You qualify for full Medicare benefits if:

- You are a U.S. ...

- You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.

- You or your spouse is a government employee or retiree who has not paid into Social Security but has paid Medicare payroll taxes while working.

How can providers verify Medicare eligibility?

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool. If you (or your spouse) did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A.

How much is taken out of your check for Medicare?

Generally, you’re eligible for Medicare Part A if you’re 65 years old and have been a legal resident of the U.S. for at least five years. In fact, the government will automatically enroll you in Medicare Part A at no cost when you reach 65 as long as you’re already collecting Social Security or Railroad Retirement benefits.

How do I complete insurance eligibility checks?

Estimate my Medicare eligibility & premium Get an estimate of when you're eligible for Medicare and your premium amount. If you don't see your situation, contact Social Security (or the Railroad Retirement Board if you get railroad benefits) to learn more about your …

What are the elegibility criteria of Medicare?

To be eligible for a Medicare Advantage Plan, you must: Qualify for Medicare Part A and Part B. Live in the area the Medicare Advantage Plan serves. Medicare Advantage Plans are offered by private companies that Medicare approves. Each Plan is licensed to serve a specific area, so you must check with your Plan to make sure it covers where you live.

How do you know if you qualify for Medicare?

You are eligible for Medicare if you are a citizen of the United States or have been a legal resident for at least 5 years and: You are age 65 or older and you or your spouse has worked for at least 10 years (or 40 quarters) in Medicare-covered employment.

Does everyone automatically get Medicare?

Who is this for? Most people are automatically enrolled in Original Medicare when they turn 65 and get Social Security benefits. There are also some other cases where you are automatically enrolled in Medicare. This page explains when you get coverage without having to do anything.Jan 28, 2020

Does a person automatically get Medicare when they turn 65?

Medicare will automatically start when you turn 65 if you've received Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday. You'll automatically be enrolled in both Medicare Part A and Part B at 65 if you get benefit checks.

Who is not automatically eligible for Medicare?

People who must pay a premium for Part A do not automatically get Medicare when they turn 65. They must: File an application to enroll by contacting the Social Security Administration; Enroll during a valid enrollment period; and.Dec 1, 2021

How do I know if I am automatically enrolled in Medicare?

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you're not getting disability benefits and Medicare when you turn 65, you'll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

How do I enroll in Medicare for the first time?

To sign up, please call our toll-free number at 1-800-772-1213 (TTY 1-800-325-0778). You also may contact your local Social Security office. You can find your local Social Security office by using our Office Locator.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Do you have to pay for Medicare?

Most people don't have to pay a monthly premium for their Medicare Part A coverage. If you've worked for a total of 40 quarters or more during your lifetime, you've already paid for your Medicare Part A coverage through those income taxes.

How long do I have to enroll in Medicare Part B after I retire?

8 monthsYou have 8 months to enroll in Medicare once you stop working OR your employer coverage ends (whichever happens first). But you'll want to plan ahead and contact Social Security before your employer coverage ends, so you don't have a gap in coverage.

Can I get Medicare if I never worked?

You can still get Medicare if you never worked, but it will likely be more expensive. Unless you worked and paid Medicare taxes for 10 years — also measured as 40 quarters — you will have to pay a monthly premium for Part A. This may differ depending on your spouse or if you spent some time in the workforce.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Am I eligible for Medicare Part A?

Generally, you’re eligible for Medicare Part A if you’re 65 years old and have been a legal resident of the U.S. for at least five years. In fact,...

Am I eligible for Medicare Part B?

When you receive notification that you’re eligible for Medicare Part A, you’ll also be notified that you’re eligible for Part B coverage, which is...

How do I become eligible for Medicare Advantage?

If you’re eligible for Medicare benefits, you have to choose how to receive them – either through the government-run Original Medicare program, or...

When can I enroll in Medicare Part D?

To be eligible for Medicare Part D prescription drug coverage, you must have either Medicare Part A or Part B, or both. You can sign up for Medicar...

Who's eligible for Medigap?

If you’re enrolled in both Medicare Part A and Part B, and don’t have Medicare Advantage or Medicaid benefits, then you’re eligible to apply for a...

Medicare eligibility: Key takeaways

Generally, you’re eligible for Medicare Part A if you’re 65 and have been a U.S. resident for at least five years.

Am I eligible for Medicare Part A?

Generally, you’re eligible for Medicare Part A if you’re 65 years old and have been a legal resident of the U.S. for at least five years. In fact, the government will automatically enroll you in Medicare Part A at no cost when you reach 65 as long as you’re already collecting Social Security or Railroad Retirement benefits.

Am I eligible for Medicare Part B?

When you receive notification that you’re eligible for Medicare Part A, you’ll also be notified that you’re eligible for Part B coverage, which is optional and has a premium for all enrollees.

How do I become eligible for Medicare Advantage?

If you’re eligible for Medicare benefits, you have to choose how to receive them – either through the government-run Original Medicare program, or through Medicare Advantage.

When can I enroll in Medicare Part D?

To be eligible for Medicare Part D prescription drug coverage, you must have either Medicare Part A or Part B, or both. You can sign up for Medicare Part D at the same time that you enroll in Medicare Part A and B.

Who's eligible for Medigap?

If you’re enrolled in both Medicare Part A and Part B, and don’t have Medicare Advantage or Medicaid benefits, then you’re eligible to apply for a Medigap policy.

Next Steps

If you still have questions about Medicare, we’re ready to help. Please call us at 305.541.5366 to schedule an appointment or learn more about the Medicare plans offered through LEON Health.

Ready to Enroll with LEON Health?

As you prepare for Medicare, you’ll be faced with many important decisions. LEON Health wants to help you select the best options for your needs.

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

What happens if you don't enroll in Part A?

If an individual did not enroll in premium Part A when first eligible, they may have to pay a higher monthly premium if they decide to enroll later. The monthly premium for Part A may increase up to 10%. The individual will have to pay the higher premium for twice the number of years the individual could have had Part A, but did not sign up.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

Why does Part A end?

There are special rules for when premium-free Part A ends for people with ESRD. Premium Part A and Part B coverage can be voluntarily terminated because premium payments are required. Premium Part A and Part B coverage ends due to: Voluntary disenrollment request (coverage ends prospectively); Failure to pay premiums;

Key Takeaways

If you receive Social Security or Railroad Retirement Benefits for at least four months before you turn 65, you’ll automatically be enrolled into Medicare Part A Medicare Part A, also called "hospital insurance," covers the care you receive while admitted to the hospital, skilled nursing facility or other inpatient services.

Will I Automatically Be Enrolled in Medicare When I Turn 65?

Are you approaching 65? You might get Medicare Part A and Part B automatically. It all depends on whether you’re receiving Social Security benefits or not.

Checking Your Medicare Application Online

Many Americans retire when they turn 65 and are not yet collecting Social Security benefits. If you keep working until 65, you’ll need to submit a Medicare application. Start by finding the Medicare application on the Social Security website. The application process is completely free, and you can fill out the entire application online.

How Soon Does Medicare Coverage Start?

Your Medicare coverage start date depends on your age and when you enrolled in Medicare. If you enroll:

FAQs

The best time to enroll in Medicare is during your Initial Enrollment Period (IEP). This seven-month period starts three months before the month you turn 65, and ends three months after your birth month. If you enroll before your birthday, your Medicare coverage starts on the first day of the month you turn 65.

How old do you have to be to get Medicare?

To enroll in original Medicare (to be eligible for Part C), in general, you must qualify by: Age. You must be at least age 65 or older and a U.S. citizen or legal permanent resident for a minimum of 5 contiguous years. Disability.

When is Medicare open enrollment?

Finally, there’s also the Medicare Advantage open enrollment period. This is from January 1 to March 31 each year. However, this period only lets you make changes to your plan if you’re already enrolled in a Medicare Advantage plan.

What is Medicare Part C?

How Part C works. Takeaway. Medicare Part C, also called Medicare Advantage, is an insurance option for people who are eligible for Medicare. These plans are offered through private insurance companies. You don’t need to buy a Medicare Part C plan. It’s an alternative to original Medicare that offers additional items and services.

How long do you have to be disabled to get ALS?

If you’re a disabled federal, state, or local government employee who’s not eligible for monthly Social Security or RRB benefits, you may be deemed entitled to disability benefits and automatically entitled to Part A after being disabled for 29 months. ALS.

When will Medicare become the main health insurance?

July 08, 2020. Most Americans understand that when they turn 65, Medicare will become their main health insurance plan. However, many Americans are less familiar with another health care program, Medicaid, and what it means if they are eligible for both Medicare and Medicaid. If you are dual eligible, Medicaid may pay for your Medicare ...

What is Medicare Advantage?

Medicare Advantage plans are private insurance health plans that provide all Part A and Part B services. Many also offer prescription drug coverage and other supplemental benefits. Similar to how Medicaid works with Original Medicare, Medicaid wraps around the services provided by the Medicare Advantage plan andserves as a payer of last resort.

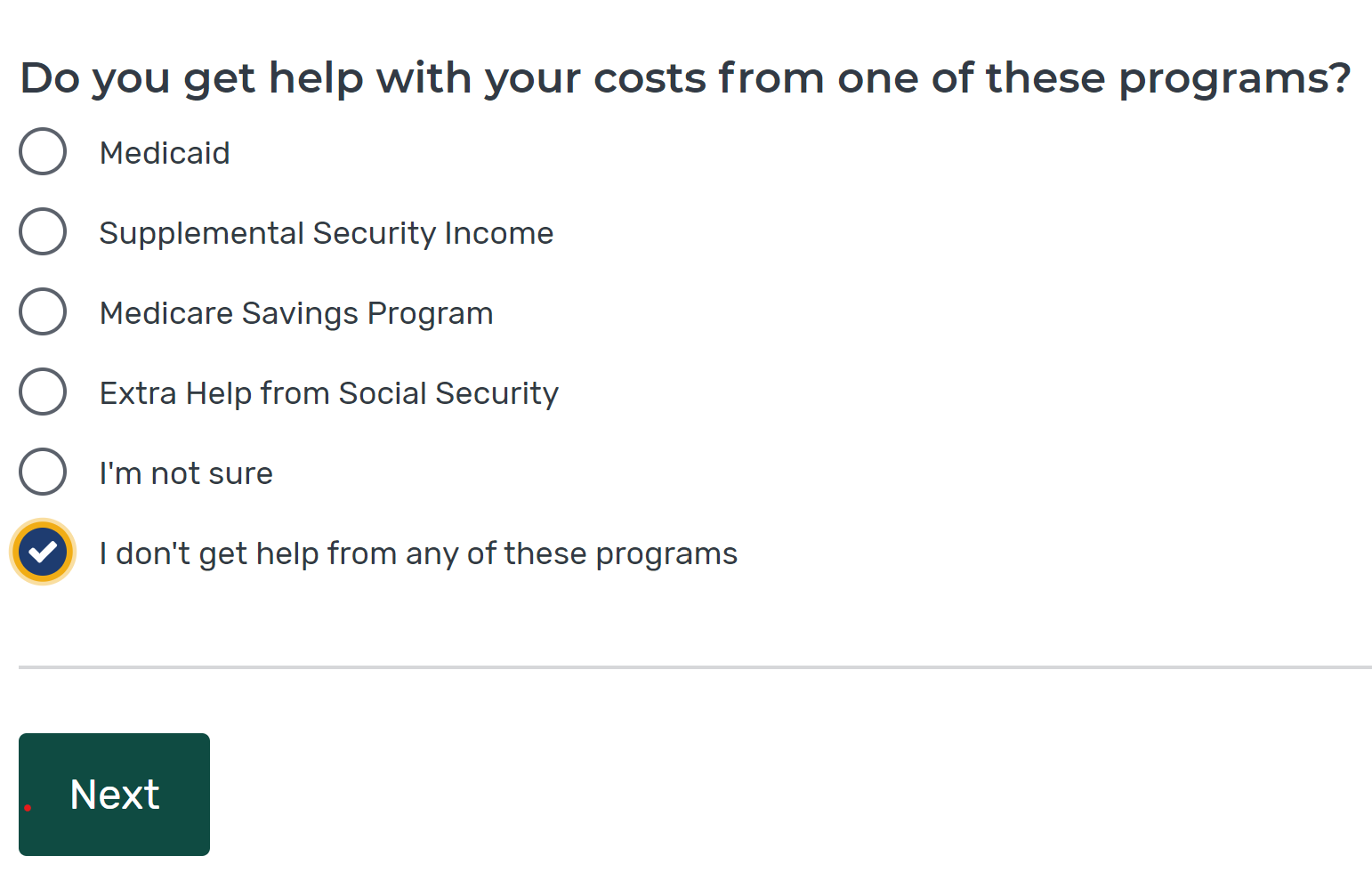

What is dual eligible?

The term “full dual eligible” refers to individuals who are enrolled in Medicare and receive full Medicaid benefits. Individuals who receive assistance from Medicaid to pay for Medicare premiums or cost sharing* are known as “partial dual eligible.”.

What is dual eligible for medicaid?

Qualifications for Medicaid vary by state, but, generally, people who qualify for full dual eligible coverage are recipients of Supplemental Security Income (SSI). The SSI program provides cash assistance to people who are aged, blind, or disabled to help them meet basic food and housing needs.

What is Medicaid managed care?

Medicaid managed care is similar to Medicare Advantage, in that states contract with private insurance health plans to manage and deliver the care. In some states, the Medicaid managed care plan is responsible for coordinating the Medicare and Medicaid services and payments.

What is a PACE plan?

Similar to D-SNPs, PACE plans provide medical and social services to frail and elderly individuals (most of whom are dual eligible). PACE operates through a “health home”-type model, where an interdisciplinary team of health care physicians and other providers work together to provide coordinated care to the patient. PACE plans also focus on helping enrollees receive care in their homes or in the community, with the goal of avoiding placement in nursing homes or other long-term care institutions.

Does Medicare cover Part A and Part B?

Some Medicare beneficiaries may choose to receive their services through the Original Medicare Program. In this case, they receive the Part A and Part B services directly through a plan administered by the federal government, which pays providers on a fee-for-service (FFS) basis. In this case, Medicaid would “wrap around” Medicare coverage by paying for services not covered by Medicare or by covering premium and cost-sharing payments, depending on whether the beneficiary is a full or partial dual eligible.

How old do you have to be to qualify for medicare?

Citizens or legal residents residing in the U.S. for a minimum of 5 years immediately preceding application for Medicare. Applicants must also be at least 65 years old. For persons who are disabled or have been diagnosed with end-stage renal disease or Lou Gehrig’s disease (amyotrophic lateral sclerosis), there is no age requirement. Eligibility for Medicare is not income based. Therefore, there are no income and asset limits.

How to apply for medicaid?

How to Apply. To apply for Medicare, contact your local Social Security Administration (SSA) office. To apply for Medicaid, contact your state’s Medicaid agency. Learn about the long-term care Medicaid application process. Prior to applying, one may wish to take a non-binding Medicaid eligibility test.

How much does Medicare Part B cost?

For Medicare Part B (medical insurance), enrollees pay a monthly premium of $148.50 in addition to an annual deductible of $203. In order to enroll in a Medicare Advantage (MA) plan, one must be enrolled in Medicare Parts A and B. The monthly premium varies by plan, but is approximately $33 / month.

What is Medicare and Medicaid?

Differentiating Medicare and Medicaid. Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. Since it can be easy to confuse the two terms, Medicare and Medicaid, it is important to differentiate between them. While Medicare is a federal health insurance program ...

What is dual eligible?

Definition: Dual Eligible. To be considered dually eligible, persons must be enrolled in Medicare Part A, which is hospital insurance, and / or Medicare Part B, which is medical insurance. As an alternative to Original Medicare (Part A and Part B), persons may opt for Medicare Part C, which is also known as Medicare Advantage.

What is the income limit for Medicaid in 2021?

In most cases, as of 2021, the individual income limit for institutional Medicaid (nursing home Medicaid) and Home and Community Based Services (HCBS) via a Medicaid Waiver is $2,382 / month. The asset limit is generally $2,000 for a single applicant.

Does Medicare cover out-of-pocket expenses?

Persons who are enrolled in both Medicaid and Medicare may receive greater healthcare coverage and have lower out-of-pocket costs. For Medicare covered expenses, such as medical and hospitalization, Medicare is always the first payer (primary payer). If Medicare does not cover the full cost, Medicaid (the secondary payer) will cover the remaining cost, given they are Medicaid covered expenses. Medicaid does cover some expenses that Medicare does not, such as personal care assistance in the home and community and long-term skilled nursing home care (Medicare limits nursing home care to 100 days). The one exception, as mentioned above, is that some Medicare Advantage plans cover the cost of some long term care services and supports. Medicaid, via Medicare Savings Programs, also helps to cover the costs of Medicare premiums, deductibles, and co-payments.