Medicare Reimbursement for Shoes For Medicare to reimburse for the cost of shoes, you’ll need to visit only doctors and suppliers that take Medicare. If you visit a doctor who doesn’t accept Medicare, you could end up footing the entire bill.

Full Answer

Will Medicare reimburse you for the cost of your shoes?

Thankfully, Medicare does cover these shoes in most cases. But if you don’t have insurance, you could be paying these high costs yourself. Medicare Reimbursement for Shoes. For Medicare to reimburse for the cost of shoes, you’ll need to visit only doctors and suppliers that take Medicare.

How much does Medicare pay for shoes?

The place that is making my new shoes says medicare will pay 80% of the cost. My supplemental insurance will pay the other 20%. Now I am told that medicare pays only a certain dollar amount and stops even though it doesn’t meet the 80% leaving my bill at $380.

Are diabetic shoes covered by Medicaid?

We can bill both Medicare and Medicaid for diabetic shoes. Since 1983, Medicare Part B has provided partial reimbursement for extra-depth shoes and inserts for qualifying patients with diabetes.Medical experts agree that many amputations resulting from diabetes-related foot complications can be prevented by appropriate, properly fitting footwear.

How much does Medicare pay for diabetic shoes?

To make sure these supplies are covered by Medicare, please note:

- A qualified doctor must prescribe the shoes or inserts.

- A qualified doctor must provide and fit you for the shoes or inserts.

- Medicare Part B covers one pair of custom-molded shoes or one pair of depth-inlay shoes per calendar year.

Does Medicare pay for a pair of shoes?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. covers the furnishing and fitting of either of these each calendar year, if you have diabetes and severe diabetic foot disease: One pair of custom-molded shoes and inserts. One pair of extra-depth shoes.

What does Medicare approved shoe mean?

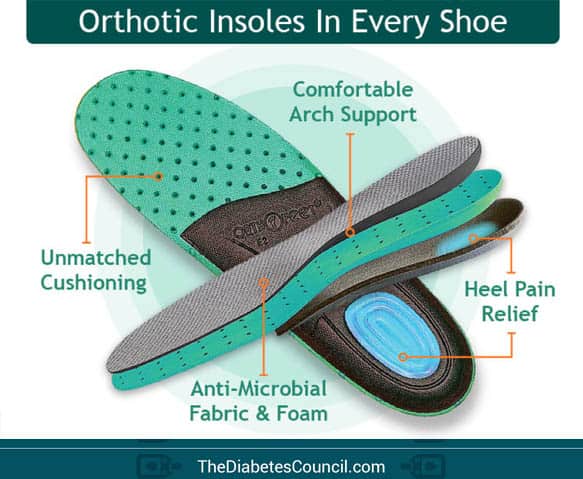

Medicare provides coverage for depth-inlay shoes, custom-molded shoes, and shoe inserts for people with diabetes who qualify under Medicare Part B. Designed to prevent lower-limb ulcers and amputations in people who have diabetes, this Medicare benefit can prevent suffering and save money.

Does Medicare cover cost of shoes for neuropathy?

Medicare will cover the cost of one pair of extra-depth shoes (diabetic shoes) and three pairs of inserts for diabetics but only if they have a medical need for them. Extra-depth shoes may be medically necessary as a protection for insensitive feet or against diabetic neuropathy (nerve damage in the feet).

What are the indications for a therapeutic footwear?

To qualify for footwear coverage, Medicare beneficiaries must have diabetes plus one of the following conditions: neuropathy with evidence of callus, previous or current ulcer, previous or current pre-ulcerative callus, previous amputation, foot deformities, or poor circulation.

What qualifies as a diabetic shoe?

Diabetic shoes are often wider and deeper than regular shoes to accommodate a special multi-density insert that is designed to reduce pressure and callouses to the bottom of feet. Diabetic shoes have a larger “toe box” to prevent squeezing of the toes.

What is a therapeutic shoe?

Therapeutic or Diabetic Shoes are shoes that offer support and protection for your feet and reduce the risk of skin breakdown, primarily in cases of poor circulation, neuropathy and foot deformities. The interior of the shoes are usually made with soft material and with no protruding stitching.

Does Medicare cover foot problems?

Foot care coverage Medicare Part B covers outpatient care, including cover for a podiatrist to evaluate and treat conditions at their office. For example, treatment could be for a foot injury, foot infection, or diabetes. Part B also pays for medically necessary care related to foot changes such as: bunions.

How do you write a prescription for diabetic shoes?

1. Detailed written order (prescription). Include space for prescribing shoes (A5500), the quantity of custom inserts (A5513) or quantity of prefab heat-moldable inserts (A5512). This must be dated within six months of dispensing shoes.

Does Medicare cover podiatry for plantar fasciitis?

Yes, as long as you met the eligibility requirements, your doctor can give you a prescription for treatment. Plantar Fasciitis is a severe breakdown of the soft tissue around your heel.

Will Medicare pay for SAS shoes?

The SAS Tripad® construction and SAS Supersoft® lightweight sole will keep you supported and comfortable through every step of your day. These shoes are also Medicare and Diabetic approved, so you know they meet the highest standards of support and comfort. These shoes are Medicare and Diabetic Approved shoes.

Does Social Security pay for diabetic shoes?

Therapeutic Shoes and inserts are covered under the Therapeutic Shoes for Individuals with Diabetes benefit (Social Security Act §1861(s)(12)).

How do diabetic shoes help your feet?

Diabetic shoes decrease the risk of diabetic foot ulcers and thereby reduce amputations. They provide support and protection while minimizing pressure points on the feet. They also have extra depth to accommodate diabetic inserts. There are many styles to choose from, and the shoes look much like any other shoe.

How much do diabetic shoes cost?

Shoes will need to be customer-fitted for your feet. Most diabetic shoes can range in cost from $50-$200 per pair . Thankfully, Medicare does cover these shoes in most cases. But if you don’t have insurance, you could be paying these high costs yourself.

Do you need to have a doctor to get shoes?

You’ll need to have your doctor certify that the shoes are necessary for your health. And on top of that, you will also need to complete some critical documents. Once you and your doctor sign the forms, you can take the forms to specific suppliers to get shoes at no cost.

Can diabetics get therapeutic shoes?

If you have diabetes and need therapeutic shoes, your doctor can help get you started. And when you choose to buy Medigap coverage, you can take assurance that your shoes won’t cost you an arm and a leg. Your Medigap plan can help with coinsurance, copays, and your Part B deductible.

Does Medicare pay for shoes?

Medicare Reimbursement for Shoes. For Medicare to reimburse for the cost of shoes, you’ll need to visit only doctors and suppliers that take Medicare. If you end up visiting a doctor who doesn’t accept Medicare, you could end up footing the entire bill.

Does Medicare cover diabetic shoes?

Since Medicare covers diabetic shoes, Medicare Advantage plans will also cover diabetic shoes. Of course, you must still meet all eligibility requirements. And keep in mind, Advantage plans have specific networks. If your particular doctor doesn’t fall into the network, you may not have coverage for your shoes and doctor.

What is original Medicare?

Your costs in Original Medicare. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference.

What is Medicare assignment?

assignment. An agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance. .

Does Medicare cover prescriptions?

applies. Medicare will only cover these items if your doctors and suppliers are enrolled in Medicare.

Can a doctor be enrolled in Medicare?

Doctors and suppliers have to meet strict standards to enroll and stay enrolled in Medicare. If your doctors or suppliers aren't enrolled, Medicare won't pay the claims submitted by them. It's also important to ask your suppliers if they participate in Medicare before you get these items.

How long does it take for Medicare to process a claim?

Medicare claims to providers take about 30 days to process. The provider usually gets direct payment from Medicare. What is the Medicare Reimbursement fee schedule? The fee schedule is a list of how Medicare is going to pay doctors. The list goes over Medicare’s fee maximums for doctors, ambulance, and more.

What to do if a pharmacist says a drug is not covered?

You may need to file a coverage determination request and seek reimbursement.

What happens if you see a doctor in your insurance network?

If you see a doctor in your plan’s network, your doctor will handle the claims process. Your doctor will only charge you for deductibles, copayments, or coinsurance. However, the situation is different if you see a doctor who is not in your plan’s network.

Does Medicare cover out of network doctors?

Coverage for out-of-network doctors depends on your Medicare Advantage plan. Many HMO plans do not cover non-emergency out-of-network care, while PPO plans might. If you obtain out of network care, you may have to pay for it up-front and then submit a claim to your insurance company.

Do participating doctors accept Medicare?

Most healthcare doctors are “participating providers” that accept Medicare assignment. They have agreed to accept Medicare’s rates as full payment for their services. If you see a participating doctor, they handle Medicare billing, and you don’t have to file any claim forms.

Do you have to pay for Medicare up front?

But in a few situations, you may have to pay for your care up-front and file a claim asking Medicare to reimburse you. The claims process is simple, but you will need an itemized receipt from your provider.

Do you have to ask for reimbursement from Medicare?

If you are in a Medicare Advantage plan, you will never have to ask for reimbursement from Medicare. Medicare pays Advantage companies to handle the claims. In some cases, you may need to ask the company to reimburse you. If you see a doctor in your plan’s network, your doctor will handle the claims process.

How many shoes does Medicare cover?

What’s Covered? Medicare allows one pair of extra-depth shoes per calendar year. For qualifying patients, Medicare will also cover three pairs of inserts each calendar year. Some shoe modifications are also covered but would replace a pair of inserts.

What are the requirements for Medicare Part B?

Coverage is for anyone with Medicare Part B (or other qualified insurance) who has diabetes, has appropriate documentation from a qualified physician, and: 1 Previous amputation of the foot, or part of either foot, or 2 History of ulcers, or 3 History of pre-ulcerative calluses, or 4 Diabetic Neuropathy with evidence of Callus formation, or 5 Foot deformity, or 6 Poor blood circulation

Does Medicare cover diabetic shoes?

Note: Medicare only covers diabetic shoes and inserts if the doctor is enrolled in Medicare. If not enrolled, Medicare won’t pay the claims submitted by them. Doctors and suppliers must meet guidelines to enroll and stay enrolled in Medicare.

What is the code for Oxford shoes?

Oxford shoes that are an integral part of a brace are billed using codes L3224 or L3225 with a KX modifier. For these codes, one unit of service is each shoe. Oxford shoes that are not part of a leg brace must be billed with codes L3215 or L3219 without a KX modifier.

What is the code for a covered leg brace?

Shoes are also covered if they are an integral part of a covered leg brace described by codes L1900, L1920, L1980-L2030, L2050, L2060, L2080, or L2090. Oxford shoes (L3224, L3225) are covered in these situations.

Can diabetic shoes be covered by TSD?

Thus, the diabetic shoes may be covered if the requirements for this section are met, while the brace may be covered if the requirements of §130 (Braces Benefit) are met. (Emphasis added). This means that the supplier of the TSD may bill separately for TSD while a different supplier may bill for the associated brace.

Is TSD covered by CMS?

CMS Internet Only Manual 100-02, Chapter 15, Section 290.B states: Orthopedic shoes and other supportive devices for the feet generally are not covered.

Can KX modifier be used on shoes?

A KX modifier must not be used in this situation. Shoes are denied as noncovered when they are put on over a partial foot prosthesis or other lower extremity prosthesis (L5010-L5600) which is attached to the residual limb by other mechanisms because there is no Medicare benefit for these items.

Does Medicare cover shoes?

Medicare has limited coverage provisions for shoes used by beneficiaries. Section 1862 (a) (8) of the Social Security Act (SSA) says: [N]o payment may be made under part A or part B for any expenses incurred for items or services … where such expenses are for orthopedic shoes or other supportive devices for the feet, ...

Can a matching shoe be billed with a KX modifier?

A matching shoe which is not attached to a brace and items related to that shoe must not be billed with a KX modifier and will be denied as noncovered because coverage is statutorily excluded. Shoes which are incorporated into a brace must be billed by the same supplier billing for the brace.

What is the code for Oxford shoes?

Oxford shoes that are an integral part of a brace are billed using codes L3224 or L3225 with a KX modifier. For these codes, one unit of service is each shoe. Oxford shoes that are not part of a leg brace must be billed with codes L3215 or L3219 without a KX modifier.

What is the code for a covered leg brace?

Shoes are also covered if they are an integral part of a covered leg brace described by codes L1900, L1920, L1980-L2030, L2050, L2060, L2080, or L2090. Oxford shoes (L3224, L3225) are covered in these situations.

Can KX modifier be used on shoes?

A KX modifier must not be used in this situation. Shoes are denied as noncovered when they are put on over a partial foot prosthesis or other lower extremity prosthesis (L5010-L5600) which is attached to the residual limb by other mechanisms because there is no Medicare benefit for these items.

Can diabetic shoes be covered by TSD?

Thus, the diabetic shoes may be covered if the requirements for this section are met, while the brace may be covered if the requirements of §130 (Braces Benefit) are met. (Emphasis added). This means that the supplier of the TSD may bill separately for TSD while a different supplier may bill for the associated brace.

Is TSD covered by CMS?

CMS Internet Only Manual 100-02, Chapter 15, Section 290.B states: Orthopedic shoes and other supportive devices for the feet generally are not covered.

Does Medicare cover shoes?

Medicare has limited coverage provisions for shoes used by beneficiaries. Section 1862 (a) (8) of the Social Security Act (SSA) says: [N]o payment may be made under part A or part B for any expenses incurred for items or services … where such expenses are for orthopedic shoes or other supportive devices for the feet, ...

Can a matching shoe be billed with a KX modifier?

A matching shoe which is not attached to a brace and items related to that shoe must not be billed with a KX modifier and will be denied as noncovered because coverage is statutorily excluded. Shoes which are incorporated into a brace must be billed by the same supplier billing for the brace.

What is included in a demand letter for Medicare?

The demand letter also includes information on administrative appeal rights. For demands issued directly to beneficiaries, Medicare will take the beneficiary’s reasonable procurement costs (e.g., attorney fees and expenses) into consideration when determining its demand amount.

What is Medicare beneficiary?

The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). For ORM, there may be multiple recoveries ...

Can CMS issue more than one demand letter?

For ORM, there may be multiple recoveries to account for the period of ORM, which means that CMS may issue more than one demand letter. When Medicare is notified of a settlement, judgment, award, or other payment, including ORM, the recovery contractor will perform a search of Medicare paid claims history.