While the average premium for a Medicare Advantage plan in Hawaii in 2022 is $47 per month, you may be able to find plans that include $0 premiums. Average in-network out-of-pocket spending limit: $5,820.83 Average drug deductible (weighted): $3082

Full Answer

How do Medicare supplement plans work in Hawaii?

Medicare Supplement plans in Hawaii help Medicare beneficiaries control the ever-rising cost of health care. Medicare Supplemental Insurance, also called Medigap health plans, pays for out-of-pocket costs such as deductibles and copays that the federal Medicare program doesn’t cover.

What is the average Medicare Advantage monthly premium in Hawaii?

The average Medicare Advantage monthly premium decreased in Hawaii compared to last year — from $56.34 in 2021 to $54.47 in 2022. There are 33 Medicare Advantage plans available in Hawaii for 2022, compared to 30 plans in 2021. All Hawaii residents with Medicare have access to buy a Medicare Advantage plan, including plans with $0 premiums.

How many Medicare recipients are in Hawaii?

More than 140,000 senior citizens and disabled individuals in Hawaii are covered under Medicare. Almost 7,500 Medicare recipients in Hawaii had Medicare Supplement plans in 2015. This is about 5.6 percent of individuals who are covered under original Medicare insurance in the state. The most popular Medigap plan in Hawaii is Plan F plans.

When is the best time to apply for Medicare Supplement Insurance in Hawaii?

The best time to apply for a Medicare Supplement insurance plan in Hawaii is during your personal Medigap Open Enrollment Period. Here’s what you need to know about that period:

What is the highest rated Medicare Supplement company?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What states have the cheapest Medicare Supplement plans?

Maine, South Carolina, New Mexico, Idaho, Missouri and Nevada have the lowest average monthly Medicare Advantage premiums in 2022, with all five states having average plan premiums of $42 or less per month.

Which Medicare Supplement plan is the most comprehensive?

Medicare Supplement Plan FMedicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What is the best and least expensive Medicare plan?

The good news: Medicare Plan F is one of the most popular Medicare Supplemental Plans available, with 45% of those enrolled in Medicare also enrolled in Plan F. 1 It offers the most coverage for hospital stays and specialists for the least cost, which explains its popularity.

What is the least expensive Medigap plan?

Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage.

Do Medigap premiums vary by state?

Original Medicare is the only coverage that does not vary by state. Medigap, Medicare Advantage and Part D prescription drug plans are all sold privately and vary by state.

Which Medigap plan is better g or n?

Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs. Costs of Medigap policies vary by state and carrier.

Is there a Medicare plan that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

Can you change your Medicare Supplement plan at any time?

As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period. An application may be “medically underwritten”.

What is the most popular Medicare plan in Hawaii?

In Hawaii, Medicare Supplement Plan G is the most popular plan. Medigap Plans do not use a network, go wherever Original Medicare is excepted. Beneficiaries concerned about Original Medicare out-of-pocket costs have the option to enroll in a Medicare Supplement plan in Hawaii. They’re secondary Medicare insurance policies ...

When to apply for medicare in Hawaii?

The best time to apply for a Medicare Supplement insurance plan in Hawaii is during your personal Medigap Open Enrollment Period. Here’s what you need to know about that period: It starts the first day of the month that you become eligible for Social Security benefits and sign up for Original Medicare.

How many standardized medicaid plans are there in Hawaii?

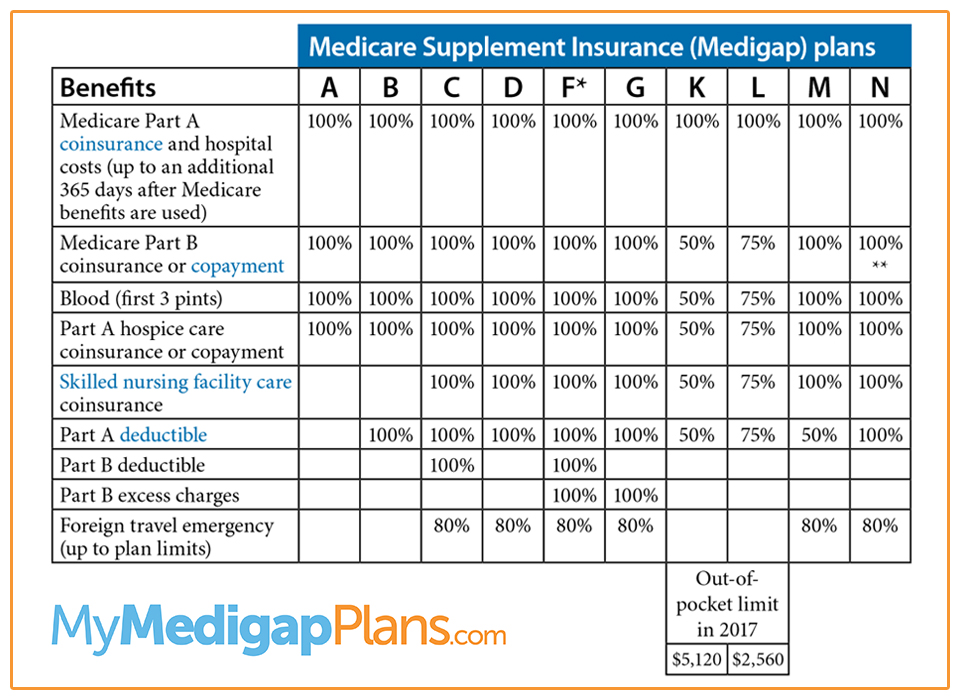

There are 10 standardized Medigap policies plus two high-deductible plan options. Not all plans are offered in all zip codes, but the leading five are available for most areas of Hawaii. If your Original Medicare effective date was prior to January 1, 2020, you have the option to sign up for Medicare Plan F. This is the most comprehensive plan ...

How much is the high deductible plan F?

The high-deductible version of Plan F offers all the benefits of the standard plan. The catch is that you have to pay the $2,370 deductible out of pocket before accessing those benefits. The rates are substantially lower for these plans.

Which is the best Medicare Supplemental Plan?

Medicare Plans F and G are the best Medicare Supplemental plans for beneficiaries interested in comprehensive Medicare coverage. Both plans severely reduce the out-of-pocket costs beneficiaries must pay each year by covering Part B excess charges, coinsurance, and deductibles.

How much does a Plan G policy cost in 2021?

In 2021, the average cost of a Plan G policy for a 65-year-old woman who doesn’t smoke and lives in zip code 96733 is $144 per month.

Is Medicare Plan N deductible?

Medicare Plan N is one of the best options for beneficiaries able to pay the Part B deductible out of pocket along with small copayments for doctor’s office and emergency room visits. Those able to pay a substantial deductible may want to consider the high-deductible plan options as well.

Why are Medicare Supplement Plans labeled as A through N?

These plans are labeled A through N to distinguish the basic benefits each provides. Each plan, such as Medicare Supplement Plan A, has the same basic benefits regardless of the insurance company that offers it or the state where it is purchased. One thing to keep in mind, though, is that the cost can vary remarkably among insurers selling ...

How long does Medicare Supplement last?

It starts the first month that you’re age 65 or older and enrolled in Medicare Part B, and goes for six months. During your OEP, you have certain guarantees. An insurance company selling Medicare Supplement plans cannot turn down your application or charge you a higher premium if you have a health condition.

Can you cancel Medicare Supplement Plan after 2006?

If you want prescription drug benefits, you can enroll in a stand-alone Medicare Part D Prescription Drug Plan. The insurance company generally can’t change the benefits covered by the Medicare Supplement plan or cancel the plan as long as you continue ...

Do you pay Medicare Supplement Insurance in Hawaii?

You’ll pay a separate premium to the insurer if you buy a Medicare Supplement Insurance plan in Hawaii. This is in addition to the Part B premium you pay Medicare . As mentioned earlier, insurers establish their own premiums. You can instantly compare premiums among Medicare Supplement plans in your area of Hawaii by typing your zip code ...

Does Medicare Supplement cover out of pocket expenses?

But Medicare Supplement plans may help cover your Medicare out-of-pocket costs and save you money.

Does Hawaii have Medicare Supplement?

Medicare Supplement plans in Hawaii (and nationwide) aren’t part of the federal Medicare program. They’re designed to work with Medicare Part A and Part B to help pay some of the out-of-pocket costs Medicare doesn’t pay. Examples of these out-of-pockets costs are deductibles, copayments, and coinsurance. Not all Medicare Supplement plans in Hawaii ...

Can I get Medicare Supplement in Hawaii?

A Medicare Supplement plan in Hawaii may be an attractive option if you have Medicare Part A and Part B and live in Hawaii—especially if you travel to the mainland with some regularity, or if you have health problems. Medicare Supplement plans in Hawaii (and nationwide) aren’ t part of the federal Medicare program.

What Are the Best Hawaii Medicare Supplement Plans?

Hawaii’s Medicare supplement plans fall into 10 categories, which are identified simply by letters. All Medigap policies must offer the same basic benefits, including coverage of Part A coinsurance and 365 days of hospital care beyond what Original Medicare reimburses for.

How Do I Enroll in a Hawaii Medigap Plan?

Hawaiians who are enrolled in Original Medicare are eligible to purchase a Medigap plan to supplement their insurance. Your Medigap open enrollment period begins the month you turn 65 and enroll in Medicare Part B.

Does Hawaii have Medicare Supplement?

Medicare Supplement plans in Hawaii help Medicare beneficiaries control the ever-rising cost of health care. Medicare Supplemental Insurance, also called Medigap health plans, pays for out-of-pocket costs such as deductibles and copays that the federal Medicare program doesn’t cover.

Can you sell Medicare Supplement insurance?

As of Jan. 1, 2020, federal law changed. A Medicare insurance company cannot sell a Medicare Supplement insurance policy that covers the Part B deductible (such as Medicare Plan F) to a beneficiary who is newly eligible for coverage. That means that Medigap Plan G is now the gold standard for new enrollees because it offers the broadest coverage at a reasonable price. There is not a deductible on Medicare Plan G, you are simply required to pay the Medicare Part B deductible before outpatient care is covered. For 2021, the Part B deductible is $203.00.

How many Medicare Advantage plans are there in Hawaii?

There are 30 Medicare Advantage plans available in Hawaii for 2021, compared to 25 plans in 2020. All Hawaii residents with Medicare have access to buy a Medicare Advantage plan, including plans with $0 premiums. There are 12 different Medigap plans offered in Hawaii for 2021.

What is the Medicare plan in Hawaii?

Medicare plans in Hawaii include: Original Medicare — parts A and B. Medicare Advantage — Part C. Prescription drug coverage — Part D.

How many people in Hawaii are on Medicare 2021?

The Centers for Medicare & Medicaid Services (CMS) reported the following information on Medicare trends in Hawaii for the 2021 plan year: A total of 280,662 residents of Hawaii are enrolled in Medicare.

How old do you have to be to get medicare in Hawaii?

Medicare enrollment in Hawaii. To be eligible for Medicare, Hawaii residents must be: 65 years old or older. a U.S. citizen or legal resident for at least the past 5 years. You may also qualify if you are under age 65 and: have end stage renal disease (ESRD) or a kidney transplant.

How to contact Hawaii Department of Health?

Medicare (800-633-4227): Contact Medicare by phone or online.

How long does it take to enroll in Medicare?

Initial enrollment period. If you’re first eligible when you turn age 65, you can sign up during this 7-month period. It starts 3 months before the month you turn age 65 and ends 3 months after the month of your 65th birthday.

When is the open enrollment period for Medicare?

The annual open enrollment period happens between October 15 and December 7. At this time, you can join a Medicare Advantage plan or switch to a new plan. Medicare Advantage open enrollment period. If you’re already in a Medicare Advantage plan, you can switch to another one between January 1 and March 31 every year.

Federal Regulations for Medicare Supplements

There are actually ten Medicare supplemental insurance plans on the market, all of which are regulated by the Centers for Medicare and Medicaid Services (CMS). In line with the CMS rules, All Medigap plans have to offer the same coverage, regardless of the company providing the policy or the state they’re in.

Medigap Enrollment In Hawaii

There are thousands of seniors living in Hawaii right now who are choosing to supplement their Medicare benefits with a Medigap policy. As you can see, they prefer Plan F to all other available plans. Plan C is a distant second, with a little over 500 members.

Plan Coverage & Cost

Many factors will determine how much your insurance company might charge you for your Medicare supplemental insurance policy. For example, a 65 year old, male non-smoker in Denver will pay a considerably different premium from a 75 year old female in Hawaii who routinely uses tobacco products.

Most Popular Medicare Supplement Plans in Hawaii

Like many other states, Hawaii citizens favor Medigap Plan F to all of the other obtainable plans. The reason behind this is quite simple: Plan F covers each and every gap in Medicare coverage, and all seniors have to do to protect themselves is pay one affordable monthly premium. Seldom is any other action demanded on their part.

How do Medicare Plan Ratings Work?

Every year Medicare releases a report on what they believe is the performance of insurance companies providing supplemental Medicare coverage. The report assigns stars for rating. You can use these ratings to get a feel for how a specific company performs.

Doctors List

Do you like the doctor you have now? If you do, and you have a Medigap plan, you will be able to stay with him or her. Other types of plans commonly restrict the healthcare providers that you can use to those that belong to a specific network.

Drug, Vision and Dental Coverage

In case you were unaware, Medicare Part D is now largely accountable for providing seniors with prescription drug coverage. Due to this, it’s no longer required for Medicare supplement policies to provide prescription drug coverage as being an option. Vision and dental are extra kinds of coverage which Medigap and Medicare will not pay for.