You could check for your name in miscellaneous personal records online at the county clerk's website. If the lien is still on file, then the lien (not the amount) will show up. However, there may be a subrogation claim (right to reimbursement) by your health insurance carrier that is being asserted.

How do I handle a Medicare lien claim?

Step One: Obtain Medicare Information from the Client at the Initial Meeting and Warn Them that Medicare Liens are Difficult and Can Cause Delays throughout Their Case In addition to finding out information about any type of lien claim at your first meeting with the client, be sure to find out if the client receives Medicare benefits.

How do I Check my Medicare claim status?

Medicare Part A (Hospital Insurance) or Medicare Part B (Medical Insurance) claims: Log into (or create) your secure Medicare account. You’ll usually be able to see a claim within 24 hours after Medicare processes it. Check your Medicare Summary Notice (Msn). The MSN is a notice that people with Original Medicare get in the mail every 3 months.

How do I look up a lien on a property?

Free Lien Search Online You have several options available to you when your goal is to look up a person’s lien records, and going to the county clerk is a great place to start. You will need the name and personal information of the person in question. Some courts will grant the request through the mail or over the phone.

How do I Find my MSN number for Medicare?

If you need it, you can also get your MSN in an accessible formatlike large print or Braille. Check your Explanation of Benefits (EOB). Your Medicare drug plan will mail you an EOB each month you fill a prescription. This notice gives you a summary of your prescription drug claims and costs.

How long does Medicare assert a lien?

Any settlement or payment must be reported to Medicare within 60 days and their valid lien amount must be paid.

How far back can Medicare recoup payments?

(1) Medicare contractors can begin recoupment no earlier than 41 days from the date of the initial overpayment demand but shall cease recoupment of the overpayment in question, upon receipt of a timely and valid request for a redetermination of an overpayment.

Are Medicare liens negotiable?

The lien gives Medicare a claim to the judgment or settlement funds and the Medicare lien is superior to any other person or entity, including you as the insured party. Unlike cases involving private health insurance, Medicare offers little to no flexibility to negotiate away, or negotiate down, its lien amount.

Do you ever have to pay Medicare back?

The payment is "conditional" because it must be repaid to Medicare if you get a settlement, judgment, award, or other payment later. You're responsible for making sure Medicare gets repaid from the settlement, judgment, award, or other payment.

How far back can Medicare audit go?

Medicare RACs perform audit and recovery activities on a postpayment basis, and claims are reviewable up to three years from the date the claim was filed.

Does Medicare have a statute of limitations?

FEDERAL STATUTE OF LIMITATIONS For Medicaid and Medicare fraud, federal law establishes (1) a civil statute of limitations of six years (42 U.S.C. § 1320a-7a(c)(1)), and (2) a criminal statute of limitations of five years (18 U.S.C. § 3282).

How can I reduce my Medicare lien?

You can challenge the Medicare lien by showing that certain medical expenses paid by Medicare were unrelated to the injuries that you sustained in your lawsuit.How do you challenge Medicare expenses unrelated to the injuries sustained in your case? ... Eliminating Unrelated Charges is the Key!More items...

What are Medicare liens?

A Medicare lien results when Medicare makes a “conditional payment” for healthcare, even though a liability claim is in process that could eventually result in payment for the same care, as is the case with many asbestos-related illnesses.

Why would I be getting a letter from CMS?

In general, CMS issues the demand letter directly to: The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment.

How is Medicare lien amount calculated?

Formula 1: Step number one: add attorney fees and costs to determine the total procurement cost. Step number two: take the total procurement cost and divide that by the gross settlement amount to determine the ratio. Step number three: multiply the lien amount by the ratio to determine the reduction amount.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

How do I claim unclaimed Medicare rebates?

0:181:15Unclaimed Medicare rebates waiting to be collected | 7NEWS - YouTubeYouTubeStart of suggested clipEnd of suggested clipDetails are up to date on the mygov. Website simply click on view and edit my details the averageMoreDetails are up to date on the mygov. Website simply click on view and edit my details the average amount people are missing out on is two hundred and thirteen.

How long does it take to see a Medicare claim?

Log into (or create) your secure Medicare account. You’ll usually be able to see a claim within 24 hours after Medicare processes it. A notice you get after the doctor, other health care provider, or supplier files a claim for Part A or Part B services in Original Medicare.

What is MSN in Medicare?

The MSN is a notice that people with Original Medicare get in the mail every 3 months. It shows: All your Part A and Part B-covered services or supplies billed to Medicare during a 3-month period. What Medicare paid. The maximum amount you may owe the provider. Learn more about the MSN, and view a sample.

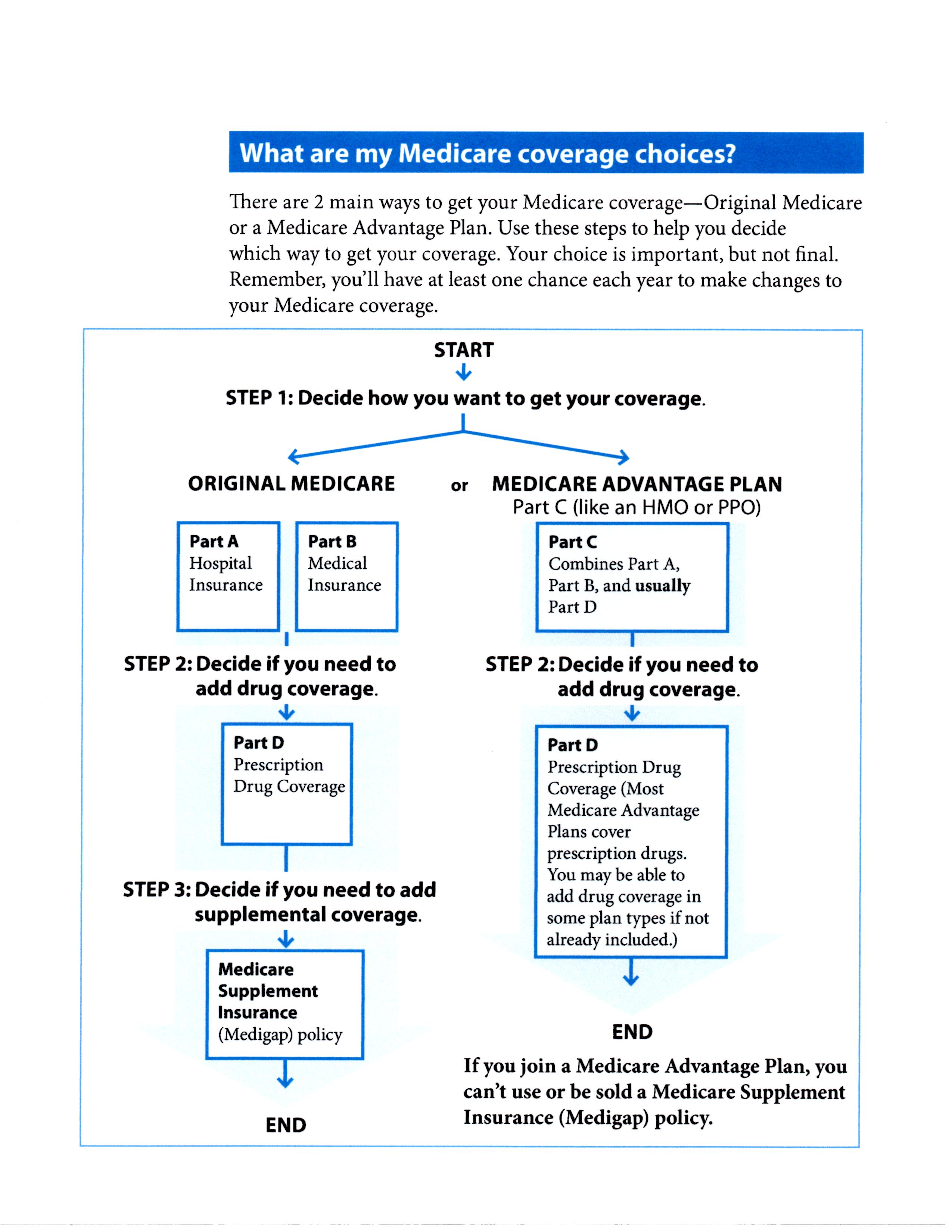

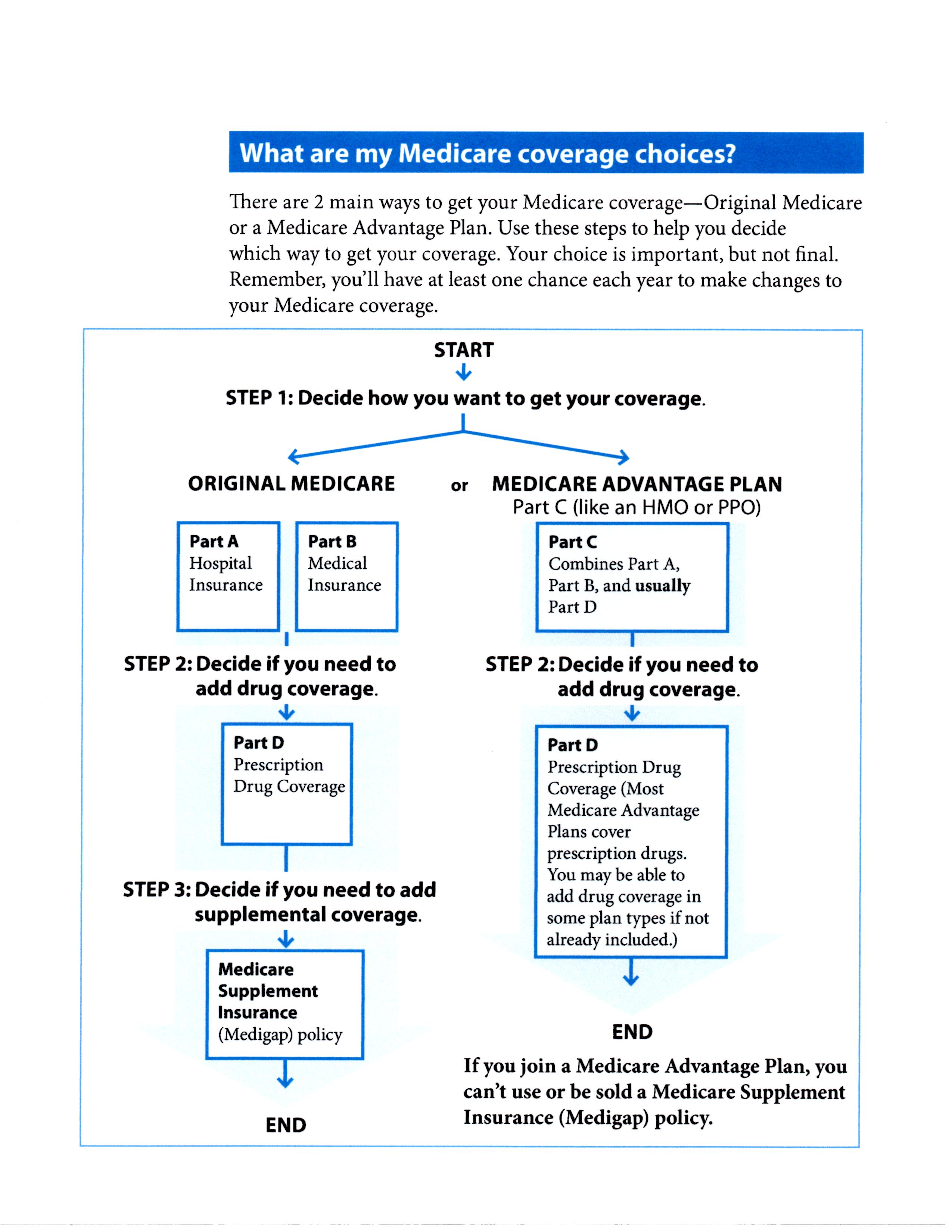

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is Medicare Part A?

Check the status of a claim. To check the status of. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. or.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or other. Medicare Health Plan. Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan.

What is Medicare lien?

To enforce this right to reimbursement, a “Medicare lien” will attach to judgment or settlement proceeds that are awarded as compensation for the accident. This means that if you get a settlement, you will have to pay back Medicare before anything else gets taken out.

How does a lien work in personal injury?

How Medicare Liens Work in Personal Injury Cases. If you are injured in an accident and Medicare pays for some of your treatment, you will be obligated to reimburse Medicare for these payments if you bring a personal injury claim and get financial compensation for the accident. To enforce this right to reimbursement, ...

How much can Medicare fine for reporting?

Additionally, Medicare can fine the “Responsible Reporting Entity,” usually the insurer, up to $1,000 for each day that they are out of compliance with Medicare’s reporting requirements. That is some harsh medicine. It leaves insurance companies stone terrified.

How long does it take for a personal injury claim to be reported to Medicare?

Any settlement or payment must be reported to Medicare within 60 days and their valid lien amount must be paid.

Does Medicare enforce a lien?

Medicare Actively Enforces These Liens. If a Medicare lien is not properly handled and paid off, Medicare is permitted to file against the defendant, the plaintiff, or the plaintiff’s counsel. If Medicare is forced to bring suit against a party to collect its lien, in some situations it is entitled to a civil penalty of two times the amount owed.

Does Medicare have a lien on personal injury settlements?

If a Medicare beneficiary receives a personal injury settlement, they will be required to reimburse Medicare for any payments made on their behalf. To enforce this requirement, the law gives Medicare an automatic priority lien against any settlement proceeds in personal injury cases.

When will an attorney receive a recovery letter?

An attorney will not receive a formal recovery demand letter until there is a final settlement, judgment, award, or other payment reported to Medicare. Once this occurs, a final demand letter will be sent out regarding the Medicare lien amount.

How long does it take for Medicare to pay final demand?

Medicare's final demand amount will account for the reduction for a share of attorneys' fees and costs. Send them a check for amount requested within 60 days, or interest will accrue.

What is the black hole in Medicare?

It takes FOREVER to get a response from the black hole that is known as Medicare's Benefits Coordination and Recovery Contractor. The BCRC collects the information for Medicare and opens the file with the Medicare Secondary Payor Recovery Center (MSPRC).

How to contact MSPRC?

Step 7: Monitor Your Case with MSPRC. Call MSPRC at (866) 677-7220, if you have not received the documents you are waiting for, and the time period for producing them have passed. Have other work to do though; wait times can be very long.

Can you self calculate Medicare payment?

You can also self-calcula te your conditional payment amount if you meet certain eligibility criteria. Use this form to indicate that you meet the criteria, and what you calculate to be the conditional payment amount, and send it in to the Medicare address listed on the form.

Does Medicare move quickly?

As you will see, Medicare does not move quickly in providing information at any step of this process. Warning your client at the outset will prevent many anxious calls from your client at the end of your case when they are wondering why they have not gotten their settlement money.

Can you groan at a lien on Medicare?

If you have any experience in personal injury cases, chances are you groan with frustration at even the thought of handling a case involving a Medicare lien. And with good reason. In my experience, getting information out of Medicare is like pulling teeth, to put it mildly. If you start early, and remain organized, ...

Can you stop Medicare from holding up settlement check?

If you start early, and remain organized, you can prevent Medicare from holding up your settlement check at the end of your case, which can happen if you do not have Medicare's final demand when it's time for the adjuster to issue the settlement check.

How to find a mechanic's lien?

A tax lien can be found by contacting the IRS directly or your state franchise tax board. A mechanics lien or personal lien can be found by using an online public record resource like SearchQuarry.com.

What is a lien on a property?

When placed on a property, a lien prevents the owner from selling their home until it is removed, and the following information will help you search for lien records. Similarly a tax lien or irs lienrecord is a result of unpaid taxes. There are also vehicle liens, mechanic liens, attorney liens and HOA liens to name a few.

What is a court order for a lien?

Court orders are often given when the lien holder asks for an unreasonable amount of money or otherwise engages in unethical behavior. A free lien search online can help you to identify the lien and what it is in reference to. The next step is to contact the relevant agencies to find out how to remove the lien.

Can you get liens removed from your property?

Although many people believe that filing for bankruptcy will help , it won’t. In fact, filing for bankruptcy makes it easier for lien holders to collect the money that you owe them.

What is a demand letter for Medicare?

This letter includes: 1) a summary of conditional payments made by Medicare; 2) the total demand amount; 3) information on applicable waiver and administrative appeal rights. For additional information about the demand process and repaying Medicare, please click the Reimbursing Medicare link.

Is Medicare a lien or a recovery claim?

Please note that CMS’ Medicare Secondary Payer (MSP) recovery claim (under its direct right of recovery as well as its subrogation right) has sometimes been referred to as a Medicare “lien”, but the proper term is Medicare or MSP “recovery claim.”.

Does Medicare require a copy of recovery correspondence?

Note: If Medicare is pursuing recovery from the insurer/workers’ compensation entity, the beneficiary and his attorney or other representative will receive a copy of recovery correspondence sent to the insurer/workers’ compensation entity. The beneficiary does not need to take any action on this correspondence.

What is included in a demand letter for Medicare?

The demand letter also includes information on administrative appeal rights. For demands issued directly to beneficiaries, Medicare will take the beneficiary’s reasonable procurement costs (e.g., attorney fees and expenses) into consideration when determining its demand amount.

What is Medicare beneficiary?

The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). For ORM, there may be multiple recoveries ...

Can CMS issue more than one demand letter?

For ORM, there may be multiple recoveries to account for the period of ORM, which means that CMS may issue more than one demand letter. When Medicare is notified of a settlement, judgment, award, or other payment, including ORM, the recovery contractor will perform a search of Medicare paid claims history.

Can interest be assessed on unpaid debt?

Interest is assessed on unpaid debts even if a debtor is pursuing an appeal or a beneficiary is requesting a waiver of recovery; the only way to avoid the interest assessment is to repay the demanded amount within the specified time frame. If the waiver of recovery or appeal is granted, the debtor will receive a refund.

Medicare Liens

- How Medicare Liens Work in Personal Injury Cases

If you are injured in an accident and Medicarepays for some of your treatment, you will be obligated to reimburse Medicare for these payments if you bring a personal injury claim and get financial compensation for the accident. This federal law also unambiguously gives the Medicar… - The Nature of the Medicare Medical Lien

To enforce this right to reimbursement, a “Medicare lien” will attach to judgment or settlement proceeds that are awarded as compensation for the accident. This means that if you get a settlement, you will have to pay back Medicare before anything else gets taken out. While you ca…

2021-2022 Medicare Supreme Court Case on Tap

- The case that the U.S. Supreme Court will hear next month to decide on the issue of compensation for future medical expenses and Medicaid liens is Gallardo v. Marstiller. The Supreme Court will decide whether a state Medicaid program can go after a beneficiary’s compensation award for future medical expenses. Right now, federal law clearly permits Medica…

Significance of The Marstiller v. Gallardo Case

- The decision of the Supreme Court in Gallardo will have a major impact on how Medicaid liens are dealt with and how much reimbursement Medicaid can collect from personal injury settlements. If the Supreme Court agrees with the decision of the 11thCircuit and holds that Medicaid reimbursement liens can cover compensation for future medical expenses, state Medicaid agen…

Medical Liens

- In this section, we will look at medical liens in personal injury cases. Medical liens differ from Medicare liens in that they involve regular health insurance as opposed to Medicare. This section explains how the health insurance company may have an interest in your case in some states….and why it is not quite as big of a deal as you may think.