When Medicare is the secondary payer, submit the claim first to the primary insurer. The primary insurer must process the claim in accordance with the coverage provisions of its contract.

Full Answer

How to deal with Medicare as a secondary insurance?

- Vision: Your medical plan will not cover you for vision care. ...

- Dental: A dental plan can cover you for preventive care such as routine teeth cleanings and some X-rays. ...

- Disability: Short- and long-term disability plans are a type of secondary insurance coverage. ...

Is Medicare a secondary payer?

Medicare is a secondary payer when the beneficiary is covered by group insurance, Workers' Compensation, or if other third-party liability (no-fault, liability) applies. For detailed information on CMS's Medicare Secondary Payer guidelines, refer to the CGS web page, ' CMS Guidelines and Resources for Medicare Secondary Payer (MSP) ', for links to the various CMS MSP regulations.

How to appeal a Medicare claim denial decision?

Questioning a Medicare Claim

- The first level of appeal, described above, is called a “redetermination.”

- If your concerns aren’t resolved to your satisfaction at this level, you can file an appeal form with Medicare to advance your request to the second “reconsideration” level in which ...

- The third level of appeal is before an administrative law judge (ALJ). ...

How to complete required Medicare questionnaire?

It can also include:

- A review of your medical and family history.

- Developing or updating a list of current providers and prescriptions.

- Height, weight, blood pressure, and other routine measurements.

- Detection of any cognitive impairment.

- Personalized health advice.

- A list of risk factors and treatment options for you.

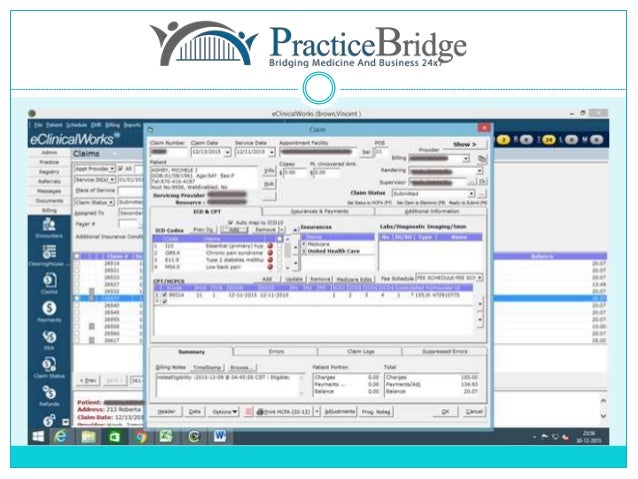

How do I submit a Medicare claim as a secondary?

Medicare Secondary Payer (MSP) claims can be submitted electronically to Novitas Solutions via your billing service/clearinghouse, directly through a Secure File Transfer Protocol (SFTP) connection, or via Novitasphere portal's batch claim submission.

How Does Medicare pay as a secondary payer?

As secondary payer, Medicare pays the lowest of the following amounts: (1) Excess of actual charge minus the primary payment: $175−120 = $55. (2) Amount Medicare would pay if the services were not covered by a primary payer: . 80 × $125 = $100.

When Medicare is the secondary payer?

The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the remaining costs. If your group health plan or retiree coverage is the secondary payer, you may need to enroll in Medicare Part B before they'll pay.

Does Medicare pay deductible as a secondary insurance?

“Medicare pays secondary to other insurance (including paying in the deductible) in situations where the other insurance is primary to Medicare.

Is Medicare my primary or secondary?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

How do you fill out CMS 1500 when Medicare is secondary?

1:239:21Medicare Secondary Payer (MSP) CMS-1500 Submission - YouTubeYouTubeStart of suggested clipEnd of suggested clipOther insurance that may be primary to medicare is shown on the cms 15 claim form when block 10 isMoreOther insurance that may be primary to medicare is shown on the cms 15 claim form when block 10 is completed a primary insurer is identified in the remarks portion of the bill items 10 a through 10c.

Is Medicare always the primary insurance?

If you don't have any other insurance, Medicare will always be your primary insurance. In most cases, when you have multiple forms of insurance, Medicare will still be your primary insurance.

How do you determine which insurance is primary and which is secondary?

The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" to pay. The insurance that pays first is called the primary payer. The primary payer pays up to the limits of its coverage. The insurance that pays second is called the secondary payer.

Is Medicare the primary payer?

When you're dual eligible for both Medicare and Medicaid, Medicare is your primary payer. Medicaid will not pay until Medicare pays first. If you're dual-eligible and need assistance covering the costs of Part B and Part D, you could qualify for a Medicare Savings Program to assist you with these costs.

How do deductibles work with two insurances?

If you have multiple health insurance policies, you'll have to pay any applicable premiums and deductibles for both plans. Your secondary insurance won't pay toward your primary's deductible. You may also owe other cost sharing or out-of-pocket costs, such as copayments or coinsurance.

Can you have Medicare and employer insurance at the same time?

Can I have Medicare and employer coverage at the same time? Yes, you can have both Medicare and employer-provided health insurance. In most cases, you will become eligible for Medicare coverage when you turn 65, even if you are still working and enrolled in your employer's health plan.

How does secondary insurance work with deductibles?

Usually, secondary insurance pays some or all of the costs left after the primary insurer has paid (e.g., deductibles, copayments, coinsurances). For example, if Original Medicare is your primary insurance, your secondary insurance may pay for some or all of the 20% coinsurance for Part B-covered services.

How does Medicare work with insurance carriers?

Generally, a Medicare recipient’s health care providers and health insurance carriers work together to coordinate benefits and coverage rules with Medicare. However, it’s important to understand when Medicare acts as the secondary payer if there are choices made on your part that can change how this coordination happens.

What is secondary payer?

A secondary payer assumes coverage of whatever amount remains after the primary payer has satisfied its portion of the benefit, up to any limit established by the policies of the secondary payer coverage terms.

Is Medicare a secondary payer?

Medicare is the secondary payer if the recipient is: Over the age of 65 and covered by an employment-related group health plan as a current employee or the spouse of a current employee in an organization with more than 20 employees.

Who is responsible for making sure their primary payer reimburses Medicare?

Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment. Medicare recipients are also responsible for responding to any claims communications from Medicare in order to ensure their coordination of benefits proceeds seamlessly.

Does Medicare pay conditional payments?

In any situation where a primary payer does not pay the portion of the claim associated with that coverage, Medicare may make a conditional payment to cover the portion of a claim owed by the primary payer. Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What happens when there is more than one payer?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) to pay. In some rare cases, there may also be a third payer.

Submitting MSP Claims via FISS DDE or 5010

All MSP claims submitted via FISS DDE or 5010 must report claim adjustment segment (CAS) information. In FISS DDE, the CAS information is entered on the "MSP Payment Information" screen (MAP1719), which is accessed from Claim Page 03 by pressing F11. This is in addition to the normal MSP coding information.

Correcting MSP Claims and Adjustments

Return to Provider (RTP): MSP claims may be corrected out of the RTP file (status/location T B9997). However, providers must ensure that claim adjustment segment (CAS) information is reported on the "MSP Payment Information" screen (MAP1719), accessed from Claim Page 03 by pressing F11.

What is Medicare Secondary Payer?

The Medicare Secondary Payer (MSP) provisions protect the Medicare Trust Fund from making payments when another entity has the responsibility of paying first. Any entity providing items and services to Medicare patients must determine if Medicare is the primary payer. This booklet gives an overview of the MSP provisions and explains your responsibilities in detail.

What happens if you don't file a claim with the primary payer?

File proper and timely claims with the primary payer. Not filing proper and timely claims with the primary payer may result in claim denial. Policies vary depending on the payer; check with the payer to learn its specific policies.

Why does Medicare make a conditional payment?

Medicare may make pending case conditional payments to avoid imposing a financial hardship on you and the patient while awaiting a contested case decision.

How long does it take to pay a no fault claim?

For no-fault insurance and WC claims, “paid promptly” means payment within 120 days after the no-fault insurance or WC carrier got the claim for specific items and services. Without contradicting information, you must treat the service date for specific items and services as the claim date when determining the paid promptly period; for inpatient services, you must treat the discharge date as the service date.

Can Medicare make a payment?

Medicare can’t make payment when payment “has been made or can reasonably be expected to be made” under liability insurance (including self-insurance), no-fault insurance, or a WC law or plan of the United States, called a primary plan.

Can Medicare deny a claim?

Medicare may mistakenly pay a claim as primary if it meets all billing requirements, including coverage and medical necessity guidelines . However, if the patient’s CWF MSP record shows another insurer should pay primary to Medicare, we deny the claim.

Medicare Secondary Institutional (Part A) Claim

1. Complete the fields as required on the Institutional claim form. See Section 2 for more information on the Institutional claim completion.

Medicare Secondary Professional (Part B) Claim

1. Comple te the fields as required on the Professional claim form. See Section 2 for more information on the Professional claim completion

What are the items that Medicare may be secondary to?

If there is insurance primary to Medicare, enter the insured’s policy or group number and then proceed to Items 11a–11c. Items 4, 6, and 7 must also be completed. Circumstances under which Medicare may be secondary to another insurer, includes: Group health plan coverage. Working aged;

What to do if there is no Medicare primary?

If there is no insurance primary to Medicare, enter the word “none”. If there has been a change in the insured’s insurance status, e.g., retired, enter the word “none” and proceed to item 11b. Item 11a-Insured's date of birth: Enter the insured’s eight-digit birth date (MM/DD/CCYY) and sex if different from Item 3.

What is EOB in Medicare?

If the primary payer’s explanation of benefits (EOB) does not contain the claims processing address, record the claims processing address directly on the EOB. Completion of this item is conditional for insurance information primary to Medicare.

What does "yes" mean on Medicare?

Any item checked "yes" indicates there may be other insurance primary to Medicare. Identify primary insurance information in item 11. Completion of items 10a-c is required for all claims; "yes" or "no" must be indicated.

What is the word "none" in Medicare?

If there is no insurance primary to Medicare, the word "none" should be entered in block 11. Completion of item 11 (i.e., insured's policy/group number or " none ") is required on all claims. Claims without this information will be rejected.

When submitting paper or electronic claims, what is item 11?

When submitting paper or electronic claims, item 11 must be completed. By completing this information, the physician / supplier acknowledges having made a good faith effort to determine whether Medicare is the primary or secondary payer. Claims without this information will be rejected.

Does Medicare cover claims submitted on paper?

Reminder: Medicare will not cover claims submitted on paper that do not meet the limited exception criteria. Claims denied for this reason will contain a claim adjustment reason code and remark code indicating that the claim will not be considered unless submitted via an electronic claim.

Monday, October 11, 2010

If there is insurance primary to Medicare for the service date (s), enter the insured’s policy or group number within the confines of the box and proceed to items 11a-11c. Items 4, 6, and 7 must also be completed. If item 11 is left blank, the claim will be denied as unprocessable.

Submitting Medicare secondary claim - cms 1500 primary insurance info

If there is insurance primary to Medicare for the service date (s), enter the insured’s policy or group number within the confines of the box and proceed to items 11a-11c. Items 4, 6, and 7 must also be completed. If item 11 is left blank, the claim will be denied as unprocessable.

Submitting MSP Claims Via Fiss DDE Or 5010

Additional Information

- Paper (UB-04) claims can only be submitted to CGS for Black Lung related services, or when a provider meets the small provider exception, (CMS Pub. 100-04, Ch. 24§90).

- When a beneficiary is entitled to benefits under the Federal Black Lung (BL) Program, and services provided are related to BL, a paper (UB-04) claim must be submitted with MSP coding and the denial...

- Paper (UB-04) claims can only be submitted to CGS for Black Lung related services, or when a provider meets the small provider exception, (CMS Pub. 100-04, Ch. 24§90).

- When a beneficiary is entitled to benefits under the Federal Black Lung (BL) Program, and services provided are related to BL, a paper (UB-04) claim must be submitted with MSP coding and the denial...

- When submitting non-group Health Plan (no fault, liability, worker's compensation) claims for services unrelated to the MSP situation, and no related diagnosis codes are reported, do not include an...

Correcting MSP Claims and Adjustments

- Return to Provider (RTP):MSP claims may be corrected out of the RTP file (status/location T B9997). However, providers must ensure that claim adjustment segment (CAS) information is reported on the "MSP Payment Information" screen (MAP1719), accessed from Claim Page 03 by pressing F11. Adjustments: Providers may submit adjustments to MSP claims via 5010 or FISS …

References

- Change Request 8486- Instructions on Using the Claim Adjustment Segment (CAS) for Medicare Secondary Payer (MSP) Part A CMS-1450 Paper Claims, Direct Data Entry (DDE), and 837 Institutional Claims...

- CMS Medicare Secondary Payer Manual (Pub. 100-05) Ch. 5 §40.7.3.2