- Use the Medicare website to search for a plan that’s right for you.

- Compare a Medicare Part D with a Medicare Advantage (Part C) plan. ...

- Check to make sure that the plan you’re looking at includes the medications that you take on their formulary.

- If you take a number of generic drugs, look for a plan that charges a low copayment for these medications.

Full Answer

When will the Medicare Donut Hole go away?

Mar 04, 2020 · In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement. However, there are ways to receive assistance for funding prescription drugs,...

Is there still a donut hole in Medicare?

Feb 10, 2022 · After you reach a total of $4,430, you enter the Coverage Gap stage, also known as the Donut Hole. 3 The Donut Hole (Coverage Gap Stage) While in this stage, you are responsible for: 25%* of the cost of generic (non-brand name) Part D medications. Tufts Health Plan pays the remaining 75% of the cost. 25% of the cost of Part D brand name medications.

What does the donut hole mean with Medicare?

How do I get out of the donut hole? In all Part D plans, you enter catastrophic coverage after you reach $7,050 in out-of-pocket costs for covered drugs. This amount is made up of what you pay for covered drugs and some costs that others pay. During this period, you pay significantly lower copays or coinsurance for your covered drugs for the remainder of the year. The out-of-pocket …

How to avoid these big Medicare mistakes?

Jan 13, 2022 · Once you and your plan pay a total of $4,430 (in 2022) in a year, you enter the coverage gap, aka the notorious donut hole. Previously coverage stopped completely at this point until total out-of-pocket spending reached a certain amount. However, the Affordable Care Act has mostly eliminated the donut hole.

What is the Medicare Donut Hole?

The term donut hole is a metaphoric reference to the coverage gap in drug costs for Medicare recipients.

How to avoid the donut hole

Take these steps to slow or avoid your approach to the donut hole each year.

Initial coverage limit

You enter the donut hole after you surpass the initial coverage limit of your Part D plan. The initial coverage limit includes the total (retail) cost of drugs — what both you and your plan pay for your prescriptions.

OOP threshold

This is the amount of OOP money that you have to spend before you exit the donut hole.

Extra Help considerations

Some people enrolled in Medicare qualify for the Medicare Extra Help program based on their income. This program helps people pay for their prescription drug costs.

Generic drugs

For generic drugs, only the amount you actually pay counts toward your OOP threshold. For example:

Brand-name drugs

For brand-name drugs, 95 percent of the total medication price will count towards reaching the OOP threshold. This includes the 25 percent that you pay OOP plus a manufacturer discount.

What happens after I exit the donut hole?

After you exit the donut hole, you’ll receive what’s called catastrophic coverage. This means that you’ll have to pay whatever is greater for the rest of the year: Five percent of a drug’s cost or a small copay.

1. Consider switching to generic drugs

These are often less expensive than brand-name drugs. If you’re taking a brand-name drug, ask your doctor about generic drugs.

How does the Medicare Donut Hole Works

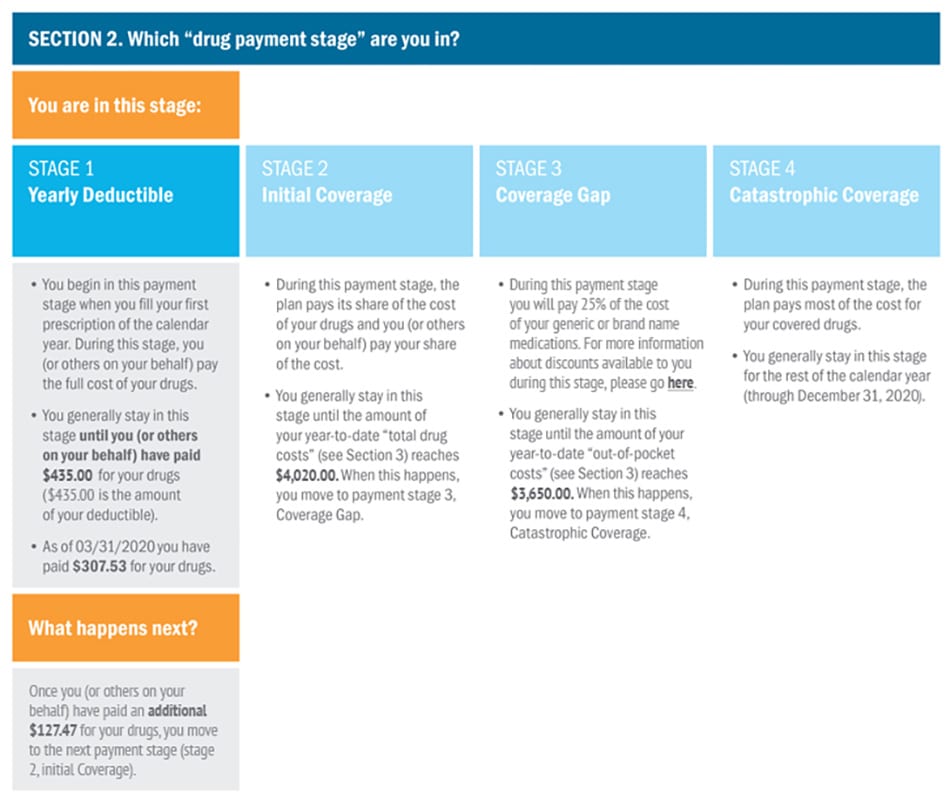

There are four stages of Medicare prescription coverage. It begins with your deductible and ends with a catastrophic coverage plan. Regular coverage begins after meeting your deductible and continues until you reach your out-of-pocket maximum of $4,130. It is where things get complicated.

Stages of Coverages

iii) Coverage gap (Donut hole) — begin when you reach the Medicare out-of-pocket maximum ($4,130 in 2021).

How much is My Deductible?

The deductible is the maximum amount of out-of-pocket costs you must pay before your insurance plan covers benefits. This amount varies depending on the program you select.

What is meant by Initial Coverage Period?

You will pay the stated coinsurance or copayment fees for generic or brand-name medications during the first year of coverage. Your specific plan details determine the exact amounts of these costs and vary based on your plan coverage.

What exactly is the Coverage Gap?

As previously stated, the coverage gap is the Medicare term commonly used to describe the donut hole. Each year, Medicare establishes a limit for out-of-pocket expenses that you can incur before reaching the donut hole.

What is the Catastrophic Coverage Stage?

If your out-of-pocket expenses are around $6,550 for the year, you enter the catastrophic coverage phase. After that, you only pay a low coinsurance or copayment for covered prescription drugs for the rest of the year.

What are the Medicare Donut Hole Rules for 2022?

Previously, being in the donut hole indicated you need to pay out-of-pocket costs until you reached the threshold value for more drug coverage. Nevertheless, the donut hole has been closing due to the introduction of the Affordable Care Act.