To drop Part B (or Part A if you have to pay a premium for it), you usually need to send your request in writing and include your signature. Contact Social Security. If you recently got a welcome packet saying you automatically got Medicare Part A and Part B, follow the instructions in your welcome packet, and send your Medicare card back.

Can I waive Medicare Part A If I receive Social Security?

If you are receiving Social Security benefits and choose to waive Part A, you will have to repay any benefits you have already received. Considering a Medicare Plan? Who May Want to Consider Not Enrolling In Medicare Part A?

How do I get help paying for Medicare Part B premiums?

Part B Only: Both the Specified Low-Income Medicare Beneficiary (SLMB) and Qualifying Individual (QI) programs will help pay for Medicare Part B premiums. SLMB program: Income must be at least 100% of the FPL but no more than 120% to get aid.

What is Medicare Part A and B?

Parts A and B: the Qualified Medicare Beneficiary (QMB) program is the only Medicare assistance program that pays premiums for both parts of Original Medicare. According to the Social Security Administration, all states must provide Medicaid to QMB enrollees for Medicare cost-sharing.

How do I drop Part B of my Medicare plan?

To drop Part B (or Part A if you have to pay a premium for it), you usually need to send your request in writing and include your signature. Contact Social Security. If you recently got a welcome packet saying you automatically got Medicare Part A and Part B, follow the instructions in your welcome packet, and send your Medicare card back.

Can I decline Medicare Part A and B?

While you can decline Medicare altogether, Part A at the very least is premium-free for most people, and won't cost you anything if you elect not to use it. Declining your Medicare Part A and Part B benefits completely is possible, but you are required to withdraw from all of your monthly benefits to do so.

How do I opt out of Medicare Part A?

If you want to disenroll from Medicare Part A, you can fill out CMS form 1763 and mail it to your local Social Security Administration Office. Remember, disenrolling from Part A would require you to pay back all the money you may have received from Social Security, as well as any Medicare benefits paid.

How can I get Medicare waiver?

If you want to defer Medicare coverage, you don't need to inform Medicare. It's simple: Just don't sign up when you become eligible. You can also sign up for Part A but not Part B during initial enrollment.

How do you qualify to get $144 back on your Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Can I delay Medicare Part A?

However, if you have to pay a premium for Part A, you can delay Part A until you (or your spouse) stop working or lose that employer coverage. You will NOT pay a penalty for delaying Part A, as long as you enroll within 8 months of losing your coverage or stopping work (whichever happens first).

What happens if you don't enroll in Medicare Part A at 65?

If you don't have to pay a Part A premium, you generally don't have to pay a Part A late enrollment penalty. The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled.

What happens if you don't take Medicare Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

Who qualifies for free Medicare Part A?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Can I opt out of Medicare Part A retroactive?

Can you opt out of Retroactive Medicare coverage? You may be able to opt out of retroactive Medicare coverage by contacting the Social Security Administration.

How can I reduce my Medicare premiums?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

How do I get my Medicare premium refund?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan. These plans are sometimes called Medicare buy back plans.

How much is Medicare Part B premium in 2021?

What About Medicare Part B? Medicare Part B DOES have a premium ( $148.50 for 2021, an increase of $3.90 from $144.60 in 2020 ). 1 Therefore, choosing whether to delay enrollment in Part B is the more pertinent question for most people.

What is Medicare Part A?

Medicare Part A is the part of Medicare that covers inpatient hospital stays, skilled nursing facility care, hospice care, and home health care. For most people, there is no premium associated with Medicare Part A.

Is there a premium for Medicare Part A?

For most people, there is no premium associated with Medicare Part A. People who are receiving Social Security benefits or are on Medicare disability will be enrolled in Part A automatically at age 65. For most everyone else, because there is no premium for this coverage, enrolling in Part A may be beneficial. ...

Why did Medicare late enrollment penalties get waived?

The federal government has ruled to issue a waiver for late-enrollment penalties that hit unsuspecting Medicare recipients who missed their enrollment deadline because they were already enrolled in another health insurance plan purchased on the individual marketplace.

What is the Medicare Part B late fee for 2021?

The standard 2021 monthly premium for Medicare Part B is $148.50. The late enrollment penalty can be as much as a 10 percent premium markup ...

How long is the initial enrollment period for Medicare?

Medicare Initial Enrollment Period and Late Penalties. When you first become eligible for Medicare: You have a seven-month Initial Enrollment Period in which to sign up. Failure to sign up during this time may result in late-enrollment penalties once you finally do enroll.

Do people who are already enrolled in the marketplace have to sign up for health insurance?

One common occurrence is that people who are already enrolled in an individual marketplace health insurance plan at the time of their Initial Enrollment Period do not bother to sign up because they already have health insurance.

Does Medicare waive late enrollment fees?

This confusion has happened so often that Medicare has temporarily changed the rules to waive the late enrollment fees for people who were enrolled in other health insurance during their Initial Enrollment Period.

What is the difference between Medicare Part A and Part B?

All programs require eligibility for Medicare Part A, but the main difference between each is the federal poverty level (FPL) range that those seeking help must be within.

How much is Part B insurance?

The standard Part B premium as of 2019 is $135.50, but most people with Social Security benefits will pay less ($130 on ).

What percentage of FPL can I get for Medicare Part B?

Not have an income that is more than 200% of the FPL (You may only get partial aid if your income is between 150% to 200% of the FPL.) Part B Only: Both the Specified Low-Income Medicare Beneficiary (SLMB) and Qualifying Individual (QI) programs will help pay for Medicare Part B premiums.

How much does Medicare Part D cost?

Medicare Part D plans are also provided through private insurance companies. The national average Part D premium is $33.19, according to My Medicare Matters. But depending on where you live and the type of plan you have, Medicare Part D costs will vary.

What is a Part C plan?

A Part C plan combines other parts of Medicare (Original Medicare and, usually, Part D) and can provide you with a broader range of benefits. These plans are sold through private insurance companies that are approved by Medicare.

When are Medicare premiums due?

Pay on time to avoid coverage cancellation. Medicare premiums are due the 25th day of the month. Don’t miss more than 3 consecutive months of payments to Medicare. Coverage will end in the fourth month if payments aren’t made.

Is QMB coverage 100%?

But if you’re approved as a QMB, you are not responsible for paying any cost-sharing, according to the Center for Medicare Advocacy. This means that your Medicare costs, including your premiums, are 100% covered. To qualify for the QMB program, your income must not exceed 100% of the FPL.

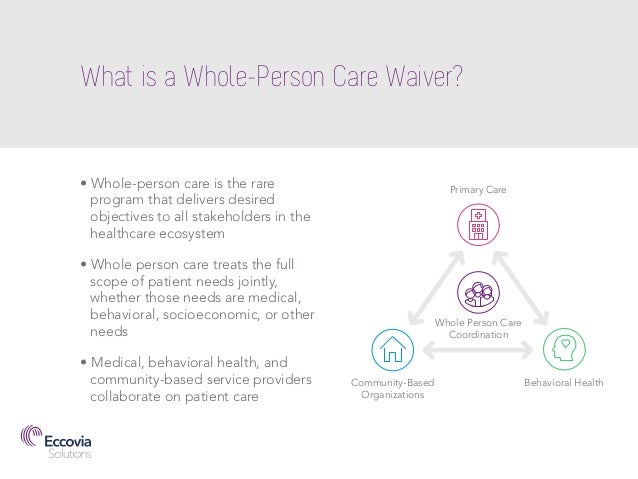

What is a medicaid waiver?

The Medicaid waiver program is one of many ways that Medicare and Medicaid work together to meet the healthcare needs of beneficiaries. Section 1915 (c) of the Social Security Act describes a waiver program that authorizes home and community-based services (HCBS) to provide health and other basic necessities to people who would otherwise be cared ...

What is HCBS waiver?

Medicaid waiver programs (HCBS waivers) may allow you to get medical care and other services at home or in a facility in your community. Each state includes different conditions in its HCBS waiver programs, so check your state’s Medicaid guidelines to see if you’re eligible. If you or a loved one has a complex health condition requiring ...

What services does Medicaid provide?

Healthcare professionals may also provide services like rehabilitation with a physical therapist or speech and language pathologist. Transportation, meal delivery, and adult day care services may also be included. Because Medicaid is run by state governments, each state’s waiver program operates differently.

What is Medicare for 65?

Medicare is a federal program that provides healthcare coverage for people with certain disabilities and those 65 years old and over. You must be a U.S. citizen or permanent legal resident to qualify for Medicare. Medicare doesn’t base your eligibility on your income level, and the program is primarily funded through payroll taxes.

What are the eligibility rules for nursing?

Eligibility rules differ from state to state, but there are a few guidelines that are true in most states. One is that you must need a level of care similar to what you’d receive in a nursing facility.

How many parts does Medicare have?

Medicare has four parts. Here is a quick overview of what each part covers: Medicare Part A. Medicare Part A is hospital insurance. It covers you during short-term, inpatient stays in hospitals and for services like hospice. It also provides limited coverage for skilled nursing facility care and select in-home services.

What is a Part D plan?

Part D plans are stand-alone plans that cover only prescriptions. These plans are also provided through private insurance companies. Because Medicare and Medicaid have similar sounding names, it’s easy to get them confused. Here’s how Medicaid is different.

When do you get Part A and Part B?

You will automatically get Part A and Part B starting the first day of the month you turn 65. (If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month.)

What happens if you don't get Part B?

NOTE: If you don’t get Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part B because you have coverage based on your (or your spouse’s) current employment.

What is the individual health insurance marketplace?

NOTE: The Individual Health Insurance Marketplace is a place where people can go to compare and enroll in health insurance. In some states the Marketplace is run by the state and in other states it is run by the federal government. The Health Insurance Marketplace was set up through the Affordable Care Act, also known as Obamacare.

Do you have to pay a penalty if you don't get Part A?

NOTE: If you don’t get Part A and Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part A and Part B because you have coverage based on your (or your spouse’s) current employment.