Generally you can reach Medicare online, by phone, by mail, or in-person at your local Social Security or Medicare offices. Additionally, online enrollment check offers fast answers and 24-hour access to information. Overall, Medicare approves Part D plans, and the plans utilize the Medicare ID to establish eligibility.

How do you qualify for Medicare Part D?

Before you can take advantage of a Part D plan, you must first be eligible to sign up. There are specific criteria you need to meet in order to qualify for the program. 1 To be eligible for Part D, you must first be eligible for Medicare at large. The rules for Medicare eligibility are straightforward.

How do I get Medicare Part D prescription drug coverage?

To be eligible for Medicare Part D prescription drug coverage, you must have either Medicare Part A or Part B, or both. You can sign up for Medicare Part D at the same time that you enroll in Medicare Part A and B.

How do I know if I am eligible for Medicare Advantage?

Medicare eligibility: Key takeaways 1 Generally, you’re eligible for Medicare Part A if you’re 65 and have been a U.S. ... 2 When you’re notified you’re eligible for Part A, you’ll be notified that you’re eligible for Medicare Part B. 3 You need to be eligible for both Medicare Part A and B in order to enroll in Medicare Advantage. More items...

What happens if I don’t enroll in Medicare Part D?

As with Part B, you are still eligible for Part D prescription drug coverage if you don’t enroll when you’re first eligible, but you may pay higher premiums if you enroll later on, unless you had creditable coverage from another plan during the time that you delayed enrollment in Part D.

Does everyone get Medicare Part D?

Medicare Cost Plan Medicare offers prescription drug coverage for everyone with Medicare. This coverage is called “Part D.” There are 2 ways to get Medicare prescription drug coverage: 1.

Can you be turned down for Medicare Part D?

To disenroll from a Medicare drug plan during Open Enrollment, you can do one of these: Call us at 1-800 MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Mail or fax a signed written notice to the plan telling them you want to disenroll.

Who is most likely to be eligible to enroll in a Part D prescription drug plan?

You are eligible for Medicare Part D drug benefits if you meet the qualifications for Medicare eligibility, which are: You are age 65 or older. You have disabilities. You have end-stage renal disease.

How do I check my Medicare Part D status?

How to Check Medicare Application StatusLogging into one's “My Social Security” account via the Social Security website.Visiting a local Social Security office. ... Contact Social Security Administration by calling 1-800-772-1213 (TTY 1-800-325-0778) anytime Monday through Friday, 7 a.m. to 7 p.m.More items...•

Is Medicare Part D optional or mandatory?

Medicare drug coverage helps pay for prescription drugs you need. Even if you don't take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare.

What is the initial enrollment period for Medicare Part D?

7 monthsFor people who are new to Medicare, the Initial Enrollment Period (IEP) for Part D is 7 months long. It begins 3 months prior to the month you become eligible for Medicare Part A or B, includes the month you become eligible and ends 3 months later.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

What is the best Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the maximum out of pocket for Medicare Part D?

Medicare Part D, the outpatient prescription drug benefit for Medicare beneficiaries, provides coverage above a catastrophic threshold for high out-of-pocket drug costs, but there is no cap on total out-of-pocket drug costs that beneficiaries pay each year.

Does Medicare automatically send you a card?

Once you're signed up for Medicare, we'll mail you your Medicare card in your welcome packet. You can also log into (or create) your secure Medicare account to print your official Medicare card. I didn't get my Medicare card in the mail. View the Medicare card if you get benefits from the Railroad Retirement Board.

Do you automatically get a Medicare card when you turn 65?

You should receive your Medicare card in the mail three months before your 65th birthday. If you are NOT receiving benefits from Social Security or the RRB at least four months before you turn 65, you will need to sign up with Social Security to get Parts A and B.

How long does Medicare approval take?

between 30-60 daysMedicare applications generally take between 30-60 days to obtain approval.

What is Medicare Part D?

Summary. Medicare Part D covers prescription drug costs. Private insurance companies administer these plans. Medicare requires people older than 65 years of age to have some form of creditable drug coverage. If a person of this age does not have prescription medication coverage, they may have to pay penalty fees.

When is Medicare Part D open enrollment?

January 1–March 31. This is the Medicare Advantage Open Enrollment Period. During this time, a person can leave a Medicare Advantage plan and enroll in a Medicare Part D plan alongside traditional Medicare.

How long does it take to pay a late enrollment penalty for Medicare?

A person will pay a late enrollment penalty if they do not have creditable prescription drug coverage 63 days after their enrollment period. Medicare will calculate the late enrollment penalty based on the length ...

How long does it take to get Medicare if you have ESRD?

A person can qualify early for Medicare benefits if they have ESRD. As a general rule, a person with ESRD can qualify for Medicare benefits within 1–3 months of undergoing dialysis or receiving a kidney transplant.

What happens if you don't have prescriptions for Medicare?

If a person of this age does not have prescription medication coverage, they may have to pay penalty fees. A person also becomes eligible for Part D if they live with a disability, end stage renal disease (ESRD), or amyotrophic lateral sclerosis (ALS). This article will cover which people are eligible for Medicare Part D, when they can enroll, ...

How long do you have to be on Medicare to qualify for it?

Have an eligible disability. People can qualify for Medicare at any age if a physician confirms that they have an eligible disability. They must also have received financial support from the Social Security Administration or Railroad Retirement Board for at least 24 months.

Can you appeal Medicare Part D penalty?

A person can appeal the penalty decision if they feel that it is unfair. People who receive Extra Help due to their income level are not subject to Medicare Part D penalties.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What are some examples of documents you can send to Medicare?

Examples of documents you can send your plan include: A purple notice from Medicare that says you automatically qualify for Extra Help. A yellow or green automatic enrollment notice from Medicare. An Extra Help "Notice of Award" from Social Security. An orange notice from Medicare that says your copayment amount will change next year.

What is an orange notice from Medicare?

An orange notice from Medicare that says your copayment amount will change next year. If you have. Supplemental Security Income (Ssi) A monthly benefit paid by Social Security to people with limited income and resources who are disabled, blind, or age 65 or older.

What is a copy of a medicaid card?

A copy of your Medicaid card (if you have one). A copy of a state document that shows you have Medicaid. A print-out from a state electronic enrollment file that shows you have Medicaid. A screen print from your state's Medicaid systems that shows you have Medicaid.

How long does Medicaid pay for stay?

Or, a copy of a state document showing Medicaid paid for your stay for at least a month. A print-out from your state’s Medicaid system showing you lived in the institution for at least a month. A document from your state that shows you have Medicaid and are getting home- and community-based services.

You Cant Get Medicare Coverage Yet

Were glad youre thinking about it already. You can sign up three months before your 65th birthday.

Sorting Out Insurance Plans And Covered Treatment Options

It is incomprehensible to me why insurance companies make the process so cumbersome and difficult and unpleasant. Add to that the fact that we often shift insurance carriers over the years for various reasons. That adds a whole new level of complication as we try to sort out which plan to get or what medications and treatments are covered.

Find Affordable Medicare Supplement Plans

How to Track the Part BDeductible The Medicare Part B deductible is an annual medical deductible. Everyone with Original Medicare is responsible for the Part B deductible.

How Does Medicare Prescription Drug Coverage Work

Medicare prescription drug coverage is an optional benefit. Medicare drug coverage is offered to everyone with Medicare. Even if you dont use prescription drugs now, you should consider joining a Medicare drug plan.

How Do I Know If I Have Medicare

Since Medicare is a national program, all Medicare insurance cards look the same. Heres an example:

Dont Rely On Your Medicare Summary Notice

Most insurance companies will mail an Explanation of Benefits after each claim is submitted, But, this isnt the case with Medicare.

Getting Prescriptions With Part D Id

Throughout the nation, each enrolled beneficiary has a Medicare ID card, provided by Social Security.

What is Medicare Part D?

Medicare Part D protects older Americans against the high costs of prescription medicines. Effectively, Part D makes drug-based treatment feasible for millions of Americans. The discounts and subsidies keep valued medicines within the budgets of those that depend on them for treatment.

Why is Medicare Part D important?

Prescription drugs are a vital part of the American healthcare system. Medicare Part D protects older Americans against the high costs of prescription medicines.

What is a Part D ID?

Getting Prescriptions with Part D ID. Throughout the nation, each enrolled beneficiary has a Medicare ID card, provided by Social Security. Upon enrolling in a Part D plan, each beneficiary gets a prescription drug plan ID card from the plan’s insurance company.

What is comparison shopping for Medicare?

Comparison shopping is an ideal method for finding the best features to meet the consumer’s priorities.

What is the main part of Medicare?

The below-itemized descriptions cover the essential parts of Medicare. First, Part A: Hospital Insurance is the main part of Original Medicare.

What is Part D drug plan?

In all cases, Part D drug plans have lists of covered drugs, called formularies, and arrangements that set their prices according to drug severity, called tiers. Plans can set rules to limit access to certain high priced drugs and require participants to consider lower cost alternatives or equally effective generics.

Is Medicare Part D good?

To begin, getting Medicare Part D is an excellent step towards health security. Unfortunately, the costs of prescription drugs can run into many thousands for intensive usages such as surgeries, transplants, and long-term maintenance of certain conditions like heart disease.

What do you need to know before enrolling in a Part D plan?

The most important preparation you can do before finding a Part D plan is recording information about your medications.

When is the best time to sign up for Part D?

If you don’t have creditable drug coverage or health insurance from a current employer, the best time to sign up for Part D is during your 7-month initial enrollment period (IEP) to avoid penalties. Under your IEP, you have a 7-month window that opens 3 months before you turn 65 and closes at the end of the 3rd month following your birthday month.

How does dosage affect Part D?

Your dosage can affect your final cost or enact certain plan restrictions depending on the Part D plan. The frequency of the medication. The number of pills you take also affects the cost, so double check how often you take your medication and write it down. Once you have these recorded, you’ll be able to compare plans, apples-to-apples.

Is Medicare Part D a good program?

Although Medicare is not without its faults, one thing is clear: Medicare Part D has been a successful program. With nearly 70% of all beneficiaries enrolled in Part D, this optional add-on to Original Medicare is a popular way to lower drug costs. 1. But before diving into the deep end of Part D plans, you’ll want to perform due diligence ...

Medicare eligibility: Key takeaways

Generally, you’re eligible for Medicare Part A if you’re 65 and have been a U.S. resident for at least five years.

Am I eligible for Medicare Part A?

Generally, you’re eligible for Medicare Part A if you’re 65 years old and have been a legal resident of the U.S. for at least five years. In fact, the government will automatically enroll you in Medicare Part A at no cost when you reach 65 as long as you’re already collecting Social Security or Railroad Retirement benefits.

Am I eligible for Medicare Part B?

When you receive notification that you’re eligible for Medicare Part A, you’ll also be notified that you’re eligible for Part B coverage, which is optional and has a premium for all enrollees.

How do I become eligible for Medicare Advantage?

If you’re eligible for Medicare benefits, you have to choose how to receive them – either through the government-run Original Medicare program, or through Medicare Advantage.

When can I enroll in Medicare Part D?

To be eligible for Medicare Part D prescription drug coverage, you must have either Medicare Part A or Part B, or both. You can sign up for Medicare Part D at the same time that you enroll in Medicare Part A and B.

Who's eligible for Medigap?

If you’re enrolled in both Medicare Part A and Part B, and don’t have Medicare Advantage or Medicaid benefits, then you’re eligible to apply for a Medigap policy.

When will Medicare become the main health insurance?

July 08, 2020. Most Americans understand that when they turn 65, Medicare will become their main health insurance plan. However, many Americans are less familiar with another health care program, Medicaid, and what it means if they are eligible for both Medicare and Medicaid. If you are dual eligible, Medicaid may pay for your Medicare ...

What is dual eligible for medicaid?

Qualifications for Medicaid vary by state, but, generally, people who qualify for full dual eligible coverage are recipients of Supplemental Security Income (SSI). The SSI program provides cash assistance to people who are aged, blind, or disabled to help them meet basic food and housing needs.

What is Medicare Advantage?

Medicare Advantage plans are private insurance health plans that provide all Part A and Part B services. Many also offer prescription drug coverage and other supplemental benefits. Similar to how Medicaid works with Original Medicare, Medicaid wraps around the services provided by the Medicare Advantage plan andserves as a payer of last resort.

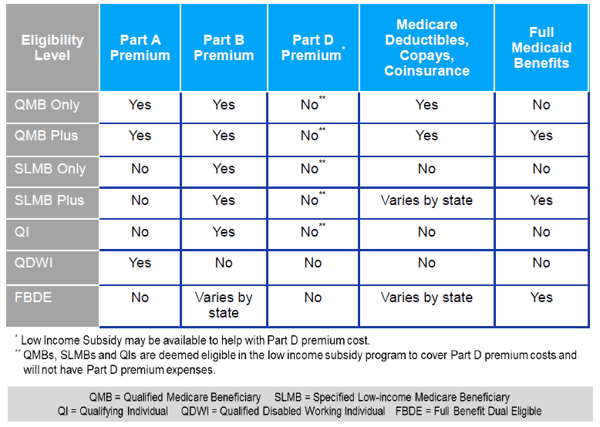

What is dual eligible?

The term “full dual eligible” refers to individuals who are enrolled in Medicare and receive full Medicaid benefits. Individuals who receive assistance from Medicaid to pay for Medicare premiums or cost sharing* are known as “partial dual eligible.”.

Does Medicare cover Part A and Part B?

Some Medicare beneficiaries may choose to receive their services through the Original Medicare Program. In this case, they receive the Part A and Part B services directly through a plan administered by the federal government, which pays providers on a fee-for-service (FFS) basis. In this case, Medicaid would “wrap around” Medicare coverage by paying for services not covered by Medicare or by covering premium and cost-sharing payments, depending on whether the beneficiary is a full or partial dual eligible.

Does Medicaid pay for out of pocket medical expenses?

If you are dual eligible, Medicaid may pay for your Medicare out-of-pocket costs and certain medical services that aren’t covered by Medicare.

Who pays the Part A premium?

Pays the Part A premium for certain people who have disabilities and are working. Asset limits are determined at any point in time, including but not limited to time of application, eligibility determination, and/or eligibility redetermination.