Full Answer

What is a Medicare cost plan?

You join a plan offered by Medicare-approved private companies that follow rules set by Medicare. Each plan can have different rules for how you get services, like needing referrals to see a specialist. Costs for monthly premiums and services you get vary depending on which plan you join. Plans must cover all emergency and urgent care, and almost all medically necessary …

How does Medicare Advantage work?

A Medicare cost plan is similar to a Medicare Advantage plan in that enrollees have access to a network of doctors and hospitals, and may have additional benefits beyond what's provided by Original Medicare. But unlike Medicare Advantage plans, a cost plan offers policyholders the option of receiving coverage outside of the network, in which case the Medicare-covered …

How does Original Medicare work?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. : Learn more about Part A costs. Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A" ). If you buy Part A, you'll pay up to $499 each month in 2022.

How does the Medicare deductible work?

Rules for Medicare Advantage Plans. Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. Each Medicare Advantage Plan can charge different out-of-pocket costs. They can also have different rules for how you get services, like:

What is the difference between a Medicare Advantage plan and a cost plan?

Like Medicare Advantage plans, Medicare cost plans are offered by private companies and may also include extra coverage. However, unlike Medicare Advantage plans, a Medicare cost plan doesn't replace your original Medicare coverage. Instead, it offers other benefits in addition to those of original Medicare.

Do Medicare cost plans have copays?

It is an alternative to original Medicare Part A and Part B, and may offer additional benefits. In addition to plan premiums, a person will have to cover copays and deductibles. Costs may vary among plans. A person can join or change Advantage plans during various enrollment periods.Dec 1, 2020

What is the definition of a Medicare cost plan?

A Medicare Cost Plan is a type of Medicare plan available in some areas. It is very similar to Medicare Advantage. In a Medicare Cost Plan: You can join even if you only have Part B. If you have Part A and Part B and go to a non-network provider, the services are covered under original Medicare.Nov 17, 2021

How Medicare cost is calculated?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What is the cost of Medicare Part D for 2021?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

Can you have a Medicare cost plan and Part D?

Even if the Cost Plan offers drug coverage, you can choose to get drug coverage from a separate Medicare drug plan. You can add or drop Medicare drug coverage only at certain times. Another type of Medicare Cost Plan only provides coverage for Part B services. These plans never include Part D.

Is Medica Prime Solution A Medicare Advantage plan?

Medica Prime Solution Premier (Cost) is a Medicare Advantage (Medicare Part C) plan offered by Medica Holding Company. Plan ID: H2450-048.

What are the Medicare income limits for 2022?

2022If your yearly income in 2020 (for what you pay in 2022) wasYou pay each month (in 2022)File individual tax returnFile joint tax return$91,000 or less$182,000 or less$170.10above $91,000 up to $114,000above $182,000 up to $228,000$238.10above $114,000 up to $142,000above $228,000 up to $284,000$340.203 more rows

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.Aug 30, 2021

How much does Medicare take out of Social Security?

What are the Medicare Part B premiums for each income group? In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

Is Social Security considered income for Medicare?

For purposes of the Medicare Prescription Drug Discount Card, we have defined “income” as money received through retirement benefits from Social Security, Railroad, the Federal or State Government, or other sources, and benefits received for a disability or as a veteran, plus any other sources of income that would be ...

What is Medicare cost plan?

What is a Medicare cost plan? A Medicare cost plan is similar to a Medicare Advantage plan in that enrollees have access to a network of doctors and hospitals, and may have additional benefits beyond what’s provided by Original Medicare.

What is the competition clause in Medicare?

The Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (which rebranded Medicare+Choice as Medicare Advantage) created a competition clause that banned Medicare Cost plans from operating in areas where they faced substantial competition from Medicare Advantage plans.

How many Medicare plans are there in Minnesota?

There wee 27 cost plans available in Minnesota as of 2018, and although that dropped in 2019, there are still 21 plans available in Minnesota in 2020. People who still have Medicare cost plans available in their area can still enroll, and there are cost plans available in 2020 in Colorado, Iowa, Illinois, Maryland, Minnesota, Nebraska, ...

How many people are on Medicare in 2019?

According to a Kaiser Family Foundation analysis, the total number of cost plan enrollees dropped to about 200,000 people as of 2019.

Which states do not have Medicare?

The rest were spread across Colorado, District of Columbia, Iowa, Illinois, Maryland, North Dakota, South Dakota, Texas, Virginia, and Wisconsin; most states do not have Medicare cost plans available. But there were far fewer Medicare cost plan enrollees as of 2019, due to the implementation of the Medicare Advantage competition clause.

Does a cost plan have supplemental Part D?

If the cost plan offers optional supplemental Part D prescription coverage, enrollment in (or disenrollment from) the Part D coverage is limited to the normal annual open enrollment period for Part D plans. If the cost plan does not have a supplemental Part D plan available — or if it does and the enrollee would prefer a different Part D plan — ...

Who can join Medicare?

Who can join a Medicare cost plan? Eligible enrollees who live within a Medicare cost plan’s service area can join the plan when it’s accepting new members. A cost plan that is accepting new enrollees must have an annual open enrollment window of at least 30 days, although they can set an enrollment cap and close enrollment once it’s reached.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Medicare Advantage Plan?

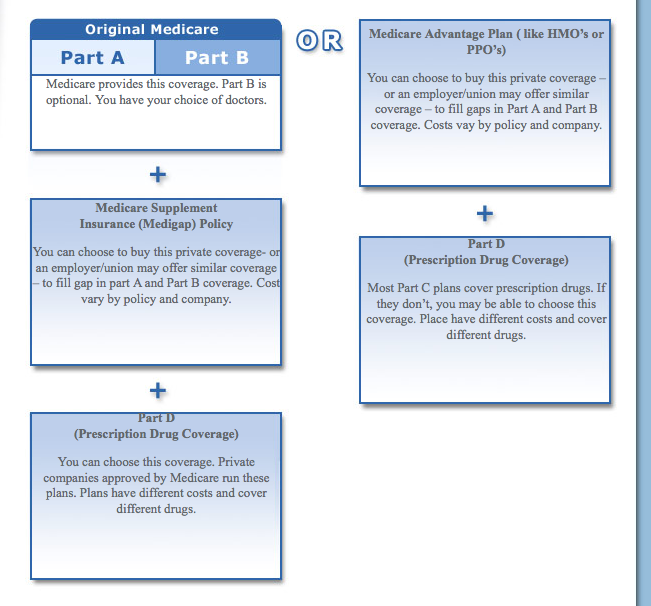

Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are an “all in one” alternative to Original Medicare. They are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, you still have. Medicare.

Can't offer drug coverage?

Can’t offer drug coverage (like Medicare Medical Savings Account plans) Choose not to offer drug coverage (like some Private Fee-for-Service plans) You’ll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare if both of these apply: You’re in a Medicare Advantage HMO or PPO.

What happens if you don't get a referral?

If you don't get a referral first, the plan may not pay for the services. to see a specialist. If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care. These rules can change each year.

Does Medicare cover dental?

Covered services in Medicare Advantage Plans. Most Medicare Advantage Plans offer coverage for things Original Medicare doesn’t cover, like some vision, hearing, dental, and fitness programs (like gym memberships or discounts). Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like ...

What are the benefits of Medicare Advantage?

These plans offer many of the extra benefits that come with Medicare Advantage plans, such as dental, vision, and hearing care . However, unlike Medicare Advantage plans, people with Medicare cost plans have more flexibility to use out-of-network doctors and to choose a separate Part D plan.

What is Medicare cost plan?

A Medicare cost plan blends parts of both original Medicare and Medicare Advantage. These plans work together with your original Medicare coverage while providing additional benefits and flexibility. Medicare cost plans are very similar to Medicare Advantage plans. However, there are some key differences between the two.

How to enroll in Medicare Part B?

To enroll in a Medicare cost plan, you must meet the following eligibility requirements: 1 be enrolled in Medicare Part B 2 live in an area where Medicare cost plans are offered 3 find a Medicare cost plan that’s accepting new members 4 complete an application during the plan’s enrollment period 5 agree to all cost plan rules that are disclosed during the enrollment process

How long does it take to enroll in Medicare?

Companies that offer Medicare cost plans must provide Medicare beneficiaries with an open enrollment period of at least 30 days. During this time, you’ll submit an application to the plan’s provider to enroll. Enrollment details may be different depending on the company that’s offering the cost plan.

What happens when you enroll in Medicare?

When you enroll in a Medicare cost plan, you gain access to the plan’s network of healthcare providers. You can either choose a provider within this network or an out-of-network provider. When you go out of network, it’s covered by original Medicare.

How old do you have to be to get Medicare?

To enroll in a Medicare cost plan, you must first be enrolled in Medicare Part B. To be eligible for Part B, you must meet one of the following criteria: be age 65 or older. have a disability and receive Social Security Disability Insurance.

Does Medicare cost plan replace original Medicare?

However, unlike Medicare Advantage plans, a Medicare cost plan doesn’t replace your original Medicare coverage. Instead, it offers other benefits in addition to those of original Medicare. Medicare cost plans also give increased flexibility to use out-of-network healthcare professionals.

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

What is Medicare Advantage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. .

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

What is a referral in health care?

referral. A written order from your primary care doctor for you to see a specialist or get certain medical services. In many Health Maintenance Organizations (HMOs), you need to get a referral before you can get medical care from anyone except your primary care doctor.

What is a coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

Does Medicare cover assignment?

The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it.

Do you have to choose a primary care doctor for Medicare?

No, in Original Medicare you don't need to choose a. primary care doctor. The doctor you see first for most health problems. He or she makes sure you get the care you need to keep you healthy. He or she also may talk with other doctors and health care providers about your care and refer you to them.

Medicare Cost Sharing Definitions

Medicare cost sharing may seem more complex than other forms of insurance because Medicare has four different parts, and each one covers something different. Two of those parts are public (Parts A and B), and two are private (Parts C and D).

Medicare Part A Cost Sharing

Medicare Part A is hospital insurance and it covers inpatient procedures, hospice care, and skilled nursing facilities. Many Medicare eligibles don’t pay a monthly premium for Part A. If you don’t meet the “premium-free Part A” requirements, you may pay up to $458 per month in 2020.

Medicare Part B Cost Sharing

Medicare Part B is medical insurance, and it helps pay for outpatient medical services such as doctor’s appointments, emergency medical transportation, outpatient therapy, and durable medical equipment (DME).

Medicare Part C Cost Sharing

Medicare Advantage (MA or Part C) are private plans that can cover additional benefits such as prescription drugs, dental, hearing, vision, and fitness classes. You must be enrolled in both Part A and Part B before you can enroll in a MA plan.

Medicare Part D Cost Sharing

Medicare Part D is prescription drug coverage. You may have to pay a monthly premium, for which the average cost was $33.19 nationwide in 2019.

Medicare Supplement Cost Sharing

Medicare Supplement (Medigap) plans have a different cost sharing structure than MA plans. Medigap plans have eight standardized coverage levels*. In 2020 there are eight different coverage levels:

We Can Help You Navigate Medicare Cost Sharing

Cost sharing with Medicare may seem complicated, and a licensed agent with Medicare Plan Finder can help you determine what you need. Our agents are highly trained, and they can find the Medicare Advantage, Medicare Supplement, and/or Medicare Part D plans in your area.

What is Medicare Supplement?

A Medicare Supplement plan fills the "gaps" that exist in Original Medicare. Unless your employer or a union pays the healthcare costs that Original Medicare doesn't pay, you may want to purchase a Medigap policy. Private insurance companies sell Medicare Supplement insurance plans.

What does Medicare Part B cover?

Enroll in or already have Part B. Medicare Part B covers outpatient care for certain doctors and preventive healthcare services. Part B also covers: Durable Medical Equipment (DME) Ambulance services. Mental health services for inpatient, outpatient, and partial hospitalization care.

What happens if you don't sign up for Medicare?

Railroad Retirement Board Benefit. Office of Personnel Management Benefit. If you don't get these benefit payments, Medicare will send you a monthly bill. Note that if you don't sign up for Medicare Part B at the beginning of your eligibility, you will have to pay a penalty for late enrollment.

What is an HMO plan?

HMO (Health Maintenance Organizations) — These plans provide medical coverage and health care from a specific set of doctors, specialists, and hospitals that are within a plan's approved network. PPO (Preferred Provider Organizations) — PPO plans offer a network of primary care doctors, specialists, and hospitals.

When does Medicare start?

Starts three months before the month you turn 65; Includes the month that you turned 65 ; or. Ends three months after the month that you turn 65. With Original Medicare, you will be able to go to any doctor, healthcare provider, hospital, or facility that's enrolled in Medicare and accepts new Medicare patients.

Does Medicare Supplement cover prescription drugs?

Medicare Supplement plans cover the costs that Original Medicare doesn't. Original Medicare won't cover your prescription drugs. Medicare Part D and Medicare Advantage plans will cover some prescription medicines.

When is the best time to sign up for Medicare Advantage?

As with Medicare Supplement plans, and a Medicare Part D plan, the best time to sign up for a Medicare Advantage plan is the Advantage Open Enrollment Period (October 15 through December 7 each year). If you don't sign up during this period, you might have to pay more for your policy.