First you have to request a Final Lien Demand by notifying the MSPRC of settlement. Be sure to include the settlement, attorneys fee, any costs incurred (plus an itemization), and the date of settlement. In 30-45 days you will receive a Final Lien Demand . This is the amount you must pay to Medicare from the settlement proceeds.

Full Answer

How do I handle a Medicare lien?

· Step One: Obtain Medicare Information from the Client at the Initial Meeting and Warn Them that Medicare Liens are... Step Two: Contact Medicare's Benefits Coordination and Recovery Contractor (BCRC) RIGHT AWAY

How long does it take to get a lien from Medicare?

The first step is to contact the Coordination of Benefits (C.O.B.) office at 1-800-999-1118. You will need the Medicare beneficiary’s information, including: full name, Medicare number (HICN), gender, date of birth, address, and phone number. If you do not have their HICN, make sure you have their social security number instead. You will also need your contact information: name, …

How do I settle my Medicare lien with msprc?

· A Medicare lien results when Medicare makes a “conditional payment” for healthcare, even though a liability claim is in process that could eventually result in payment for …

What is a Medicare Lien and how does it affect me?

· The case is settled, how do I pay Medicare? First you have to request a Final Lien Demand by notifying the MSPRC of settlement. Be sure to include the settlement, attorneys fee, …

How is Medicare lien amount calculated?

Formula 1: Step number one: add attorney fees and costs to determine the total procurement cost. Step number two: take the total procurement cost and divide that by the gross settlement amount to determine the ratio. Step number three: multiply the lien amount by the ratio to determine the reduction amount.

Can you negotiate Medicare liens?

Medicaid and Medicare liens are administered through the Benefits Coordination and Recovery Center (BCRC). If you can prove any hardship, you'll likely be able to negotiate your lien substantially downward with a BCRC representative.

Does Medicare Subrogate?

Subrogation rules are written into the statutes that govern Medicare and Medicaid. Virtually always, if Medicare or Medicaid paid medical expenses incurred because of a personal injury, there will be at least some subrogation payment from a personal injury judgment or settlement.

Do you have to repay Medicare?

The payment is "conditional" because it must be repaid to Medicare if you get a settlement, judgment, award, or other payment later. You're responsible for making sure Medicare gets repaid from the settlement, judgment, award, or other payment.

Does Medicare have a statute of limitations?

Answer: Under the statute of limitations (28 U.S.C. 2415), Medicare has six (6) years and three (3) months to recover Medicare's claim. The statute of limitations begins at the time Medicare is made aware that the overpayment exists.

What is a Medicare demand letter?

When the most recent search is completed and related claims are identified, the recovery contractor will issue a demand letter advising the debtor of the amount of money owed to the Medicare program and how to resolve the debt by repayment. The demand letter also includes information on administrative appeal rights.

What is a subrogation agreement?

A waiver of subrogation is an agreement that prevents your insurance company from acting on your behalf to recoup expenses from the at-fault party. A waiver of subrogation comes into play when the at-fault driver wants to settle the accident but with your insurer out of the picture.

What do you mean by subrogation?

Subrogation is a term describing a right held by most insurance carriers to legally pursue a third party that caused an insurance loss to the insured. This is done in order to recover the amount of the claim paid by the insurance carrier to the insured for the loss.

How do I call Medicare?

(800) 633-4227Centers for Medicare & Medicaid Services / Customer service

What is a Medicare settlement payment?

The recommended method to protect Medicare's interests is a Workers' Compensation Medicare Set-Aside Arrangement (WCMSA). A WCMSA is a financial agreement that allocates a portion of a workers' compensation settlement to pay for future medical services related to the workers' compensation injury, illness or disease.

How do I stop Medicare set aside?

There is one approach to avoiding MSAs that works — go to court or to the work comp board. The Centers for Medicare and Medicaid Services (CMS) will honor judicial decisions by a court or state work comp boards after a hearing on the merits of a work comp claim.

What is a conditional payment from Medicare?

• A conditional payment is a payment that Medicare makes. for services where another payer may be responsible. This. conditional payment is made so that the Medicare beneficiary won't have to use their own money to pay the bill.

What are procurement expenses Medicare?

In individual cases, Medicare will reduce or offset its lien for part of what's called “procurement costs.” Procurement costs are the costs typically incurred pursuing a personal injury claims (such as court costs, attorney's fees, and other case expenses).

How do I call Medicare?

(800) 633-4227Centers for Medicare & Medicaid Services / Customer service

What to ask a client about Medicare?

Ask the client if they have received any correspondence from Medicare; be sure to make copies of those as well. These may be in the form of Explanation of Benefits statements, bills, or letters.

How long does it take to get a final demand from Medicare?

Warn your clients though, even with timely reporting of the settlement information, obtaining the Final Demand amount can take up to a month if you are lucky, and if you are not, well, then buckle in, because it could be a very long while.

What is the black hole in Medicare?

It takes FOREVER to get a response from the black hole that is known as Medicare's Benefits Coordination and Recovery Contractor. The BCRC collects the information for Medicare and opens the file with the Medicare Secondary Payor Recovery Center (MSPRC).

How to mark unrelated claims?

Make sure to mark the unrelated claims with pen, either by crossing it out or by marking it with an "X." One thing that Medicare mentions nowhere on their website is that when documents are transmitted to them, for some reason, highlighting does not show up, so do not use highlighting as your means of indicating what charges are unrelated. Fax a letter back to MSPRC asking them to remove the unrelated charges, and include a copy of the itemization with the crossed out claims.

How long does it take to get a conditional payment letter?

If you do not receive the Conditional Payment Letter after 65 days of receiving the Rights and Responsibilities letter, be sure to call MSPRC at (866) 677-7220.

Can you stop Medicare from holding up settlement check?

If you start early, and remain organized, you can prevent Medicare from holding up your settlement check at the end of your case, which can happen if you do not have Medicare's final demand when it's time for the adjuster to issue the settlement check.

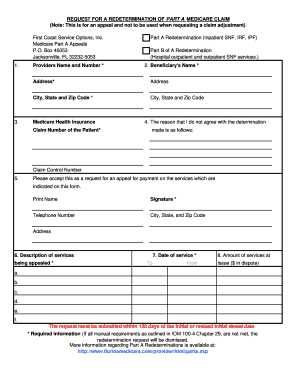

Can you self calculate Medicare payment?

You can also self-calcula te your conditional payment amount if you meet certain eligibility criteria. Use this form to indicate that you meet the criteria, and what you calculate to be the conditional payment amount, and send it in to the Medicare address listed on the form.

How long does it take to pay a final demand letter?

There is a possibility that the Final Demand Letter will be incorrect when it does come. You absolutely must pay the amount demanded within 60 days, no matter what. You may also dispute the amount in the Final Demand Letter. But if you do not pay the amount demanded within 60 days, interest will accrue, starting from the date of the Final Demand Letter, regardless of whether you were correct and the amount demanded was inaccurate.

How long does it take for a CPL to be issued?

Within 65 days from the issuance of the Rights and Responsibilities letter, MSPRC will issue the Conditional Payment Letter (CPL). You need to make sure that MSPRC has your Proof of Representation in time so that you receive a copy of this. MSPRC will not send you the CPL or even talk to you about your client before they have processed your Proof of Representation.

Does Medicare delay a case?

Medicare has extremely specific reporting procedures that, if not followed correctly, can delay your entire case. Thus, any time a client has medical bills that have been paid by Medicare, you will want to start this process as soon as you decide to pursue the case.

Does MSPRC have a deadline for final demand letters?

Unfortunately, MSPRC does not have a deadline for issuing the Final Demand Letter, and is processing them on a first-come, first-served basis. The operators are not allowed to “expedite” the letters, even if an excessive amount of time has passed. Many insurance companies will not issue settlement checks until the Final Demand Letter is received, resulting in continued delay of payment, and likely, client frustration. Odds are, the number that was on the most recent CPL is the same (unless there have been bills paid in the interim) as the amount on the Final Demand Letter. As such, some insurance companies will accept a recent CPL as proof of the amount of the Medicare lien or at least proof that you will take care of the Medicare lien. However, if the insurance company needs the Final Demand Letter, just sit tight and eventually MSPRC will send it to you.

What is a closure letter for Medicare lien?

Once payment of the lien is made to CMS, a closure letter will be issued advising the parties that the lien issue has been resolved.

How to determine if a claimant is a Medicare beneficiary?

This can usually be determined by evaluating a claimant’s age. Most individuals are entitled to Medicare coverage when they reach sixty-five (65) years of age. However, a claimant can become a Medicare beneficiary prior to reaching sixty-five (65) years of age in certain circumstances. Usually, this will occur when a claimant has applied for, and is awarded, Social Security Disability benefits. A claimant can also be entitled to Medicare coverage if he/she had End Stage Renal Disease (ESRD). As such, prior to settling a claim, you always want to determine if the claimant is a Medicare beneficiary, and in fact, federal law requires you to make that determination.

How old do you have to be to get Medicare?

Most individuals are entitled to Medicare coverage when they reach sixty-five (65) years of age. However, a claimant can become a Medicare beneficiary prior to reaching sixty-five (65) years of age in certain circumstances.

Does an Erisa lien complicate a settlement?

In our last post, we discussed the issues posed by ERISA liens and how the presence of an ERISA lien can complicate a potential settlement. Another similar issue that complicates settlements is the potential presence of a Medicare lien. This applies to workers’ compensation and liability cases.

Does Medicare have a lien on workers compensation?

Usually, if a workers’ compensation claim has been accepted as compensable and all medical payments have been made through workers’ compensation, there should be no lien. However, you will still need to confirm this with Medicare prior to any settlement through a request for lien information to the Centers for Medicare and Medicaid Services’ (CMS) relevant contractor. The CMS contractor that handles lien recovery in accepted workers’ compensation claims is the Commercial Repayment Center (CRC).

What is included in a demand letter for Medicare?

The demand letter also includes information on administrative appeal rights. For demands issued directly to beneficiaries, Medicare will take the beneficiary’s reasonable procurement costs (e.g., attorney fees and expenses) into consideration when determining its demand amount.

What is Medicare beneficiary?

The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). For ORM, there may be multiple recoveries ...

Does a waiver of recovery apply to a demand letter?

Note: The waiver of recovery provisions do not apply when the demand letter is issued directly to the insurer or WC entity. See Section 1870 of the Social Security Act (42 U.S.C. 1395gg).

Can CMS issue more than one demand letter?

For ORM, there may be multiple recoveries to account for the period of ORM, which means that CMS may issue more than one demand letter. When Medicare is notified of a settlement, judgment, award, or other payment, including ORM, the recovery contractor will perform a search of Medicare paid claims history.

Can Medicare waive recovery of demand?

The beneficiary has the right to request that the Medicare program waive recovery of the demand amount owed in full or in part. The right to request a waiver of recovery is separate from the right to appeal the demand letter, and both a waiver of recovery and an appeal may be requested at the same time. The Medicare program may waive recovery of the amount owed if the following conditions are met:

How to report a case to Medicare?

In situations where an attorney has been hired, one of the first steps should be to report the case by accessing the Medicare Secondary Payer Recovery Portal (MSPRP) Report a Case link, or by contacting the Benefits Coordination & Recovery Center (BCRC). Details regarding what must be reported and contact information for the BCRC are contained on the Reporting a Case page.

What is a demand letter for Medicare?

This letter includes: 1) a summary of conditional payments made by Medicare; 2) the total demand amount; 3) information on applicable waiver and administrative appeal rights. For additional information about the demand process and repaying Medicare, please click the Reimbursing Medicare link.

Is Medicare a lien or a recovery claim?

Please note that CMS’ Medicare Secondary Payer (MSP) recovery claim (under its direct right of recovery as well as its subrogation right) has sometimes been referred to as a Medicare “lien”, but the proper term is Medicare or MSP “recovery claim.”.

Can Medicare pay conditionally?

If the item or service is reimbursable under Medicare rules, Medicare may pay conditionally, subject to later recovery if there is a subsequent settlement, judgment, award, or other payment. In situations such as this, the beneficiary may choose to hire an attorney to help them recover damages.

Does Medicare require a copy of recovery correspondence?

Note: If Medicare is pursuing recovery from the insurer/workers’ compensation entity, the beneficiary and his attorney or other representative will receive a copy of recovery correspondence sent to the insurer/workers’ compensation entity. The beneficiary does not need to take any action on this correspondence.

Enrollment forms

I have Part A and want to apply for Part B (Application for Enrollment in Part B/CMS-40B).

Appeals forms

I want to appoint a representative to help me file an appeal (Appointment of Representative form/CMS-1696).