Visiting a local Social Security office The United States Social Security Administration is an independent agency of the U.S. federal government that administers Social Security, a social insurance program consisting of retirement, disability, and survivors' benefits. To qualify for most of these benefits, most workers pay Social …Social Security Administration

Full Answer

How to enrol and get started in Medicare?

- income tax form that shows health insurance premiums paid;

- W-2s reflecting pre-tax medical contributions;

- pay stubs that reflect health insurance premium deductions;

- health insurance cards with a policy effective date;

- explanations of benefits paid by the GHP or LGHP; or

- statements or receipts that reflect payment of health insurance premiums.

Will I be automatically enrolled in Medicare?

Enrollment will happen automatically. For example, if you took retirement benefits at 62 instead of full retirement age, you’ll be enrolled in Medicare three months before your 65th birthday. You could also be automatically enrolled if you’ve been receiving Social Security Disability Insurance (SSDI) for 24 months.

When can you enroll in Medicare?

When you first qualify for Medicare you enroll during the Initial Enrollment Period. The Initial Enrollment Period is a seven-month period that starts three months before you are first eligible for Medicare. For example, Mary Doe Jones turned 65 on April 27, 2021. She is first eligible for Medicare starting in April 2021 because she is turning 65.

How do I enroll in Medicare?

How do I enroll in Medicare? You apply for Medicare with the Social Security Administration. Contact the Social Security Administration in the way that is most convenient for you. Call Social Security at a toll-free number (800) 772-1213 to schedule an appointment with your local Social Security office - in person or over phone.

How do I know which Medicare plan is right for me?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

What are the four different types of Medicare plans one can be enrolled in?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

Which 2 Medicare plans Cannot be enrolled together?

You generally cannot enroll in both a Medicare Advantage plan and a Medigap plan at the same time.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Who does AARP recommend for Medicare?

UnitedHealthcareAARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Who is the best provider for Medicare?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCoverage areaBlue Cross Blue Shield5.0Offers plans in 48 statesCigna4.5Offers plans in 26 states and Washington, D.C.United Healthcare4.0Offers plans in all 50 statesAetna3.5Offers plans in 44 states1 more row•Jun 8, 2022

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

What is the difference between advantage and supplement plans?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Is a Medigap plan better than an Advantage plan?

If you are in good health with few medical expenses, Medicare Advantage can be a suitable and money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

What is Medicare Supplement Insurance?

You can get a Medicare Supplement Insurance (Medigap) policy to help pay your remaining out-of-pocket costs (like your 20% coinsurance). Or, you can use coverage from a former employer or union, or Medicaid.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What are the extra benefits that Medicare doesn't cover?

Plans may offer some extra benefits that Original Medicare doesn’t cover—like vision, hearing, and dental services.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

How to join a health insurance plan?

Contact the plan to join. You can call them or visit their website. You can also ask for a paper form to fill out and mail back to the plan, but they must get it before your enrollment period ends.

Where is Medicare and You listed?

Use your “Medicare & You” handbook to find plans – they’re listed in the back.

What to do if you have other health insurance?

If you have other health insurance or drug coverage, talk to your benefits administrator or other insurance provider before you make any changes to your current coverage.

Can you join a plan at certain times?

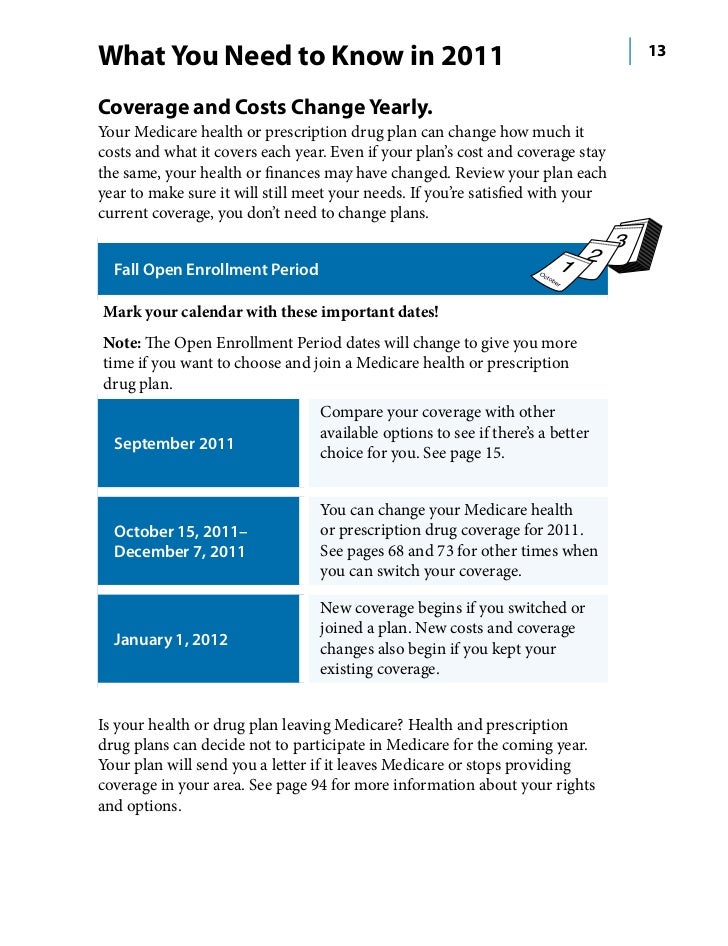

You can only join, switch, or drop a plan at certain times, called enrollment periods. Learn more about enrollment periods, when you can use them, and the types of plans you can join.

How many days are there to make Medicare choices?

That’s day one of the 54 days when Americans 65 and older have to make their Medicare choices for 2018. These choices could save you hundreds, perhaps thousands of dollars a year and could well determine the quality of your health care, and your health, for years to come.

How much does Medicare cost a month?

Part A is free to most people who qualify for Medicare. You need to pay for Part B — the standard premium this year is about $134 a month, or $109 a month for most people who have their premium deducted from their Social Security checks. However, the premium rate is higher if your income is above a certain threshold. There are deductibles and copays involved with both parts.

How much does Medicare cover for hospital stays?

There are many other costs you need to cover under Medicare. For example, Medicare Part A covers 100 percent of the first 60 days of a hospital stay. But for original Medicare enrollees, you must cover a deductible for each hospital stay. In 2017 that deductible was $1,316.

How much is Medicare Advantage premium?

The Centers for Medicare and Medicaid Services (CMS) says the average Medicare Advantage premium is expected to be about $30 a month for 2018, a slight dip from 2017. CMS also is predicting that enrollment in MA plans will reach an all-time high next year of 20.4 million people.

What is the difference between Medicare Part A and Medicare Part B?

Original Medicare comprises two parts: Medicare Part A, which provides coverage for most costs related to hospital stays , and Medicare Part B, which covers doctor visits, lab work, outpatient services and preventive care. Part A is free to most people who qualify ...

What is Medicare Part D?

It approved the creation of Medicare Part D, which provides low-cost plans that cover prescription drugs. If you choose not to enroll in Part D when you're first eligible, you likely will pay a penalty when you do sign up, unless you’ve had creditable drug coverage from another source.

What happens if you don't enroll in Part D?

If you choose not to enroll in Part D when you're first eligible, you likely will pay a penalty when you do sign up, unless you’ve had creditable drug coverage from another source. One challenge: Part D plans vary widely. For example, two plans may have very different copays for the same drug.

When Can I Enroll In Medicare?

Remember, you are automatically eligible to receive Medicare the day you turn 65. If you are already receiving Social Security benefits and enrolled in Medicare before you hit 65, you will automatically be enrolled in Part A of Medicare.

Can I Add, Drop, And Change Coverage?

You can’t add, drop, and change coverage as you please. There are certain times and dates when you can do this. There can also be some confusion as to whether or not there will be fees or penalties for adding certain coverage or dropping it from your plan.

How to determine which Medicare plan is right for you?

To determine which type of Medicare coverage is right for you, you’ll need to compare coverage and prices for Medicare Advantage plans available in your area against Original Medicare with or without Supplement Insurance. Here’s what to consider.

What to check after choosing Medicare Advantage?

So, after you choose a Medicare Advantage plan, you’ll want to check each year during open enrollment to see if there are any changes in your network. It’s also a good idea to find out which specialists, hospitals, home health agencies and skilled nursing facilities are in the plan’s network.

What is coinsurance in Medicare?

Copays are a set amount you pay for each prescription filled, say $10 or $20. Coinsurance is the percentage of the drug cost that you pay, such as 10% or 20%.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance helps cover the out-of-pocket health care costs you can incur with Original Medicare Part A and Part B and hospice and home health care services. (If you have an Advantage plan, you may not purchase Medicare Supplement Insurance.) There are 10 standardized plans and premiums are regulated by the states. Massachusetts, Maine and WIsconsin have their own standardization. What you pay in monthly premiums can depend on where you live, what coverage you get and how old you are. You can learn more in this guide on comparing and selecting plans, with a side-by-side comparison of the different policies.

How much is Medicare Part A 2021?

Medicare Part A beneficiaries who have Original Medicare pay an inpatient hospital deductible of $1,484 in 2021 for a benefit period of up to 60 days. There is no coinsurance for hospital stays up to 60 days.

What is Medicare Advantage?

Medicare Advantage plans usually contract with a network of providers to help keep costs down, enabling most plans to provide additional benefits beyond those offered in Original Medicare.

What is the difference between Medicare Advantage and Original Medicare?

One main difference between Medicare Advantage and Original Medicare is access to providers. With Original Medicare, you may visit any provider that accepts Medicare payments.

How to get free health insurance counseling?

Contact your local State Health Insurance Assistance Program (SHIP) to get free personalized health insurance counseling. SHIPs aren’t connected to any insurance company or health plan.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare.

What extra benefits does Medicare not cover?

Some extra benefits (that Original Medicare doesn’t cover – like vision, hearing, and dental services )

Do you pay monthly premiums for Part B?

Most plans have a monthly premium that you pay in addition to your Part B premium. You’ll also pay other costs when you get prescriptions.

What happens if you don't sign up for Medicare?

If you don’t sign up within seven months of turning 65 (three months before your 65 th birthday, your birthday month, and three months after), you will pay a 10% penalty for every year you delay. Enroll in a Medicare Advantage plan, which is a privately-run health plan approved by the government to provide Medicare benefits.

What is a Medigap plan?

If you have Original Medicare, you might also consider a Medigap plan, which will fill in other the gaps in Medicare coverage, reducing how much you spend each time you go for medical care.

Does Part D cover prescriptions?

It will help cover the cost of your prescription medications. Similar to Part B, there is a financial penalty if you do not sign up for a Part D plan when you are first eligible, unless you have other prescription drug coverage.

How long before Medicare card is sent out?

We’ll mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

How long after you sign up for Part A do you have to sign up for Part B?

You get Part A automatically. If you want Part B, you need to sign up for it. If you don’t sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

How long do you have to sign up for Part A?

You get Part A automatically. If you want Part B, you need to sign up for it. If you don’t sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

How to contact railroad retirement board?

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

How to find Medicare Advantage plan?

While you search for your Medicare Advantage plan, here are a few questions to keep in mind: 1 Do you have a favorite doctor you’ve been seeing for years? If you choose a plan with a network of preferred providers, make sure your doctor is on the list. The same is true of hospitals — if you have several in your region, it’s good to know that the one you prefer will accept your Advantage insurance. 2 Do you take medications on a maintenance schedule? If so, make sure that your plan includes drug coverage. Most Medicare Advantage plans do — but not all of them. 3 What is your chosen plan’s deductible? The higher the deductible, the more you’ll pay out-of-pocket before your plan kicks in. 4 Likewise, what are the copays? If you frequently need to see a healthcare professional for a chronic condition, a plan with lower copays makes sense, and may even make up for higher monthly premiums. 5 Do you have frequent vision, dental, or hearing issues? A plan that covers these health care needs may save you money.

How many people are eligible for Medicare Advantage?

In fact, more than 23 million people, out of the 61 million who are eligible for Medicare choose Advantage plans over Original Medicare.

Why are Medicare Advantage plans so popular?

Why the popularity? Medicare Advantage plans differ depending on the company that is overseeing them, but in general they offer benefits beyond what Medicare Part A and B offer, such as vision, hearing, and dental coverage, gym memberships, and drug coverage. Plus, the all-in-one nature of the plans makes them easy to manage. Choosing a plan that’s right for your circumstances may also save you money in the end.

Does Medicare cover all areas of the country?

Since most insurance companies offer only regional coverage, not all plans will be active in all areas of the country. To find out the plans that are available in your area, start with the Medicare “ Find a Medicare Plan” page.

Is it worth it to compare health insurance plans?

It may take a little time to compare all the plans and weigh your options, but it’s worth it to find a plan that will provide you with excellent and comprehensive health care at a cost that works for you.

Can you go out of network with Medicare Advantage?

But you can go out-of-network when needed, though there may be a higher copay or coinsurance cost.