- Get your benefit verification letter;

- Check your benefit and payment information;

- Change your address and phone number;

- Change your direct deposit information;

- Request a replacement Medicare card; or.

- Report your wages if you work and receive Social Security disability insurance or Supplemental Security Income (SSI) benefits.

Does Medicare send a 1099?

Jun 06, 2019 · To add the self-employed health insurance to your return: · Type self-employed health insurance deduction in the search bar. · Click Jump to self-employed health insurance deduction. See the screenshot below. · Continue the onscreen interview until you get to the Enter Your Business Expenses, ...

Does SSI get a 1099?

Here’s how to access your Form SSA-1099: Simply login to your My Social Security Account at www.socialsecurity.gov and click on “Replacement Documents” on the far-right side of the screen (see image to the right for a reference of what this looks like). This will take you to a page where you can access a copy of the form.

Does Social Security send out 1099?

Mar 15, 2022 · There're three ways for you to obtain your SSA-1099: Contact your local Social Security office; Call the SSA at +1(###) ###-####(TTY +1(###) ###-#### Monday through Friday from 7 AM to 7 PM; Use the "My Social Security Account" on the SSA website.

Does 1099 income affect social security?

Nov 18, 2019 · Select Financials from the top navigation or home page and then choose the 1099 tab. Choose TIN, NPI, PTAN and Program under Provider/Supplier Details; Choose the Financial Year; Response. The results will display the 1099 forms …

Does Medicare send out 1099 forms?

How can I access my 1099 form online?

- Log in to Benefit Programs Online and select UI Online.

- Select Payments.

- Select Form 1099G.

- Select View next to the desired year. ...

- Select Print to print your Form 1099G information.

- Select Request Duplicate to request an official paper copy.

How do I get a copy of my Medicare Form 1095-B?

How can I retrieve my 1099 form?

Can you print your 1099 from Social Security?

Why have I not received a 1099 from Social Security?

How do I get a copy of my 1095-B form online?

- Log in to your HealthCare.gov account.

- Under "Your Existing Applications," select your 2021 application — not your 2022 application.

- Select “Tax Forms” from the menu on the left.

- Download all 1095-As shown on the screen.

Can I get a copy of my 1095-B online?

Do Medicare recipients receive a 1095?

For the entire year, your insurance provider will not send a 1095 form. Retirees that are age 65 and older, and who are on Medicare, may receive instructions from Medicare about how to report their health insurance coverage.

How do I know if I have a 1099?

Where can I get my 1099 form from Social Security?

- Using your online my Social Security account. ...

- Calling us at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, 8:00 am – 7:00 pm; or.

- Contacting your local Social Security office.

What do I do if I didn't receive my 1099 G 2020?

What is a 1099 form?

A Social Security 1099 or 1042S Benefit Statement, also called an SSA-1099 or SSA-1042S, is a tax form that shows the total amount of benefits you received from Social Security in the previous year. It is mailed out each January to people who receive benefits and tells you how much Social Security income to report to the IRS on your tax return.

Can non-citizens receive SSA 1099?

Noncitizens who live outside of the United States receive the SSA-1042S instead of the SSA-1099. The forms SSA-1099 and SSA-1042S are not available for people who receive Supplemental Security Income (SSI).

When is the SSA 1042S mailed?

It is mailed out each January to people who receive benefits and tells you how much Social Security income to report to the IRS on your tax return. Noncitizens who live outside of the United States receive the SSA-1042S instead of the SSA-1099.

What is a 1099 form?

The Social Security 1099 form (SSA-1099) is especially important if you’re currently receiving Social Security retirement or disability benefits. This document details the total retirement or disability benefits you received in the previous tax year, which needs to be properly reported on your income tax return.

How to check my Social Security benefits?

Here are a few other things you can do when logged in to your My Social Security account online: 1 View your Benefit Verification Letter 2 Change your address or phone number 3 Request a replacement Medicare card 4 Request a replacement Social Security card 5 Change your direct deposit information for Social Security benefits 6 Verify your Social Security benefit amount

Inquiry

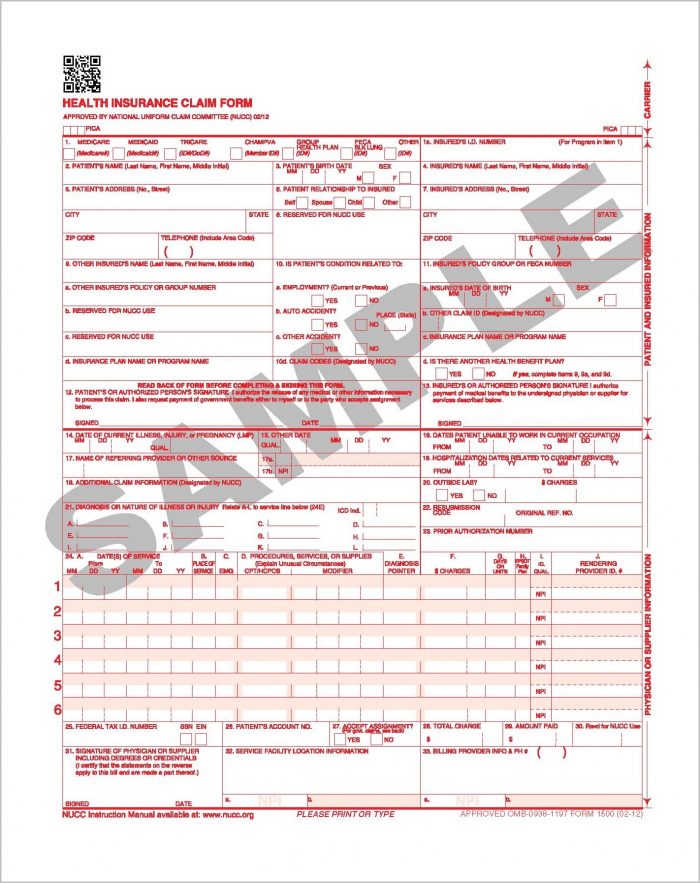

Select Financials from the top navigation or home page and then choose the 1099 tab.

Response

The results will display the 1099 forms applicable to the Tax ID used for the inquiry.

Can I get a copy of my SSA 1099?

The forms SSA-1099 and SSA-1042S are not available for people who receive Supplemental Security Income (SSI). With a personal my Social Security account, you can do much of your business with us online, on your time, like get a copy of your SSA-1099 form. Visit our website to find out more. See Comments.

How long does it take to create a Social Security document?

If you don’t have a my Social Security account, creating one is very easy to do and usually takes less than 10 minutes.

Do you get a 1095B form if you have Medicare?

Here’s what you need to know about the 1095-B form.

Is Medicare Part A essential?

Medicare Part A and Medicare Part C were considered minimum essential coverage under the ACA. If you have one of these plans, the form was sent to prove compliance with the individual mandate and minimal essential coverage requirements.

What happens if you don't have Medicare?

If you had Medicare Part A or Medicare Part C, you met the individual mandate. If you didn’t have health insurance coverage, though, you were subject to a penalty fee, which was calculated as a percentage of your income. In 2019, the U.S. Department of Justice and federal appeals courts ruled that the individual mandate was unconstitutional.

What is a 1095-B?

The 1095-B Qualifying Health Coverage Notice is a tax form that was developed in response to a provision of the 2010 Affordable Care Act (ACA). The ACA was phased in over several years, and in 2014, everyone was required to have health insurance through the individual mandate provision. If you had Medicare Part A or Medicare Part C, ...