How do Medicare Advantage Plans work? When you join a Medicare Advantage Plan, Medicare pays a fixed amount for your coverage each month to the company offering your Medicare Advantage Plan. Companies that offer Medicare Advantage plans must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and

Full Answer

What companies offer Medicare Advantage plans?

What Companies Offer Medicare Advantage Plans Currently

- Aetna Medicare Advantage Plans. ...

- Benefits of Aetna Medicare Advantage Plans. ...

- Blue Cross and Blue Shield Medicare Advantage Plans. ...

- Benefits of Blue Medicare Advantage Plans. ...

- Cigna Medicare Advantage Plans. ...

- Benefits of Cigna Medicare Advantage Plans. ...

- Humana Medicare Advantage Plans. ...

- Benefits of Humana Medicare Advantage Plans. ...

What are the problems with Medicare Advantage plans?

The U.S. Department of Justice increasingly has scrutinized how health plans, providers and health care vendors compile and report risk adjustment data in connection with the Medicare Advantage program, also known as Medicare Part C. The DOJ has intervened ...

What are the advantages and disadvantages of Medicare Advantage plans?

Your recent article on Medicare Advantage plans provided a good overview but omitted essential information. Traditional Medicare coverage includes a well-defined set of benefits, rules and regulations with regards to coverage. Adverse coverage determinations can be appealed. The appeals process is well defined.

How much does a Medicare Advantage plan really cost?

The average Medicare Advantage premium in 2019 was $8, according to eHealth research. This was a result of the popularity of $0 premium plans. Medicare Advantage cost sharing Aside from your monthly premium, Medicare Advantage plans typically have cost sharing.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Does Medicare Advantage pay for everything?

Medicare Advantage Plans must cover all of the services that Original Medicare covers except hospice care. Original Medicare covers hospice care even if you're in a Medicare Advantage Plan. In all types of Medicare Advantage Plans, you're always covered for emergency and urgent care.

What are the advantages and disadvantages of Medicare Advantage plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Does Medicare Advantage pay 80%?

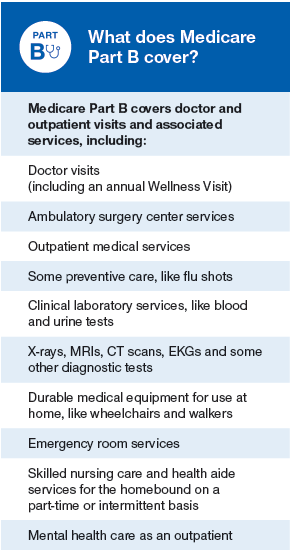

Under Medicare Part B, patients usually pay 20% of their medical bills and Medicare pays the remaining 80%. Medicare Advantage, however, can charge patients coinsurance rates above 20%.

What is not covered by Medicare Advantage plans?

Most Medicare Advantage Plans offer coverage for things Original Medicare doesn't cover, like fitness programs (like gym memberships or discounts) and some vision, hearing, and dental services. Plans can also choose to cover even more benefits.

Do Medicare Advantage plans pay for hospitalization?

Some Medicare Advantage plans may cover unlimited days for an inpatient hospital stay. You may pay a copayment for a certain number of days and then not have a copayment for another period of days. As you compare Medicare Advantage plans remember that coverage costs and limits may differ from plan to plan.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Do Medicare Advantage plan premiums increase with age?

The way they set the price affects how much you pay now and in the future. Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

What is the maximum out-of-pocket for Medicare Advantage?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

Does Medicare Advantage pay 100 percent?

Medicare Advantage plans must limit how much their members pay out-of-pocket for covered Medicare expenses. Medicare set the maximum but some plans voluntarily establish lower limits. After reaching the limit, Medicare Advantage plans pay 100% of eligible expenses.

Why is Medicare Advantage so popular?

Medicare Advantage is a popular health insurance option because it works like private health insurance for Medicare beneficiaries. In fact, according to the Centers for Medicare & Medicaid Services, more than 60 million Americans enrolled in Medicare in 2019. Of these Medicare enrollees, more than 37 percent were enrolled in a Medicare Advantage ...

How long does it take to sign up for Medicare?

Initial enrollment period. This is a 7-month window around your 65th birthday when you can sign up for Medicare. It begins 3 months before your birth month, includes the month of your birthday, and then extends 3 months after your birthday. During this time, you can enroll for all parts of Medicare without a penalty.

Does Medicare Advantage have coinsurance?

Most Medicare Advantage plans charge a copayment or coinsurance amount for services rendered. These services could include a doctor’s office visit, specialist’s office visit, or even a prescription drug refill. Specific coinsurance and copayment amounts are set by the plan you’re enrolled in.

Does Medicare Advantage cover hospital services?

This includes any hospital services covered under Medicare Part A and any medical services covered under Medicare Part B. Some Medicare Advantage plans also cover additional healthcare needs, including: However, this coverage varies by plan, and each Medicare Advantage plan can choose what additional coverage to offer.

When is the open enrollment period for Medicare?

Open enrollment period (October 15–December 7). During this time, you can switch from original Medicare (parts A and B) to Part C (Medicare Advantage), or from Part C back to original Medicare. You can also switch Part C plans or add, remove, or change a Part D plan. General enrollment period (January 1–March 31).

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage plans include this coverage, which helps pay for the cost of your medications. Only certain types of prescription drugs are required to be covered under Part D, however — so you’ll want to make sure to check for coverage of your medications before enrolling in an Advantage plan.

Can you charge separate deductibles for Medicare Advantage?

In addition, Advantage plans can charge separate drug and health plan deductibles. Individual healthcare needs play a huge role in how much you may end up paying out of pocket for your Medicare Advantage plan. For example, your plan costs can be affected by: how often you seek services.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

What is Medicare Advantage?

Medicare Advantage is known as Part C and is sometimes referred to as the MA plan. This type of plan is only available through Medicare-approved private insurance companies.MA plans are required to include the same Part A and Part B coverage as Original Medicare. In addition to Part D for prescription drugs, most MA plans today feature Medicare coverage offerings such as vision, hearing, dental and wellness programs. As the trend is toward care that extends beyond hospital inpatient services and primary physician sick visits, look for additional benefits like transportation to the doctor’s office, over-the-counter drugs and adult day care.

What are the rules for Medicare?

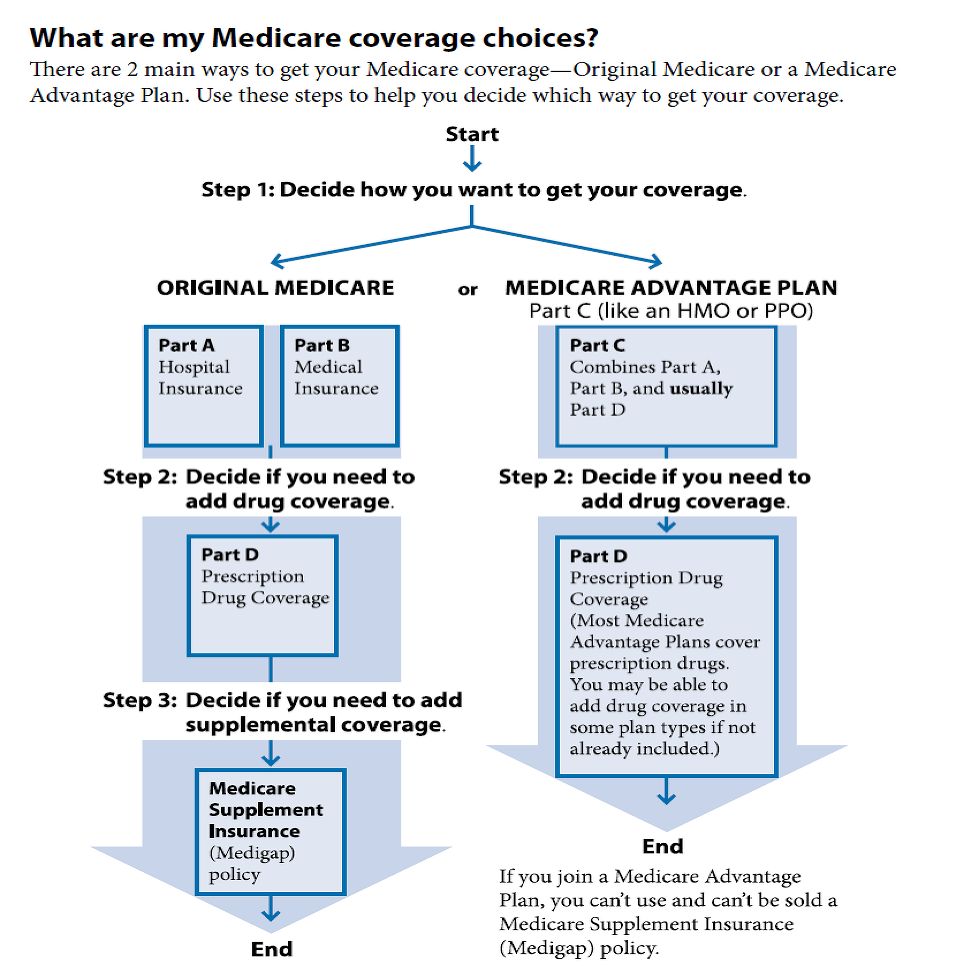

Special rules apply for Medicare recipients who continue to work and retain health insurance through an employer or union. For others, the options are as follows: 1 Original Medicare, which includes Parts A and B. 2 Original Medicare plus Part D plus supplemental coverage (Medicare Supplement, or Medigap). 3 Medicare Advantage, which bundles Part A, Part B and often Part D.

Is MA plan a Medicare Advantage plan?

Based on enrollment statistics, the MA plan is a favored alternate to Original Medicare. Kaiser Family Foundation attributes increased enrollment to gradual changes in Medicare payment policy for Part A and Part B Medicare-covered services. Whereas the policy historically slanted toward generating savings, the focus has shifted over the years toward expansion of access to Medicare-approved private plans and the provision of additional benefits for participants. KFF advises that 34% of Medicare recipients in 2019 enrolled in Medicare Advantage plans and that the Congressional Budget Office expects this enrollment to reach 47% by 2029.

What is Medicare Advantage?

Medicare Advantage plans are similar to health plans that people have with their jobs. Medicare provides health insurance coverage to people 65 and over. It also covers Americans with disabilities who receive Social Security disability benefits for a period and people with end-stage renal failure.

How many Medicare Advantage plans will be available in 2021?

This competition has led to dozens of choices for beneficiaries. In fact, the average Medicare Advantage member has 47 plan options in 2021.

How many people will have Medicare Advantage in 2021?

The Centers for Medicare and Medicaid Services predicted that nearly 27 million Medicare members will have Medicare Advantage in 2021. That's 42% of people with Medicare.

When is Medicare open enrollment?

There is also a Medicare Advantage open enrollment period from Jan. 1-March 31. During that period, you can. Change Medicare Advantage plans. Switch from Medicare Advantage to Original Medicare. You can also make changes to your plans if you have a qualifying life event, which starts a special enrollment period.

When can I sign up for Medicare Advantage?

You can sign up for Medicare Advantage when you become eligible at 65 years old. As you approach your 65th birthday, you’ll receive information from Medicare about your options. After that, you’ll be able to make changes each year to your plan during Medicare open enrollment period, which runs from Oct. 15-Dec. 7.

Which states have multiple Medicare Advantage plans?

For instance, Engle said Pennsylvania, Wisconsin, Florida, Minnesota and Oregon all have more than 40% of Medicare beneficiaries in an Advantage plan.

Does Medicare cover you?

Original Medicare covers you no matter where you are in the country. That’s not always the case with Medicare Advantage. Instead, you might be out of the plan’s service area and you may need to get a primary care provider referral to see a specialist.

How does Original Medicare work?

Original Medicare covers most, but not all of the costs for approved health care services and supplies. After you meet your deductible, you pay your share of costs for services and supplies as you get them.

How does Medicare Advantage work?

Medicare Advantage bundles your Part A, Part B, and usually Part D coverage into one plan. Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

What is Medicare Advantage?

A Medicare Advantage private fee-for-service (PFFS) plan is private insurance. These plans are different from PPO and HMO plans in that the plan rules vary greatly from plan to plan. Each plan has its own reimbursement rates and copays. Some important things to consider include:

What is Medicare Advantage Health Maintenance Organization?

A Medicare Advantage health maintenance organization (HMO) offers care within a network of providers. Except in certain emergency situations, you must seek care from one of the network's preferred providers. Some important things to know about these plans include:

What is Medicare Advantage Special Needs Plan?

A Medicare Advantage special needs plan (SNP) caters to a group of people with specific needs. These plans often work with people who have similar or related disabilities, such as dementia, autoimmune disease, or diabetes. You must seek care from in-network providers unless there is an emergency, you have end-stage renal disease and need dialysis outside of the coverage area, or you travel outside of the area the plan covers and need urgent care. Some other considerations include:

What is a PPO plan?

A Medicare Advantage preferred provider organization (PPO) offers discounts for choosing providers within the plan's preferred provider network. In some cases, there may not be coverage for other providers until you reach your deductible. In other cases, the copay for choosing an out-of-network provider may be significantly higher. Some other important facts about PPO plans include: