Full Answer

What is the maximum premium for Medicare Part B?

The standard monthly premium for Part B, which covers outpatient care and durable equipment ... or offers a different copay and an out-of-pocket maximum (a Medicare Advantage Plan). The Aduhelm situation highlights the ripple effect that expensive drugs ...

How to collect a part B deductible?

- The beneficiary was later determined to have been entitled to Medicare benefits;

- The beneficiary’s entitlement period fell within the time the provider’s agreement with CMS was in effect; and

- Such amounts exceed the beneficiary’s deductible, coinsurance or non covered services liability. ...

How much does Part B insurance cost?

Part B costs: What you pay 2021: Premium $170.10 each month (or higher depending on your income). The amount can change each year. You’ll pay the premium each month, even if you don’t get any Part B-covered services.

Does Medicaid pay for Part B premium?

Does Medicaid pay for Medicare premiums? Medicaid pays Part A (if any) and Part B premiums. Medicaid pays Medicare deductibles, coinsurance, and copayments for services furnished by Medicare providers for Medicare-covered items and services (even if the Medicaid State Plan payment does not fully pay these charges, the QMB is not liable for them).

How do you pay the Medicare Part B deductible?

3:045:05How Do You Pay the Part B Deductible? - YouTubeYouTubeStart of suggested clipEnd of suggested clipItself you just pay the first 233. Dollars of your first part me medical care in that year. ThisMoreItself you just pay the first 233. Dollars of your first part me medical care in that year. This means you pay that deductible to a medical provider.

How are Medicare deductibles paid?

Typically, you'll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year. In this instance, you'd be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%.

How often do you pay the Medicare Part B deductible?

You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

Do you have to meet a deductible with Medicare Part B?

Both Medicare Parts A and B have deductibles that must be met before Medicare starts paying. Medicare Advantage, Medigap and Part D plans are all sold by private insurance companies that set their own deductibles.

What is the Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Are Medicare deductibles based on calendar year?

The concept of a benefit period is important because the Medicare Part A deductible is based on the benefit period, rather than a calendar year. With most other types of health insurance (ie, non-Medicare), the deductible is based on the calendar year.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

How do I find out if my Medicare deductible has been met?

CMS mails your Medicare Summary Notice once a quarter. And, it doesn't provide important details about the Part B deductible. It will simply indicate if you've met the deductible.

What is Medicare Part A deductible for 2022?

The 2022 Medicare deductible for Part A (inpatient hospital) is $1,556, which reflects an increase of $72 from the annual deductible of $1,484 in 2021. This is the amount you'd pay if you were admitted to the hospital.

What is the Medicare Part B deductible for 2020?

$198 in 2020The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

What is the Part B deductible?

Alongside the premium, this coverage includes an annual deductible and 20% coinsurance, for which you are responsible for paying out-of-pocket. In 2022, the Medicare Part B deductible is $233. Once you meet the annual deductible, Medicare will cover 80% of your Medicare Part B expenses.

Does Medicare Secondary cover primary deductible?

“Medicare pays secondary to other insurance (including paying in the deductible) in situations where the other insurance is primary to Medicare.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't sign up for Part B?

If you don't sign up for Part B when you're first eligible, you may have to pay a late enrollment penalty.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much is Medicare Part B premium?

2019 Medicare Part B Premium. The standard premium for Medicare Part B in 2019 is $135.50 per month , although some people might pay more than that amount. The Part B premium is based on your reported income from two years prior. So that means your 2019 premiums are based off of your reported income from 2017.

How much is Part B medical insurance?

This is the first medical care covered by Part B you have received in 2019. You will be responsible for the full $120 for your appointment since you have not yet satisfied your 2019 Part B deductible. In July, you injure your knee and schedule another appointment with your doctor.

What Is the 2022 Medicare Part B Deductible?

As mentioned above, the annual Medicare Part B deductible for 2022 is $233. So what exactly does that mean?

What Are Other Part B Costs in 2022?

There are several types of Part B costs you may face in 2022, such as:

How much coinsurance do you pay for Medicare Part B?

After you reach your Medicare Part B deductible, you will typically pay a 20% coinsurance for all services and items that are covered by Part B for the remainder of 2019.

How much is the $65 out of pocket for Part B?

After the $65 is paid, you have reached $185 in out-of-pocket spending for covered Part B services in 2019. You have reached your deductible and you will now be responsible for any Part B coinsurance charges. There is still $85 remaining for your doctor's visit ($150 total charge minus the $65 you paid out of pocket).

What is the 2019 Medicare premium based on?

So that means your 2019 premiums are based off of your reported income from 2017. Most people pay the standard Part B premium amount, but higher income earners may pay a higher amount called the Income-Related Monthly Adjusted Amount, or IRMAA.

What is medical expense deduction?

A tax deduction – like the well-known medical expense deduction – reduces the amount of money that you have to pay taxes on. Choosing to take the medical expense deduction gives you a write-off that will reduce, but not erase, the taxes that you owe.

Can you deduct insurance premiums on your taxes?

Insurance premiums are among the many items that qualify for the medical expense deduction. Since it’s not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

Is Medicare Part B tax deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it’s not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense. Considering a Medicare Plan?

Can you deduct medical expenses on taxes?

Follow the Rules to Deduct. However, you can only benefit from the medical expense deduction by following specific rules. You’ll need to file your taxes in a certain way, itemizing your deductions instead of choosing the standard deduction. Additionally, your medical expense deductions only begin to count after they surpass 10% ...

How much is Medicare Part B deductible for 2021?

The Medicare Part B deductible in 2021 is $203 per year. You must meet this deductible before Medicare pays for any Part B services. Unlike the Part A deductible, Part B only requires you to pay one deductible per year, no matter how often you see the doctor. After your Part B deductible is met, you typically pay 20 percent ...

What percentage of Medicare deductible is paid?

After your Part B deductible is met, you typically pay 20 percent of the Medicare-approved amount for most doctor services. This 20 percent is known as your Medicare Part B coinsurance (mentioned in the section above).

What is a copay in Medicare?

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met. A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin ...

How much is Medicare coinsurance for days 91?

For hospital and mental health facility stays, the first 60 days require no Medicare coinsurance. Days 91 and beyond come with a $742 per day coinsurance for a total of 60 “lifetime reserve" days.

What is deductible insurance?

A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin to pay.

How much is the deductible for Medicare 2021?

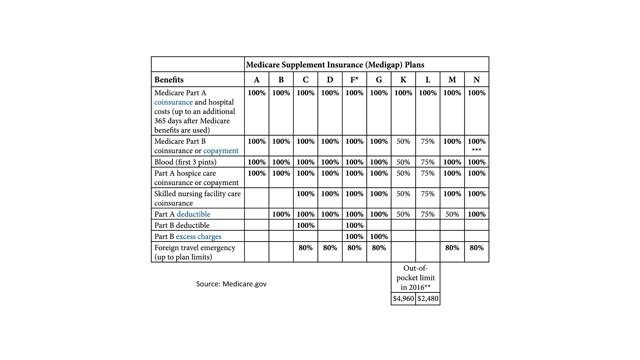

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is Medicare approved amount?

The Medicare-approved amount is the maximum amount that a doctor or other health care provider can be paid by Medicare. Some screenings and other preventive services covered by Part B do not require any Medicare copays or coinsurance.

What is the cost of Part B insurance?

Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium of $148.50 in 2021. Parts C and D are optional and may cover additional costs, including prescriptions.

How much does Medicare cost?

The cost of Medicare depends on how much you worked, when you sign up, and which types of coverage options you choose. If you paid Medicare taxes for 40 or more quarters, you're eligible for premium-free Medicare Part A. You'll pay a premium for Part A if you worked less than 40 quarters, and you'll also pay a premium for additional coverage you want from Part B, Part C, or Part D, as well as penalties if you enroll in these after your initial enrollment period. 5

What does Medicare cover?

What you pay for Medicare depends on the type of enrollment you have: Parts A, B, C, and/or D. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. It doesn't generally charge a premium. Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium ...

What is Medicare Part A 2021?

Medicare Part A Costs in 2021. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. 1 For most people, this is the closest thing to free they’ll get from Medicare, as Medicare Part A (generally) doesn't charge a premium. 2 . Tip: If you don't qualify for Part A, you can buy Part A coverage.

What is the Medicare Advantage premium for 2021?

The average plan premium is about $21.00 a month in 2021. 7 . But coinsurance, copayments, premiums, and deductibles may still vary depending on your plan of choice. 3 .

How much does Medicare pay for a hospital stay in 2021?

Part A also charges coinsurance if your hospital stay lasts more than 60 days. In 2021, for days 61 to 90 of your hospital stay, you pay $371 per day; days 91 through the balance of your lifetime reserve days, you pay $742 per day. 3 Lifetime reserve days are 60 days that Medicare gives you to use if you stay in the hospital for more than 90 days.

How much is the Medicare premium for 2021?

It covers medical treatments and comes with a monthly premium of $148.50 in 2021. A small percentage of people will pay more than that amount if reporting income greater than $88,000 as single filers or more than $176,000 as joint filers. 3 . Part B also comes with a deductible of $203 per year in 2021. Unlike Part A, your deductible isn’t tied ...

How does Medicare Part B deductible work?

The Medicare Part B deductible is applied on a basis of first claim received, first claim applied to the deductible. This means that when the new year starts Medicare will apply your first claim or claims received to your deductible until the full deductible has been satisfied.

What does summary notice mean for Medicare?

Your summary notice will show which provider’s services Medicare applied to the deductible, the amount of the deductible owed to that provider and how much of the deductible has been met for the year. You will receive a bill from the provider for the amount owed.

Does Medicare pay for in-home care?

ANSWER: In-home care is a complex subject and you are not alone in your thinking. Medicare pays only for “medically necessary” services and does not pay for “custodial” care.

How to track Medicare Part B deduction?

But, if that’s not your cup of tea…then use your paper calendar to track the Medicare Part B Deductible. Simply, mark on the calendar the day you paid the Medicare provider and how much you paid. Then, you can use this information to cross reference with the next tip.

How much was the Part B deductible in 2016?

Now, this occurred in 2016 when the Part B deductible was $166. So, keep that in mind as we go through this case study. When the client received this bill he had already paid $63 towards the Part B deductible.

How to keep track of Medicare payments?

Keep a folder or notebook dedicated to Medicare and write down exactly what you’ve paid. This includes the provider name, date of service, check number, or date you paid online. I really like the ideas of documenting this information on the actual bill and storing it in a file.

Why is it important to pay Medicare Supplement Plan G?

This is especially important if you have Medicare Supplement Plan G or Medicare Supplement Plan N…because you’ll receive bills from medical providers. And, you want to make sure you only pay the amount you’re responsible for. Once you overpay, then you have to try and get your money back from the provider.

How often does Medicare send a summary notice?

CMS mails your Medicare Summary Notice once a quarter. And, it doesn’t provide important details about the Part B deductible. It will simply indicate if you’ve met the deductible. Which means you still need to make sure that you actually paid Medicare’s Part B deductible.

Does Medicare keep track of what you paid out of your pocket?

And, that’s because your online Medicare account tells you when you’ve met the Part B deductible, but it doesn’t keep track of what you’ve actually paid out of your pocket towards the Medicare deductible. So, you need to look at actual claims and cross reference them with what you’ve paid.

Does Medigap Plan N count towards Part B?

If you have Medigap Plan N, you must remember that the co-payment doesn’t count towards the Part B deductible.

What is the standard deduction for Medicare Part B?

As of 2020, the standard deduction is $12,400 for single people and $24,800 for married couples filing jointly . This may mean that it no longer makes sense for some people to claim Medicare Part B premiums and other medical expenses on their taxes, since they'll save more simply taking the standard deduction.

What is Medicare Part B?

Medicare Part B is an insurance plan that helps pay for doctor and medical service in exchange for a monthly premium.

What is the medical deduction for $50,000?

Now, 7.5 percent of $50,000 is $3,750 and your total medical bill for the year exceeds that. You can deduct the amount you paid that’s more than 7.5 percent of your AGI so here, you could deduct $6,000 minus $3,750 , which is $2,250 .

How much of your adjusted gross income must be medical expenses?

To claim any medical expenses at all, your expenses must exceed 7.5 percent of your adjusted gross income. For example, suppose you had an AGI of $50,000 . The first step is to gather up all your medical receipts, insurance statements and summary notices, and add those together. Let's imagine your expenses come to $6,000 .

Can you deduct Medicare Part C and Part D?

Brought to you by Sapling. In addition to Medicare Part B, you might also pay monthly premiums for Medicare Part C, also known as Medicare Advantage, and Part D for prescription drug coverage. The IRS allows you to deduct any of your out-of-pocket medical expenses, including the premiums you paid for Part C and Part D.

Can you deduct medical expenses on taxes?

The amount of medical expenses you can deduct on your taxes, however, depends on your adjusted gross income. Any medical expense you pay for out of pocket because it's not covered by Medicare or falls under your Medicare annual deductible is included.

Are Medicare Premiums Tax Deductible?

The IRS offers two deductions: the standard deduction and itemized deductions, both of which reduce your taxable income. When you itemize your taxes, you opt to claim various actual deductible expenses, instead of just choosing the one-size-fits-all standard deduction. Only certain expenses, such as home mortgage interest, charitable contributions and medical expenses, qualify as itemized deductions. When you itemize, you enter all of your qualifying expenses in Schedule A on your Form 1040.