Pay by credit card or debit card. Complete the bottom portion of the payment coupon on your Medicare bill. You'll need to provide the account information and expiration date as it appears on your card. Mail your payment to: 3. Pay through your bank's online bill payment service.

- Pay online through your secure Medicare account (fastest way to pay). ...

- Sign up for Medicare Easy Pay. ...

- Pay directly from your savings or checking account through your bank's online bill payment service. ...

- Mail your payment to Medicare.

What is the monthly premium for Medicare Part B?

You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security; Railroad Retirement Board; Office of Personnel Management; If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount. If your modified adjusted gross …

How is the premium calculated for Medicare Part B?

Mar 07, 2022 · There are 5 ways to make your Medicare payments: 1. Pay by check or money order. Mail your Medicare premium payments to: Medicare Premium Collection Center. P.O. Box 790355. St. Louis, MO 63179-0355. 2. Pay by credit card or debit card. 3. Pay through your bank's online bill payment service. 4. Sign ...

Does everyone pay the same for Medicare Part B?

Apr 18, 2018 · You have been charged for 4 months of Medicare Part B premiums. Since you are not receiving a Social Security check, then all Social Security can do is bill you for your Medicare premiums in a quarterly lump sum. Most Americans enrolled in Medicare are paying their Medicare premiums monthly from their Social Security check.

Does Medicare Part B cost money?

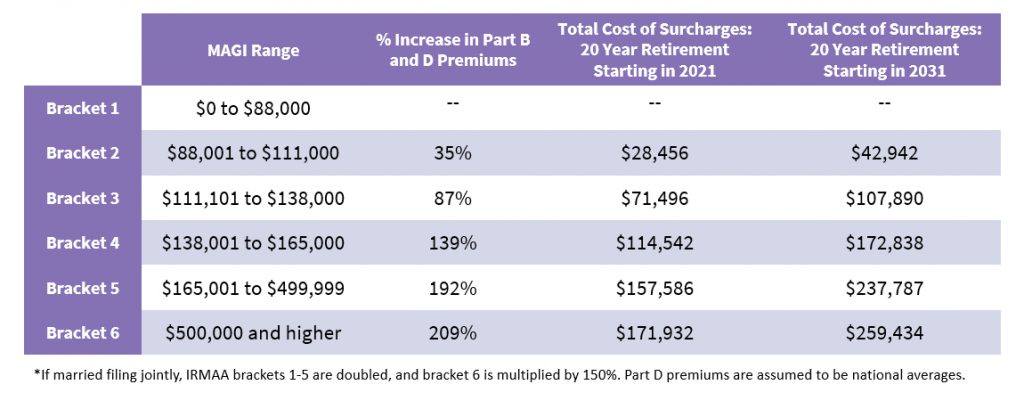

Nov 24, 2021 · Depending on their income, these higher-income beneficiaries will pay premiums that amount to 35, 50, 65, or 80 percent of the total cost of coverage. You can get details at Medicare.gov or by calling 1-800-MEDICARE ( 1-800-633-4227 ) (TTY 1-877-486-2048 ). Medicare Premiums: Rules for Higher-Income Beneficiaries Part B premiums by income

Can you pay Medicare Part B monthly?

Part B premiums You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

Is Medicare Part B free for anyone?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Is Medicare Part B automatically deducted?

Your Medicare Part B premiums will be automatically deducted from your Social Security benefits. Most people receive Part A without paying a premium.Dec 1, 2021

How do I pay my Medicare premium if not receiving Social Security?

If you are enrolled in Part B but not yet collecting Social Security, you'll be billed quarterly by Medicare. You can pay electronically or by mail. The Medicare fact sheet "Pay Part A & Part B Premiums" has details on your options.

Which of the following services are covered by Medicare Part B?

Medicare Part B helps cover medically-necessary services like doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services.Sep 11, 2014

What is the Medicare Part B deductible for 2021?

$203 in 2021Medicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.Nov 6, 2020

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

What month is Medicare deducted from Social Security?

Hi RCK. The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.Mar 5, 2021

Is Medicare Part B worth the cost for federal retirees?

Overall, we see far less expense for retirees in BCBS Basic compared to BCBS Standard, and with Basic there is an additional benefit of a partial Part B premium reimbursement. Medicare Advantage Eligibility—By joining Part B, federal retirees gain access to Medicare Advantage (MA) plans offered by a few FEHB carriers.Nov 14, 2021

Why is my first Medicare premium bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.Dec 3, 2021

Can I pay Medicare monthly instead of quarterly?

Can I instead pay monthly? Hi, Probably not. Part B Medicare premiums are billed on a quarterly basis if they can't be withheld from a person's benefits, although if a person is also paying premiums for Part A of Medicare then they're billed monthly.Oct 16, 2019

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Do you pay Medicare premiums monthly?

If you’re like most people, you don’t pay a monthly premium for your Medicare Part A. However, if you have Medicare Part B and you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium is usually deducted from your monthly benefit payment.

How much is Part B insurance?

The average Part B premium for those who income is $85,000 or less as an individual or $170,000 or less as a couple is $134, and yours, Fred, if you divide your premium of $536 by 4 months equals $134 per month.

How long do you have to pay Medicare premiums?

You have been charged for 4 months of Medicare Part B premiums. Since you are not receiving a Social Security check, then all Social Security can do is bill you for your Medicare premiums in a quarterly lump sum. Most Americans enrolled in Medicare are paying their Medicare premiums monthly from their Social Security check.

What happens if you don't pay Medicare premiums?

If one does not keep up with your Medicare premiums, whether it is Part A, B, C and/or D, then they can lose their benefits and may be charged a penalty when they re-enroll. (When one does not have 40 working quarters to qualify for Medicare, then they may have to pay a premium for Part A.)