Below, we’ve listed step-by-step instructions on how to conduct your own Part D comparison:

- Go to Medicare’s website, Medicare.gov.

- Click the green button on the left hand side, about midway down the page, that says “Find Health and Drug Plans”.

- Enter your zip code and click “Find Plans”. ...

- Answer the two questions on the next page and click “Continue to Plan Results”.

- Enter the names and dosages of your medications and add them to your list. ...

Full Answer

What to consider when comparing Medicare plans?

What to Ask When Comparing Medicare Advantage Plans

- How much are monthly premiums?

- What portion of costs do you have to pay before the plan begins coverage (also known as the deductible)?

- How much of the cost of a doctor’s visit or hospital stay are you required to pay?

- What is the plan’s cap on annual out-of-pocket costs? ...

- Does your current doctor accept the plan? ...

What are the best Medicare plans?

... Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers. Sign up today for a FREE virtual event and let Silver Supplements Solutions help you understand your best option for your own peace of mind!

How to find the best Medicare plan for You?

- How many states in which they provide coverage

- Lowest costs available in terms of monthly premiums and copays (though they vary from plan to plan)

- The types of benefits they can offer (though it varies from plan to plan)

- How the Centers for Medicare and Medicaid Services (CMS) ranked their plans, using an average to represent the company as a whole

How to choose the best Medicare drug plan?

How to Choose With 5 Tips

- Consider the Timing. Timing plays a key role in signing up for a Medicare plan. ...

- Do Your Research. There are two main types of Medicare plans: Original Medicare and Medicare Advantage. ...

- Review Drug Coverage. Many Medicare eligibles overpay for their Medicare plan by hundreds of dollars. ...

- Choose the Right Plan. ...

- Enroll. ...

What is the best way to compare Medicare Advantage plans?

The Medicare Plan Finder on Medicare.gov is currently the most comprehensive tool for comparing Medicare Advantage plan benefits, prescription drug coverage and costs.

Is there a website to compare Medicare Advantage plans?

If you want to compare plans online and have one-on-one support from a licensed insurance agent, then you can use MedicareAdvantage.com. MedicareAdvantage.com offers an online plan comparison tool where you can review Medicare Advantage plans side by side.

How do I choose the right Medicare plan?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

What are the top 3 most popular Medicare supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Who has the highest rated Medicare Advantage plan?

Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states. Overall, Aetna Medicare ranks the best in the most (23) states. That said, there is no single “best plan.” Your needs and preferences will determine the best choice for you.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is the difference between AARP Medicare Complete and AARP Medicare Advantage?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Which Medigap is most comprehensive?

Medigap Plan FMedigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

Who is the largest Medicare Supplement provider?

UnitedHealthCareAARP/United Health Group has the largest number of Medicare Supplement customers in the country, covering 43 million people in all 50 states and most U.S. territories. AARP licenses its name to insurer UnitedHealthCare, which helps make these policies so popular.

Original Medicare vs Medicare Advantage Plans, Aka Medicare Part C

Commonly known as “straight” Medicare by the medical community, Original Medicare (OM) comprises two parts. Medicare Part A provides services for h...

What Is Medicare Advantage?

Medicare Advantage or “Medicare Part-C” was introduced with the specific purpose of driving down costs as it provided more options for consumers. T...

Myths About Original Medicare and Medicare Advantage

There are a few misconceptions floating around about Medicare and Medicare Advantage since changes from Affordable Care Act. Some of these myths in...

Two Basic Medicare Advantage Plans: HMO and Non-Hmo

Medicare Part C plans break down into different types that you can most commonly refer to as HMO and non-HMO. While some people prefer HMO because...

Choosing Original Medicare Or Medicare Advantage

Since Medicare isn’t just for individuals over the age of 65, there are a lot of people who have questions about how to get Medicare Advantage or P...

What’S Covered in Medicare Part A and Part B?

Original Medicare is known as Part A and Part B. Part A covers expenses from hospitalization. Part B covers bills from doctors and other expenses s...

What’S Covered in Medicare Advantage Or Part C Plans?

Many individuals interested in Medicare actually find that Medicare Advantage plans are better because of the flexibility and choices when it comes...

Comparing The Costs of Original Medicare and MA Plans

Most Medicare Advantage plans cost the same or much less than Original Medicare with supplemental coverage extras. Then there are some Medicare Adv...

What Is Included in Original Medicare Plans?

These plans are for Part A and B. They do not include Part C or Part D. Original Medicare is completely offered through the federal government. You...

What Is Included in Medicare Advantage Plans?

Plans are sold by private companies approved by Medicare. Plans include Part A, Part B and typically, Part D or prescription drug coverage. However...

What is Medicare Part A?

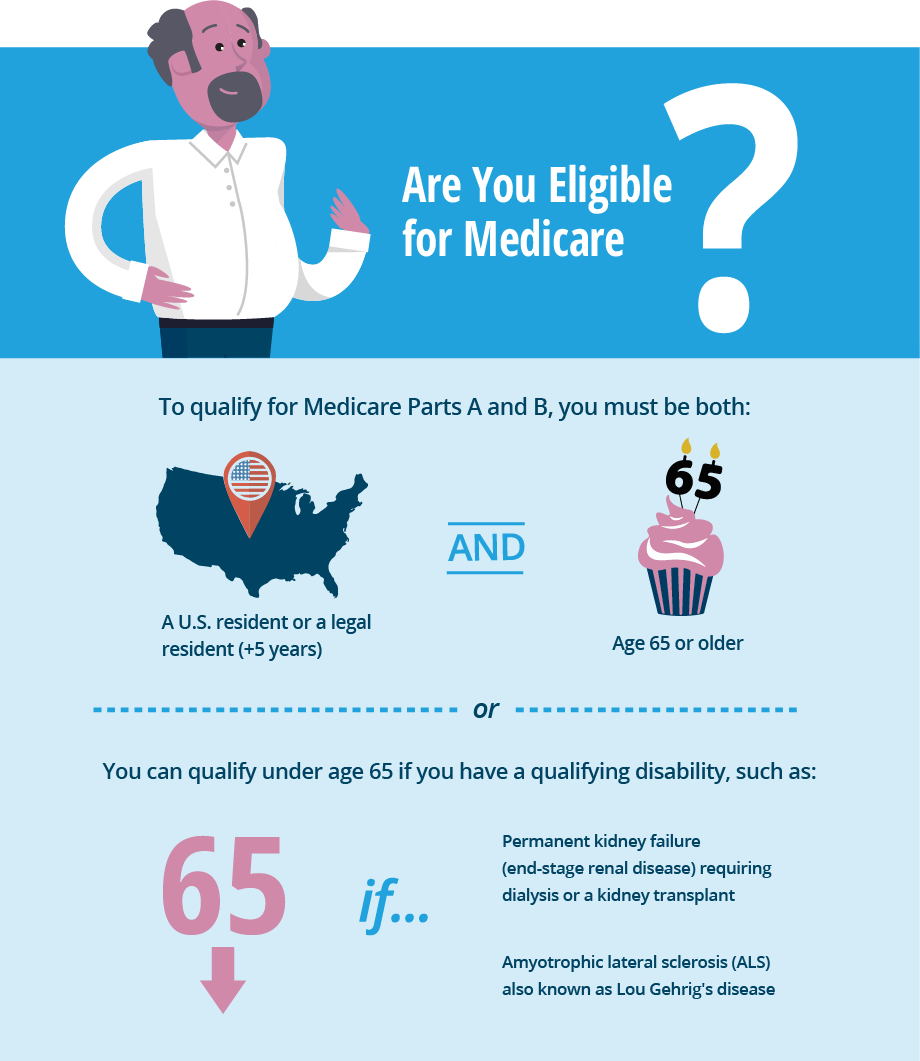

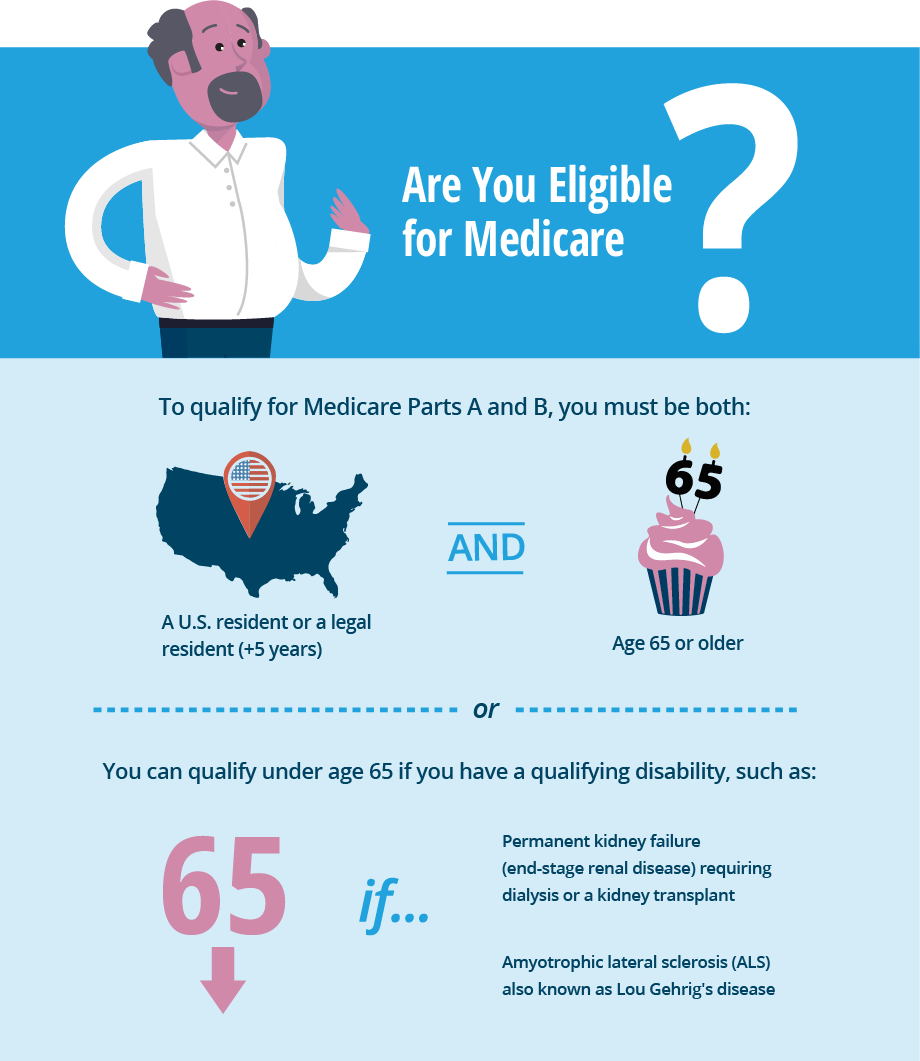

Medicare Part A provides services for hospital, nursing and hospice care. Medicare Part B provides services for physician care, labs, tests and durable medical equipment. Medicare Part D covers medical prescriptions and is purchased through commercial insurance providers. Under Original Medicare, providers carry the bulk of service responsibilities. They bill and are generally paid within 14 days of providing service. This is known as “Fee for Service” (FFS). FFS is a single-payer plan administered by the federal government. Once you turn 65 or after 24 months of receiving Social Security for a disability, you are automatically enrolled in Medicare. However, you have the option of choosing Medicare Part C (Medicare Advantage).

How many stars are Medicare Advantage plans?

Medicare Advantage plans are offered through private health insurance companies and must be approved by Medicare. They are also rated from one to five stars with five stars being an excellent plan. For all of Your Tomorrows FIND THE RIGHT MEDICARE PLAN TODAY. Compare Plans ›.

How much is Medicare Advantage 2019?

Medicare Advantage payments were increased by 3.4% for 2019, which is more than the anticipated 1.84% that was projected. Thankfully, the premiums for 2020 are decreasing for many carriers. The Affordable Care Act made more than $200 billion in cuts to Medicare Advantage payments that will be phased in each year.

When does Medicare open enrollment end?

You can only switch Medicare Advantage plans and Original Medicare Plans during the fall Open Enrollment that starts October 15th and ends December 7th. New coverage starts January 1st.

Is Medicare Advantage free?

Original Medicare is free, Medicare Advantage is not. False. Original Medicare is like any other insurance plan, and there are costs. Out-of-pocket costs for Original Medicare include premiums, deductibles and copayments. You pay a premium each month for Part B whether you have Original Medicare or Medicare Advantage.

What is the number to call for Medicare?

1-800-810-1437 TTY 711. When people think about Medicare, they think about the healthcare of an older generation. Baby boomers started to reach retirement age two years ago. The boomers as well as their older peers, are known as the “greatest generation.”. This is the generation known known for sound decision making and practicing pragmatism.

Is it important to compare Medicare plans?

Now that it is time that you compare medicare plans, it is important to note that when it comes to healthcare, it can be difficult to understand all of the different plans that come with Medicare, but making the right decision is important to saving money and worrying less about your coverage.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What Does Medicare Part D Cover?

Before 2006, there was no meaningful prescription drug coverage under Medicare. Part D was created in the Medicare Modernization Act of 2003 to help offset the cost of prescription drugs.

How Do You Get Medicare Part D?

There are two ways to get your prescription drug coverage through Medicare. If you have Original Medicare (Part A and Part B), you have to buy a standalone Part D plan.

Did the Medicare Part D Donut Hole Close in 2020?

Technically, the donut hole is closed, but you still pay for prescription drugs if you hit the coverage gap.

Using the Medicare Part D Plan Finder 2020

When you’re ready to compare Medicare Part D plans, there are several things you should keep in mind:

Compare Medicare Part D Plans 2020

Most insurers release new plans and change-of-coverage notices in the fall for the upcoming plan year. The 2020 plans are generally listed in Part D plan finder tools by October, so you should already have access to the most current information for this year when you’re ready to shop.

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

How much coinsurance is required for skilled nursing?

There is no coinsurance requirement for the first 20 days of inpatient skilled nursing facility care. However, a $185.50 per day coinsurance requirement begins on day 21 of your stay, and you are then responsible for all costs after day 101 of inpatient skilled nursing facility care (in 2021).

How to find Medicare Advantage plan?

While you search for your Medicare Advantage plan, here are a few questions to keep in mind: 1 Do you have a favorite doctor you’ve been seeing for years? If you choose a plan with a network of preferred providers, make sure your doctor is on the list. The same is true of hospitals — if you have several in your region, it’s good to know that the one you prefer will accept your Advantage insurance. 2 Do you take medications on a maintenance schedule? If so, make sure that your plan includes drug coverage. Most Medicare Advantage plans do — but not all of them. 3 What is your chosen plan’s deductible? The higher the deductible, the more you’ll pay out-of-pocket before your plan kicks in. 4 Likewise, what are the copays? If you frequently need to see a healthcare professional for a chronic condition, a plan with lower copays makes sense, and may even make up for higher monthly premiums. 5 Do you have frequent vision, dental, or hearing issues? A plan that covers these health care needs may save you money.

What are the benefits of Medicare Advantage?

Medicare Advantage plans differ depending on the company that is overseeing them, but in general they offer benefits beyond what Medicare Part A and B offer, such as vision, hearing, and dental coverage, gym memberships, and drug coverage. Plus, the all-in-one nature of the plans makes them easy to manage. Choosing a plan that’s right ...

What is an HMO plan?

These plans feature a network of approved health care providers in your region, and in order for your insurance to pay for a doctor’s visit or other health care need, you must use the providers that are in your network. The exceptions are for emergency care, out-of-area urgent care, ...

Is a HMO POS plan the same as a PPO?

An HMO POS plan is similar in many respects to the basic HMO plans, and also bears some similarities to PPO systems. You’ll choose your health care providers from within an approved network, but can go out-of-network in certain circumstances.

Can you go out of network with Medicare Advantage?

But you can go out-of-network when needed, though there may be a higher copay or coinsurance cost.