Your enrollment status shows the name of your plan, what type of coverage you have, and how long you’ve had it. You can check your status online at www.mymedicare.gov or call Medicare at 1-800-633-4227. Continue Learning about Medicare

Full Answer

How do I know what Medicare plan I have?

Nov 29, 2021 · Check your Medicare enrollment by following these three easy steps: Visit the Check Your Enrollment page on Medicare.gov, the official website for Medicare. Fill out the requested information, including your zip code, Medicare number, name, date of birth and your effective date for Medicare Part A coverage or Part B coverage.

How to find a Medicare office near you?

Contracts with Medicare to provide. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. and. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. benefits.

How to compare Medicare Part D plans?

Create a personalized Medicare road map to understand your plan options, costs, and timelines. Select the right Medicare Plan for your needs, based on the doctors you prefer and the prescription drugs you need - using BlueButton to import your drug list.

How to switch your Medicare drug plan?

Log in to your account at bcbsm.com to learn more. If you're already a member of one of our Medicare Advantage plans, you can find all of this information in the My Coverage section of your online account. Log in to get started. Need help? If you have questions about what's covered, call the number on the back of your Blue Cross ID card and we'll help.

How do I know what plan I have with Medicare?

You will know if you have Original Medicare or a Medicare Advantage plan by checking your enrollment status. Your enrollment status shows the name of your plan, what type of coverage you have, and how long you've had it. You can check your status online at www.mymedicare.gov or call Medicare at 1-800-633-4227.

Can I check my Medicare coverage online?

The status of your medical enrollment can be checked online through your My Social Security or MyMedicare.gov accounts. You can also call the Social Security Administration at 1-800-772-1213 or go to your local Social Security office.

Is there a website to compare Medicare plans?

Medicare.gov, the official government website for Medicare, features a plan finder tool that allows you to find and compare Medicare Advantage, Medicare Part D and Medigap plans. Learn how to use the plan finder tool and how you can get started finding a Medicare plan.Jan 20, 2022

How do I review my Medicare coverage?

Visit Medicare.gov/plan-compare to learn about and compare coverage options and shop for health and drug plans. 2. Look at your most recent “Medicare & You” handbook to see a listing of plans in your area. Review any information you get from your current plan, including the “Annual Notice of Change” letter.

How can I check my insurance coverage?

Verify your enrollment onlineLog in to your HealthCare.gov account.Click on your name in the top right and select "My applications & coverage" from the dropdown.Select your completed application under “Your existing applications.”Here you'll see a summary of your coverage.More items...•Aug 24, 2017

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What is the best way to compare Medicare Advantage plans?

The Medicare Plan Finder on Medicare.gov is currently the most comprehensive tool for comparing Medicare Advantage plan benefits, prescription drug coverage and costs.Feb 28, 2022

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Do you have to renew Medicare supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.May 16, 2018

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

How long do Medicare plans last?

It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65....When your coverage starts.If you sign up:Coverage starts:The month you turn 65The next month1 month after you turn 652 months after you sign up2 more rows

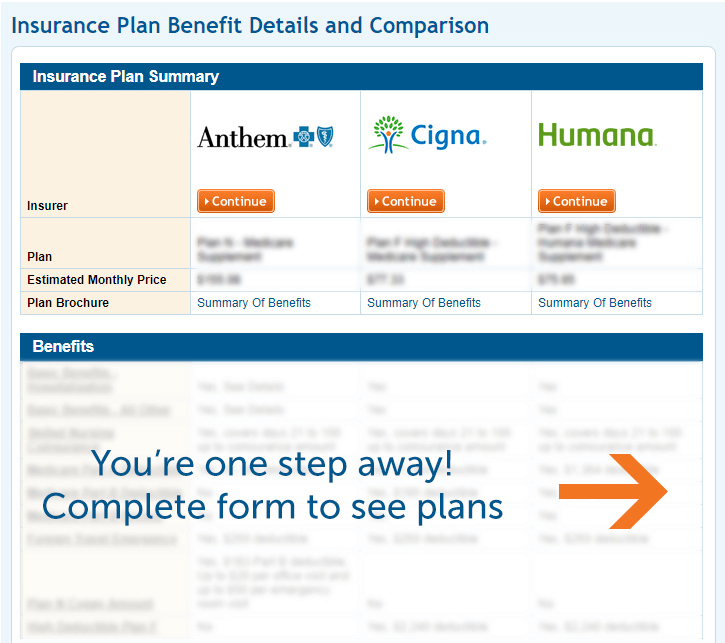

Summary of Benefits

This document highlights the plan’s most-used benefits. It’s helpful for shoppers who want a basic understanding of what’s covered. Find your Summary of Benefits.

Log in to your account at bcbsm.com to learn more

If you're already a member of one of our Medicare Advantage plans, you can find all of this information in the My Coverage section of your online account. Log in to get started.

Need help?

If you have questions about what's covered, call the number on the back of your Blue Cross ID card and we'll help.

Why do you keep your Medicare card?

Keep your red, white, and blue Medicare card in a safe place because you’ll need it if you ever switch back to Original Medicare. Below are the most common types of Medicare Advantage Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

What is a special needs plan?

Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

How long does it take to see a Medicare claim?

Log into (or create) your secure Medicare account. You’ll usually be able to see a claim within 24 hours after Medicare processes it. A notice you get after the doctor, other health care provider, or supplier files a claim for Part A or Part B services in Original Medicare.

What is Medicare Part A?

Check the status of a claim. To check the status of. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. or.

What is MSN in Medicare?

The MSN is a notice that people with Original Medicare get in the mail every 3 months. It shows: All your Part A and Part B-covered services or supplies billed to Medicare during a 3-month period. What Medicare paid. The maximum amount you may owe the provider. Learn more about the MSN, and view a sample.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is a PACE plan?

PACE plans can be offered by public or private companies and provide Part D and other benefits in addition to Part A and Part B benefits. claims: Contact your plan.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or other. Medicare Health Plan. Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan.

Does Medicare Advantage offer prescription drug coverage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. Check your Explanation of Benefits (EOB). Your Medicare drug plan will mail you an EOB each month you fill a prescription. This notice gives you a summary of your prescription drug claims and costs.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

Does Medicare Advantage have coinsurance?

They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage.

What is Medicare Advantage Plan?

Medicare Advantage plans are offered by private insurance companies contracted with the Medicare program to provide benefits covered by Part A and Part B (except for hospice care, which is covered under Part A). These private companies look for ways to control health care expenses to help keep costs low for their members.

What is a PPO plan?

PPOs let you see any provider or doctor who accepts your Medicare Advantage plan, but you pay a lot less when you use providers in the plan’s preferred provider network. Like HMOs, your plan network will include specialists, hospitals, and other providers you need for your health care needs. Private Fee-for-Service Plans (PFFS).

What are the providers of HMO?

HMO provider networks include doctors and specialists, hospitals, surgical centers, lab and x-ray facilities, and even pharmacies if your plan covers prescription drugs. You must get all care, except emergency treatment, from doctors who accept your Medicare Advantage HMO, or your plan may not pay any of your expenses.

What is an HMO?

Health Maintenance Organizations (HMOs). Most HMOs require you to get your health care from providers in the plan’s network. You’ll choose a primary care provider (PCP) who will handle all your routine health care and refer you to specialists as needed to treat you.

Can a non-network provider charge for Medicare?

In addition, a doctor who accepts your Medicare Advantage plan must accept your copayment or coinsurance amount as payment in full for your share of your health-care expenses. A non-network provider can charge you whatever their usual rate may be .

Does Medicare Advantage charge a copayment?

Your plan may charge you a lower copayment or coinsurance amount when you use health-care providers who participate in your plan; for example, you may pay a 20% coinsurance amount for in-network providers, but 50% for out-of-network care. In addition, a doctor who accepts your Medicare Advantage plan must accept your copayment or coinsurance amount ...

Can I see a doctor who accepts my Medicare Advantage plan?

If your plan has a provider network, you may want to see doctors who accept your Medicare Advantage plan to avoid paying more for out-of-network providers. Medicare Advantage plans often use different incentives to encourage you to get care from network providers. Your plan may charge you a lower copayment or coinsurance amount when you use ...

What percentage of medical expenses does Medicare cover?

While Original Medicare insurance covers 80 percent of medical and hospital expenses, beneficiaries are responsible for the remaining 20 percent, as well as copayments, coinsurance, and deductibles.

What is Medicare Advantage?

In general, private insurance companies across the United States offer Medicare Advantage (Part C) plans to those who are eligible for Medicare. What plan is available in your location depends on what insurance companies are approved by Medicare to sell Part C plans.

Is Kaiser a non profit?

Today, Kaiser has one of the country’s largest nonprofit health care plans and provides coverage for over 12 million people enrolled in the program. Medicare recipients can enroll in a Kaiser Permanente program if they are a resident of Hawaii, Washington, Oregon, California, Colorado, Maryland, Virginia, Georgia, or the District of Columbia.

Does Kaiser offer Medicare Advantage?

If you live in a state that offers Kaiser Permanente Medicare Advantage plans, you can get full coverage that includes Original Medicare Parts A and B, prescription drug coverage (Part D), and additional optional benefits like hearing, vision, and dental care.