To find out if Medicare paid a certain bill, you can review your Medicare Summary Notice, which is sent out every three months or so to the address Medicare has on file for you. If you need this information now, you can go online and look at your Medicare Summary Notice which will be up to date.

- Log into (or create) your Medicare account. Select “My premiums,” then, “Payment history.”

- Call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048.

Did not receive Medicare bill?

If you’re having trouble paying your premiums now or if you have any questions about your Medicare premium bill, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. If you have limited income and resources, your state may help pay your Medicare premiums. You may also qualify for Extra Help to pay for your Part D drug coverage.

How to read Medicare bill?

Main St. in Red Springs. During that time, West allegedly conspired with the owner of the pharmacy and others to bill fraudulent claims to Medicare, Medicaid, and private health insurers, such as Blue Cross and Blue Shield of NC. According to the charge ...

Who pays Medicare bills?

4 Reasons You Might Want to Use a Credit Card to Pay Medical Bills

- Credit Card Rewards. Rewards credit cards give you the potential to earn points, miles or cash back on purchases you need to make anyway.

- Convenience. Credit cards are a convenient way to pay for medical bills and a wide variety of other charges. ...

- Fraud Protections. ...

How to get help when you have problems with Medicare?

What To Do If There Is A Medicare Billing Error, Or You Suspect One Occurred

- It could be an accident. Accidents happen—even with billion-dollar government programs. ...

- Make sure you’re not being scammed. On the other hand, an “accident” could disguise itself as fraud. ...

- Check with Social Security. ...

- Fill out the right form. ...

- Know who is billing you. ...

How do I check my Medicare payments?

Visiting MyMedicare.gov. Calling 1-800-MEDICARE (1-800-633-4227) and using the automated phone system. TTY users can call 1-877-486-2048 and ask a customer service representative for this information. If your health care provider files the claim electronically, it takes about 3 days to show up in Medicare's system.

Can I see my Medicare bill online?

You can use your online MyMedicare account to view your Medicare premium bills, check your payment history and set up Medicare Easy Pay for auto payments.

How do I find out when my Medicare payment is due?

All Medicare bills are due on the 25th of the month. In most cases, your premium is due the same month that you get the bill. Example of our billing timeline. For your payment to be on time, we must get your payment by the due date on your bill.

Is your Medicare premium deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

How often are Medicare Part B premiums paid?

You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

How often do you get Medicare premiums?

If you only have Medicare Part B and don’t get your Part B premiums deducted from your benefits, you’ll receive a premium bill every three months . If you have to buy Part A or owe Part D income-related monthly adjustment amounts (IRMAA), you’ll get a monthly premium bill.

What to do if you don't receive Medicare?

If you don’t receive these benefits, you’ll need to decide how to pay your Medicare premium bill (in which case, you may need to use Form CMS-500 ). There are several payment options, including sending a check or money order, mailing your credit card information or using your bank’s payment service.

How many characters are required for a password?

Choose a password. It must be 8-16 characters, with at least one letter, one number and one of the approved special characters. It should not contain your username, Medicare, or Social Security number. Type your password in the two separate fields to confirm it.

How long does it take to get your Easy Pay payment?

Complete the online form with your details and submit it. It will take between 6-8 weeks before Easy Pay starts deducting your payments, so remember to make manual payments until you receive confirmation you’re signed up to Easy Pay.

How many people used the internet in 2000?

In 2000, just 14% of Americans aged 65 and older used the internet. A Pew Research Center report released in 2019 found that the number had grown to 73%. 1. If you’re one of these digitally-savvy people, you’re probably interested in the ways technology can simplify your life. Signing up for Medicare’s MyMedicare online portal is a great way ...

Does Medicare Easy Pay work?

Medicare Easy Pay is another payment option available to MyMedicare members. This program costs nothing to use, and it automatically deducts premiums from your checking or savings account when they’re due, ensuring you maintain continuous coverage. You’re also able to view your premium payment history online with Easy Pay.

When is Medicare payment due?

You’ll have your payment due on the 25th of the month, so pay early to allow processing time. Whether you prefer making individual payments or enjoy the convenience of automated payment options, Medicare's online portal has you covered.

What is MSN in Medicare?

The MSN is a notice that people with Original Medicare get in the mail every 3 months. It shows: All your Part A and Part B-covered services or supplies billed to Medicare during a 3-month period. What Medicare paid. The maximum amount you may owe the provider. Learn more about the MSN, and view a sample.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

How long does it take to see a Medicare claim?

Log into (or create) your secure Medicare account. You’ll usually be able to see a claim within 24 hours after Medicare processes it. A notice you get after the doctor, other health care provider, or supplier files a claim for Part A or Part B services in Original Medicare.

What is Medicare Part A?

Check the status of a claim. To check the status of. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. or.

What is a PACE plan?

PACE plans can be offered by public or private companies and provide Part D and other benefits in addition to Part A and Part B benefits. claims: Contact your plan.

Does Medicare Advantage offer prescription drug coverage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. Check your Explanation of Benefits (EOB). Your Medicare drug plan will mail you an EOB each month you fill a prescription. This notice gives you a summary of your prescription drug claims and costs.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or other. Medicare Health Plan. Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan.

What to do with Medicare notice?

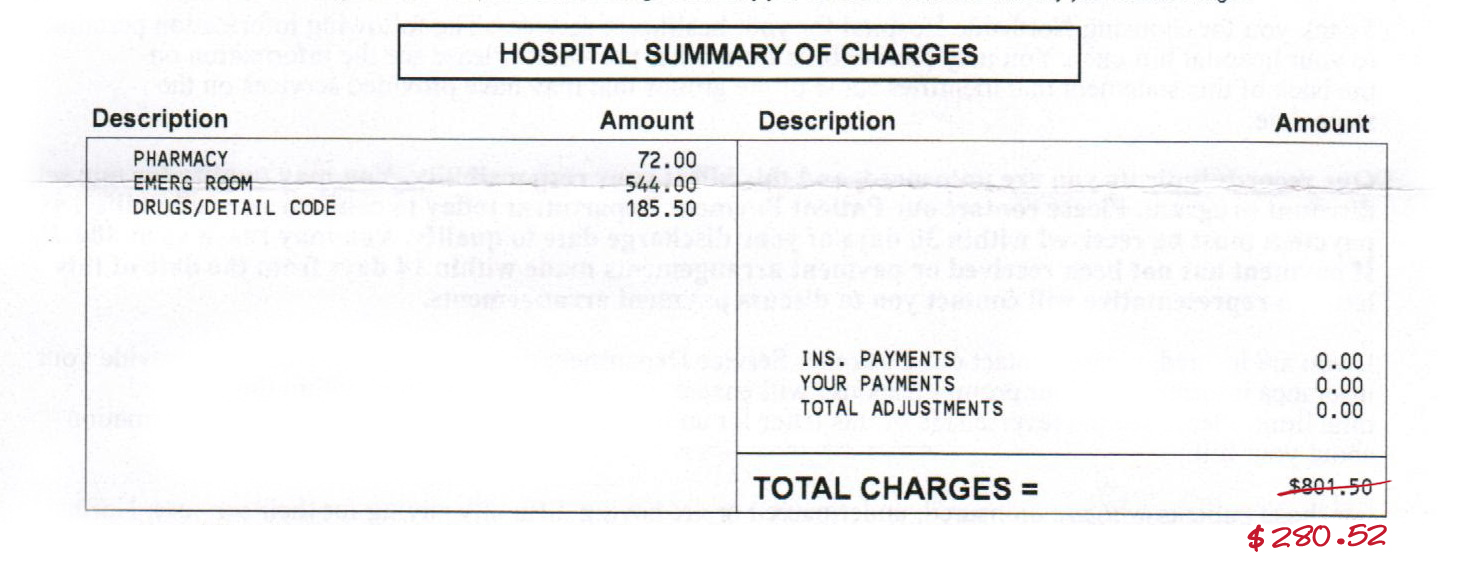

What to do with the notice. If you have other insurance, check to see if it covers anything that Medicare didn’t. Keep your receipts and bills, and compare them to your MSN to be sure you got all the services, supplies, or equipment listed. If you paid a bill before you got your notice, compare your MSN with the bill to make sure you paid ...

What to do if you paid before you got your MSN?

If you paid a bill before you got your notice, compare your MSN with the bill to make sure you paid the right amount for your services. If an item or service is denied, call your medical provider's office to make sure they submitted the correct information. If not, the office may resubmit.

How often do you get a Medicare summary notice?

Medicare summary notice. People with Original Medicare will receive a Medicare Summary Notice (MSN) in the mail every three months for their Medicare Parts A and B-covered services. This is strictly a notice, not a bill.

Get help paying costs

Learn about programs that may help you save money on medical and drug costs.

Part A costs

Learn about Medicare Part A (hospital insurance) monthly premium and Part A late enrollment penalty.

Part B costs

How much Medicare Part B (medical insurance) costs, including Income Related Monthly Adjustment Amount (IRMAA) and late enrollment penalty.

Costs for Medicare health plans

Learn about what factors contribute to how much you pay out-of-pocket when you have a Medicare Advantage Plan (Part C).

Compare procedure costs

Compare national average prices for procedures done in both ambulatory surgical centers and hospital outpatient departments.

Ways to pay Part A & Part B premiums

Learn more about how you can pay for your Medicare Part A and/or Medicare Part B premiums. Find out what to do if your payment is late.

Costs at a glance

Medicare Part A, Part B, Part C, and Part D costs for monthly premiums, deductibles, penalties, copayments, and coinsurance.

When do you need to update your Medicare premium?

You’ll need to tell the bank how much money to deduct from your account to pay for the Medicare premium. You’ll also need to update the amount with your bank whenever there is a change in the Medicare premium amount. This usually happens in January when CMS announces the new Medicare premium rates.

Does Medicare charge a fee for electronic payments?

This usually happens in January when CMS announces the new Medicare premium rates. You can find more information at Medicare.gov or CMS’s online bill pay webpage. Remember, CMS does not charge a fee for processing the electronic payments, but in some situations, a bank may charge their customers a fee for using their online bill payment service.

What is Medicare beneficiary?

The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). For ORM, there may be multiple recoveries ...

How long does interest accrue?

Interest accrues from the date of the demand letter, but is only assessed if the debt is not repaid or otherwise resolved within the time period specified in the recovery demand letter. Interest is due and payable for each full 30-day period the debt remains unresolved; payments are applied to interest first and then to the principal. Interest is assessed on unpaid debts even if a debtor is pursuing an appeal or a beneficiary is requesting a waiver of recovery; the only way to avoid the interest assessment is to repay the demanded amount within the specified time frame. If the waiver of recovery or appeal is granted, the debtor will receive a refund.

What is included in a demand letter for Medicare?

The demand letter also includes information on administrative appeal rights. For demands issued directly to beneficiaries, Medicare will take the beneficiary’s reasonable procurement costs (e.g., attorney fees and expenses) into consideration when determining its demand amount.

How long does it take to appeal a debt?

The appeal must be filed no later than 120 days from the date the demand letter is received. To file an appeal, send a letter explaining why the amount or existence of the debt is incorrect with applicable supporting documentation.

Can interest be assessed on unpaid debt?

Interest is assessed on unpaid debts even if a debtor is pursuing an appeal or a beneficiary is requesting a waiver of recovery; the only way to avoid the interest assessment is to repay the demanded amount within the specified time frame. If the waiver of recovery or appeal is granted, the debtor will receive a refund.

Who has the right to appeal a demand letter?

This means that if the demand letter is directed to the beneficiary, the beneficiary has the right to appeal. If the demand letter is directed to the liability insurer, no-fault insurer or WC entity, that entity has the right to appeal.

Can CMS issue more than one demand letter?

For ORM, there may be multiple recoveries to account for the period of ORM, which means that CMS may issue more than one demand letter. When Medicare is notified of a settlement, judgment, award, or other payment, including ORM, the recovery contractor will perform a search of Medicare paid claims history.