- Choose and join a high-deductible Medicare MSA Plan.

- You set up an MSA with a bank the plan selects.

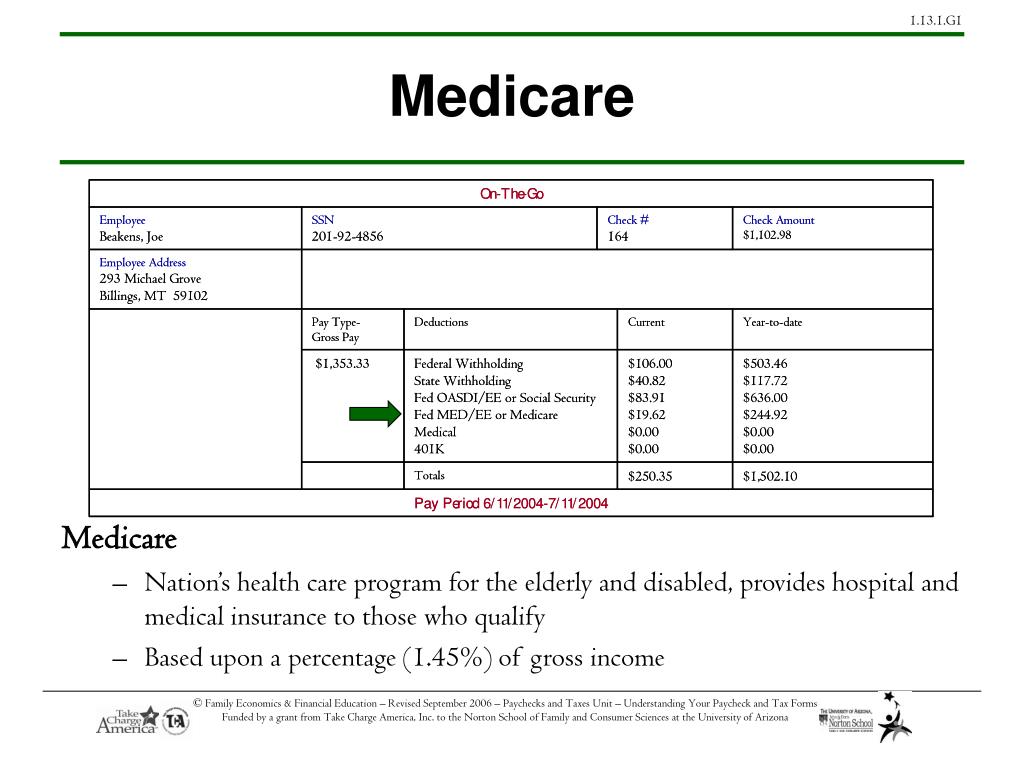

- Medicare gives the plan an amount of money each year for your health care.

- The plan deposits some money into your account.

- You can use the money in your account to pay your health care costs, including health care costs that aren't covered by Medicare. ...

Full Answer

What are the benefits of Medicare savings program?

Types of Medicare Savings Programs

- Qualified Medicare Beneficiary (QMB) Programs pay most out-of-pocket costs for Medicare, protecting beneficiaries from cost-sharing. ...

- Specified Low-Income Medicare Beneficiary (SLMB) Programs pay your Part B premium. ...

- Qualifying Individual (QI) Programs are also known as Additional Low-Income Medicare Beneficiary (ALMB) programs. ...

How do I apply for Medicare savings program?

To qualify for the QI program, you must meet the following:

- Individual monthly income limit of $1,469 (limits may be higher in Alaska or Hawaii)

- Married couple monthly income limit of $1,890 (limits may be higher in Alaska or Hawaii)

- Individual resource limit of $7,970

- Married couple resource limit of $11,960

How does income affect monthly Medicare premiums?

- Marriage

- Divorce/Annulment

- Death of Your Spouse

- Work Stoppage or Reduction

- Loss of Income-Producing Property

- Loss of Pension Income

- Employer Settlement Payment

Does Medicaid replace Medicare?

More than 8 million people have both Medicare and Medicaid. In this situation, Medicare becomes your primary insurance and settles your medical bills first; and Medicaid become secondary, paying for services that Medicare doesn’t cover and also paying most of your out-of-pocket expenses in Medicare (premiums, deductibles and copays).

What happens to money left in a MSA at the end of the year?

Any money left in your account at the end of the year will remain in your account. If you stay with the Medicare MSA Plan the following year, the new deposit will be added to any leftover amount.

What are the advantages of an MSA?

Some MSAs offer additional benefits, such as vision and hearing care. Unlike other Medicare Advantage Plans, MSA plans include both a high deductible health plan (HDHP) and a bank account to help pay your medical costs. HDHPs have large deductibles that you must meet before receiving coverage.

How does a MSA account work?

The Medicare MSA Plan deposits money in a special savings account for you to use to pay health care expenses. The amount of the deposit varies by plan. You can use this money to pay your Medicare-covered costs before you meet the deductible.

What is the deductible for Medicare savings account?

On January 1, the plan deposits $1,500 into his account. The plan's yearly deductible is $3,000. The plan pays for all Medicare-covered services once Mr. Anderson meets the deductible....Examples of Medicare Medical Savings Account (MSA) plans.Account balanceMrs. Chang's out-of-pocket costsDeductible$0$1,500$1,500 − $1,500 = $0 (deductible is met)

Is medical savings account the same as health savings account?

MSAs are only for people enrolled in high-deductible Medicare plans. HSAs are restricted to people in high-deductible private insurance plans. Medicare funds MSAs, while individuals make contributions to HSAs.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How much does Medicare contribute to an MSA?

After reaching your deductible, your MSA plan covers 100% of the cost for Medicare-covered services. Funds contributed to an MSA are not taxed as long as they are used to pay for qualified medical expenses.

How do I set up an MSA account?

You must open an MSA through your health plan provider. Your provider will then open your account with Optum Bank, Member FDIC. Your health plan provider will then deposit money into your account.

Do Medicare savings accounts have networks?

MSA plans cannot restrict access to a network of providers. The plan will cover Medicare costs once an enrollee meets the yearly deductible. Only Medicare Part A and Part B expenses can count towards the plan deductible.

Who can contribute to an MSA?

If you're not covered for a whole year, use our Form 8853 screen to calculate your contribution limit. You also can't contribute more than your income from the employer that provides the coverage. Who can contribute to an MSA? Either you or your employer can contribute to your MSA, but not both.

How do you get Medicare Part C?

To be eligible for a Medicare Part C (Medicare Advantage) plan:You must be enrolled in original Medicare (Medicare parts A and B).You must live in the service area of a Medicare Advantage insurance provider that's offering the coverage/price you want and that's accepting new users during your enrollment period.

Who is eligible for a medical savings account?

To qualify, you must be under age 65 and have a high-deductible health insurance plan. If you have a spouse who uses your insurance as secondary coverage, he or she also must be enrolled in a high-deductible plan. This high-deductible health plan must be your only health insurance.

What is a medical savings account?

A Medicare Medical Savings Account (MSA), in particular, has a lot to offer. These accounts give you quality care through a Medicare Advantage plan while also giving you a bank account to pay for health expenses tax-free.

What is MSA in Medicare?

An MSA is a special type of Medicare Advantage plan with two components: A high-deductible health plan: This type of health plan requires you to pay an expensive annual deductible before your coverage benefits kick in. Specifically, you will pay full cost for any Part A or Part B Medicare-covered services until you spend a dollar amount equal ...

What medical expenses can be deducted from taxes?

This list applies to flexible spending arrangements (FSAs), health reimbursement arrangements (HRAs), health savings accounts (HSAs), medical savings accounts, and Medicare Advantage medical savings accounts. 6

How does MSA work?

How an MSA Works. You can use your MSA to pay for services right away. You do not have to wait until you spend the full deductible amount out of your own pocket. In fact, any money you spend for Medicare-covered services from this account will help pay down your deductible.

How much did Medicare spend in 2016?

People on Medicare are more likely to have fixed incomes, but spent as much as $5,460 in healthcare out-of-pocket costs in 2016. 1 Picking a plan that will save the most money could have a major impact on your ability to afford life’s essentials.

Does Medicare pay 100% of your deductible?

A bank account set up by your health plan: Medicare funds this bank account with a fixed dollar amount every year. The amount varies based on the specific plan you choose, but will be less than your annual deductible.

Is a qualified health account tax free?

Any money from this account used to pay for qualified health expenses will be tax-free, but using it to pay for expenses that do not qualify could literally cost you. You could face a 50% tax penalty for non-qualifying expenses. 5

How to contact Medicare about savings account?

If you’re considering a Medicare savings account, you may want to speak to a financial planner or call Medicare directly (800-633-4227) to see if one is right for you.

Why are Medicare savings accounts not widely used?

Medicare savings accounts aren’t as widely used as you might think — probably because there’s a lot of confusion about who’s eligible and how they work.

What is an MSA plan?

The major difference is that MSAs are a type of Medicare Advantage plan, also known as Medicare Part C. MSAs are sold by private insurance companies that contract with banks to create the savings accounts. If you have an MSA, Medicare seeds that account with a certain amount of money at the beginning of each year.

What is covered by MSA?

Once you have reached your annual deductible using the MSA, the rest of your Medicare-eligible healthcare costs are covered through the end of the year. Vision plans, hearing aids, and dental coverage are offered if you decide to pay an additional premium, and you can use the MSA for associated costs.

Is Medicare seed tax free?

If you have an MSA, Medicare seeds that account with a certain amount of money at the beginning of each year. The money that’s deposited in your MSA is tax-exempt. As long as you use the money in your MSA for eligible healthcare costs, it’s tax-free to withdraw.

Is Medicare Advantage a Part C plan?

Since Medicare savings account plans are Medicare Advantage plans (Part C), the network of doctors and healthcare coverage may be more comprehensive than original Medicare.

Can you get MSA if you have Medicare?

Some people who are eligible for Medicare aren’t eligible for a Medicare savings account. You’re not eligible for an MSA if: you’re eligible for Medicaid. you’re in hospice care. you have end stage renal disease. you already have health coverage that would cover all or part of your annual deductible.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . If you use all of the money in your account and you have additional health care costs, you'll have to pay for your Medicare-covered services out-of-pocket until you reach your plan's ...

What is out of pocket medical insurance?

out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance. . Money left in your account at the end of the year stays in the account, and may be used for health care costs in future years.

How to use MSA?

10 steps to use a Medicare MSA Plan. Choose and join a high-deductible Medicare MSA Plan. You set up an MSA with a bank the plan selects. Medicare gives the plan an amount of money each year for your health care. The plan deposits some money into your account.

How does a Medicare MSA work?

How Medicare Medical Savings Accounts (MSA) work. When you enroll in a Medicare Medical Savings Account, the Medicare MSA plan will designate an amount of money to be deposited into a savings account each year. You will then be able to use the money in this account to pay for covered health care services and products.

How to contact Medicare Advantage MSA?

Special Needs Plan (SNP) To learn more about Medicare Advantage MSA plans, including which Medicare Advantage MSA plans may be available for sale near you and how you can enroll, speak with a licensed insurance agent by calling. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 24 hours a day, 7 days a week.

What is MSA plan?

MSA Plans combine a high deductible Medicare Advantage Plan and a trust or custodial savings account (as defined and/or approved by the IRS). The plan deposits money from Medicare into the account. You can use this money to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

Does Medicare MSA have a deductible?

Medicare MSA plans include a deductible that is greater than the amount of money that the Medicare MSA plan deposits into the account. The money deposited into your account can be used toward the plan deductible before the plan’s additional coverage kicks in.

Is Medicare Advantage MSA deposited into a Medicare Advantage plan subject to taxes?

Money that is deposited into your Medicare Advantage MSA plan account that is used for qualified medical expenses through the year is not subject to taxes.

Does Medicare Advantage cover prescription drugs?

Medicare Advantage MSA plans may also provide coverage for benefits not offered by Original Medicare. These additional benefits can include: MSA plans do not provide coverage for prescription drugs.

Does Medicare cover hearing?

Hearing. Long-term care not covered by Original Medicare 1. MSA plans do not provide coverage for prescription drugs. If you wish to enroll in Medicare prescription drug coverage, you may enroll in a Medicare Part D plan in addition to your Medicare Advantage MSA plan.

How to stop Medicare charges?

If you have a Medicare Advantage Plan: Contact the plan to ask them to stop the charges.

What is the number to call for Medicare?

If your provider won't stop billing you, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048.

What is a Medicare notice?

A notice you get after the doctor, other health care provider, or supplier files a claim for Part A or Part B services in Original Medicare. It explains what the doctor, other health care provider, or supplier billed for, the Medicare-approved amount, how much Medicare paid, and what you must pay.

How much money can you put aside for burial?

Up to $1,500 for burial expenses if you have put that money aside

Can you get help paying Medicare premiums?

You can get help from your state paying your Medicare premiums. In some cases, Medicare Savings Programs may also pay

Can you be charged for Medicare deductibles?

If you get a bill for Medicare charges: Tell your provider or the debt collector that you’re in the QMB Program and can’t be charged for Medicare deductibles, coinsurance, and copayments.

How does Medicare work?

Medicare works with private insurance companies to offer you ways to get your health care coverage. These companies can choose to offer a consumer-directed Medicare Advantage Plan, called a Medicare Medical Savings Account (MSA) Plan. This type of plan combines a high-deductible health insurance plan with a medical savings account that you can use to pay for your health care costs. Medicare MSA Plans give you freedom to control your health care dollars and provide you with important coverage against high health care costs.

What rights do you have with Medicare?

As a person with Medicare, you have certain rights. One of these is the right to a fair process to appeal decisions about your health care payment of services.

What is Medicare MSA?

Medicare MSA Plans (offered by private companies) are Medicare Advantage Plan options . Medicare MSA Plans are similar to Health Savings Account plans available outside of Medicare. If you choose a Medicare MSA Plan, you’re still in Medicare and you will still have Medicare rights and protections.

What is assignment in Medicare?

Assignment—An agreement by your doctor or other supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance.

What is MSA plan?

A MSA combines a high-deductible health plan and a special savings account that works like a Medicare version of a health savings account (HSA). At the beginning of the year, the MSA plan deposits into your account a lump sum from Medicare that remains tax free as long as you use the money to pay for qualified medical expenses. This type of plan will require you to keep track of your medical bills and out-of-pocket healthcare spending.

Does an annual deposit cover deductible?

Con: The annual deposit doesn’t cover the whole deductible, and you are expected to pay the difference out of pocket.

Is Medicare MSA tax free?

A Medicare MSA plan has tax benefits as well. If you spend the money on Medicare-covered Part A or Part B services or other qualified medical expenses, the funds — and any interest earned — are tax free. However, if you spend any of the cash on nonmedical expenses such as rent or travel, you’ll have to pay income tax on the amount you’ve spent, and you’ll also be hit with a 50% penalty.

Does MSA have deductible?

You already have health insurance that would cover the MSA plan deductible, such as employer-provided healthcare benefits or a union retiree healthcare plan.

Do you have to pay for MSA?

MSA plans typically don’t have a separate premium for you to pay, though some of them may. Regardless, you do have to pay the regular Medicare Plan B premium. To meet the high deductible, you can pay toward it with MSA funds or other money of your own. Once you’ve spent the MSA funds, you’ll pay out of pocket for any additional healthcare costs, at Medicare-approved rates, until you hit your deductible. After that, the plan pays for 100% of Medicare-covered services for the rest of the calendar year. Any funds remaining in the account at year end roll over to the next year.

Can MSA debit cards track expenses?

Some MSA plans provide you with a debit card. If you keep the money in the plan’s chosen account, its monthly statements will track your spending; you can also find out whether your expenses count toward your deductible. However, if you transfer it to a different savings account, you’ll be fully responsible for saving your healthcare receipts and keeping tabs on your spending.

Can MSA cancel my health insurance?

If you’re eligible now, keep in mind that certain actions or events could disqualify you. Your MSA insurer can cancel your plan if you begin getting health benefits through Medicaid, FEHBP, Tricare, or the VA. Your plan can also be canceled if you join an employer or union health plan that covers any portion of your deductible, if you move out of the plan’s service area, or if you stay outside that area for more than 6 months.