You have the opportunity to get money back from Medicare if you:

- Have limited income and limited resources

- Have Supplemental Security Income

- Received any of the following: A PURPLE notice from Medicare stating you are eligible for Extra Help A YELLOW or GREEN automatic enrollment from Medicare An Extra Help “Notice of ...

What if I overpaid my Medicare premium?

Jan 20, 2017 · You have the opportunity to get money back from Medicare if you: Have limited income and limited resources Have Supplemental Security Income Received any of the following: A PURPLE notice from Medicare stating you are eligible for Extra Help A YELLOW or GREEN... A PURPLE notice from Medicare stating ...

Who qualifies for the GIVE BACK benefit?

When you're enrolled in Medicare Part B, you must pay a monthly premium of $170.10. The giveback benefit, or Part B premium reduction, is when the Part C Medicare Advantage (MA) plan reduces the amount you pay toward that premium. Your reduction could range from less than $1 to the full premium amount. Even though you're paying less for the monthly premium, you don't …

Who is eligible for Medicare Part B reimbursement?

To receive the Medicare give back benefit, you'll need to enroll in a plan that offers to pay your Part B monthly premium. 2. Location Is Key.

Are you eligible for a Medicare reimbursement?

If you receive financial assistance through Medicaid or another program, then you cannot also qualify for the Give Back benefit. You then need to enroll in a Medicare Advantage plan that offers a Give Back benefit. Instead of receiving reimbursement from the plan, you will simply pay a lower Part B premium each month.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

How do you qualify to get money back on Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.Jan 14, 2022

Can I get my Social Security money back?

Social Security is withholding money from my retirement benefit because I'm still working. Will I get that money back? Yes, but not in a tidy lump sum. What Social Security does instead is increase your benefit when you reach full retirement age to account for the previous withholding.

What is the income limit for extra help in 2021?

To qualify for Extra Help, your annual income must be limited to $20,385 for an individual or $27,465 for a married couple living together.

What is the Part B premium reduction benefit?

When you're enrolled in Medicare Part B, you must pay a monthly premium of $170.10. The giveback benefit, or Part B premium reduction, is when the Part C Medicare Advantage (MA) plan reduces the amount you pay toward that premium. Your reduction could range from less than $1 to the full premium amount.

How do I receive the giveback benefit?

If you enroll in a plan that offers a giveback benefit, you'll find a section in the plan's summary of benefits or evidence of coverage (EOC) that outlines the Part B premium buy-down. Here, you'll see how much of a reduction you'll get. Or, you can contact the plan directly.

How to find plans that offer the giveback benefit

Not all MA plans offer this benefit, so you must find a plan that does to take advantage of the savings opportunity.

Downsides to the Medicare giveback benefit

While the giveback benefit can help save you money, there are a few things to be aware of when considering enrolling in an MA plan that offers it.

What is Medicare Part B give back?

Part B Premium Reduction Give Back Plans. The Medicare Part B give back plan, or premium reduction plan is a feature of Medicare Advantage. Yet, only some Medicare Advantage plans offer this benefit, and it isn’t available in all areas. Those with this plan may see a higher amount on their Social Security check, ...

How many states will have Medicare Advantage in 2021?

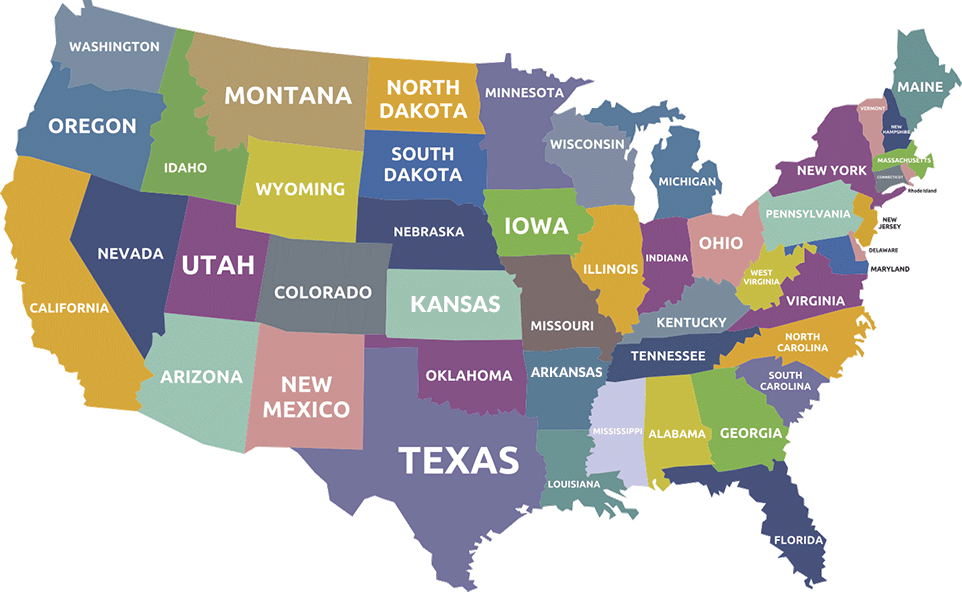

In 2021, there will be 48 states offering a Medicare Advantage plan with a Part B premium reduction. So, it’s fair to say the popularity of these plans is increasing.

What is a Part B premium reduction plan?

The Part B premium reduction plan is just like it sounds. You enroll in the policy, and the carrier pays either part or the whole premium for your outpatient coverage. In the summary of benefits or evidence of coverage , you’ll see a section that says Part B premium buy-down; this is where you can see how much of a reduction you’ll get.

How much does Part B premium cost?

These plans reduce your Part B premium up to the full standard amount of $148.50 each month and add the money to your Social Security check.

Does Cigna have a Part B plan?

In some areas, Cigna may have a Part B premium reduction plan. Even Aetna has a Part B give back in some areas. Further, there are likely more companies offering this type of policy than just the ones we’ve mentioned. Also, consider the plan ratings before you enroll.

Can Medicare Advantage pay Part B?

The Medicare Advantage insurance company can pay either the whole or a portion of the Part B premium for enrollees. Since the Advantage plan handles your claim instead of Medicare, these plans make more sense than a standard Part C policy. How can Medicare Advantage plans give you back some of your Part B premium money?

Is Part B reduction worth it?

Many beneficiaries are unaware of the many limitations that come with Advantage plans. A Part B reduction may not be worth the additional cost-sharing . Beneficiaries on a budget should consider High Deductible Plan G or High Deductible Plan F. The premiums are more affordable than the standard versions.

What Is The Medicare Part B Give Back Benefit?

The Give Back benefit is a benefit offered by some Medicare Advantage plan carriers that can help you reduce your Medicare Part B premium. You should know, however, that the Give Back benefit is not an official Medicare program. This benefit is provided as part of some Medicare Part C plans as a way to encourage participation in a specific plan.

Who Is Eligible For The Medicare Part B Give Back Benefit?

It is pretty easy to qualify for the Medicare Give Back benefit as the eligibility criteria are straightforward. First, you must be enrolled in Original Medicare. You need to have both Medicare Part A and Medicare Part B coverage. Next, you must pay your own monthly Part B premium.

Applying For A Medicare Part B Give Back Benefit

So, what is the enrollment process for the Give Back benefit? Many people are looking to save as much money as possible when it comes to their health care costs, so they want to know how to get signed up for this program. The process is quite simple, so here is how to do it.

The Bottom Line

Since most people on Medicare are receiving Social Security benefits, finding a way to reduce the cost of your health insurance is always a plus. The Medicare Give Back program can do just that by paying for a portion or even all of your Medicare Part B premium.

What is the deadline for Medicare give back benefit?

There is no deadline to qualify for the give back benefit. You must already be enrolled in Medicare Part A and Part B, and you must pay your own monthly Part B premium. You then simply need to enroll in a Medicare Advantage plan that offers this benefit.

What is this benefit?

The giveback benefit is actually part of the Part B premium reduction that first appeared in 2003. A Federal regulation allowed for a reduction in payments of the Medicare +Choice plans and that helped to fund the giveback.

How do you qualify?

There are two common ways to get up to $144 back on Medicare premiums.

Always Be Wary of Scams

Remember to watch out for ads that say “you may” qualify. The key word here is MAY. Also, these are usually ads that come from insurance agents or companies that sell leads to agents. Medicare or Social Security will never call you and if you are getting a letter from them it will clearly state who it is from.

Additional Benefits Possible

Yet another question we hear all the time is “am I getting every benefit I can?” Things to consider: • Ads you see can list all the benefits that are on every plan, everywhere. • No plan will have every benefit in existence. • Some benefits may not be offered in your county or state.

What is this benefit?

The giveback benefit is actually part of the Part B premium reduction that first appeared in 2003. A Federal regulation allowed for a reduction in payments of the Medicare +Choice plans and that helped to fund the giveback.

How do you qualify?

There are two common ways to get up to $144 back on Medicare premiums.

Always Be Wary of Scams

Remember to watch out for ads that say “you may” qualify. The key word here is MAY. Also, these are usually ads that come from insurance agents or companies that sell leads to agents. Medicare or Social Security will never call you and if you are getting a letter from them it will clearly state who it is from.

What happens if you call Medicare?

However, if you call (as noted in the commercial’s small print), your call will be transferred to a licensed insurance agent who may or may not sell plans in your area. And, if there is no plan in your area, you may hear about other plans that are available to you. The best place to start is the Medicare Plan Finder.

How to qualify for Medicare premium reduction?

To qualify for a premium reduction, you must: Be a Medicare beneficiary enrolled in Part A and Part B, Be responsible for paying the Part B premium, and. Live in a service area of a plan that has chosen to participate in this program.

What is a reduction in Part B premium?

This is a reduction in the Part B premium you must pay. For example, if a beneficiary is on Social Security, the Part B premium comes out of the monthly benefit before it hits the individual’s bank account. The reduction in the plan’s payment reduces that premium, which means more money in the individual’s bank account.

Does SNP include prescription drug coverage?

A few of these plans do not include prescription drug coverage. Some Special Needs Plans (SNP) also offer this benefit. But, in these cases, the beneficiary may not qualify. For example, there is a SNP for those residing in nursing homes.

How much is Medicare giveback?

In some cases, the giveback may be as low as $10, while in others it may be the entire premium. Generally, it falls somewhere between $20 and $100. You will occasionally see above $100.

What is Medicare Part B premium giveback?

As we mentioned, the Medicare Part B Premium Giveback is a program in place to help you receive some money back on your Part B premium. The program is for Medicare Part C plans, also called Medicare Advantage plans, which are offered by private insurance companies but still approved and regulated by the Centers for Medicare & Medicaid Services ...

How much is Social Security giveback 2021?

Let’s say your monthly Social Security benefit is $1,543 (roughly the expected average for 2021) and your giveback is $80. Once the giveback kicks in, your check would begin to be $1,623, since that $80 would be added in.

How much is Medicare Part B 2021?

In 2021, the standard monthly Part B premium cost is $148.50. Most people have this premium taken directly out of their Social Security check each month. The carrier that offers ...

How long does it take for Social Security to kick in?

It can take a few months for the benefit to kick in once you’ve enrolled in a plan with the giveback, but this will be credited to you. If it takes two months for the benefit to begin, you’ll receive two months of giveback on your first Social Security check with the benefit.

Does Medicare Advantage give back premiums?

So, not only can some Medicare Advantage plans help you afford your health care, they can also reduce the monthly premium that covers the care, too. This makes the Medicare Part B Premium Giveback yet another way that Medicare can help make your health care available and affordable! Just like you, your health is one of a kind.

Does Medicare Advantage take out Social Security?

Most people have this premium taken directly out of their Social Security check each month. The carrier that offers the Medicare Advantage plan has notified CM S and the SSA that they’ll be covering all or a portion of the Part B premium.