- Pay by check or money order. Mail your Medicare premium payments to: Medicare Premium Collection Center P.O. Box 790355 St. Louis, MO 63179-0355

- Pay by credit card or debit card. Complete the bottom portion of the payment coupon on your Medicare bill. ...

- Pay through your bank's online bill payment service. Contact your bank or go to their website to set up this service. ...

- Sign up for Medicare Easy Pay, a free service that automatically deducts your premium payments from your savings or checking account each month. ...

- If you get a bill from the Railroad Retirement Board (RRB):

Full Answer

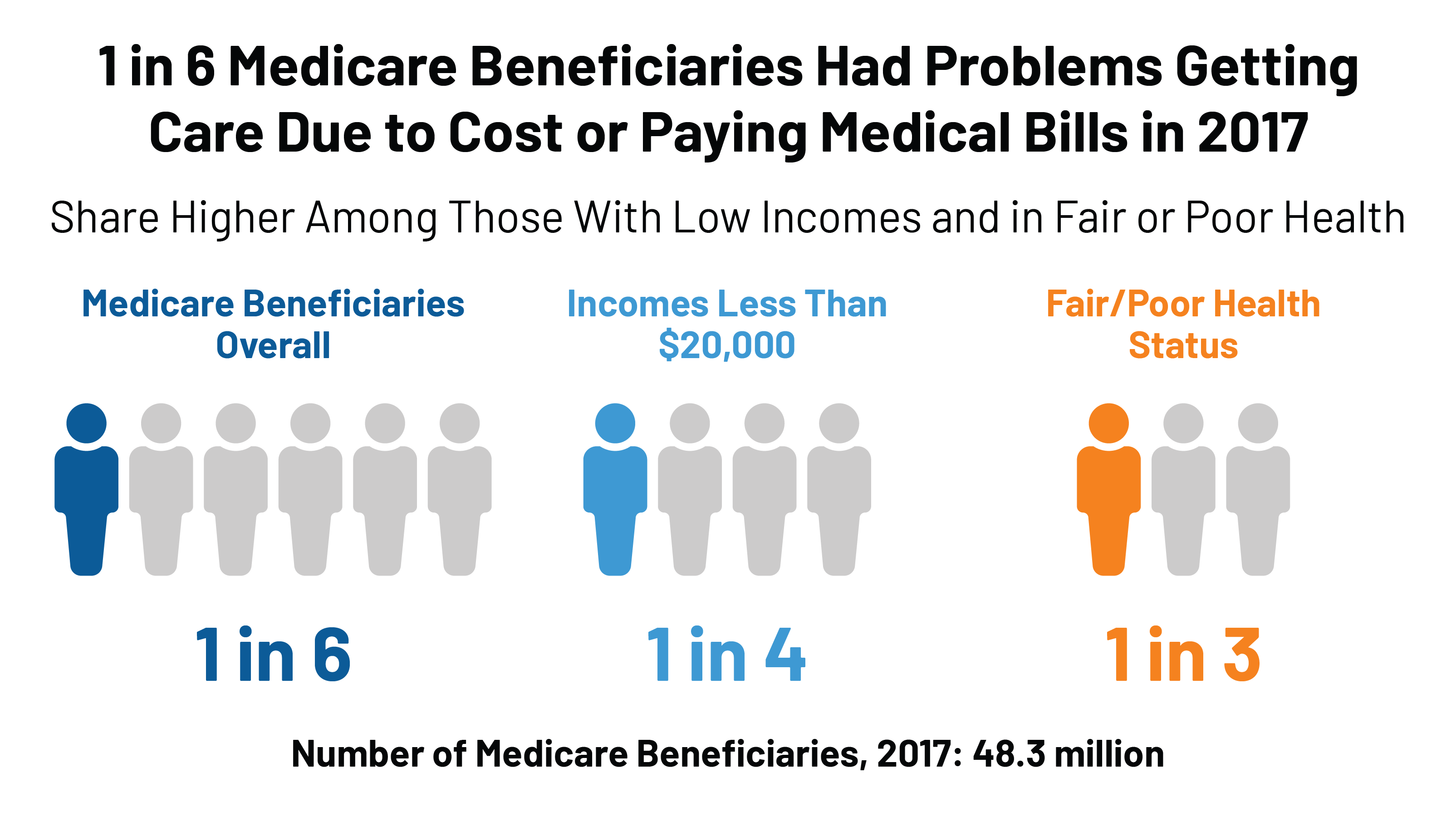

What if I need help paying for Medicare?

- Qualified Medicare Beneficiary Program (QMB). Helps to pay premiums for Part A and Part B, as well as copays, deductibles, and coinsurance. ...

- Specified Low Income Medicare Beneficiary Program (SLMB). Helps to pay premiums for Part B. ...

- Qualified Individual Program (QI). ...

- Qualified Disabled and Working Individuals Program (QDWI). ...

How do I know if I am eligible for Medicare?

- Estate Recovery

- MAGI Conversion Plan

- Seniors & Medicare and Medicaid Enrollees

- Verification Plans

- Minimum Essential Coverage

- Spousal Impoverishment

- Medicaid Third Party Liability & Coordination of Benefits

- Medicaid Eligibility Quality Control Program

How do I get reimbursed for my Medicare?

- Redetermination by your Part D plan sponsor (insurer).

- Reconsideration by the Independent Review Entity.

- Hearing by an administrative law judge or attorney adjudicator.

- Review by the Medicare Appeals Council.

- Review by a federal district court.

Is Medicare worth it?

Medicare Advantage may be worth it for those with specialized healthcare needs that may cost a lot. While it’s not always a necessity, it’s a great safety net to have especially as you age. For more tips on elderly care, read the rest of the articles on the AZNHA Blog.

How do I make payments to Medicare?

4 ways to pay your Medicare premium bill:Pay online through your secure Medicare account (fastest way to pay). ... Sign up for Medicare Easy Pay. ... Pay directly from your savings or checking account through your bank's online bill payment service. ... Mail your payment to Medicare.

Do we pay into Medicare from your paychecks?

Medicare tax is a federal payroll tax that helps pay for the Medicare program. The Medicare tax is generally withheld from your paycheck as part of your FICA taxes — what are usually called “payroll taxes.” FICA stands for Federal Insurance Contributions Act.

How do I pay Medicare Part B premium if not on Social Security?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

What is the monthly Medicare fee?

How much does Medicare cost?Medicare planTypical monthly costPart B (medical)$170.10Part C (bundle)$33Part D (prescriptions)$42Medicare Supplement$1631 more row•Mar 18, 2022

Is Medicare automatically deducted from paycheck?

Medicare tax is deducted automatically from your paycheck to pay for Medicare Part A, which provides hospital insurance to seniors and people with disabilities. The total tax amount is split between employers and employees, each paying 1.45% of the employee's income.

Why do I get charged for Medicare on my paycheck?

When Medicare was enacted as a federal law in 1965, the funds to support the program became a payroll tax on earned income. The payroll taxes required for the Federal Insurance Compensation Act (FICA) are to support both your Social Security and Medicare benefits programs.

Can I pay my Medicare Part B premium monthly?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What month is Medicare deducted from Social Security?

The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.

Is Medicare free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Why is my Medicare bill for three months?

If your income exceeds a certain amount, you'll receive a monthly bill for your Part D income-related monthly adjustment amount (IRMAA) surcharge. If you have only Part B, the bill for your Part B premium will be sent quarterly and will include the cost of 3 months' worth of premiums.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

How much does Medicare pay for lab visits?

Medicare Part B – Medical/doctor visits. Most people pay $135.30 each month. Some who are at a higher-income level pay more. The deductible is $185 per year. After your deductible is met, you typically pay 20 percent of the cost of the services. You can expect to pay: $0 for Medicare-approved laboratory services.

How much is the average out of pocket medical bill?

All Advantage Plans have a yearly limit on your out-of-pocket costs for medical services. The average out-of-pocket limit typically ranges from $3,000 to $4,000.

What percentage of Medicare coverage is a generic drug?

During the coverage gap, you’ll pay 25 percent for most brand-name drugs, and 63 percent for generic drugs. If you have a Medicare plan that includes coverage in the gap, you may get an additional discount after your coverage is applied to the price of the drug. Click here for up-to-date information on the coverage gap.

What is the maximum out of pocket limit for Medicare?

The average out-of-pocket limit typically ranges from $3,000 to $4,000. In 2019, the maximum out-of-pocket limit is $6,700. With most plans, once you reach this limit, you’ll pay nothing for covered services. Any monthly premium you pay for Medicare Advantage coverage does not count towards your plan’s out-of-pocket maximum.

What percentage of Medicare is for outpatient services?

20 percent of the Medicare-approved amount for durable medical equipment, such as a walker, wheelchair, or hospital bed. 20 percent for outpatient mental health services. 20 percent for outpatient hospital services. Late enrollment fees can be equal to 10 percent of your premium amount. The fees are payable for twice the number ...

What happens if you spend $5,100 out of pocket?

Once you have spent $5,100 out-of-pocket, you’re out of the coverage gap and automatically into what is called “ catastrophic coverage .” When you’re in catastrophic coverage, you only play a small coinsurance amount (copayment) for covered drugs for the rest of the year.

What is the coverage gap for Medicare?

After you reach a predetermined amount in copayments, you’ve reached the coverage gap, also called “the donut hole .”. According to the Medicare website for 2019, once you and your plan have spent $3,820 on covered drugs, you’re in the coverage gap. This amount may change from year to year.

What does Medicare Part A pay for?

Medicare Part A (hospital insurance) helps pay for inpatient care in a hospital or limited time at a skilled nursing facility (following a hospital stay). Part A also pays for some home health care and hospice care.

How to apply for Medicare Part B?

Go to “ Apply Online for Medicare Part B During a Special Enrollment Period ” and complete CMS-40B and CMS-L564. Then upload your evidence of Group Health Plan or Large Group Health Plan.

What happens if you don't enroll in Medicare Part B?

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B , but didn’t sign up for it, unless you qualify for a " Special Enrollment Period " (SEP).

What is Medicare Advantage Plan?

Medicare Advantage Plan (previously known as Part C) includes all benefits and services covered under Part A and Part B — prescription drugs and additional benefits such as vision, hearing, and dental — bundled together in one plan. Medicare Part D (Medicare prescription drug coverage) helps cover the cost of prescription drugs.

How long does a spouse have to be covered by a group health plan?

Any month you remain covered under the group health plan and you or your spouse's employment continues. The 8-month period that begins with the month after your group health plan coverage or the employment it is based on ends, whichever comes first.

Does Medicare cover long term care?

The program helps with the cost of health care, but it does not cover all medical expenses or the cost of most long-term care. You have choices for how you get Medicare coverage. If you choose to have Original Medicare (Part A and Part B) coverage, you can buy a Medicare Supplement Insurance (Medigap) policy from a private insurance company.

Who manages Medicare?

The Centers for Medicare & Medicaid Services (CMS) manages Medicare. After you are enrolled, they will send you a Welcome to Medicare packet in the mail with your Medicare card. You will also receive the Medicare & You handbook, with important information about your Medicare coverage choices.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

What is Medicare Easy Pay?

Medicare Easy Pay is a free way to set up recurring payments for your Medicare premium. If you sign up for Medicare Easy Pay, your Medicare premiums will be automatically deducted from your checking or savings account each month. If you get a "Medicare Premium Bill" (Form CMS-500) from Medicare, you can sign up for Medicare Easy Pay.

How long does it take to get Medicare Easy Pay?

Mail your completed form to: It can take up to 6-8 weeks for your automatic deductions to start. Until your automatic deductions start, you'll need to pay your premiums another way. If you can't process your Medicare Easy Pay request, we'll send you a letter explaining why.

How do I change bank accounts or stop Medicare Easy Pay?

Log into your secure Medicare account — Select "My Premiums" and then "See or change my Medicare Easy Pay" to complete a short, online form.

How to sign up for Medicare online?

Log in or create your secure Medicare account — Select "My Premiums" and then "Sign Up" to complete a short, online form.

When will Medicare Easy Pay deduct premiums?

We'll deduct your premium from your bank account on or around the 20th of the month.

How long does it take to get Medicare if you change your bank account?

If you stop Medicare Easy Pay: It can take up to 4 weeks for your automatic deductions to stop.

Where to mail Medicare premium payment?

Mail your payment to: Medicare Premium Collection Center. P.O. Box 790355. St. Louis, MO 63179-0355. 3. Pay through your bank's online bill payment service. Contact your bank or go to their website to set up this service.

How to contact Medicare helpline?

For more information, contact the Medicare helpline 24 hours a day, seven days a week at 1-800- MEDICARE (1-800-633-4227) , TTY 1-877-486-2048.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Do you pay Medicare premiums monthly?

If you’re like most people, you don’t pay a monthly premium for your Medicare Part A. However, if you have Medicare Part B and you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium is usually deducted from your monthly benefit payment.

When did Medicare start providing prescription drugs?

Since January 1, 2006, everyone with Medicare, regardless of income, health status, or prescription drug usage has had access to prescription drug coverage. For more information, you may wish to visit the Prescription Drug Coverage site.

How long do you have to be on disability to receive Social Security?

You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months. ( Note: If you have Lou Gehrig's disease, your Medicare benefits begin the first month you get disability benefits.)

Does Medicare deduct premiums?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Medicare Part A free?

Medicare Part A, which covers hospitalization, is free for anyone who is eligible for Social Security, even if they have not claimed benefits yet. If you are getting Medicare Part C (additional health coverage through a private insurer) or Part D (prescriptions), you have the option to have the premium deducted from your Social Security benefit ...