How to maximize social security with spousal benefits?

Sep 02, 2019 · If your spouse is younger than you when you turn 65 and become Medicare eligible, he or she must wait until turning 65 to be automatically enrolled in premium-free …

Can you collect government pension and spousal benefits?

May 07, 2021 · If a nonworking spouse is older than you, and they meet the 40 quarters requirement. If your spouse is older than you, they’ll qualify for Medicare benefits at age 65. …

How are spousal Social Security benefits calculated?

Sep 25, 2013 · Then we compute the reduction factor, which is 36 times 25/36 of one percent, or 25 percent. Applying a 25 percent reduction to the $800 amount gives a spousal benefit of …

How to calculate spouse SSA benefit?

This will also transfer from you to your spouse. If you have paid the Medicare Tax for just one year, but your spouse has paid it for 8 years, then you’ll pay the $274 per month premium. If …

How is the spousal benefit calculated?

What percentage is the spousal benefit?

How are spousal Social Security benefits determined?

Can I collect ex spousal benefits and wait until I am 70 to collect my own Social Security?

Does my spouse's income affect my Social Security benefits?

When can a spouse claim spousal benefits?

What is the best Social Security strategy for married couples?

How is Social Security calculated?

At what age is Social Security no longer taxed?

Can a divorced woman collect her ex husband's Social Security?

Thus, divorced women receive Social Security benefits either as retired workers, divorced spouses, or surviving divorced spouses. They can also receive widow benefits from a prior marriage that ended in widowhood.

Can you collect 1/2 of spouse's Social Security and then your full amount?

How to apply for Medicare Part A?

To qualify for Medicare Part A benefits at age 65 based on your spouse’s work history, you must meet one of the following requirements: 1 You have been married to your spouse who qualifies for Social Security benefits for at least 1 year before applying for Social Security benefits. 2 You are divorced, but were married to a spouse for at least 10 years who qualifies for Social Security benefits. You must now be single to apply for Medicare benefits. 3 You are widowed, but were married for at least 9 months before your spouse died, and they qualified for Social Security benefits. You must now be single.

What is the number to call for Medicare?

If you have further questions about Medicare benefits, you can call the Social Security Administration (SSA) at 800-772-1213 or visit your local SSA office for more information. Read this article in Spanish.

What is Medicare Advantage?

One of these options is Medicare Advantage (Part C), which bundles both Part A and Part B together and offers additional coverage and benefits. If extra coverage, like dental, vision, or hearing care, is important to maintaining your individual health, give some thought to whether original Medicare or Medicare Advantage will work best for you.

How old do you have to be to qualify for Medicare?

If your spouse is older than you, they’ll qualify for Medicare benefits at age 65. You may be able to receive Medicare benefits slightly earlier if you’re at least 62 years old, married to someone who is age 65, and also worked for 40 quarters ...

Does Healthline Media offer insurance?

Healthline Media does not transact the business of insurance in any manner and is not licensed as an insurance company or producer in any U.S. jurisdiction. Healthline Media does not recommend or endorse any third parties that may transact the business of insurance. Last medically reviewed on December 20, 2019.

How much is spousal benefit reduced?

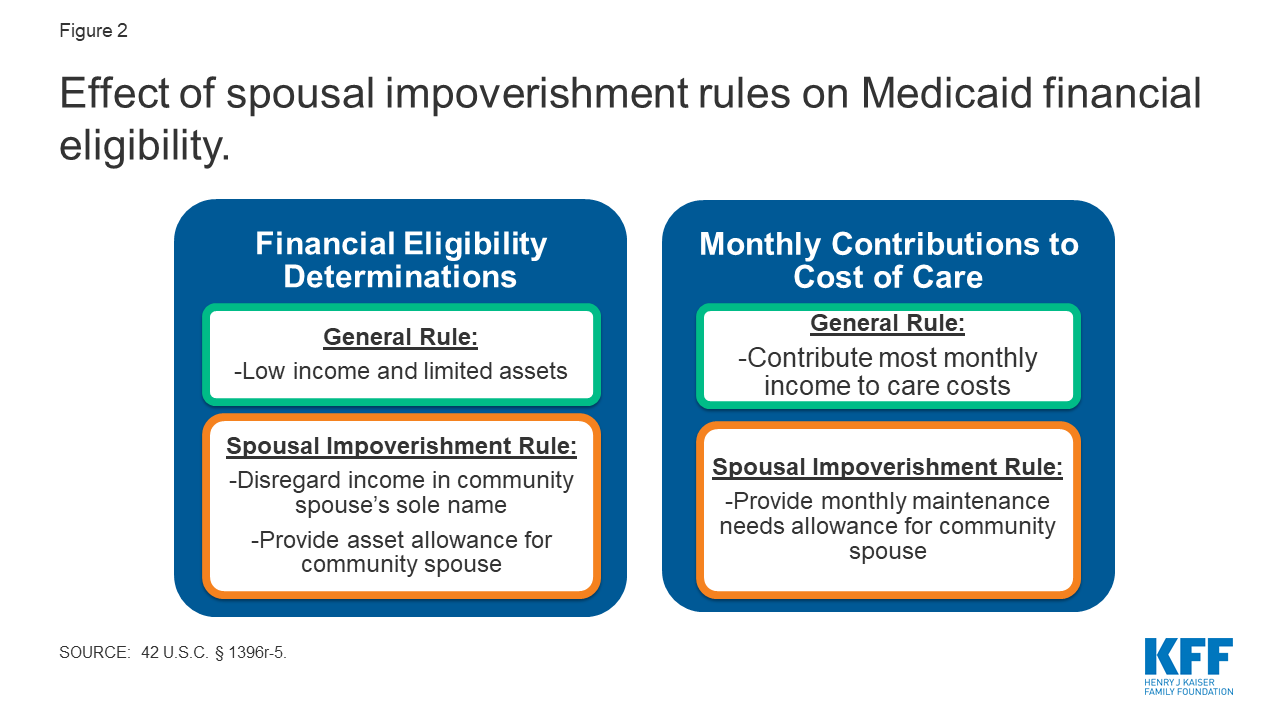

A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months. If the number of months exceeds 36, then the benefit is further reduced 5/12 of one percent per month.

What age can a child receive Social Security?

By a qualifying child, we mean a child who is under age 16 or who receives Social Security disability benefits. The spousal benefit can be as much as half of the worker's " primary insurance amount ," depending on the spouse's age at retirement. If the spouse begins receiving benefits before " normal ...

What age do you have to be to file for retirement?

Another requirement is that the spouse must be at least age 62 or have a qualifying child in her/his care.

Social Security Spouse's Benefit Estimates

Plan for your future with a my Social Security account. With a my Social Security account, you can view the benefits you could receive based on your spouse’s earnings history, or the benefits your spouse could receive based on your earnings history.

Follow these steps to get started

Ask your spouse to create or open their my Social Security account, go to the ‘Plan for Retirement’ section, and note their retirement benefit estimate at their full retirement age or Primary Insurance Amount (PIA).

How much is spousal benefit reduction?

If you file for a spousal benefit prior to your full retirement age, that spousal benefit will be reduced due to early filing. The reduction is 25/36 of 1% for each month early, up to 36 months. For each month in excess of 36 months, the reduction is 5/12 of 1%.

Can spousal benefits be reduced?

For example: If you are receiving a retirement benefit of your own, your spousal benefit will be reduced. If you file for spousal benefits prior to your full retirement age, your spousal benefit will be reduced.

What is the primary insurance amount?

A person’s primary insurance amount is the amount of their monthly retirement benefit, if they file for that benefit exactly at their full retirement age. A Social Security spousal benefit is calculated as 50% of the other spouse’s PIA.

How much will Medicare Part B cost in 2021?

The higher your combined annual income, the more your Medicare Part B premiums will cost, up to $750,000 in 2021. In 2021, you’ll also pay $203 for your Part B deductible before your some of your Part B benefits kick in.

What is Medicare Part B premium?

This higher Part B premium amount is called the Medicare income-related monthly adjustment amount, or IRMAA. The higher your combined annual income, the more your Medicare Part B premiums will ...

Who is Zia Sherrell?

About the author. Zia Sherrell is a digital health journalist with over a decade of healthcare experience, a bachelor’s degree in science from the University of Leeds and a master’s degree in public health from the University of Manchester.

How long do you have to be married to get spousal benefits?

The Two Exceptions to Know Around the 1 Year Marriage Requirement. Normally, you must be married for at least 12 continuous months to meet the spousal benefit duration-of-marriage requirement. However, there are two exceptions to this rule.

Can a spouse receive Social Security?

They have no benefit of their own, but thanks to the Social Security spousal benefit available under their spouse’s work record, they can still receive payments. This particular benefit doesn’t just provide retirement income, either. As an eligible spouse, you could also receive premium-free Medicare benefits.

When does a widow receive Social Security?

A widow or widower who has reached full retirement age, and whose spouse did not receive Social Security benefits until 70 years old, receives the full benefit amount of the deceased spouse.

When do people start thinking about retirement?

When most people reach their 60s , they start thinking about their retirement benefits from Social Security. For married couples, there are advantages to making decisions about retirement as a couple, rather than as individuals.

How old do you have to be to get spousal benefits?

You are at least 62 years old. Regardless of your age, if you care for a child who is entitled to receive benefits on your spouse’s record, and who is under age 16 or disabled. 2 . When you apply for spousal benefits, you will also be applying for benefits based on your own work history.

Can a widow receive spousal benefits?

Spouses and ex-spouses generally are eligible for up to half of the spouse's entitlement. Widows and widowers can receive up to 100%.

What is the normal retirement age?

As you might expect, "normal" retirement age is becoming later in life, but the changes to the Social Security rules are being phased in. It is age 66 for those born between 1943 and 1955. It increases gradually to age 67 for those born from 1955 to 1960. For those born after 1960, it's 67.

Do same sex couples get Social Security?

Same-sex married couples have enjoyed the same rights as all other couples since the 2015 Supreme Court ruling affirming their constitutional rights to marriage recognition. And that means they're eligible for Social Security spousal and dependant benefits. 6

How much can a widow receive?

A widow or widower can receive up to 100% of a spouse's benefit amount. That's if the survivor has reached full retirement age at the time of the application. The payment is reduced to somewhere between 71% and 99% of the deceased's entitlement if the widowed person is at least 60 but under full retirement age. 8 .

Who is Claire Boyte White?

Claire Boyte-White is the lead writer for NapkinFinance.com, co-author of I Am Net Worthy, and an Investopedia contributor. Claire's expertise lies in corporate finance & accounting, mutual funds, retirement planning, and technical analysis.