Medicare uses prospective payment systems for most of its providers in traditional Medicare. In general, these systems require that Medicare pre-determine a base payment rate for a given unit of service (e.g., a hospital stay, an episode of care, a particular service).

Full Answer

How do doctors get paid by Medicare?

The specific amount you’ll owe may depend on several things, like:

- Other insurance you may have

- How much your doctor charges

- Whether your doctor accepts assignment

- The type of facility

- Where you get your test, item, or service

What does Medicare pay as the secondary payer?

The Medicare secondary payment is $100. When Medicare is the secondary payer, the combined payment made by the primary payer and Medicare on behalf of the beneficiary is $3,000. The beneficiary has no liability for Medicare-covered services since the primary payment satisfied the $520 deductible.

What kind of home care does Medicare pay for?

What types of in-home health care does Medicare cover? If your situation meets Medicare criteria, Medicare may cover in-home health care such as: Skilled nursing care (part-time or intermittent) Part-time home health aides (intermittent) Medical social services; Physical or occupational therapy; Speech language pathology; Medicare benefits might also cover:

Where can I find a doctor that accepts Medicare and Medicaid?

How to find a doctor who accepts Medicare There are a few simple ways to find a doctor who accepts your Medicare plan: Visit physician compare. The Centers for Medicare & Medicaid Services (CMS) has a tool that allows you to look up doctors near you and compare them side-by-side.

How do providers get reimbursed by Medicare?

Traditional Medicare reimbursements When an individual has traditional Medicare, they will generally never see a bill from a healthcare provider. Instead, the law states that providers must send the claim directly to Medicare. Medicare then reimburses the medical costs directly to the service provider.

What determines Medicare payments to physicians?

Payment rates for these services are determined based on the relative, average costs of providing each to a Medicare patient, and then adjusted to account for other provider expenses, including malpractice insurance and office-based practice costs.

How are insurance companies paid by Medicare?

The plans receive some funding through monthly plan premiums, but most of the money comes from Medicare. The private insurance companies that offer the plans receive a payment each month from Medicare. This covers the costs of Medicare parts A and B for each beneficiary.

How Does Medicare pay providers in Part B?

If the provider accepts assignment (agrees to accept Medicare's approved amount as full reimbursement), Medicare pays the Part B claim directly to him/her for 80% of the approved amount. You are responsible for the remaining 20% (this is your coinsurance ).

How and what does CMS use to determine payment rates?

The Centers for Medicare and Medicaid Services (CMS) determines the final relative value unit (RVU) for each code, which is then multiplied by the annual conversion factor (a dollar amount) to yield the national average fee. Rates are adjusted according to geographic indices based on provider locality.

What is the control mechanism the government uses on Medicare payments to physicians and how is it applied?

5. What is the control mechanism the government uses on Medicare payments to physicians, and how is it applied? The conversion factor (CF) is the control (constant) CMS raises or lowers annually to adjust physician payments.

Where does the money come from for Medicare Advantage plans?

Three sources of revenue for Advantage plans include general revenues, Medicare premiums, and payroll taxes. The government sets a pre-determined amount every year to private insurers for each Advantage member. These funds come from both the HI and the SMI trust funds.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Is Medicare funded by private insurance companies?

Medicare is funded through a mix of general revenue and the Medicare levy. The Medicare levy is currently set at 1.5% of taxable income with an additional surcharge of 1% for high-income earners without private health insurance cover.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How do providers submit claims to Medicare?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

What is Medicare special payment method?

A Prospective Payment System (PPS) is a method of reimbursement in which Medicare payment is made based on a predetermined, fixed amount. The payment amount for a particular service is derived based on the classification system of that service (for example, diagnosis-related groups for inpatient hospital services).

How much did Medicare pay hospitals in 2015?

The ACA study showed how much federal healthcare payments are below actual costs to the dollar. Medicare paid hospitals only 88 cents for every dollar spent by the hospital for a Medicare patient care in 2015. More troubling for providers is that Medicare underpayments may also be greater for hospitals in the near future.

How much was Medicare reimbursement in 2015?

At the end of last year, it was reported by the American Hospital Association (AHA) that Medicaid and Medicare reimbursement in 2015 was less than the actual hospital costs for treating beneficiaries by $57.8 billion. That is billion with a “B”.

How much will CMS decrease in 2025?

However, the ACA mandated that CMS decrease certain uncompensated care payments by $2 billion by 2018 and by another $8 billion by 2025, making some hospitals particularly vulnerable.

Do hospitals accept Medicare?

While physicians have more leeway in whether to accept Medicare and/or Medicaid patients, hospitals have little to no choice. Despite low Medicaid and Medicare reimbursement rates and high uncompensated care costs, the AHA report pointed out that few hospitals can elect not to participate in federal healthcare programs.

Does Medicare cover medical expenses?

The ACA survey results showed that Medicaid and Medicare payments do not cover the amounts hospitals pay for personnel, technology, and other goods and services required to provide care to Medicare and Medicaid beneficiaries. This is critical in areas where the population is largely covered by Medicare and Medicaid.

Do hospitals provide community care?

The AHA also noted that the recent reports only account for two services and programs that hospitals provide to meet community healthcare needs. While hospitals benefit their geographic areas by covering federal healthcare payment shortfalls and providing uncompensated care, they also implement other community programs that may strain hospital revenue cycles.

What percentage of Medicare beneficiaries have managed care?

About 20 percent of beneficiaries who have a managed care option have chosen to enroll in a plan. They comprise about 11 percent of the total Medicare population. Medicare managed health care options have been available to some Medicare beneficiaries since 1982 and Medicare has paid health plans a monthly per person county rate.

What is Medicare per capita?

Medicare uses monthly per person, or “per capita” (capitated), county rates to determine payments to managed care plans. In the last decade, Congress has made several changes to how CMS must calculate these county rates. The old methodology was based on the Adjusted Average Per Capita Cost methodology, or “AAPCC.”.

What is the MMA for Medicare?

The Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA) returned to the idea of linking managed care rates and local fee-for-service costs. The MMA mandated that for 2004, a fourth amount of 100 percent of projected fee-for-service Medicare (with adjustments to exclude direct medical education and include a VA/DOD adjustment) be added to the payment methodology. For the years after 2004, the Secretary is required to recalculate 100 percent of the fee-for-service Medicare costs at least every 3 years, so at least every three years the MA capitation rate will be the higher of the fee-for-service rate and the minimum increase rate.

How many people are eligible for Medicare?

Background: Nearly all Americans over the age of 65 or disabled Americans under 65 are eligible for the Medicare program and most of them receive care through traditional, fee-for-service Medicare. Of the nearly 41 million Americans in Medicare, almost 60 percent live in an area where they can enroll in a Medicare managed care plan, an alternative to traditional Medicare. About 20 percent of beneficiaries who have a managed care option have chosen to enroll in a plan. They comprise about 11 percent of the total Medicare population.

When did CMS start a risk adjustment program?

The BBA required CMS to implement a risk adjustment payment system for Medicare health plans by January 2000. CMS initially phased-in risk adjustment with a risk adjustment model that based payment on principal hospital inpatient diagnoses, as well as demographic factors such as gender, age, and Medicaid eligibility.

When did Medicare change to Advantage?

Most recently, in the Medicare Prescription Drug, Improvement and Modernization Act (MMA) of 2003, Congress changed Medicare+Choice into the Medicare Advantage program that will begin in 2004 and provided for additional funding to stabilize and strengthen the Medicare health plan program to further benefit people with Medicare.

What is blended amount?

Blended amount blending local (county) and national average per capita expenditures, to bring county rates closer to the national average. Each year, from 1998 to 2003, a greater percentage of the blend rate was based on the national rate, until a 50/50 blend was reached in 2003. Before determining the final rates, a budget neutrality adjustment is applied to the blend amounts to ensure that total managed care payments are no higher than they would be if plans were paid using only the local expenditure rates.

How much does Medicare pay for medical services?

The Medicare reimbursement rates for traditional medical procedures and services are mostly established at 80 percent of the cost for services provided. Some medical providers are reimbursed at different rates. Clinical nurse specialists are paid 85 percent for most of their billed services and clinical social workers are paid 75 percent ...

How much can Medicare increase from current budget?

By Federal statute, the Medicare annual budget request cannot increase more than $20 million from the current budget.

What is Medicare reimbursement rate?

The reimbursement rates are the monetary amounts that Medicare pays to health care providers, hospitals, laboratories, and medical equipment companies for performing certain services and providing medical supplies for individuals enrolled in Medicare insurance. To receive reimbursement payments at the current rates established by Medicare, health care professionals and service companies need to be participants in the Medicare program. While non-participating professionals and companies are able to submit claims and receive reimbursements for their services, their reimbursements will be slightly lower than the rates paid to participants.

What is the Medicare coinsurance?

Today, Medicare enrollees who use the services of participating health care professionals will be responsible for the portion of a billing claim not paid by Medicare. The majority of enrollee responsibility will be 20 percent, often referred to as coinsurance. With clinical nurse specialists that responsibility would be 15 percent and 25 percent for clinical social workers.

How many specialists are on the Medicare committee?

Medicare establishes the reimbursement rates based on recommendations from a select committee of 52 specialists. The committee is composed of 29 medical professionals and 23 others nominated by professional societies.

Why use established rates for health care reimbursements?

Using established rates for health care reimbursements enables the Medicare insurance program to plan and project for their annual budget. The intent is to inform health care providers what payments they will receive for their Medicare patients.

What percentage of Medicare bill is not paid?

The majority of enrollee responsibility will be 20 percent , often referred to as coinsurance.

How is Medicare funded?

Medicare is mainly funded by payroll taxes, so ultimately, all of us are funding the Medicare Advantage plans that offer a $0 monthly premium.

How to create a Medicare action plan?

Create a Medicare action plan by estimating your total monthly premiums for healthcare and related expenses in retirement.

What is Medicare Advantage?

Medicare Advantage plans are managed care, which means you might need prior authorization for a medication, you may need a referral to see a specialist, and you may have to try a cheaper treatment plan before your plan will approve a more expensive one. That’s how Medicare Advantage plans manage their costs.

Does Medicare Advantage have a contract with the government?

Medicare Advantage companies have a contract with the federal government.

Is Medicare Advantage a low premium?

Most Medicare Advantage plans are paid enough by the government to offer very low – sometimes even $0 premium plans – in addition to extra benefits that go above and beyond what Medicare regularly covers. For example, you might get some dental, vision, and fitness benefits.

How much did Medicare add in 2018?

In actual practice, for 2018 they added 4% to the average plan’s benchmark and 3% to plan payments, according to the Medicare Payment Advisory Commission (MedPAC), a nonpartisan agency that advises Congress on Medicare.

How much did Medicare overpayments cost in 2010?

Indeed, Harvard health economist Vilsa Curto and his colleagues studied Medicare costs from the year 2010 and found that basing MA benchmarks on FFS Medicare costs caused $21 billion in overpayments that year.

What are quality bonuses for Medicare?

Plans with four- or five-star ratings are awarded quality bonuses that nominally are supposed to boost benchmarks by 5%. In actual practice, for 2018 they added 4% to the average plan’s benchmark and 3% to plan payments, according to the Medicare Payment Advisory Commission (MedPAC), a nonpartisan agency that advises Congress on Medicare. Two important details about quality bonuses: First, in roughly half of U.S. counties, benchmarks are capped at pre-ACA levels, which may block some or all of a quality bonus from applying, and second, bonuses may be doubled in certain urban counties with low fee-for-service spending and historically high MA penetration. MedPAC has called for an end to that practice.

How is MA plan payment influenced?

It makes sense in this value-focused era that MA plan payment should be influenced by the quality of care and service, and it is—with some limitations, as we’ll see. Plans are assessed with a quality rating of from one to five stars (five is tops) based on nearly 50 measures that include how well they provide screenings, immunizations, and checkups; help members manage chronic conditions; and satisfy customers and respond to their calls and questions. Data come from member surveys, reports by plans, and reviews of billing, among other sources. For plans’ Part D services, a separate rating is based on drug safety, accuracy of drug pricing, and member satisfaction, and the two ratings are combined to create an overall plan rating.

When did CMS publish its call letter?

February 2019: CMS publishes Advance Notice and draft of its “call letter.”

When you give plans a benchmark to bet against, what do you tell them?

Agrees the Urban Institute’s Skopec: “When you give plans a benchmark to bet against—when you tell them, basically, the maximum you’re willing to pay— you may get higher bids than if they were bidding blind.” She concedes that fewer plans might bid if true price competition ruled instead. But she believes the present Rube Goldberg-style MA payment system suffers from an unresolved tension between two goals: maximum choice for seniors and maximum savings for taxpayers.

When is the MA open enrollment period?

Oct. 15–Dec. 7, 2019: MA open-enrollment period, in which members sign up for the coming year.

How does Medicare and Medigap work?

Medicare and Medigap work together smoothly to pay for your medical bills. It’s done automatically and usually without any input from you; that’s how Medigap policies work. That ease-of-use is a big appeal of owning a Medigap policy. Your doctors are in charge of your medical care. They know that Medicare’s rules require ...

What is the role of a Medigap insurer?

A Medigap insurer’s only role is to pay bills, bills that Medicare has already approved.

How often does Medicare send out EOB?

To help you monitor that, every three months Medicare will mail you an Explanation of Benefits (EOB) that summarizes all the bills they approved and paid on your behalf. You can also create an online Medicare account and view your bills there.

What is Medicare's rule for MRI?

They know that Medicare’s rules require that any procedure or treatment, such as surgery, a blood test or MRI, that the order is medically necessary. That means it is necessary to diagnose and treat a medical condition.

Does Healthcare.com sell insurance?

We do not sell insurance products, but there may be forms that will connect you with partners of healthcare.com who do sell insurance products. You may submit your information through this form, or call 855-617-1871 to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

Does Medicare cover gaps?

After that, Medicare uses a system called “crossover” to electronically notify your Medigap insurance company that they have to pay the part of the remainder (the gaps) that your Medigap policy covers. All you have to remember is this: always show your Medigap policy identification card, along with your Medicare card, to your medical providers. The rest is done automatically for you.

Dive Brief

A new JAMA Internal Medicine report found that health insurance companies involved in Medicare Advantage (MA) pay nearly the same as traditional Medicare. The report explored how payers in MA reimburse physicians compared to traditional Medicare and commercial health insurance.

Dive Insight

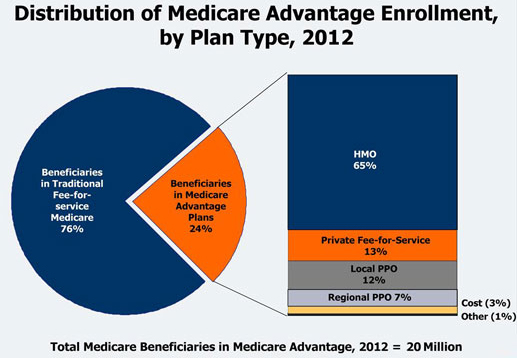

MA has gained popularity with 19 million beneficiaries — about one-third of Medicare beneficiaries — now enrolled in a MA plan.