To find out if there is a copay, you can simply ask your provider. For example, if you need to fill a prescription, you can ask the pharmacy about a copay. Or, if you need to see your doctor, check with him or her to see if it qualifies as a preventative visit (no copay) or as an outpatient service (may require copay).

Full Answer

How can I find out if I am eligible for Medicare?

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool. If you (or your spouse) did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A.

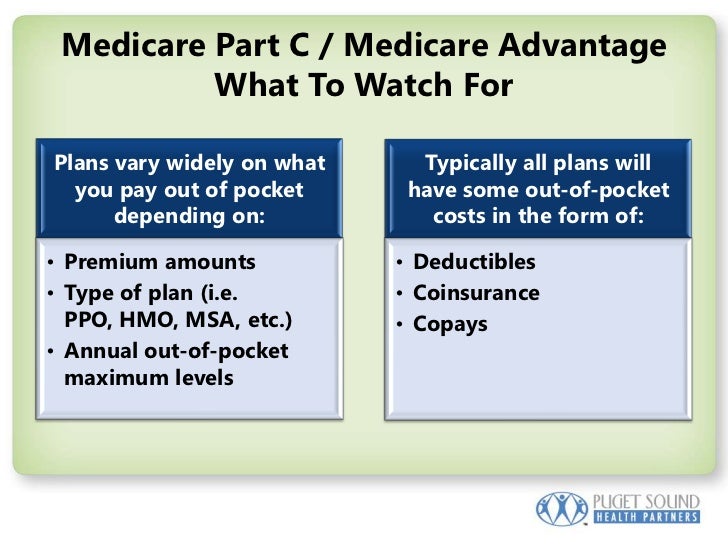

How are Medicare Part C and Part D copay amounts determined?

Part C and Part D copay amounts vary depending on the plan you enroll in, and are usually determined by the benefits you receive, the plan type you choose, and the location in which you live. Who’s eligible for Medicare? Medicare is available for certain individuals who meet eligibility requirements.

What is a medicare copay?

Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met. A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin to pay. Understanding Medicare Copayments & Coinsurance

Can I get financial assistance to pay my Medicare copays?

There are financial assistance programs available for Medicare enrollees that can help pay for your copays, among other costs. Medicare is one of the most popular health insurance options for adults age 65 and older in the United States. When you enroll in Medicare, you will owe various out-of-pocket costs for the services you receive.

What is your copay with Medicare?

When you enroll in Medicare, you will owe various out-of-pocket costs for the services you receive. A copayment, or copay, is a fixed amount of money that you pay out-of-pocket for a specific service. Copays generally apply to doctor visits, specialist visits, and prescription drug refills.

What is the Medicare copay for 2022?

The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Do Medicare cost Plans have copays?

A Medicare Advantage (Part C) plan is offered by private companies. It is an alternative to original Medicare Part A and Part B, and may offer additional benefits. In addition to plan premiums, a person will have to cover copays and deductibles. Costs may vary among plans.

What is the Medicare deductible for 2021?

$203 inThe standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

How much does Social Security take out for Medicare each month?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

Does Medicare have an out of pocket max?

The Medicare out of pocket maximum for Medicare Advantage plans in 2021 is $7,550 for in-network expenses and $11,300 for combined in-network and out-of-network expenses, according to Kaiser Family Foundation.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Do Medicare cost plans include Part D?

Medicare Part D enrollment Some Medicare cost plans include prescription drug coverage under Medicare Part D. However, others offer medical benefits only. If your plan doesn't include prescription drug coverage, you can enroll in a Part D plan separately.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Does Medicare Part B pay for prescriptions?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. covers a limited number of outpatient prescription drugs under certain conditions. A part of a hospital where you get outpatient services, like an emergency department, observation unit, surgery center, or pain clinic.