Call your insurance company or state Medicaid and CHIP program. Look at their website or check your member handbook to find providers in your network who take your health coverage. Ask your friends or family if they have providers they like and use these tools to compare health care providers in your area.

How do I Choose my Medicare coverage choices?

Your Medicare coverage choices Step 1: Decide if you want Original Medicare or a Medicare Advantage Plan (like an HMO or PPO) Step 2: Decide if you want prescription drug coverage (Part D) Step 3: Decide if you want supplemental coverage Other options

How do I get Medicare?

There are 2 main ways to get Medicare: Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles).

How do I find a doctor that accepts Medicare payments?

To find a doctor that accepts Medicare payments, you may want to visit the Centers for Medicare and Medicaid Services' Physician Compare. You can search by entering a health care professional’s last name or group practice name, a medical specialty, a medical condition, a body part, or an organ system.

How do I find out if a professional accepts Medicaid?

Medicaid programs vary by state and each state Medicaid agency maintains their own list of professionals that accept Medicaid. For further assistance, please contact your health plan or state Medicaid agency. For more information about Medicaid, visit the Medicaid & CHIP page on Healthcare.gov.

How long does it take for Medicare to approve a provider?

Medicare takes approximately 30 days to process each claim. Medicare pays Part A claims (inpatient hospital care, inpatient skilled nursing facility care, skilled home health care and hospice care) directly to the facility or agency that provides the care.

How do I find out what providers are on my network?

Call your insurance company. You can also call your insurance company to verify in-network providers. Before you call, make sure you have your policy number and plan information. This call will help your insurance company verify approved in-network providers.

What are some things to consider when choosing a provider?

Five tips for choosing a new primary care physicianDetermine Which Doctors Are “In-Network” ... Find a Doctor with Expertise that Meets Your Health Needs. ... Ask for Referrals. ... Think About Logistics. ... Visit the Doctor.

What does it mean to select a provider?

When your Provider Selection is activated this enables your customers to choose the provider they would like for the service they are selecting.

What is a PPO plan?

A type of health plan that contracts with medical providers, such as hospitals and doctors, to create a network of participating providers. You pay less if you use providers that belong to the plan's network.

What is the difference between a preferred provider and a participating provider?

Differences Between Participating and Preferred Providers Preferred providers are in a network that receives higher reimbursement rates than participating providers. This is because preferred providers are required to meet quality standards while participating providers are not.

How do I choose a healthcare service?

There are many things to consider, including:What your insurance covers.Whether a health care provider or service is accredited.The location of a service.Hours that the service is available.Whether you like a health care provider's personality.

What is the difference between family medicine and internal medicine?

This is one of the clearest ways the two areas of medicine differ. “Internal medicine focuses exclusively on adult medicine, while family medicine typically sees all the members of a family—children as well as adults,” explains Dr. Linda Girgis, a family physician and graduate of St. George's University (SGU).

What kind of doctor should I see?

All adults should have a primary care doctor. These are usually internal medicine (internists) or family medicine doctors. Getting an annual checkup can help your doctor spot health issues early on. Untreated conditions, such as high blood pressure, can lead to serious problems that are harder to treat.

What is the difference between Medicare and Medicaid?

The difference between Medicaid and Medicare is that Medicaid is managed by states and is based on income. Medicare is managed by the federal government and is mainly based on age. But there are special circumstances, like certain disabilities, that may allow younger people to get Medicare.

What do you call your main doctor?

A primary care physician (PCP), or primary care provider, is a health care professional who practices general medicine.

Who is Medicare through?

The Centers for Medicare & Medicaid Services (CMS) is the federal agency that runs Medicare. The program is funded in part by Social Security and Medicare taxes you pay on your income, in part through premiums that people with Medicare pay, and in part by the federal budget.

When does Medicare change?

Benefits, premiums and/or copayments/co-insurance may change on January 1 of each year. The Formulary, pharmacy network, and/or provider network may change at any time. You will receive notice when necessary.

What is the good news about Medicare Part D?

The good news is that you may have a lot of options when it comes to choosing a Medicare Part D plan. Here’s what you need to know when you are selecting a health insurance provider for your Medicare Part D plan.

What is Medicare Part D?

Medicare Part D Plans are offered by private insurance companies approved by Medicare, which means that each company sets its own cost structure. There are three elements to consider in comparing plan costs: The monthly premium, the yearly deductible, and the coinsurance or copayment structure. Unless you get your prescription drug coverage ...

Does Medicare cover prescription drugs?

All plans must cover certain prescription drugs and certain classes of prescription drugs as required by Medicare. Beyond that, companies may choose to cover other medications, as well. The list of prescription drugs covered by a Medicare Part D Plan is called a “formulary.”.

Do you have to pay a deductible on Medicare Part D?

Unless you get your prescription drug coverage through a Medicare Advantage plan, you’ll generally pay a separate monthly premium to your insurance company for Medicare Part D. Your plan may also have an annual deductible, although many plans do not. A deductible is the amount you pay out of pocket before the plan begins to pay.

Do you pay out of pocket if you go outside the network?

In some cases, the plan may not pay at all if you go outside the provider network, and in other cases, the plan will pay something, but you’ll pay more out-of-pocket if you go outside the network.

Add your favorite providers

Keep a list of all your favorite providers – Select the button above to find and compare providers. Then, select the heart icon next to any of the providers to add them to your list of favorites.

Not sure what type of provider you need?

Use our provider search tool to find quality data, services offered, and other information for these type of providers:

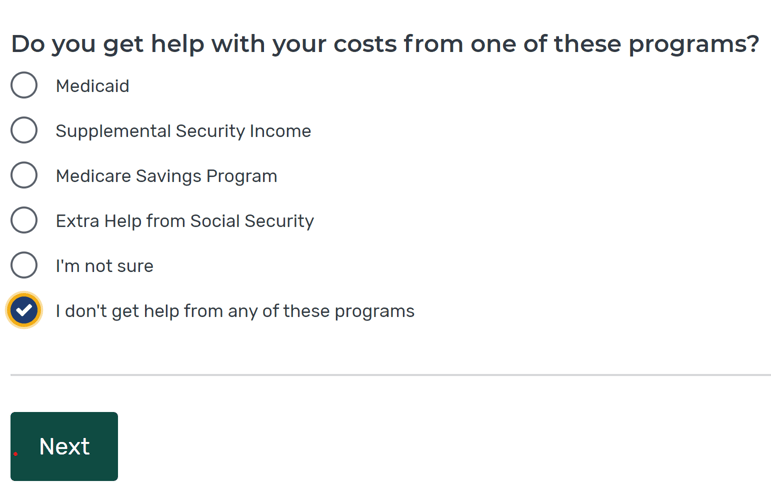

Your other coverage

Do you have, or are you eligible for, other types of health or prescription drug coverage (like from a former or current employer or union)? If so, read the materials from your insurer or plan, or call them to find out how the coverage works with, or is affected by, Medicare.

Cost

How much are your premiums, deductibles, and other costs? How much do you pay for services like hospital stays or doctor visits? What’s the yearly limit on what you pay out-of-pocket? Your costs vary and may be different if you don’t follow the coverage rules.

Doctor and hospital choice

Do your doctors and other health care providers accept the coverage? Are the doctors you want to see accepting new patients? Do you have to choose your hospital and health care providers from a network? Do you need to get referrals?

Prescription drugs

Do you need to join a Medicare drug plan? Do you already have creditable prescription drug coverag e? Will you pay a penalty if you join a drug plan later? What will your prescription drugs cost under each plan? Are your drugs covered under the plan’s formulary? Are there any coverage rules that apply to your prescriptions?

Quality of care

Are you satisfied with your medical care? The quality of care and services given by plans and other health care providers can vary. Get help comparing plans and providers

Convenience

Where are the doctors’ offices? What are their hours? Which pharmacies can you use? Can you get your prescriptions by mail? Do the doctors use electronic health records prescribe electronically?

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.