- Most people don’t receive a bill from Medicare for their Part A and Part B premiums.

- If you do receive a bill (Medicare form CMS-500), you can pay it online through your bank or Medicare Easy Pay.

- You can use your debit or credit card to pay, either online or by mailing your credit card information to Medicare.

- You can also pay using a check or money order.

What is the standard premium for Medicare Part B?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

How much will you pay for Medicare Part B?

The standard Part B premium in 2021 is $148.50 per month, though you could potentially pay more, depending on your income. Your Medicare Part B premium largely depends on the income reported on your tax return from two years prior.

Does Medicaid pay for Part B premium?

Does Medicaid pay for Medicare premiums? Medicaid pays Part A (if any) and Part B premiums. Medicaid pays Medicare deductibles, coinsurance, and copayments for services furnished by Medicare providers for Medicare-covered items and services (even if the Medicaid State Plan payment does not fully pay these charges, the QMB is not liable for them).

Does Medicare Part B have a premium?

Most people actually pay less than the standard Medicare Part B premium amount, which is determined by the federal government each year. In 2021, the standard Medicare Part B premium is $148.50. You might pay more if you have a high income. See details below.

How are Medicare Part B premiums paid?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. premium deducted automatically from their Social Security benefit payment (or Railroad Retirement Board benefit payment).

How are Medicare premiums billed?

Most people don't get a bill from Medicare because they get these premiums deducted automatically from their Social Security (or Railroad Retirement Board) benefit.) Your bill pays for next month's coverage (and future months if you get the bill every 3 months). Your bill lists the dates you're paying for.

Can I pay my Medicare bill over the phone?

Call us at 1-800-MEDICARE (1-800-633-4227).

Does Medicare send you a bill?

Medicare Part A premium bill If you don't qualify for premium-free Medicare Part A, then you will be charged a monthly premium, also known as a “Notice of Medicare Premium Payment Due.” You may get a bill, or it may be deducted from your monthly benefits as described below.

Is your Medicare premium deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Medicare Part B deducted from your Social Security check?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Where do I send my Medicare payment?

Medicare premium payments by mail Mail your check or money order to Medicare at Medicare Premium Collection Center, P.O. Box 790355, St. Louis, MO 63179-0355. Follow the instructions in your Medicare premium bill and mail your payment to the address listed in the form.

What is the Medicare Part B premium for 2022?

$170.10In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022. This increase was driven in part by the statutory requirement to prepare for potential expenses, such as spending trends driven by COVID-19 and uncertain pricing and utilization of Aduhelm™.

Can you prepay Medicare premiums?

You can choose to pay by check, money order, credit card or automatic electronic transfer from your checking or savings account. If paying three months of premiums at a time causes hardship, call Medicare's help line at 1-800-633-4227 to request an arrangement to pay monthly.

How much is taken out of your Social Security check for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

Why is my Medicare bill for 5 months?

You have been charged for 5 months of Medicare Part B premiums because you are not receiving a Social Security check to have your Medicare premiums deducted.

Do you have to pay for Medicare Part B?

Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Where to mail Medicare premium payment?

Mail your payment to: Medicare Premium Collection Center. P.O. Box 790355. St. Louis, MO 63179-0355. 3. Pay through your bank's online bill payment service. Contact your bank or go to their website to set up this service.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Do you pay Medicare premiums monthly?

If you’re like most people, you don’t pay a monthly premium for your Medicare Part A. However, if you have Medicare Part B and you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium is usually deducted from your monthly benefit payment.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

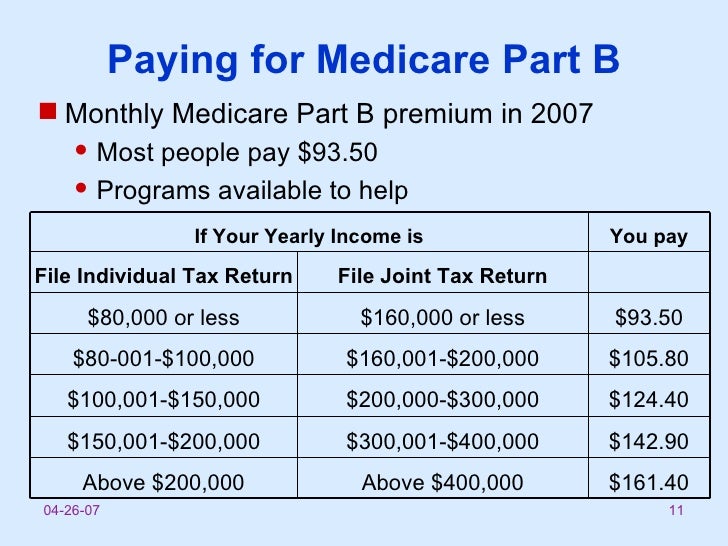

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How many people pay Medicare Part B?

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals.

When was the Medicare buy in manual released?

Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”) On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal ...

What is the Medicare premium for 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Will Social Security send out a letter to all people who collect Social Security benefits?

Social Security will send a letter to all people who collect Social Security benefits ( and those who pay higher premiums because of their income) that states each person’s exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most.

How much is Medicare Part B premium 2020?

The standard Medicare Part B premium for 2020 is $144.60. While most Medicare beneficiaries will pay the standard premium amount, the premium you will pay is dependent on your income. If your income falls below the federal standards, help is available for Medicare beneficiaries through Medicare Savings Programs (MSP).

What are the resources that can't be counted as assets in Medicare?

Each Medicare Savings Plan has a specific income and asset limit, resources that can’t be counted as assets include: Your primary house. One car. Household goods and wedding/ engagement rings. Burial spaces.

Is Medicare Part A free?

Medicare Part A, which covers hospitalization, is free for anyone eligible for Social Security, even if they have not claimed benefits yet. If enrolled in Part B but not yet collecting Social Security benefits, you’ll be billed quarterly by Medicare. As a Medicare beneficiary, you have many options when it comes to how you receive your Medicare ...

Does Medicare Part B deduct premiums?

If you sign up for both Social Security and Medicare Part B – the part of Original Medicare that covers medically necessary and preventative services, The Social Security Administration will automatically deduct the premium from your monthly benefit.