Full Answer

How often can I change Medicare plans?

Sep 07, 2021 · How Does a Medicare Replacement Plan Work? Advantage, or Part C – often coined replacement plans – stand in place of your Medicare for 12 months. They don’t act as a permanent replacement, and you can always return to Original Medicare during the Medicare Advantage Open Enrollment Period or Annual Enrollment Period.

Which Medicare plan is best for You?

Dec 14, 2021 · Medicare replacement plans are private insurance policies that pay healthcare expenses instead of Medicare. The policies are called Medicare Advantage plans and are also called Medicare Part C. These are not Medicare supplement plans and have a completely different benefit structure. If you would like to compare the two types of Medicare plans and …

How do I decide on which Medicare plan to use?

Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. Each Medicare Advantage Plan can charge different out-of-pocket costs . They can also have different rules for how you get services, like: Whether you need a referral to see a specialist

Why are Medicare Advantage plans bad?

Aug 23, 2020 · How Medicare Replacement Plans Work as Your Primary Coverage When you enroll in a Medicare Advantage plan, Medicare pays that insurance company a hefty monthly fee to handle your claims and pay out any benefits necessary. The plan must offer you all the same Medicare Part A and Part B services that you would normally get from Original Medicare too.

How do you explain a Medicare replacement plan?

A Medicare replacement plan provides a way for people to get their original Medicare benefits and, usually, prescription drug coverage in one place. Some people refer to these replacement plans as Medicare Advantage plans or Medicare Part C.Jan 11, 2021

Is a Medicare replacement plan the same as Medicare?

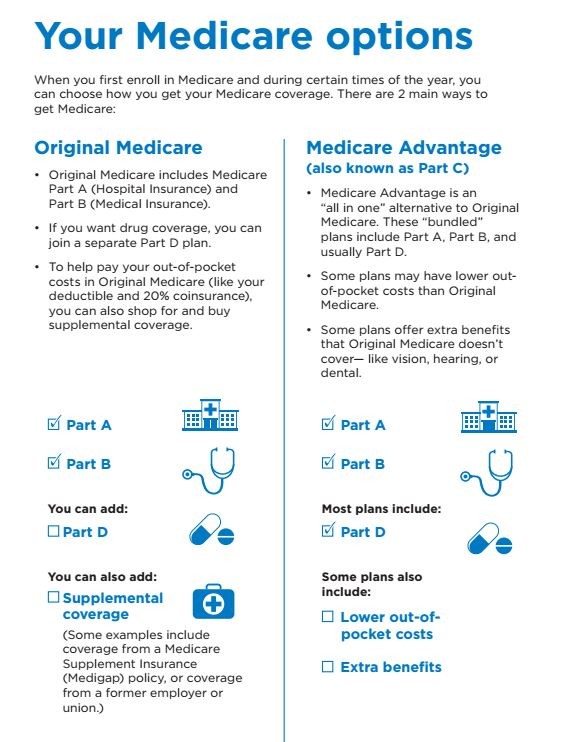

Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Plans may have lower out-of- pocket costs than Original Medicare. In many cases, you'll need to use doctors who are in the plan's network.

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

Does Medicare Advantage replace Original Medicare?

Medicare Advantage does not replace original Medicare. Instead, Medicare Advantage is an alternative to original Medicare. These two choices have differences which may make one a better choice for you.

Does a Medicare Advantage plan Replace Part B?

Medicare Advantage doesn't replace Original Medicare Part A and Part B coverage; it simply delivers these benefits through an alternative channel: private insurance companies. Medicare Advantage plans are offered by private insurance companies that contract with Medicare.Jun 30, 2021

What are the 4 phases of Medicare Part D coverage?

If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage. Select a stage to learn more about the differences between them.Oct 1, 2021

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

Why does zip code affect Medicare?

Because Medicare Advantage networks of care are dependent upon the private insurer supplying each individual plan, the availability of Medicare Advantage Plans will vary according to region. This is where your zip code matters in terms of Medicare eligibility.

What are 4 types of Medicare Advantage Plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What is Medicare Advantage Plan?

Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are an “all in one” alternative to Original Medicare. They are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, you still have. Medicare.

What happens if you don't get a referral?

If you don't get a referral first, the plan may not pay for the services. to see a specialist. If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care. These rules can change each year.

Does Medicare cover dental?

Covered services in Medicare Advantage Plans. Most Medicare Advantage Plans offer coverage for things Original Medicare doesn’t cover, like some vision, hearing, dental, and fitness programs (like gym memberships or discounts). Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like ...

What is Medicare replacement plan?

Medicare Replacement plans combine the core parts of Medicare and create a private healthcare plan. These plans often have other benefits such as dental, vision, and hearing. When you enroll in a Medicare Advantage plan, you are formally telling Medicare that until December 31 st, you are choosing to get your Part A and Part B benefits through ...

What are the extras of Medicare Advantage?

These plans can offer extra benefits for something that Medicare doesn’t cover, like routine dental, vision, and hearing services. Some plans may even offer free fitness memberships.

When was Medicare Advantage created?

The Medicare Advantage program was created in the late 1990s to give beneficiaries another option besides Original Medicare and a Medigap plan. Some people cannot afford Medigap plan premiums so these Medicare Advantage “replacement plans” give them an alternative – a way to get their benefits from a private plan instead of Medicare.

Does Medicare change benefits?

Benefits Change Annually. Something else to be aware of about Medicare Replacement plans is that the benefits change from year to year. When you enroll in a plan, the premiums and cost-sharing that you pay are for that one year only. In September, the plan will mail you an annual notice of change letter. This will go over all the things that are ...

Does Medicare replace Medicare?

Does Medicare Advantage replace Medicare? The answer is yes and no. “Medicare replacement plans” is a phrase commonly used by Medicare beneficiaries and medical providers when referring to Medicare Advantage plans. Advantage plans are private insurance policies that pay instead of Medicare for the calendar year that you enroll in them. ...

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

How much does Medicare Advantage cost in 2020?

In the case of a standalone plan, you also pay a set annual deductible. As of 2020, the amount can be no more than $435.00 per year.

What is the difference between tier one and tier two?

The amount you pay depends on the formulary of your plan and the tier on which your drug is categorized. Tier one includes generic brands of permitted drugs and they have the lowest copay ment. Tier two includes brand-name, preferred drugs and carry a higher copayment than tier one.

Does Medicare cover prescriptions?

Original Medicare benefits do not cover prescription drug costs unless the drugs are part of inpatient hospital care or are certain drugs that your health care provider administers in a medical facility. Today, prescriptions drugs that you take at home are not inexpensive, but there are more prescription drugs are available now to treat conditions ...

What is Medicare Advantage Plan?

People use Medicare Advantage plans as an alternative to Medicare parts A and B. Private companies sell and administer them, just as they do Medicare supplement plans. They provide bundled plans that may cover more than separate Medicare plans, such as dental or vision care.

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs. This article explains how Medicare supplement plans work, how to find one, and how to work out which plan is best.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

How many Medicare Supplement Plans are there?

These plans cover more than just out-of-pocket costs from Medicare and may provide additional benefits for some people. Currently, 10 Medicare supplement plans are available. These are:

Does Medicare cover all of the costs?

A person can choose to enroll in Medicare parts A and B. However, these may not cover all healthcare costs. People with Medicare will still have to pay different deductibles and coinsurances based on the type of care they receive. Medicare supplement plans can help a person reduce out-of-pocket costs on Medicare parts A and B. ...

What is Medicare Part A and B?

Medicare parts A and B, which would serve as the primary payer, administer their coverage first . Afterward, Medigap coverage takes over to fund the out-of-pocket costs of treatment and any other agreed costs, such as treatment received outside the United States on some Medigap plans.

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

How much does it cost to treat a broken arm?

If you refer back to your broken arm example. Say your treatment cost you $80. If you broke your arm before you reached your Part B deductible amount of $198, you’d have to pay the full $80 for your care or whichever amount you had left to hit your $198 cap.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is tricare medical?

Published by: Medicare Made Clear. TRICARE® is the health care program that serves uniformed service members, retirees and their families worldwide. Medicare is a federal health care program for U.S. citizens age 65 and older, under age 65 with certain disabilities and those who have end-stage renal disease. You may be eligible for both TRICARE and ...

How long do you have to enroll in tricare?

This means for Medicare, you’ll need to enroll during your Medicare Initial Enrollment Period. And with TRICARE, you have 90 days after you become eligible for Medicare to change your TRICARE health plan, and your plan options will depend on your specific situation including how you qualify for Medicare, you or a family member’s active duty status ...

Is there a fee for tricare for life?

Coverage is automatic if you have Parts A and B and pay your Part B premiums. There is no fee for enrolling in TRICARE For Life.

Does Tricare work with Medicare?

TRICARE For Life may work with Original Medicare (Parts A & B), a Medicare Advantage plan or a Part D prescription drug plan. However, you may want to think carefully about whether you need Medicare drug coverage. TRICARE For Life includes a prescription drug benefit, so you may not need Part D.

Do you have to have Medicare Part B to get tricare?

Most people with TRICARE, who become Medicare eligible and get Medicare Part A, must also have Medicare Part B to be able to remain eligible. Part D is not required to maintain eligibility.