The Medicare Hospital Insurance, or HI Trust Fund gets money primarily from payroll taxes. It gets much smaller amounts from income tax on Social Security benefits and Medicare Part A premiums paid by those who don’t qualify for premium-free Part A.

How do Medicare managed care plans work?

Medicare managed care plans are offered by private companies that have a contract with Medicare. These plans work in place of your original Medicare coverage. Many managed care plans offer coverage for services that original Medicare doesn’t.

How does Medicare pay for hospitals?

This type of payment system is approved by the hospitals and allows Medicare to pay a simple flat rate depending on the specific medical issues a patient presents with and the care they require. In addition, In some cases, Medicare may provide increased or decreased payment to some hospitals based on a few factors.

What are the pros and cons of Medicare managed care plans?

With the good, comes the bad, in life as well as Medicare coverage. Let’s look at the pros. Medicare Managed Care plans include equivalent coverage as Parts A and B. Plus, these plans include extra benefits like routine vision, hearing, and dental services.

Are managed care plans and Medicare supplements the same?

Managed Care vs Medicare Supplements. Managed-care plans and Medicare Supplement plans are not the same. This misconception is common. Both provide additional benefits to Original Medicare. However, they serve two totally different purposes. Managed-care plans or Advantage plans bundles all health-care coverage under one neat plan.

How does managed care make money?

Under managed care, states sign contracts with "managed care organizations," or MCOs, that provide medical services through their own networks of doctors and hospitals. The state pays the MCO a fixed annual fee for each Medicaid patient. And the MCO takes responsibility for overseeing each person's care.

Where does the money come from for Medicare Advantage plans?

Three sources of revenue for Advantage plans include general revenues, Medicare premiums, and payroll taxes. The government sets a pre-determined amount every year to private insurers for each Advantage member. These funds come from both the HI and the SMI trust funds.

How are insurance companies paid by Medicare?

The plans receive some funding through monthly plan premiums, but most of the money comes from Medicare. The private insurance companies that offer the plans receive a payment each month from Medicare. This covers the costs of Medicare parts A and B for each beneficiary.

How are healthcare organizations reimbursed for Medicare?

Providers furnishing the services primarily receive Medicare reimbursement via the hospital outpatient prospective payment system (OPPS) or the Physician Fee Schedule. CMS pays hospitals where Medicare Part B beneficiaries receive outpatient care under the OPPS.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Are Medicare Advantage plans profitable?

Medicare Advantage is the common thread. Big-name health insurers raked in $8.2 billion in profit for the fourth quarter of 2019 and $35.7 billion over the course of the year.

How is Medicare funded in Australia?

The Australian government pays for Medicare through the Medicare levy. Working Australians pay the Medicare levy as part of their income tax. High income earners who don't have an appropriate level of private hospital insurance also pay a Medicare levy surcharge.

How do insurance companies generate revenue?

Most insurance companies generate revenue in two ways: Charging premiums in exchange for insurance coverage, then reinvesting those premiums into other interest-generating assets. Like all private businesses, insurance companies try to market effectively and minimize administrative costs.

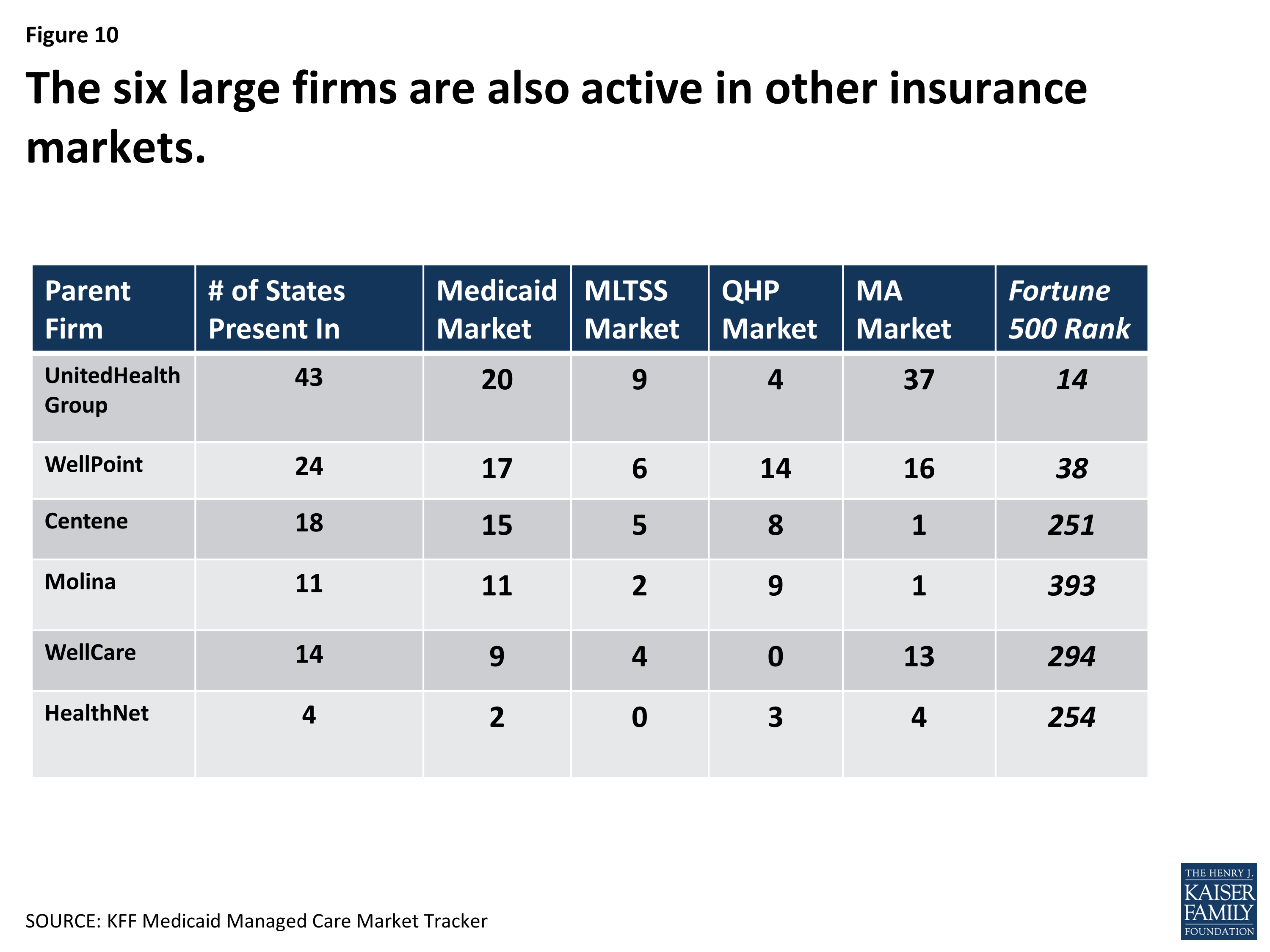

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

How do hospitals get paid by CMS?

Hospitals are reimbursed for the care they provide Medicare patients by the Centers for Medicare and Medicaid Services (CMS) using a system of payment known as the inpatient prospective payment system (IPPS).

What is the average Medicare reimbursement rate?

roughly 80 percentAccording to the Centers for Medicare & Medicaid Services (CMS), Medicare's reimbursement rate on average is roughly 80 percent of the total bill. Not all types of health care providers are reimbursed at the same rate.

How are healthcare services reimbursed in the United States?

Reimbursement mechanisms for healthcare have included salary, Fee-for-service (FFS), capitation, Pay-for-performance (P4P), and diagnosis-based payment (DRGs, diagnosis-related groups).

What is Medicare managed care?

A Medicare managed care plan is a type of Medicare Advantage plan. Learn what managed care plans are and how they could be a good fit for you. A Medicare managed care plan is one type of Medicare Advantage plan. The term “managed care plan” generally refers to HMO (health maintenance organization), PPO (preferred provider organization) ...

What doctor do you see on a managed care plan?

As a member of a managed care plan, a beneficiary will typically see a primary care physician for any illnesses, injuries or conditions. When possible, the primary care physician will treat the patient.

What is a HMO plan?

Health maintenance organization (HMO) In a Medicare HMO plan, you use a primary care physician to coordinate your care, and you receive services from a network of health care providers that partner with your plan. Preferred provider organization (PPO)

What are the different types of Medicare plans?

Types of Medicare managed care plans 1 Health maintenance organization (HMO)#N#In a Medicare HMO plan, you use a primary care physician to coordinate your care, and you receive services from a network of health care providers that partner with your plan. 2 Preferred provider organization (PPO)#N#In a Medicare PPO plan, you may or may not use a primary care physician, and you are typically not required to get a referral to see a specialist. You’ll have a network of providers from which to choose .You will generally can receive at least some coverage when receiving care outside of the network of providers, though your health care services may cost more than if you received them from a provider within your plan network. 3 Point of service (POS)#N#You can use a primary care physician in a Point of Service plan, as you would with an HMO plan. But as with a PPO plan, you can go outside of the plan network and still receive some coverage for services, though you may pay higher out-of-pocket costs than if you selected an in-network provider.

How to contact Medicare Advantage?

For more information about managed care plans or other types of Medicare Advantage plans, including plan benefits, eligibility, enrollment and availability, contact a licensed insurance agent by calling. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 24 hours a day, 7 days a week.

Why do you see a primary care physician?

Seeing a primary care physician allows patients to build a rapport with their doctor, and the doctor gets to know the patient’s health history firsthand . When a patient is referred to a specialist, there is communication between the primary care physician and the specialist regarding the patient’s health and treatment.

Is there less uncertainty about a beneficiary's costs for care in a managed care plan?

There’s less uncertainty about a beneficiary’s costs for care in a managed care plan, provided they stay within the assigned network for qualified services.

What is Medicare managed care?

Medicare care managed care plans are an optional coverage choice for people with Medicare. Managed care plans take the place of your original Medicare coverage. Original Medicare is made up of Part A (hospital insurance) and Part B (medical insurance). Plans are offered by private companies overseen by Medicare.

How much does Medicare cost in 2021?

Most people receive Part A without paying a premium, but the standard Part B premium in 2021 is $148.50. The cost of your managed care plan will be on top of that $148.50.

What is a Medigap plan?

A Medigap plan, also known as Medicare supplement insurance, is optional coverage you can add to original Medicare to help cover out-of-pocket costs. Medigap plans can help you pay for things like: coinsurance costs. copayments. deductibles. These aren’t a type of managed care plan.

What is Medicare Advantage?

Sometimes referred to as Medicare Part C or Medicare Advantage, Medicare managed care plans are offered by private companies. These companies have a contract with Medicare and need to follow set rules and regulations. For example, plans must cover all the same services as original Medicare.

What is an HMO plan?

Health Maintenance Organization Point of Service (HMO-POS). An HMO-POS plan works with a network, like all HMO plans. The difference is that an HMO-POS plan allows you to get certain services from out-of-network providers — but you’ll likely pay a higher cost for these services than if you see an in-network provider.

What is a PPO provider?

Preferred Provider Organization (PPO). A PPO also works with a network. However, unlike with an HMO, you can see providers who aren’t part of your network. Your out-of-pocket cost to see those providers will be higher, though, than if you see an in-network provider.

What is an HMO?

Health Maintenance Organization (HMO). An HMO is a very common health plan type that works with a network. You’ll need to see providers who are part of your plan’s network to get your care covered. An exception is made for emergency care; this will be covered even if you go to an out-of-network provider.

What is Medicare Advantage?

Medicare Advantage (Medicare Part C) is an alternative way to get your benefits under Original Medicare (Part A and Part B). By law, Medicare Advantage plans must cover everything that is covered under Original Medicare, except for hospice care, which is still covered by Original Medicare Part A.

How does HI get money?

The Medicare Hospital Insurance, or HI Trust Fund gets money primarily from payroll taxes. It gets much smaller amounts from income tax on Social Security benefits and Medicare Part A premiums paid by those who don’t qualify for premium-free Part A. The money in this trust fund pays for Part A expenses such as inpatient hospital care, skilled nursing facility care, and hospice.

How does the SMI fund work?

The Medicare Supplemental Medical Insurance, or SMI Trust Fund gets its Medicare funding primarily from money Congress allocates for the program and from Part B premiums and Medicare Part D Prescription Drug Plan premiums. This fund pays for outpatient health care, durable medical equipment, certain preventative services and prescription drugs.

Does Medicare Advantage pay for claims?

The insurance company uses this pool of money from the Medicare Trust Funds plus any additional premiums paid by plan members to pay the covered health care expenses for everyone enrolled in a particular plan. Claims for people enrolled in Medicare Advantage are paid by the insurance company and not by the Medicare program as they are for those enrolled in Original Medicare.

Does Medicare Advantage charge a monthly premium?

In addition to the Part B premium, which you must continue to pay when you enroll in Medicare Advantage, some Medicare Advantage plans also charge a separate monthly premium.

Is Medicare the same as Medicare Advantage?

Although the Medicare funding is the same for all insurance companies offering Medicare Advantage plans, each company chooses what types of plans and benefits it will offer. No matter what company and plan type you select, however, you are still entitled to all the same rights and protections you have under Original Medicare.

How is Medicare funded?

Medicare is mainly funded by payroll taxes, so ultimately, all of us are funding the Medicare Advantage plans that offer a $0 monthly premium.

What is Medicare Advantage?

Medicare Advantage plans are managed care, which means you might need prior authorization for a medication, you may need a referral to see a specialist, and you may have to try a cheaper treatment plan before your plan will approve a more expensive one. That’s how Medicare Advantage plans manage their costs.

How to create a Medicare action plan?

Create a Medicare action plan by estimating your total monthly premiums for healthcare and related expenses in retirement.

Does Medicare Advantage have a contract with the government?

Medicare Advantage companies have a contract with the federal government.

Is Medicare Advantage a low premium?

Most Medicare Advantage plans are paid enough by the government to offer very low – sometimes even $0 premium plans – in addition to extra benefits that go above and beyond what Medicare regularly covers. For example, you might get some dental, vision, and fitness benefits.

How much extra do you have to pay for Medicare?

This means that the patient may be required to pay up to 20 percent extra in addition to their standard deductible, copayments, coinsurance payments, and premium payments. While rare, some hospitals completely opt out of Medicare services.

How much higher is Medicare approved?

The amount for each procedure or test that is not contracted with Medicare can be up to 15 percent higher than the Medicare approved amount. In addition, Medicare will only reimburse patients for 95 percent of the Medicare approved amount.

How many DRGs can be assigned to a patient?

Each DRG is based on a specific primary or secondary diagnosis, and these groups are assigned to a patient during their stay depending on the reason for their visit. Up to 25 procedures can impact the specific DRG that is assigned to a patient, and multiple DRGs can be assigned to a patient during a single stay.

What is Medicare reimbursement based on?

Reimbursement is based on the DRGs and procedures that were assigned and performed during the patient’s hospital stay. Each DRG is assigned a cost based on the average cost based on previous visits. This assigned cost provides a simple method for Medicare to reimburse hospitals as it is only a simple flat rate based on the services provided.

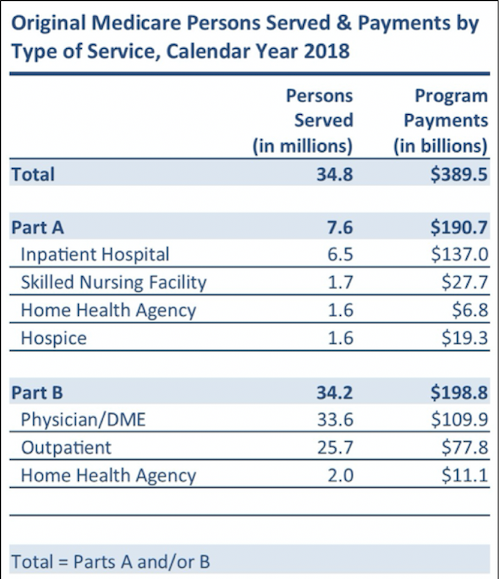

What is Medicare Part A?

What Medicare Benefits Cover Hospital Expenses? Medicare Part A is responsible for covering hospital expenses when a Medicare recipient is formally admitted. Part A may include coverage for inpatient surgeries, recovery from surgery, multi-day hospital stays due to illness or injury, or other inpatient procedures.

What does it mean when a provider is not a participating provider?

If a provider is a non-participating provider, it means that they have not signed a contract with Medicare to accept the insurance company’s prices for all procedures, but they do for accept assignment for some. This is mainly due to the fact that Medicare reimbursement amounts are often lower than those received from private insurance companies. For these providers, the patient may be required to pay for the full cost of the visit up front and can then seek personal reimbursement from Medicare afterwards.

Does Medicare cover permanent disability?

Medicare provides coverage for millions of Americans over the age of 65 or individuals under 65 who have certain permanent disabilities. Medicare recipients can receive care at a variety of facilities, and hospitals are commonly used for emergency care, inpatient procedures, and longer hospital stays. Medicare benefits often cover care ...

Why is managed care important?

Managed care also helps control costs so you can save money .

What is Medicare Advantage?

Medicare Advantage (Part C) is personal insurance from private companies that’s approved by Medicare. Plan types that are available run the gamut — from HMO to PPO to POS — and include coverage for preventive healthcare, routine and major care, prescription drug coverage, even emergency coverage when traveling outside Nevada.

How many primary care providers does Intermountain Healthcare have?

Intermountain Healthcare has a network of nearly 300 primary care providers and more than 1,500 specialists. With medical clinics and specialty care affiliates throughout Southern Nevada, we provide patient-centered, comprehensive primary care, specialty care and urgent care services. In addition, for patients age 65+ and enrolled in certain Medicare Advantage plans, our myGeneration Senior Clinics offer senior-focused healthcare at nearly 30 convenient locations.

What is the difference between a PPO and an HMO?

Like an HMO, PPO plans also have a network. The big difference is that members can go out of network for their healthcare — often without a referral — but they will pay more. Most of the time , monthly premiums are higher than an HMO.

What is an HMO plan?

HMO: lower monthly premiums, comprehensive benefits. With an HMO plan, a primary care physician (PCP) typically must be selected. The PCP is responsible for coordinating all the members’ healthcare — a referral is often required before seeing a specialist or another physician.

How to contact mygeneration senior clinic?

See how myGeneration Senior Clinics and managed care help make for a healthier you. Call us at 702-852-9000.

Do managed care plans have copays?

There are other financial incentives for members of managed care plans, including tiered copays for prescription drugs. For example, when you choose generic drugs you’ll pay less than if you opt for brand-name drugs.

What is HCPP in Medicare?

An HCPP is paid the reasonable cost of the covered nonprovider Part B services it furnishes directly to or arranges for its Medicare enrollees. The determination of reasonable cost is based on the Medicare reimbursement principles which are used to calculate the reasonable cost of hospitals, Skilled Nursing Facilities (SNFs), Home Health Agencies (HHAs), and other entities paid by the Medicare program on a cost basis and also on principles contained in this manual. In addition to the costs directly related to the provision of health services, the costs incurred by the HCPP such as marketing, enrollment, and membership expenses are also taken into account in determining reasonable costs.

How to determine interim per capita rate for HCPP?

The interim per capita rate for an HCPP is determined by dividing estimated reimbursable costs of providing Medicare-covered services to the HCPP's Medicare enrollees by projected Medicare enrollee months for the reporting period. Estimated reimbursable costs and the projected number of Medicare enrollee months are derived from the HCPP's annual operating budget and enrollment forecast. The number of Medicare enrollees may be compared to CMS' latest updated records of enrollment for reasonableness. These records will identify the number of Medicare beneficiaries CMS has identified as enrollees of the HCPP.

How long does it take to submit interim cost and enrollment report?

The interim cost and enrollment report must be submitted to CMS within 45 days after the close of the first 6 month period of the HCPP's reporting period. The report may be used to adjust the interim rate. If the reports are not submitted timely, CMS may adjust the interim rate based on the best available information. An adjustment to the interim rate will remain in effect until such time as the required report is submitted. If there is not enough data available, interim payments will not be made.

What happens if the final settlement determination is greater than payments already made to the HCPP through monthly capitation payments?

If the final settlement determination is greater than payments already made to the HCPP through monthly capitation payments, an underpayment will be declared , and CMS will make a lump-sum payment to the HCPP.

What is the Medicare tax code for interest payments?

Section 117 of the Tax Equity and Fiscal Responsibility Act of 1982 (P.L. 97-248) requires interest payments for Medicare overpayments and underpayments. The 42 CFR 405.378 sets forth the rules for charging and payment of interest. The following subsections set forth the rules governing interest on overpayments /underpayments for

Does CMS send ACH payments?

The CMS, in conjunction with the Department of Treasury, may utilize electronic funds transfers. Interim and other types of payments are electronically sent to HCPPs through the Automated Clearing House (ACH). This process improves the efficiency of Federal financial management and also benefits the HCPPs.

Does Medicare pay for hospice?

If a Medicare enrollee of an HCPP makes an election to receive hospice care services under §1812(d) of the Act, payment for these hospice care services is made to the Medicare participat ing hospice that furnishes the services, in accordance with

What is Medicare insurance?

Medicare insurance is one of the most popular options for those who qualify, and the number of people using this insurance continues to grow as life expectancy continues to increase. Medicare policies come available with many different parts, including Part A, Part B, Part C, and Part D.

When a patient uses Medicare as their primary insurance company, is the hospital required to choose appropriate and accurate diagnoses that?

When a patient uses Medicare as their primary insurance company, the hospital is required to choose appropriate and accurate diagnoses that apply to the patient so that they can bill for the associated care.

What is IPPS in Medicare?

This is known as the Inpatient Prospective Payment System , or IPPS. This system is based on diagnosis-related groups (DRGs). A DRG assignment is made based on a patient’s primary diagnosis and any secondary diagnoses that they have during a hospital stay. These diagnoses can be added as needed throughout a stay as long as they are appropriate for the care being received.

How long do you have to pay coinsurance for hospital?

As far as out-of-pocket costs, you will be responsible for paying your deductible, coinsurance payments if your hospital stay is beyond 60 days, and for any care that is not deemed medically necessary. However, the remainder of the costs will be covered by your Medicare plan.

Does Medicare pay flat rate?

This type of payment system is approved by the hospitals and allows Medicare to pay a simple flat rate depending on the specific medical issues a patient presents with and the care they require. In addition, In some cases, Medicare may provide increased or decreased payment to some hospitals based on a few factors.

Does Medicare cover inpatient care?

If you receive care as an inpatient in a hospital, Medicare Part A will help to provide coverage for care. Part A Medicare coverage is responsible for all inpatient care , which may include surgeries and their recovery, hospital stays due to illness or injury, certain tests and procedures, and more. As far as out-of-pocket costs, you will be ...