How can I get $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

How do you qualify to get money back on Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.Jan 14, 2022

Does Medicare give back money?

In order to enroll in a Medicare Advantage plan, you'll need to be enrolled in or eligible for both Medicare Part A and B. To receive the Medicare give back benefit, you'll need to enroll in a plan that offers to pay your Part B monthly premium.

How does the Give Back program work?

If you pay your Medicare Part B premium through Social Security, you'll see the reimbursed amount given back in your Social Security check. If you pay Medicare directly, once you are enrolled in your plan that offers the Medicare Give Back Benefit, you'll pay Medicare the reduced amount.Aug 20, 2021

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What is the income limit for extra help in 2021?

To qualify for Extra Help, your annual income must be limited to $20,385 for an individual or $27,465 for a married couple living together.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

What is a Medicare Part B reimbursement?

The Medicare Part B Reimbursement program reimburses the cost of eligible retirees' Medicare Part B premiums using funds from the retiree's Sick Leave Bank. The Medicare Part B reimbursement payments are not taxable to the retiree.

Which company has the best Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is a Part B premium buyback?

What is a Medicare give back benefit? A Part B give back plan is simply a Medicare Advantage plan with a premium reduction benefit. These plans are sometimes called giveback plans, Medicare buyback plans, or premium reduction plans. The premium reduction benefit helps lower your monthly Part B premium.Dec 13, 2021

Will Medicaid pay for my Medicare Part B premium?

Medicaid can provide premium assistance: In many cases, if you have Medicare and Medicaid, you will automatically be enrolled in a Medicare Savings Program (MSP). MSPs pay your Medicare Part B premium, and may offer additional assistance.

What Is The Medicare Part B Give Back Benefit?

The Give Back benefit is a benefit offered by some Medicare Advantage plan carriers that can help you reduce your Medicare Part B premium. You should know, however, that the Give Back benefit is not an official Medicare program. This benefit is provided as part of some Medicare Part C plans as a way to encourage participation in a specific plan.

Who Is Eligible For The Medicare Part B Give Back Benefit?

It is pretty easy to qualify for the Medicare Give Back benefit as the eligibility criteria are straightforward. First, you must be enrolled in Original Medicare. You need to have both Medicare Part A and Medicare Part B coverage. Next, you must pay your own monthly Part B premium.

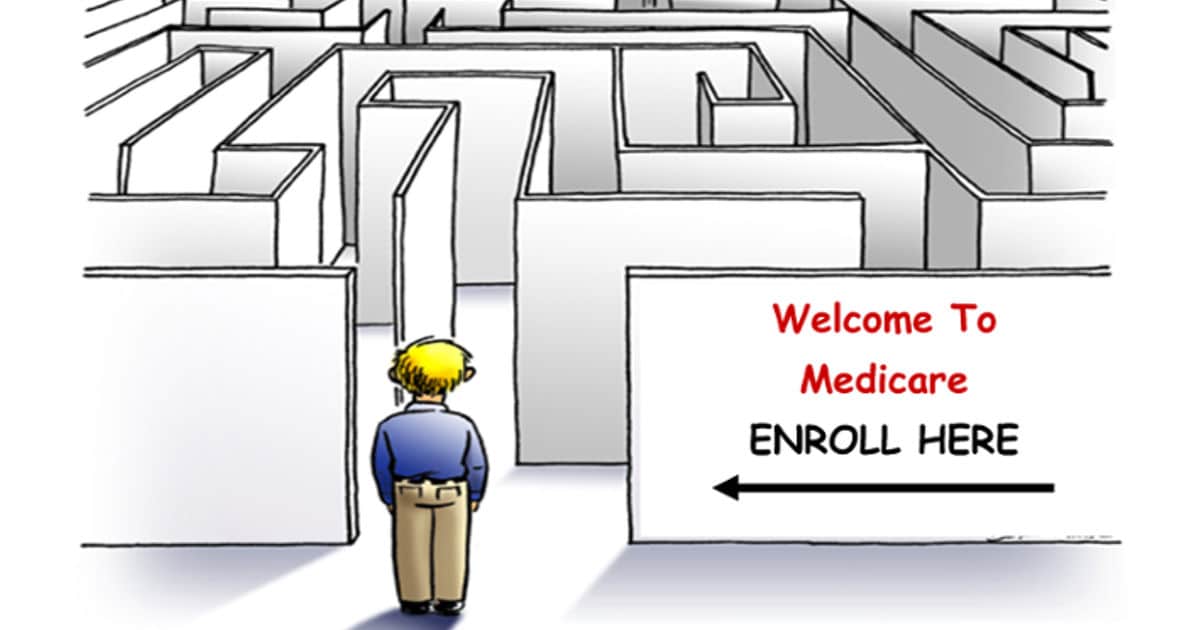

Applying For A Medicare Part B Give Back Benefit

So, what is the enrollment process for the Give Back benefit? Many people are looking to save as much money as possible when it comes to their health care costs, so they want to know how to get signed up for this program. The process is quite simple, so here is how to do it.

The Bottom Line

Since most people on Medicare are receiving Social Security benefits, finding a way to reduce the cost of your health insurance is always a plus. The Medicare Give Back program can do just that by paying for a portion or even all of your Medicare Part B premium.

What is the deadline for Medicare give back benefit?

There is no deadline to qualify for the give back benefit. You must already be enrolled in Medicare Part A and Part B, and you must pay your own monthly Part B premium. You then simply need to enroll in a Medicare Advantage plan that offers this benefit.

What Does Medicare Pay For?

Medicare provides healthcare coverage to those 65 and older, as well as people with disabilities and some chronic diseases, through five major options:

Medicare Give Back – What Is It?

If you are on Medicare and looking forward to maximizing your savings, you might wonder what the Medicare give back benefit is. This is a term for a Medicare Part B premium decrease featured in some Medicare Advantage plans rather than an official Medicare program. The Part B premium reduction is the give back benefit.

How Does Medicare Part B Give Back Plans Work?

Instead of Medicare, Part B Give Back plans are health plans offered by commercial insurance firms.

How Can I Qualify for the Give Back Benefit?

Well, that depends on where you reside and whether or not you have access to a Medicare Advantage Plan that provides this benefit. To enroll in this plan, you must live in the plan’s service area.

With a Part B Give-Back Plan, How Much Do I Get Back?

The amount you get back ranges between $0.10 to $148.50 in various jurisdictions. In addition, the amount you receive will be determined by the options available in your location. Furthermore, multiple give back counties may have varying premium buy-downs for the same plan name.

Where Can I Look For Plans That Include This Benefit?

The Medicare Plan Finder is undoubtedly the best place to start. On the details page, you will notice if a plan offers the Part B premium reduction. Finding the exact amount of the reduction will almost certainly necessitate a search through plan paperwork or a phone call to the plan.

Bottom Line

We think that now you must have answers to the question “what is the Medicare give back benefit ?” The monthly Give Back may not be worth it if the prices are significantly greater than other plans. You might be able to find another plan that is more cost-effective in the end.

What is a Medicare give back benefit?

A Part B give back plan is simply a Medicare Advantage plan with a premium reduction benefit. These plans are sometimes called giveback plans, Medicare buyback plans, or premium reduction plans. The premium reduction benefit helps lower your monthly Part B premium.

How does a Part B give back plan work?

Medicare Advantage plans with the premium reduction benefit work exactly the same as other Medicare Advantage plans. The only difference is that your monthly Part B premium will be reduced by the giveback amount in your plan.

How much will I save with a give back plan?

The premium reduction amount varies widely depending on the plan you choose and where you live. Some giveback plans give back as little as $0.10 each month while others pay the full Part B premium.

Is there an income requirement for the give back benefit?

No, there is no income test for the giveback benefit. Anyone eligible to enroll in Medicare Advantage can buy any Medicare giveback plan sold in their area. However, you must pay your own Part B premium. If you get premium assistance from Medicaid or another source, you aren’t eligible for the giveback benefit.

What should I watch for with the Part B give back benefit?

It’s always a good idea to compare all the costs and benefits of any Medicare plan you are considering. Think of premium reduction as just another extra benefit available with Medicare Advantage.

How can I find a Medicare Advantage giveback plan in my area?

The Boomer Benefits team uses a comprehensive comparison tool to see if a buyback plan is available in your area. We represent the top carriers in the country to be able to present our clients with many options. Talk to a Medicare expert on our team today to see what plan is right for you.

What is the Medicare Part B Giveback Benefit?

The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C (Medicare Advantage) plans.

How do I receive the Medicare Giveback Benefit?

You will not receive checks directly from your Medicare Advantage plan carrier. You can get your reduction in 2 ways:

Is the Medicare Giveback Benefit a type of Medicare Savings Program?

No. The Medicare Giveback Benefit is only available to people enrolled in certain Medicare Advantage plans. Medicare Savings Programs (MSPs) are available to people enrolled in Original Medicare who have limited income and resources.

Learn more about Medicare

For more helpful information on Medicare, check out these 10 frequently asked questions about Medicare plans.

How to qualify for Medicare premium reduction?

To qualify for a premium reduction, you must: Be a Medicare beneficiary enrolled in Part A and Part B, Be responsible for paying the Part B premium, and. Live in a service area of a plan that has chosen to participate in this program.

What is a reduction in Part B premium?

This is a reduction in the Part B premium you must pay. For example, if a beneficiary is on Social Security, the Part B premium comes out of the monthly benefit before it hits the individual’s bank account. The reduction in the plan’s payment reduces that premium, which means more money in the individual’s bank account.

What happens if you call Medicare?

However, if you call (as noted in the commercial’s small print), your call will be transferred to a licensed insurance agent who may or may not sell plans in your area. And, if there is no plan in your area, you may hear about other plans that are available to you. The best place to start is the Medicare Plan Finder.

Does SNP include prescription drug coverage?

A few of these plans do not include prescription drug coverage. Some Special Needs Plans (SNP) also offer this benefit. But, in these cases, the beneficiary may not qualify. For example, there is a SNP for those residing in nursing homes.

What is the Part B premium reduction benefit?

When you're enrolled in Medicare Part B, you must pay a monthly premium of $170.10. The giveback benefit, or Part B premium reduction, is when the Part C Medicare Advantage (MA) plan reduces the amount you pay toward that premium. Your reduction could range from less than $1 to the full premium amount.

How do I receive the giveback benefit?

If you enroll in a plan that offers a giveback benefit, you'll find a section in the plan's summary of benefits or evidence of coverage (EOC) that outlines the Part B premium buy-down. Here, you'll see how much of a reduction you'll get. Or, you can contact the plan directly.

How to find plans that offer the giveback benefit

Not all MA plans offer this benefit, so you must find a plan that does to take advantage of the savings opportunity.

Downsides to the Medicare giveback benefit

While the giveback benefit can help save you money, there are a few things to be aware of when considering enrolling in an MA plan that offers it.

For those who qualify, there are multiple ways to have your Medicare Part B premium paid

In 2022, the standard Medicare Part B monthly premium is $170.10. Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

What is the Part B premium reduction benefit?

The giveback benefit, or Part B premium reduction, is when a Part C Medicare Advantage (MA) plan reduces the amount you pay toward your Part B monthly premium. Your reimbursement amount could range from less than $1 to the full premium amount, which is $170.10 in 2022.

How to find plans that offer the giveback benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2022, these plans are offered in nearly all states, so you may find one close to you.

Other Part B reimbursement options

There are other ways you can lower or eliminate how much you pay for the Medicare Part B premium. This includes certain Medicaid programs or benefits from some retiree health plans.