to an IRA. If the total is over a certain amount, you can't deduct anything you added to an IRA for that tax year.

Frequently Asked Questions (FAQs)

MAGI is not included on your tax return, but you can use the information on your 1040 to calculate it. You'll need to find your adjusted gross income (line 8b) and add several deductions back to it, including deductions for IRAs, student loan interest and tuition, certain types of income losses, and more.

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

What is Medicare's look back period?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.

What is the Medicare premium for 2020?

For 2020, the standard monthly rate is $144.60. However, it will be more if you reported above a certain level of modified adjusted gross income on your federal tax return two years ago. Any additional amount charged to you is known as IRMAA, which stands for income-related monthly adjustment amount. Visit Medicare.gov, point to “Your Medicare Costs,” and then click “Part B costs” to see a matrix of premiums corresponding to income ranges across different tax filing statuses.

How long do you have to be on Medicare to receive Part A?

People under age 65 may receive Part A with no liability for premiums under the following circumstances: Have received Social Security or Railroad Retirement Board disability benefits for two years.

How many years of work do you need to be eligible for Medicare?

Four is the maximum number of credits a person can earn per year, so it takes at least 10 years or 40 quarters of employment to be eligible for Medicare.

Is Medicare the same for everyone?

Medicare is a federal program that mandates standardization of services nationwide, so many people may assume the premiums would be the same for everyone. In reality, there are variations in the premiums people pay, if they pay any at all.

Can Medicare be charged at 65?

For Part A, most Medicare recipients are not charged any premium at all. Seniors at age 65 are eligible for premium-free Part A if they meet the following criteria: Currently collect retirement benefits from Social Security or the Railroad Retirement Board. Qualify for Social Security or Railroad benefits not yet claimed.

What is the MAGI for health insurance?

MAGI is adjusted gross income (AGI) plus these, if any: untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest.

Does MAGI include SSI?

For many people, MAGI is identical or very close to adjusted gross income. MAGI doesn’t include Supplemental Security Income (SSI). MAGI does not appear as a line on your tax return.

How to keep MAGI low?

Strategies to keep MAGI Low 1 1 – Don’t make any income! This is important. 2 2a – Remember tax exempt income is pulled back in, so interest paid by municipal bonds will count against you! Don’t own Municipal bonds. 3 2b – All the income you get from cash and bonds will be included. 4 3b – Ordinary dividends will be pulled in. If you buy and sell stocks, mutual funds or ETFs frequently (or have actively managed funds) this can hurt! 5 4b – Pension income will fully count against you, as will ALL or part of social security. If you want ACA Premium Tax Credits, delay taking pensions and social security until at least age 65. In addition, pre-tax accounts (IRAs, 401k) should not be accessed for income. This includes Roth Conversions! 6 Schedule 1 – Again, check out the sources of income you want to avoid on schedule 1. Note that you include capital gain harvesting here!

What line on 1040 adds income?

Back on form 1040, in line 6 we add the income from schedule 1 to get your total income.

What is above the line deduction on 1040?

This is because they were on the front page of the old 1040 and above the bottom line on that form: the adjusted gross income. Also called “adjustments to your income,” you can look at schedule 1 again to see what they are.

How often does the IRS pay premium tax credits?

With the ACA, the IRS pays Premium Tax Credits to your insurance company every month to lower the cost of your insurance.

What line do you add back Social Security?

Note you add back the non-taxable social security benefits (which is line 51 minus line 5b). In addition, add back tax-exempt interest on line 2a. Finally, if you have any (non-investment) foreign earned income from form 2555, this is added as well.

How many additional forms are there on Schedule 1?

As you can tell, schedule 1 is also very complicated and potentially pulls in 5 additional forms! You are best off to look at last year’s tax return and see what might be applicable to you this year.

What line do you add on to 1040?

In line 6 of Form 1040, you add on any income on line 22 from schedule 1. It is best to take a look at lines 1-22 of schedule 1, as it pulls in a lot of different income sources that will be included in you MAGI! This is your so-called total income.