You can search the MPFS on the federal Medicare website to find out the Medicare reimbursement rate for specific services, treatments or devices. Simply enter the HCPCS code and click “Search fees” to view Medicare’s reimbursement rate for the given service or item. You may enter up to five codes at a time or a range of codes.

Full Answer

How can I see how much a patient pays with Medicare?

You’ll see how much the patient pays with Original Medicare and no supplement (Medigap) policy. code. Enter a CPT code or HCPCS code. These are used for billing insurance. You might get them from your health care provider.

How do I Pay my Medicare premiums?

There are several payment options, including sending a check or money order, mailing your credit card information or using your bank’s payment service. However, paying online via the MyMedicare.gov website is one of the best options because it’s free and secure. It’s also fast, with payments usually processed in five business days.

How do I find Medicare reimbursement rates?

You can also find Medicare reimbursement rates if you know the CPT or HCPCS code for the service or item being billed and have access to the Medicare Physician Fee Schedule, which is essentially a master list of all reimbursement rates. The MPFS is updated on a quarterly basis to reflect the most recent changes to reimbursement rates.

How do I View my Medicare premium payment history online?

You’re also able to view your premium payment history online with Easy Pay. Type your username and password into the MyMedicare account page. Select “My Premiums” from the navigation menu at the top of the screen, then choose “Sign Up.” Complete the online form with your details and submit it.

How do I check my Medicare payments?

Visiting MyMedicare.gov. Calling 1-800-MEDICARE (1-800-633-4227) and using the automated phone system. TTY users can call 1-877-486-2048 and ask a customer service representative for this information. If your health care provider files the claim electronically, it takes about 3 days to show up in Medicare's system.

How much do I pay every month for Medicare?

$170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Is your Medicare premium deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What will Medicare cost in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How much will be deducted from my Social Security check for Medicare in 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

At what income level do my Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

Is Medicare Part B automatically deducted?

If you collect RRB or Social Security benefits, Part B is deducted automatically. One of the main perks of Medicare is that you can have your Medicare premiums automatically taken out of your Social Security or Railroad Retirement Board benefits.

What to do with Medicare notice?

What to do with the notice. If you have other insurance, check to see if it covers anything that Medicare didn’t. Keep your receipts and bills, and compare them to your MSN to be sure you got all the services, supplies, or equipment listed. If you paid a bill before you got your notice, compare your MSN with the bill to make sure you paid ...

How often do you get a Medicare summary notice?

Medicare summary notice. People with Original Medicare will receive a Medicare Summary Notice (MSN) in the mail every three months for their Medicare Parts A and B-covered services. This is strictly a notice, not a bill.

What to do if you paid before you got your MSN?

If you paid a bill before you got your notice, compare your MSN with the bill to make sure you paid the right amount for your services. If an item or service is denied, call your medical provider's office to make sure they submitted the correct information. If not, the office may resubmit.

How often do you get Medicare premiums?

If you only have Medicare Part B and don’t get your Part B premiums deducted from your benefits, you’ll receive a premium bill every three months . If you have to buy Part A or owe Part D income-related monthly adjustment amounts (IRMAA), you’ll get a monthly premium bill.

When is Medicare payment due?

You’ll have your payment due on the 25th of the month, so pay early to allow processing time. Whether you prefer making individual payments or enjoy the convenience of automated payment options, Medicare's online portal has you covered.

What to do if you don't receive Medicare?

If you don’t receive these benefits, you’ll need to decide how to pay your Medicare premium bill (in which case, you may need to use Form CMS-500 ). There are several payment options, including sending a check or money order, mailing your credit card information or using your bank’s payment service.

How long does it take to get your Easy Pay payment?

Complete the online form with your details and submit it. It will take between 6-8 weeks before Easy Pay starts deducting your payments, so remember to make manual payments until you receive confirmation you’re signed up to Easy Pay.

Can you save on Medicare Supplement?

Learn How to Save on Medicare. Medicare Supplement Insurance plans (also called Medigap) can’t cover your Medicare premiums, but they can help make your Medicare spending more predictable by paying for some of your other out-of-pocket costs such as Medicare deductibles, copayments, coinsurance and more.

Does Medicare Easy Pay work?

Medicare Easy Pay is another payment option available to MyMedicare members. This program costs nothing to use, and it automatically deducts premiums from your checking or savings account when they’re due, ensuring you maintain continuous coverage. You’re also able to view your premium payment history online with Easy Pay.

How much does Medicare cover?

Since Medicare only covers about 80% of your medical bills, many people add on a Medicare Supplement to pick up the remaining costs. The monthly premium for a Medicare Supplement will depend on which plan you choose, your age, your gender, your zip code, and your tobacco usage.

How much does Medicare Part B cost in MA?

Often times, MA plans also include a drug benefit, so you also replace Part D. However, you still must pay the $148.50 monthly premium for Medicare Part B. MA premiums vary, depending on which type of plan you choose, which area you’re in, and other similar factors.

What is Medicare MSA?

A Medicare MSA, a type of Medicare Advantage plan, is another option for seniors. The most widely available plan is from Lasso Healthcare, and it is $0 premium. An MSA combines high-deductible health coverage with an annually funded medical savings account.

How much is Medicare Part A deductible for 2021?

The Medicare Part A deductible, as well as the coinsurance for care, fluctuates slightly every year, but here are the current costs for 2021: $1,484 deductible. Days 1-60: $0 coinsurance. Days 61-90: $371 coinsurance. Days 91+: $742 coinsurance per “lifetime reserve day,” which caps at 60 days. Beyond lifetime reserve days: You pay all costs.

What will Medicare pay for in 2021?

2021 Medicare Part A Costs. Medicare Part A helps cover bills from the hospital. So, if you are admitted and receive inpatient care, Medicare Part A is going to help with those costs. If you’ve worked at least 10 years or can draw off a spouse who has, Medicare Part A is free to have.

How much is coinsurance for days 21 through 100?

For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $185.50 in 2021.

Does Medicare Part A have coinsurance?

That means you don’t have any monthly costs to have Medicare Part A . This doesn’t mean that Medicare Part A doesn’t have other costs like a deductible and coinsurance – because it does – but you won’t have to pay those costs unless you actually need care. For most people, having Medicare Part A is free.

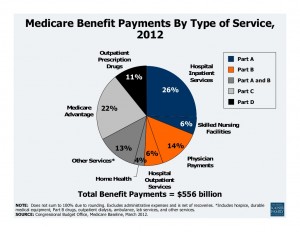

What does Medicare cover?

What you pay for Medicare depends on the type of enrollment you have: Parts A, B, C, and/or D. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. It doesn't generally charge a premium. Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium ...

How much does Medicare pay for a hospital stay in 2021?

Part A also charges coinsurance if your hospital stay lasts more than 60 days. In 2021, for days 61 to 90 of your hospital stay, you pay $371 per day; days 91 through the balance of your lifetime reserve days, you pay $742 per day. 3 Lifetime reserve days are 60 days that Medicare gives you to use if you stay in the hospital for more than 90 days.

What is Medicare Part A 2021?

Medicare Part A Costs in 2021. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. 1 For most people, this is the closest thing to free they’ll get from Medicare, as Medicare Part A (generally) doesn't charge a premium. 2 . Tip: If you don't qualify for Part A, you can buy Part A coverage.

How much will Medicare cost in 2021?

In 2021, it costs $259 or $471 each month, depending on how long you paid Medicare taxes. 2 . That doesn’t mean you aren’t charged a deductible. For each benefit period, you pay the first $1,484 in 2021. A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days.

What is the premium for Part B?

Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium of $148.50 in 2021. A small percentage of people will pay more than that amount if reporting income greater than $88,000 as single filers or more than $176,000 as joint filers. 3

What is the cost of Part B insurance?

Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium of $148.50 in 2021. Parts C and D are optional and may cover additional costs, including prescriptions.

Can you get Medicare Supplement if you don't have other health insurance?

If you did some simple math, you probably noticed that an extended hospital stay could cost you a lot of money. That’s why it’s important to consider adding a Medicare supplement to your Original Medicare plan or enrolling in a Medicare Advantage plan if you don't have other health coverage in addition to Medicare.

How much does Medicare pay for coinsurance?

In fact, Medicare’s reimbursement rate is generally around only 80% of the total bill as the beneficiary is typically responsible for paying the remaining 20% as coinsurance. Medicare predetermines what it will pay health care providers for each service or item. This cost is sometimes called the allowed amount but is more commonly referred ...

How much more can a health care provider charge than the Medicare approved amount?

Certain health care providers maintain a contract agreement with Medicare that allows them to charge up to 15% more than the Medicare-approved amount in what is called an “excess charge.”.

What is Medicare reimbursement rate?

A Medicare reimbursement rate is the amount of money that Medicare pays doctors and other health care providers for the services and items they administer to Medicare beneficiaries. CPT codes are the numeric codes used to identify different medical services, procedures and items for billing purposes. When a health care provider bills Medicare ...

Is it a good idea to check your Medicare bill?

It’s a good idea for Medicare beneficiaries to review their medical bills in detail. Medicare fraud is not uncommon, and a quick check of your HCPCS codes can verify whether or not you were correctly billed for the care you received.