To claim a refund of Social Security and Medicare taxes, you will need to complete and submit IRS Form 843 . Attach a copy of your Form W-2 for the tax year in question to substantiate how much was withheld from your pay. Boxes 4 and 6 on the W-2 show how much Social Security and Medicare taxes were withheld.

Can I deduct Medicare costs on my income tax?

You may be eligible to deduct Medicare costs such as copayments or premiums if you itemize your income taxes. Unreimbursed medical or dental expenses may be deductible if they exceed 7.5% your adjusted gross income. Part A premiums can be deducted under certain circumstances.

Do I get a refund on Medicare tax withheld?

If social security or Medicare taxes were withheld in error from pay that is not subject to these taxes, contact the employer who withheld the taxes for a refund. If you are unable to get a full refund of the amount from your employer, file a claim for refund with the Internal Revenue Service on Form 843, Claim for Refund and Request for Abatement.

Can you deduct Medicare payments?

beneficiaries who are admitted to hospital will pay $1,556 inpatient hospital deductible for their share of costs for the first 60 days under Medicare Part A. This is an increase of $72 from $ ...

Are Medicare premiums taxable?

You may be able to receive additional breaks when filing your 2021 income-tax return. Whether you have health insurance through your employer or on your own, or even if you’re covered by Medicare, you usually have to pay monthly premiums for your coverage.

Can I claim Medicare on my tax return?

Since 2012, the IRS has allowed self-employed individuals to deduct all Medicare premiums (including premiums for Medicare Part B – and Part A, for people who have to pay a premium for it – Medigap, Medicare Advantage plans, and Part D) from their federal taxes, and this includes Medicare premiums for their spouse.

Are Medicare premiums included in taxable income?

The IRS permits someone to deduct many medical expenses from their income tax return. This includes the premiums, coinsurance, copays, and deductibles associated with Medicare programs. A person may also deduct some healthcare expenses that Medicare does not cover.

Can I deduct Social Security and Medicare taxes?

However, you figure self-employment tax (SE tax) yourself using Schedule SE (Form 1040 or 1040-SR). Also, you can deduct the employer-equivalent portion of your SE tax in figuring your adjusted gross income. Wage earners cannot deduct Social Security and Medicare taxes.

Does income tax include Social Security and Medicare?

FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings.

How much can I deduct for Medicare?

For example: Let’s say your AGI is $40,000, and your total out-of-pocket Medicare expenses during the year are $4,500. Because of the 7.5% threshold, you’ll be able to deduct expenses beyond the first $3,000. Your total deduction on your tax return would be $1,500.

How do income limits work for Medicare tax deductions?

First, your qualified medical expenses must exceed 7.5% of your adjusted gross income (AGI). Tally up the costs of all unreimbursed Medicare and other health or dental expenses to determine if you’ve spent enough money to qualify for the de duction.

What expenses are not eligible for a Medicare tax deduction?

However, you should be aware of costs that don't fit the bill. For example, Medicare expenses that are reimbursable are not eligible for a tax deduction.

How many parts does Medicare have?

Medicare has four major parts: Parts A, B, C ( Medicare Advantage ), and D. How many premiums you pay per month depends on what kind of additional coverage you choose, if any.

What percentage of Medicare is deductible?

Medicare expenses that exceed 7.5% of your adjusted gross income may be deductible.

Can you deduct Part B premiums?

Late penalties on Part B or Part D premiums are not eligible to be deducted. Generally, you can't deduct prescription drugs purchased abroad unless it's legal in the other country and the U.S. Nonprescription drugs — like supplements or vitamins — are not usually considered allowable unless specifically recommended to you by your doctor to treat a particular medical condition.

Can you deduct Uber ride to medical appointments?

Surprisingly, the IRS’ list of allowable expenses is fairly comprehensive. Many of the costs associated with the diagnosis or treatment of an illness or injury are considered “allowable.” This includes everything from preventative care and medical equipment to transportation to obtain healthcare services. That’s right: You can deduct your mileage, taxi fare or Uber ride to your healthcare appointments.

How much of your Medicare premiums are deductible?

Your unreimbursed medical and dental expenses, including premiums, deductibles, copayments and other Medicare expenses, may be deductible to the extent that they exceed 7.5% of your adjusted gross income.

How much can you deduct for long term care insurance?

For tax year 2020, the maximum tax deduction for long-term care premiums for people ages 61 to 70 is $4,350 per person; for age 71 and up, the limit is $5,430.

Is copayment deductible?

If you itemize, premiums, copayments and certain other expenses may be deductible.

Is long term care insurance tax deductible?

Other health care expenses may be deductible. Medicare recipients may incur a variety of medical expenses that their insurance does not cover, from long-term care to lodging during a trip to receive medical care. Some of these expenses may be tax deductible, within limits. There are limits on the deductibility of long-term care insurance premiums.

How to file a medical claim?

Follow the instructions for the type of claim you're filing (listed above under "How do I file a claim?"). Generally, you’ll need to submit these items: 1 The completed claim form (Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB]) 2 The itemized bill from your doctor, supplier, or other health care provider 3 A letter explaining in detail your reason for submitting the claim, like your provider or supplier isn’t able to file the claim, your provider or supplier refuses to file the claim, and/or your provider or supplier isn’t enrolled in Medicare 4 Any supporting documents related to your claim

What to call if you don't file a Medicare claim?

If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227) . TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got. If it's close to the end of the time limit and your doctor or supplier still hasn't filed the claim, you should file the claim.

How do I file a claim?

Fill out the claim form, called the Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB). You can also fill out the CMS-1490S claim form in Spanish.

What is an itemized bill?

The itemized bill from your doctor, supplier, or other health care provider. A letter explaining in detail your reason for submitting the claim, like your provider or supplier isn’t able to file the claim, your provider or supplier refuses to file the claim, and/or your provider or supplier isn’t enrolled in Medicare.

How long does it take for Medicare to pay?

Medicare claims must be filed no later than 12 months (or 1 full calendar year) after the date when the services were provided. If a claim isn't filed within this time limit, Medicare can't pay its share. For example, if you see your doctor on March 22, 2019, your doctor must file the Medicare claim for that visit no later than March 22, 2020.

What happens after you pay a deductible?

After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). , the law requires doctors and suppliers to file Medicare. claim. A request for payment that you submit to Medicare or other health insurance when you get items and services that you think are covered.

When do you have to file Medicare claim for 2020?

For example, if you see your doctor on March 22, 2019, your doctor must file the Medicare claim for that visit no later than March 22, 2020. Check the "Medicare Summary Notice" (MSN) you get in the mail every 3 months, or log into your secure Medicare account to make sure claims are being filed in a timely way.

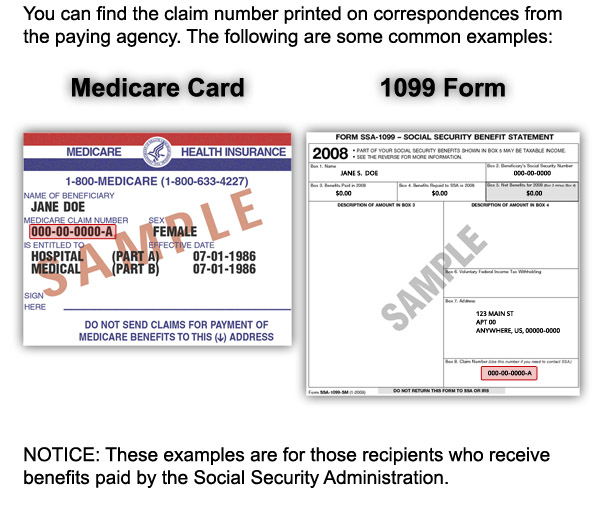

What Documents Do You Need To Deduct Medicare Premiums?

Most people have any Medicare Part A and Part B premiums deducted from their Social Security benefit. If you do, you will receive a form each year called SSA-1099. The SSA-1099 statement will show the premiums you paid for Part B, and you can use this information to itemize your premiums when you file your taxes.

How to look up local Medicare insurance agents?

Use the Association’s free online directory to look up local Medicare insurance agents in your immediate area. Over 1,000 of the nation’s top professionals are listed. Many offer all Medicare options including Medicare Advantage, Medicare Supplement and Part D prescription drug plans.

What is SSA-1099?

The SSA-1099 statement will show the premiums you paid for Part B, and you can use this information to itemize your premiums when you file your taxes. In addition, you will receive a form from Medicare called a Medicare Summary Notice.

Is Medicare Part B tax deductible?

Medicare Part B premiums are tax deductible as long as you meet the income rules. Medicare Part C premiums. You can deduct any Medicare Part C premiums if you meet the income rules. Medicare Part D premiums. As with Parts B and C, you can deduct your Part D premiums if you meet the income rules. Medicare Supplement insurance (Medigap).

Do you need to itemize Medicare premiums?

on for their health insurance premiums, including Medicare premiums. So, they don’t need to itemize to get the tax savings from their premiums.

Can you deduct medical expenses on Medicare?

In addition to your Medicare premiums, and Medicare insurance premiums, you can deduct various medical expenses. They include:

Does Medicare Supplement Insurance give tax advice?

The American Association for Medicare Supplement Insurance does NOT offer or give any tax advice.

How to find out if Medicare premiums came out of Social Security?

“It doesn’t exactly pop out at you.” You’ll receive an SSA-1099 from the Social Security Administration which will have a summary of the Medicare premiums that were withheld from your Social Security check during the past year. And keep in mind that if you’re paying premiums directly to an insurance company for Medigap, Medicare Part D, or Medicare Advantage, you should tally up those amounts too. (In some cases, they might be withheld from your Social Security check as well, and will then be reflected on the SSA-1099.)

How much is the standard deduction for 2021?

For 2021, the standard deduction is $12,550 for individuals, $25,100 for married joint filers, and $18,800 for those who file as head of household. Most people come out ahead with the standard deduction, but the best approach will depend on your specific circumstances.

Can I deduct health insurance premiums on 1040?

Self-employed people (who earn a profit from their self-employment) are allowed to deduct their health insurance premiums on Schedule 1 of the 1040, as an “above the line” deduction — which means it lowers their AGI.

Can a S corporation pay Medicare premiums?

If you’ve established your business as an S corporation, the corporation can either pay your Medicare premiums directly on your behalf (and count them as a business expense) or the corporation can reimburse you for the premiums, with the amount included in your gross wages reported on your W2, and you can then deduct it on Schedule 1 of your 1040.

Do you have to be self employed to itemize medical expenses?

So you don’t have to be self-employed to itemize your deductions, including medical expenses – and your Medicare premiums count as medical expenses if you’re itemizing. But if you’re using the itemized deduction approach, you can only deduct medical expenses that exceed a certain amount, as explained below.

Can you deduct Medicare premiums on your taxes?

Some Medicare beneficiaries, however, have the opportunity to deduct their Medicare premiums when they file their taxes. “It’s really simple and it’s often overlooked and it will not happen automatically,” says Mark Steber, Chief Tax Officer at Jackson Hewitt. “It doesn’t make its way to your tax return, your tax software – even your tax professional may not know – so ask about it and see if you qualify.”

Can self employed people deduct Medicare premiums?

Since 2012, the IRS has allowed self-employed individuals to deduct all Medicare premiums (including premiums for Medicare Part B – and Part A, for people who have to pay a premium for it – Medigap, Medicare Advantage plans, and Part D) from their federal taxes, and this includes Medicare premiums for their spouse.

How to claim FICA tax refund?

How to Claim a FICA Tax Refund. To claim a refund of Social Security and Medicare taxes, you will need to complete and submit IRS Form 843 . When you apply for a refund from the IRS, include either: A letter from your employer stating how much you were reimbursed.

Who Is Exempt From FICA Taxes?

An exemption from Social Security and Medicare taxes applies to non-immigrant students, scholars, teachers, researchers, and trainees (including medical interns) who are temporarily present in the United States on F-1, J-1, M-1, or Q-1 visas as long as they remain nonresidents for federal income tax purposes .

Is what you pay into Social Security and Medicare calculated in your tax refund?

You can claim excess FICA taxes as a credit toward your income taxes in some cases. You can do this when you file your Form 1040 if you had multiple employers and too much withheld. But the IRS requires you to first try to get the credit back from your employer if you had just one employer. File Form 843 if that's unsuccessful. You can't claim a credit on Form 1040 in this case. 11

How long does it take to get a FICA refund?

Requesting a FICA refund isn't a very quick process. It can take the IRS three to four months to review your request and issue your refund.

How much is Social Security taxed in 2020?

If you are an employee, FICA taxes are withheld from your paycheck along with income tax. The Social Security portion of the FICA tax is subject to a cap—$137,700 in 2020, and $142,800 in 2021. This is referred to as the " wage base .".

What is the FICA tax for 2021?

The Social Security and Medicare taxes that are withheld from your paychecks are collectively referred to as the Federal Insurance Contributions Act tax, or "FICA tax.". You pay half of these taxes, and your employer pays half: 7.65% of your salary or wages each for a total of 15.3%. 1.

What box on W-2 shows Social Security?

Attach a copy of your Form W-2 for the tax year in question to substantiate how much was withheld from your pay. 8 Boxes 4 and 6 on the W-2 show how much in Social Security and Medicare taxes was withheld.

What Are the Allowable Tax Deductions for Medicare Beneficiaries?

Any costs associated with the treatment or diagnosis of a medical condition or an injury can be deducted. This includes preventive care and the cost of any medical equipment or supplies.

What is above the line deduction?

Another example is work-related moving expenses. Above-the-line tax deductions refer to the types of contributions and payments mentioned above . Those amounts get deducted before your AGI is calculated.

Are All Medicare Expenses Applicable to Deductions?

Not all Medicare Supplement expenses are applicable for tax deductions. Although the cost of Medigap premiums is subject to tax deductions, not all expenses are deductible.

What Are the Four Major Categories of Tax Deductions?

There are four primary categories of tax deductions. These are business deductions, standard deductions, above-the-line deductions, and below-the-line deductions. We will explain in detail what each means below.

What is a Business Tax Deduction?

Business owners are required to incorporate their business earnings when they file their tax returns. Sole proprietors do this by a separate calculation of net profit or loss where all income and deductions are reported.

What are the different types of deductions?

What Are the Four Major Categories of Tax Deductions? 1 Business Deductions 2 Standard Deductions 3 Above the Line Deductions 4 Below the Line Deductions

What is the AGI for taxes?

The AGI is your gross income minus adjustments, such as student loan interest, retirement account contributions, and alimony payments. Another example is work-related moving expenses.

When Do I Need to File A Claim?

How Do I File A Claim?

- Fill out the claim form, called the Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB). You can also fill out the CMS-1490S claim form in Spanish.

What Do I Submit with The Claim?

- Follow the instructions for the type of claim you're filing (listed above under "How do I file a claim?"). Generally, you’ll need to submit these items: 1. The completed claim form (Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB]) 2. The itemized bill from your doctor, supplier, or other health care provider 3. A letter explaining in detail your reason for subm…

Where Do I Send The Claim?

- The address for where to send your claim can be found in 2 places: 1. On the second page of the instructions for the type of claim you’re filing (listed above under "How do I file a claim?"). 2. On your "Medicare Summary Notice" (MSN). You can also log into your Medicare accountto sign up to get your MSNs electronically and view or download them an...