You may want to call Medicare (contact information below) and your spouse’s insurance company for details. Generally, you qualify for premium-free Part A when you’ve worked at least 10 years (40 quarters) paying Medicare taxes. Beneficiaries typically pay a Part B premium.

Full Answer

How can I help my spouse qualify for Medicare?

May 28, 2019 · Getting Medicare When You’re Married. Last Updated : 05/28/2019 3 min read. You’re generally eligible for Original Medicare (Part A and Part B) when you turn 65 or receive disability benefits, whether or not you’re married. If you’re married and haven’t worked in a paying job or didn’t work enough quarters, you may still qualify for premium-free Medicare Part A …

What happens to my health insurance when my spouse goes on Medicare?

Sep 02, 2019 · For your spouse to have Medicare coverage, he or she must have a separate, individual policy. Your non-working spouse is eligible for premium-free Medicare Part A coverage at the age of 65 based on your work record and if you meet the necessary requirements for Medicare coverage mentioned above.

Can I get Medicare if my spouse is covered by my employer?

Feb 02, 2014 · Buy Health Insurance on Your State’s Health Insurance Exchange . Thanks to the Affordable Care Act, you can buy a private, individual health insurance policy on your state’s health insurance exchange. If your health insurance exchange isn’t having open enrollment when you lose your spousal

Do I qualify for Medicare if I’m not married?

Feb 07, 2018 · With group coverage, you qualify for a Special Enrollment Period. That means you can enroll in Part B after the Medicare Initial Enrollment Period. You have 8 months after group coverage ends to enroll in Medicare without paying a penalty. If you’re interested in Medicare Supplement Insurance, you will also have a guaranteed issue right to buy for six months after …

Can I add my wife to my Medicare health plan?

But when a person asks “Can my non-working spouse get Medicare?” they really are asking “Can my spouse be on my Medicare plan?” The answer is no. Medicare is individual insurance, so spouses cannot be on the same Medicare plan together.

What happens to my spouse when I go on Medicare?

Your Medicare insurance doesn't cover your spouse – no matter whether your spouse is 62, 65, or any age. But in some cases, a younger spouse can help you get Medicare Part A with no monthly premium. Traditional Medicare includes Part A (hospital insurance) and Part B (medical insurance).Apr 19, 2022

Does Medicare cover married couples?

The good news about marriage and Medicare is that your coverage won't change. Neither will your spouse's. Whether you're already married, thinking about getting married, or no longer married, here's what you need to know.Nov 17, 2020

Can I add my family to my Medicare?

You can't add your family to your Medicare coverage. Here's a list of ways to make sure they have family health insurance once you're enrolled.Jun 21, 2021

Can my wife go on Medicare when I retire?

Eligibility for Medicare Medicare benefits cannot start earlier than when you turn 65, unless you are disabled, have ALS, or have end-stage renal disease. Medicare will only cover you, not your spouse or children if they are not eligible on their own.Jun 4, 2018

Do both spouses have to be 65 for Medicare?

No. Although your husband now qualifies for Medicare, you will not qualify for Medicare until you turn age 65. If you do not have health insurance now, you can consider signing up for health insurance coverage through a Marketplace plan.

What does Medicare cost for a couple?

Medicare considers you and your spouse's combined income (if you're married and file your income taxes jointly) when calculating Part B premiums. In most cases, you'll each pay the standard monthly Part B premium, which is $170.10 per month in 2022.Nov 19, 2021

Can husband and wife both pay Medicare Part B premiums?

You and your spouse pay separate premiums for Medicare benefits under Medicare Part B, and Medicare Part D if you sign up for it. If one or both of you choose to enroll in a Medicare Advantage plan, you will continue to pay separately the Medicare Part B premium and possibly a separate plan premium.

Can my wife get Medicare if she never worked?

If you don't have enough work quarters to qualify for premium-free Part A through your own work history, you may be able to qualify through your spouse. Note that you'll both have to separately enroll in Medicare, but neither of you would have to pay a monthly premium for Part A.

Can I add my husband to Medicare?

you're 15 or older. your name on your current Medicare card has less than 25 characters. someone else doesn't act on your behalf for Medicare purposes. you're not in the care of a state or territory child protection authority.Mar 15, 2022

Can I add my husband to my Medicare card?

When you apply for your new card online, you can add someone 15 years or older. You'll need to submit your application for a new card first, then invite them to your card. Read more about how to manage invites to your Medicare card online.Mar 8, 2022

Why is my Medicare premium higher than my husbands?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $170,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $85,000, you'll pay higher premiums.

How old do you have to be to get Medicare?

In a case such as this, you must be at least 62 years old.

How long do you have to work to qualify for Medicare?

In the United States, as soon as you turn 65 you are eligible for Medicare benefits if you are citizen or have been a legal resident for five years or more and have worked for at least 40 quarters (10 years) paying federal taxes.

How long do you have to pick a new insurance plan after losing your spouse's insurance?

Losing the coverage you had under your spouse's plan will make you eligible for a time-limited special enrollment period in the individual insurance market, on- or off-exchange (note that in this case, you have 60 days before the loss of coverage, and 60 days after the loss of coverage, during which you can pick a new plan).

Who is Elizabeth Davis?

Elizabeth Davis, RN, is a health insurance expert and patient liaison. She's held board certifications in emergency nursing and infusion nursing. If your health insurance coverage comes through your spouse’s job, you may lose that coverage when he or she retires and goes on Medicare. Not so long ago, this was a scary and expensive prospect, ...

How long can you keep cobra?

In most cases, COBRA allows you to continue coverage for 18 months. But if your spouse became eligible for Medicare and then left his or her employment (and thus lost access to employer-sponsored coverage) within 18 months of becoming eligible for Medicare, you can continue your spousal coverage with COBRA for up to 36 months from ...

Is Medicaid a separate program from Medicare?

It’s easy to confuse Medicaid and Medicare, but they're separate programs with different benefits and different eligibility criteria. In many states, low-income people making up to 138% of federal poverty level are eligible for Medicaid.

Can I get medicaid if my income is low?

If your income is low enough, you may be eligible for government-provided health insurance through Medicaid. In some states, the Medicaid program goes by another name like SoonerCare in Oklahoma or Medi-Cal in California. It’s easy to confuse Medicaid and Medicare, but they're separate programs with different benefits and different eligibility criteria.

Who is the Primary Insurer, Your Group Plan or Medicare?

When health insurance claims are filed, there is typically a primary insurer (who pays first) and a secondary insurer (who pays second). Whether or not you should enroll in Part B depends on who is the primary insurer, Medicare or your group plan. How do you know? The number of people employed at your company is the deciding factor.

Sometimes Group Insurance Changes When You Become Eligible for Medicare

Even if you know that your employer will be the primary insurer, take a look at your benefits. Sometimes they change when you become eligible for Medicare. Read over your group coverage benefits to see how they work once you or your spouse turn 65. Then decide if it’s better for you to enroll in Part B now or delay enrollment.

What About Penalties, Will You Qualify for a Special Enrollment Period to Enroll in Medicare Later?

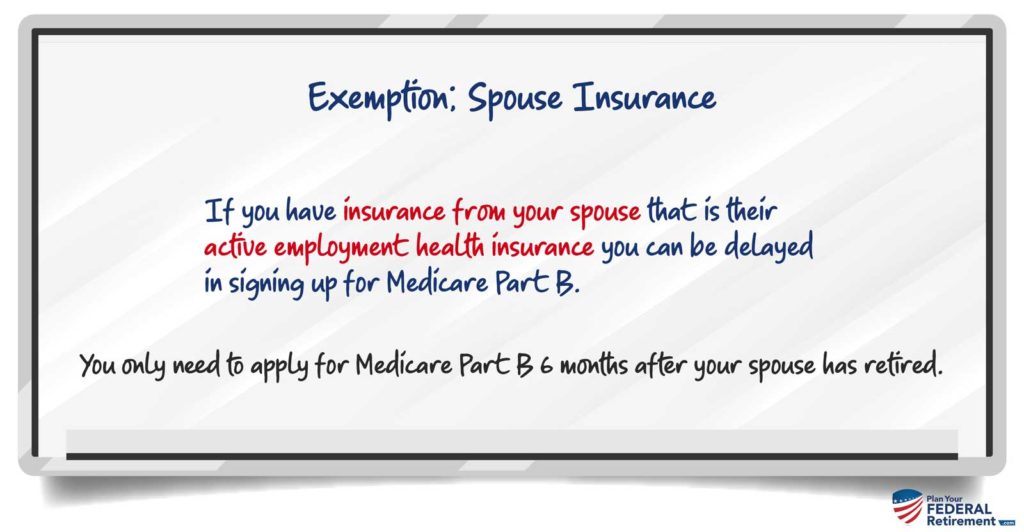

With group coverage, you qualify for a Special Enrollment Period. That means you can enroll in Part B after the Medicare Initial Enrollment Period. You have 8 months after group coverage ends to enroll in Medicare without paying a penalty.

Enrolling in Medicare at 65

If you want to enroll when you are turning 65, you can enroll in Medicare Parts A & B, Part D prescription drug coverage or a Medicare Advantage (Part C) plan. You can also look at adding a Medicare supplement insurance plan to Original Medicare (Parts A & B) to help with the out-of-pocket costs of Medicare.

Enrolling in Medicare Part A at 65

Many people who are covered by a spouse’s employer plan choose to either wait to enroll until they lose their spouse’s employer coverage or choose to only enroll in Part A since Part A usually has no premium.

Delaying Medicare Enrollment

Just because you are turning 65, doesn’t necessarily mean you have to get Medicare right now. If you decide that waiting to enroll in Medicare is the best option both financially and in terms of healthcare coverage for you, just follow Medicare’s rules, and you’ll avoid enrollment penalties when you do enroll.

When Would I Enroll If I Delay or Only Take Part A?

If you are able to delay enrolling in either all or part of Medicare, you will have a Special Enrollment Period of eight months that begins when the employer coverage is lost or when your spouse retires. During this time, you’ll be able to enroll in Medicare Parts A & B. You can also enroll in a Part D prescription drug plan.

Medicare Made Clear

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.

How does Medicare work with my job-based health insurance?

Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 — Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security (or the Railroad Retirement Board).

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What happens if a group health plan doesn't pay?

If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment. Medicare may pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim.

What is the ACA eligibility for Medicaid?

The ACA gives states the option to expand Medicaid eligibility to people with incomes of up to 138 percent of the federal poverty level ($17,236 in 2020).

What is individual insurance?

Individual insurance. This is insurance you buy on your own. Even though it's called "individual" — to distinguish it from "group" employer insurance — you can purchase a family policy that will cover you, your spouse and any dependent children. This type of insurance is often costly, especially for people older than 50.

When is open enrollment for ACA?

Open enrollment for ACA plans only runs from November 1 to December 15 in most states, but people who are losing their current health coverage may qualify for a special enrollment period. Depending on your income and the plan you choose, you may be eligible for subsidies (in the form of tax credits) to reduce your premiums.

How many people are on medicaid?

Jointly funded by the federal and state governments, Medicaid is the nation's public health insurance program for people with limited income and financial resources, serving nearly 65 million people as of late 2019.

How long can you keep Cobra insurance?

The COBRA law allows people who have left or lost a job to continue coverage through their former employer for up to 18 months by paying the full premiums. If eligible, spouses and dependent children can receive this coverage, even if departing employees don't take it themselves.

How long does Medicare coverage last?

This special period lasts for eight months after the first month you go without your employer’s health insurance. Many people avoid having a coverage gap by signing up for Medicare the month before your employer’s health insurance coverage ends.

How many employees does Medicare pay?

If your company has 20 employees or less and you’re over 65, Medicare will pay primary. Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage a small group health plan.

Does Medicare pay for secondary insurance?

If Medicare pays secondary to your insurance through your employer, your employer’s insurance pays first. Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance coverage in different ways. If your company has 20 employees or less and you’re over 65, Medicare will pay primary.

When does Medicare enrollment end?

For most people, the Initial Enrollment Period starts 3 months before their 65th birthday and ends 3 months after their 65th birthday.

When does Medicare pay late enrollment penalty?

If you enroll in Medicare after your Initial Enrollment Period ends, you may have to pay a Part B late enrollment penalty for as long as you have Medicare. In addition, you can enroll in Medicare Part B (and Part A if you have to pay a premium for it) only during the Medicare general enrollment period (from January 1 to March 31 each year).