Here are some tips on how to Choose the Best Medicare Advantage Health Plans Options and Coverage for You:

- Decide what you need in a health plan. Do you need access to a wide variety of doctors and hospitals? Are certain...

- Compare plans based on price and features. Different Medicare Advantage health plans offer different levels of...

Full Answer

What is the best Medicare plan?

They are here to talk about their 5 star medicare plans available to switch your current plan or during the election periods throughout the year. As independent agents, Deb and Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers.

How to choose the right Medicare plan for You?

Original Medicare

- Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance).

- You can join a separate Medicare drug plan to get Medicare drug coverage (Part D).

- You can use any doctor or hospital that takes Medicare, anywhere in the U.S.

Who qualifies for free Medicare?

- You’re eligible for or receive monthly benefits under Social Security or the railroad retirement system.

- You’ve worked long enough in a Medicare-covered government job.

- You’re the child or spouse (including a divorced spouse) of a worker (living or deceased) who has worked long enough under Social Security or in a Medicare-covered government job.

What Medicare plan to choose?

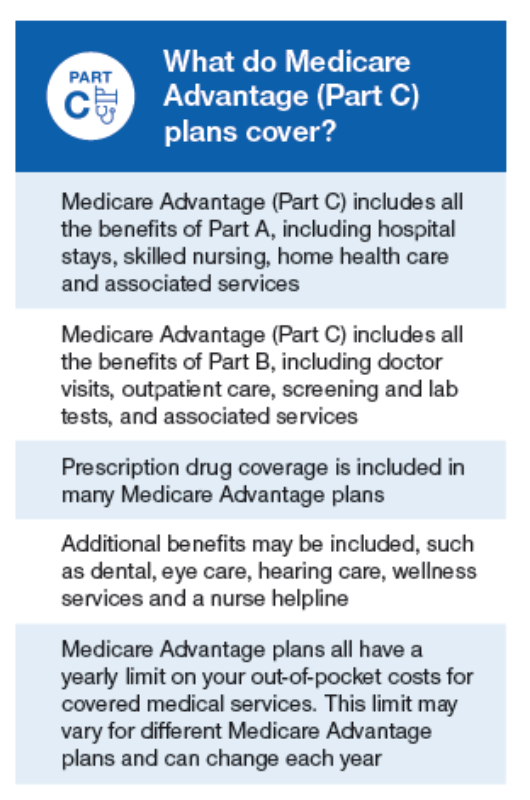

- Medicare Advantage offers Part A, Part B as well as additional benefits such as prescription, dental, vision, and hearing coverage and even fitness club memberships. ...

- You have to see in-network providers, which is problematic if you want to select your own doctor.

- It offers low-cost premiums, deductibles, coinsurance, and copays.

What is Medicare Advantage Plan?

What is the original Medicare?

What happens if you don't get Medicare?

How much does Medicare pay for Part B?

Does Medicare Advantage cover prescriptions?

See more

About this website

How do I know which Medicare plan is right for me?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

What are the four types of coverage in Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is the most widely accepted Medicare plan?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.

Why do I need Medicare Part B?

Medicare Part B helps cover medical services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary.

What is the average cost of Medicare Part C?

Currently insured? For 2022, a Medicare Part C plan costs an average of $33 per month. These bundled plans combine benefits for hospital care, medical treatment, doctor visits, prescription drugs and frequently, add-on coverage for dental, vision and hearing.

What does Medicare Part D pay for?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan's list of covered drugs is called a “formulary,” and each plan has its own formulary.

Why do I need Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

The parts of Medicare (A, B, C, D) - Medicare Interactive

Generally, the different parts of Medicare help cover specific services. Most beneficiaries choose to receive their Part A and B benefits through Original Medicare, the traditional fee-for-service program offered directly through the federal government. It is sometimes called Traditional Medicare or Fee-for-Service (FFS) Medicare. Under Original Medicare, the government pays directly for the ...

What's the Right Medicare Coverage for You? - WebMD

This information will help you decide which Medicare plans best suit your health care needs.. Key Points in Making Your Decision. There are many choices for health coverage in the Medicare system.

Shop & compare plans for 2022| Medicare.gov

Medicare’s Open Enrollment is now – December 7. Review your Medicare health and drug coverage and compare it with other plans that may better meet your needs. Official Medicare site.

2022 Medicare Parts A & B Premiums and Deductibles/2022 Medicare Part D ...

On November 12, 2021, the Centers for Medicare & Medicaid Services (CMS) released the 2022 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2022 Medicare Part D income-related monthly adjustment amounts. Medicare Part B Premium and Deductible

Medicare & You handbook | Medicare

Audio files for Medicare & You. Medicare & You 2022 Revised: September 2021 Publication ID: 10050. Welcome to Medicare & You 2022 [MP3, 7038 MB]. Section 1: Signing Up for Medicare Part A and Part B - Pages - 15-19 [(MP3, 7.13 MB]. Section 1: Signing Up for Medicare Part A and Part B - Pages 20-24 [MP3, 25.14 MB]. Section 2: Find Out if Medicare Covers Your Test, Service, Or Item - Pages 25-28 ...

Your other coverage

Do you have, or are you eligible for, other types of health or prescription drug coverage (like from a former or current employer or union)? If so, read the materials from your insurer or plan, or call them to find out how the coverage works with, or is affected by, Medicare.

Cost

How much are your premiums, deductibles, and other costs? How much do you pay for services like hospital stays or doctor visits? What’s the yearly limit on what you pay out-of-pocket? Your costs vary and may be different if you don’t follow the coverage rules.

Doctor and hospital choice

Do your doctors and other health care providers accept the coverage? Are the doctors you want to see accepting new patients? Do you have to choose your hospital and health care providers from a network? Do you need to get referrals?

Prescription drugs

Do you need to join a Medicare drug plan? Do you already have creditable prescription drug coverag e? Will you pay a penalty if you join a drug plan later? What will your prescription drugs cost under each plan? Are your drugs covered under the plan’s formulary? Are there any coverage rules that apply to your prescriptions?

Quality of care

Are you satisfied with your medical care? The quality of care and services given by plans and other health care providers can vary. Get help comparing plans and providers

Convenience

Where are the doctors’ offices? What are their hours? Which pharmacies can you use? Can you get your prescriptions by mail? Do the doctors use electronic health records prescribe electronically?

Medicare Advantage (Part C)

You pay for services as you get them. When you get a covered service, Medicare pays part of the cost and you pay your share.

You can add

You join a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage.

Most plans include

Some extra benefits (that Original Medicare doesn’t cover – like vision, hearing, and dental services)

Medicare drug coverage (Part D)

If you chose Original Medicare and want to add drug coverage, you can join a separate Medicare drug plan. Medicare drug coverage is optional. It’s available to everyone with Medicare.

Medicare Supplement Insurance (Medigap)

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare.

What to check after choosing Medicare Advantage?

So, after you choose a Medicare Advantage plan, you’ll want to check each year during open enrollment to see if there are any changes in your network. It’s also a good idea to find out which specialists, hospitals, home health agencies and skilled nursing facilities are in the plan’s network.

What is the copayment for Medicare?

Part D and Medicare Advantage plans with prescription drug coverage almost always charge a copayment or coinsurance for each of the medicines you purchase. Copays are a set amount you pay for each prescription filled, say $10 or $20.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance helps cover the out-of-pocket health care costs you can incur with Original Medicare Part A and Part B and hospice and home health care services. (If you have an Advantage plan, you may not purchase Medicare Supplement Insurance.) There are 10 standardized plans and premiums are regulated by the states. Massachusetts, Maine and WIsconsin have their own standardization. What you pay in monthly premiums can depend on where you live, what coverage you get and how old you are. You can learn more in this guide on comparing and selecting plans, with a side-by-side comparison of the different policies.

How much is Medicare Part B 2020?

Medicare Part B comes with an annual deductible of $198 for 2020. After you meet the deductible for the year, you typically pay 20% of the Medicare-approved amount for doctor services and other Medicare Part B benefits.

How many standardized plans are there?

There are 10 standardized plans and premiums are regulated by the states. Massachusetts, Maine and WIsconsin have their own standardization. What you pay in monthly premiums can depend on where you live, what coverage you get and how old you are.

Does Medicare.gov compare plans?

Medicare.gov offers a tool to help compare Medicare Advantage Plans.

Does Medicare have a yearly limit?

Medicare Advantage plans have a yearly limit on how much members will pay in out-of-pocket costs. Be aware that cost sharing and benefits of the Medicare Advantage plan you choose can change from year to year. If you choose Medicare Advantage and are happy with your coverage, you will still need to look for changes and compare plans ...

What is Medicare Advantage?

Medicare covers medical services and supplies in hospitals, doctors’ offices, and other health care settings. Services are either covered under Part A or Part B. Coverage in Medicare Advantage. Plans must cover all of the services that Original Medicare covers.

Does Medicare Advantage have a yearly limit?

If you join a Medicare Advantage Plan, once you reach a certain limit, you’ll pay nothing for covered services for the rest of the year. This option may be more cost effective for you. note:

Is coinsurance a part of Medicare Advantage?

Supplemental coverage in Medicare Advantage. It may be more cost effective for you to join a Medicare Advantage Plan because your cost sharing is lower (or included). And, many Medicare Advantage plans offer vision, hearing, and dental.

Can you use a Medigap policy?

You can’t use (and can’t be sold) a Medigap policy if you’re in a Medicare Advantage Plan. note: If you're in a Medicare plan, review the "Evidence of Coverage" (EOC)and "Annual Notice of Change" (ANOC) . Prescription drugs.

Does Medicare cover hearing?

Some plans offer benefits that Original Medicare doesn’t cover like vision, hearing, or dental. note: If you're in a Medicare plan, review the "Evidence of Coverage" (EOC)and "Annual Notice of Change" (ANOC) . Your other coverage.

Does Medicare Advantage include prescription drugs?

Most Medicare Advantage Plans include drug coverage. If yours doesn't, you may be able to join a separate Part D plan. note: If you're in a Medicare plan, review the "Evidence of Coverage" (EOC)and "Annual Notice of Change" (ANOC) . Doctor and hospital choice.

What happens if you don't sign up for Medicare?

If you don’t sign up within seven months of turning 65 (three months before your 65 th birthday, your birthday month, and three months after), you will pay a 10% penalty for every year you delay. Enroll in a Medicare Advantage plan, which is a privately-run health plan approved by the government to provide Medicare benefits.

Does Part D cover prescriptions?

It will help cover the cost of your prescription medications. Similar to Part B, there is a financial penalty if you do not sign up for a Part D plan when you are first eligible, unless you have other prescription drug coverage.

When Can I Enroll In Medicare?

Remember, you are automatically eligible to receive Medicare the day you turn 65. If you are already receiving Social Security benefits and enrolled in Medicare before you hit 65, you will automatically be enrolled in Part A of Medicare.

Can I Add, Drop, And Change Coverage?

You can’t add, drop, and change coverage as you please. There are certain times and dates when you can do this. There can also be some confusion as to whether or not there will be fees or penalties for adding certain coverage or dropping it from your plan.

How many days are there to make Medicare choices?

That’s day one of the 54 days when Americans 65 and older have to make their Medicare choices for 2018. These choices could save you hundreds, perhaps thousands of dollars a year and could well determine the quality of your health care, and your health, for years to come.

How much is Medicare Advantage premium?

The Centers for Medicare and Medicaid Services (CMS) says the average Medicare Advantage premium is expected to be about $30 a month for 2018, a slight dip from 2017. CMS also is predicting that enrollment in MA plans will reach an all-time high next year of 20.4 million people.

How much does Medicare cover for hospital stays?

There are many other costs you need to cover under Medicare. For example, Medicare Part A covers 100 percent of the first 60 days of a hospital stay. But for original Medicare enrollees, you must cover a deductible for each hospital stay. In 2017 that deductible was $1,316.

What is the difference between Medicare Part A and Medicare Part B?

Original Medicare comprises two parts: Medicare Part A, which provides coverage for most costs related to hospital stays , and Medicare Part B, which covers doctor visits, lab work, outpatient services and preventive care. Part A is free to most people who qualify ...

When did Medicare Part C start?

So in 1997 it created Medicare Part C, or what is known today as Medicare Advantage plans.

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

What is Medicare Advantage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. .

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

What is a referral in health care?

referral. A written order from your primary care doctor for you to see a specialist or get certain medical services. In many Health Maintenance Organizations (HMOs), you need to get a referral before you can get medical care from anyone except your primary care doctor.

What is a coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

Does Medicare cover assignment?

The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it.

Do you have to choose a primary care doctor for Medicare?

No, in Original Medicare you don't need to choose a. primary care doctor. The doctor you see first for most health problems. He or she makes sure you get the care you need to keep you healthy. He or she also may talk with other doctors and health care providers about your care and refer you to them.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.