Is Medicare affected by the Affordable Care Act?

Medicare Premiums and Prescription Drug Costs The ACA closed the Medicare Part D coverage gap, or “doughnut hole,” helping to reduce prescription drug spending. It also increased Part B and D premiums for higher-income beneficiaries. The Bipartisan Budget Act (BBA) of 2018 modified both of these policies.

How does Obamacare affect Medicare Advantage plans?

The Marketplace won't affect your Medicare choices or benefits. No matter how you get Medicare, whether through Original Medicare or a Medicare Advantage Plan (like an HMO or PPO), you won't have to make any changes. IMPORTANTThe Marketplace doesn't offer Medicare supplement (Medigap) insurance or Part D drug plans.

How will ACA repeal affect Medicare?

Dismantling the ACA could thus eliminate those savings and increase Medicare spending by approximately $350 billion over the ten years of 2016- 2025. This would accelerate the insolvency of the Medicare Trust Fund.

Can you have Medicare and ACA at the same time?

Can I get a Marketplace plan in addition to Medicare? No. It's against the law for someone who knows that you have Medicare to sell you a Marketplace plan. This is true even if you have only Part A (Hospital Insurance) or only Part B (Medical Insurance).

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Is Medicare more expensive than Obamacare?

The average Medicare Part D plan premium in 2021 is $47.59 per month. The average Medicare Supplement Insurance plan premium in 2019 was $125.93 per month. The average Obamacare benchmark premium in 2021 is $452 per month.

How does the Affordable Care Act affect the elderly?

"The ACA expanded access to affordable coverage for adults under 65, increasing coverage for all age groups, races and ethnicities, education levels, and incomes."Under the ACA, older adults' uninsured rate has dropped by a third, indicators of their health and wellness have improved, and they're now protected from ...

Is Medicare Advantage the same as ObamaCare?

Medicare isn't part of the Affordable Care Act (ObamaCare) neither is supplemental Medigap insurance nor Medicare Advantage plans. You won't shop for your coverage through the marketplace. Instead, you'll want to follow the instructions under the “how to sign up for Medicare Advantage” section below.

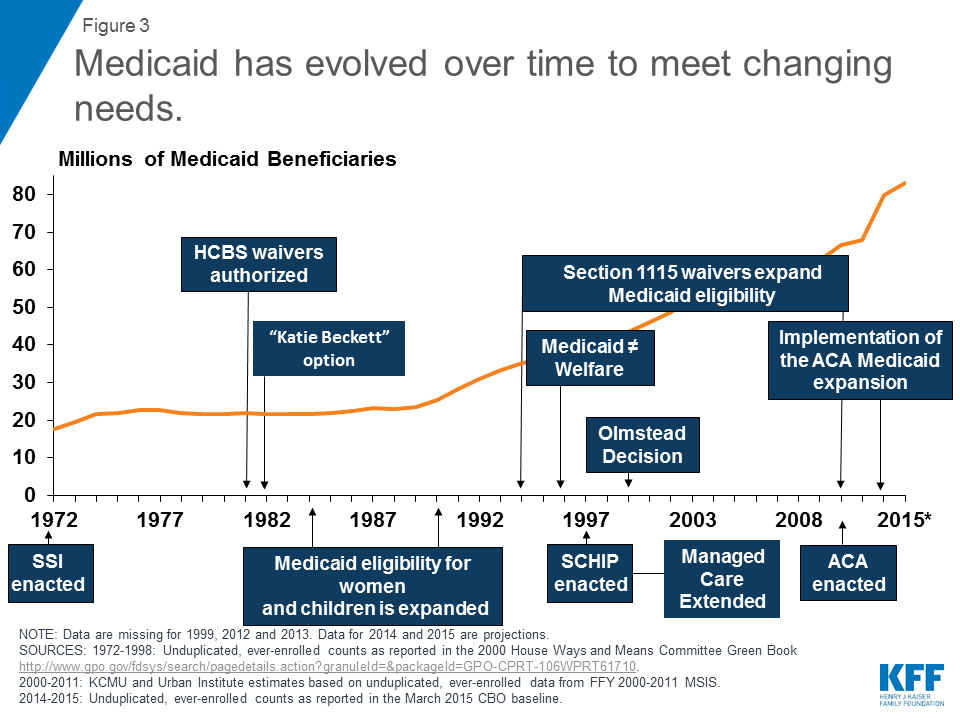

How did the ACA impact Medicaid?

Perhaps the most widely discussed change that the Patient Protection and Affordable Care Act (ACA, P.L. 111-148, as amended) made to Medicaid was expanding eligibility to adults with incomes up to 138 percent of the federal poverty level (FPL).

What happens to a couples premium with one turning 65 and on the Affordable Care Act with a subsidy?

Individual market plans no longer terminate automatically when you turn 65. You can keep your individual market plan, but premium subsidies will terminate when you become eligible for premium-free Medicare Part A (there is some flexibility here, and the date the subsidy terminates will depend on when you enroll).

Can I keep Obamacare instead of Medicare?

A: The law allows you to keep your plan if you want, instead of signing up for Medicare, but there are good reasons why you shouldn't. If you bought a Marketplace plan, the chances are very high that you do not have employer-based health care coverage.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Can I keep Obamacare instead of Medicare?

A: The law allows you to keep your plan if you want, instead of signing up for Medicare, but there are good reasons why you shouldn't. If you bought a Marketplace plan, the chances are very high that you do not have employer-based health care coverage.

What's the difference between Medicare and Obamacare?

What Is the Difference Between Medicare and Obamacare? Medicare is insurance provided by the federal government for people over the age of 65 and the disabled, and Obamacare is a set of laws governing people's access to health insurance.

What percent of Medicare Advantage plan funds must be spent on health care?

Because of the ACA, Medicare Advantage plans must spend at least 85 percent of their revenue on senior care rather than on profits or overhead.

What is the difference between medical and Obamacare?

The most important difference between Medicaid and Obamacare is that Obamacare health plans are offered by private health insurance companies while Medicaid is a government program (albeit often administered by private insurance companies that offer Medicaid managed care services).

How did the ACA reduce Medicare costs?

Cost savings through Medicare Advantage. The ACA gradually reduced costs by restructuring payments to Medicare Advantage, based on the fact that the government was spending more money per enrollee for Medicare Advantage than for Original Medicare. But implementing the cuts has been a bit of an uphill battle.

Why did Medicare enrollment drop?

When the ACA was enacted, there were expectations that Medicare Advantage enrollment would drop because the payment cuts would trigger benefit reductions and premium increases that would drive enrollees away from Medicare Advantage plans.

What is Medicare D subsidy?

When Medicare D was created, it included a provision to provide a subsidy to employers who continued to offer prescription drug coverage to their retirees, as long as the drug covered was at least as good as Medicare D. The subsidy amounts to 28 percent of what the employer spends on retiree drug costs.

How much will Medicare Part B cost in 2021?

In 2021, most Medicare Part B enrollees pay $148.50/month in premiums. But beneficiaries with higher incomes pay additional amounts – up to $504.90 for those with the highest incomes (individuals with income above $500,000, and couples above $750,000). Medicare D premiums are also higher for enrollees with higher incomes.

What percentage of Medicare donut holes are paid?

The issue was addressed immediately by the ACA, which began phasing in coverage adjustments to ensure that enrollees will pay only 25 percent of “donut hole” expenses by 2020, compared to 100 percent in 2010 and before.

How many people will be on Medicare in 2021?

However, those concerns have turned out to be unfounded. In 2021, there were 26 million Medicare Advantage enrollees, and enrollment in Advantage plans had been steadily growing since 2004.; Medicare Advantage now accounts for 42% of all Medicare beneficiaries. That’s up from 24% in 2010, which is the year the ACA was enacted (overall Medicare enrollment has been growing sharply as the Baby Boomer population ages into Medicare, but Medicare Advantage enrollment is growing at an even faster pace).

What is the medical loss ratio for Medicare Advantage?

This is the same medical loss ratio that was imposed on the private large group health insurance market starting in 2011, and most Medicare Advantage plans were already conforming to this requirement; in 2011, the average medical loss ratio for Medicare Advantage plans was 86.3%. The medical loss ratio rules remain in effect, but starting in 2019, the federal government has reduced the reporting burden for Medicare Advantage insurers.

How did the Affordable Care Act affect Medicare?

The Affordable Care Act also affected Medicare by adding coverage for a "Wellness Visit" and a “Welcome to Medicare” preventative visit. It also eliminated cost-sharing for almost all of the preventive services covered by Medicare.

What is the Affordable Care Act?

The Affordable Care Act provides ways for hospitals, doctors and other health care providers to coordinate their care for Medicare beneficiaries. As a result, health care quality is improved and unnecessary spending is reduced.

What are the initiatives under the Affordable Care Act?

Under these initiatives, your doctor may get additional resources that will help ensure that your treatment is consistent. The Affordable Care Act provides ways for hospitals, doctors and other health care providers to coordinate their care for Medicare beneficiaries. As a result, health care quality is improved and unnecessary spending is reduced.

How much does Medicare pay for generic drugs?

In 2016, people with Medicare paid 45% for brand-name drugs and 58% for generic drugs while in the coverage gap. These percentages have shrunk over the last few years. Starting in 2020, however, you’ll pay only 25% for covered brand-name and generic drugs during the coverage gap.

How long does Medicare cover preventive visits?

This is a one-time visit. During the visit, your health care provider will review your health, as well as provide education and counseling about preventive services and other care.

How long does it take to sign up for Medicare?

You will get an initial enrollment period to sign up for Medicare. In most cases, the initial enrollment period begins three months before your 65th birthday and ends three months afterward. For most people, it’s beneficial to sign up for Medicare during this time. This is because those who sign up for Medicare after the initial enrollment period ends, face some negative consequences. For example, you might be required to pay a Part B (medical insurance) late enrollment penalty for as long as you have Medicare. Also, you are only permitted to enroll in Medicare Part B (and Part A in some cases) during the Medicare general enrollment period that runs from January 1 to March 31 each year. However, coverage will not begin until July of that year. This could create a gap in your insurance coverage.

When will Medicare be extended?

Under the Affordable Care Act, the Medicare Trust fund will be extended to at least the year 2029. This is a 12-year extension that is primarily the result of a reduction in waste, fraud, and abuse, as well as Medicare costs.

How does the Medicare law affect hospitals?

It also penalizes hospitals with too many readmissions of Medicare patients who have heart attacks , heart failure or pneumonia within 30 days of a hospital stay.

How much will Medicare be reduced?

The nonpartisan Congressional Budget Office estimated that Medicare spending would be reduced by $716 billion over 10 years, mainly because the law puts the brakes on annual increases in Medicare reimbursement for Medicare Advantage, hospital costs, home health services, hospices and skilled nursing services.

How many states have Medicare cut doctors?

The American Medical Association says that in at least 11 states, Medicare Advantage plans have cut thousands of physicians. Critics worry that more doctors may stop taking Medicare patients or that patients will face lengthy waits for appointments or other changes.

How much less will Medicare get in 2022?

Other cuts include $66 billion less for home health, $39 billion less for skilled nursing services and $17 billion less for hospice care — all by 2022. Medicare costs will still grow, just more slowly than they would without the ACA. But some experts predict that beneficiaries will feel ...

What is Medicare Advantage?

About three in 10 Medicare beneficiaries are enrolled in Medicare Advantage options, which are premium insurance plans that often include dental, vision and drug insurance. These plans have been subsidized by the federal government for years. The ACA is simply aiming to equalize costs, according to its proponents.

Did Medicare change before the law?

Insurers changed Medicare Advantage plans before the law, and they're still changing them, he says. "Overall, seniors are not paying that much more, and more people are still enrolling in Medicare Advantage plans," says Gruber, who advised the Obama administration on the ACA.

Is the ACA good for Medicare?

But Henry J. Aaron of the Brookings Institution, a liberal think tank, insists that "the ACA is unalloyed good news" for Medicare beneficiaries because it improves the financial health of Medicare Part A, the hospital insurance program.

What happens if you don't enroll in Medicare at 65?

Even worse, if you fail to enroll in Medicare at age 65 because you choose to keep your Obamacare plan instead, you will later owe a Part B late enrollment penalty that will stay with you for as long as you remain enrolled in Medicare. It’s a 10% penalty per year for every year that you could have been enrolled in Medicare (at 65).

What happens if you miss your window to switch to Medicare?

If you miss your window to switch to Medicare, the federal government will catch up to you soon enough. When it finds that you should have moved to Medicare at age 65, it will assess you a fine to make you pay back any subsidy dollars that you have received toward your ACA coverage since you turn 65.

How long do you have to wait to cancel ACA?

Don’t be tempted to gamble with your health by cancelling your ACA plan early. If you have more than a 63-day window between when your ACA plan ends and your Medicare begins, then when you enroll in a Medigap plan, they can impose a waiting period for pre-existing conditions.

How much is the penalty for Medicare if you wait two years?

It’s a 10% penalty per year for every year that you could have been enrolled in Medicare (at 65). So if you waited two years, your would pay a 20% higher monthly premium for Part B for the rest of your life. This can be disappointing news if you’ve been getting your ACA plan very inexpensively due to a subsidy.

What is Medicare Supplement Plan G?

Coverage from Medicare and a Medicare Supplement Plan G would give you comprehensive benefits where you will pay nothing but the Part B deductible for Medicare-approved services and your monthly premiums.

Does ACA cover Medicare?

Your ACA coverage was never meant to replace Medicare. If you do not sign up for Medicare during your Initial Enrollment Period, you will be subject to substantial penalties when you later enroll in Medicare.

Can you cancel ACA coverage once you join Medicare?

So if you are enrolled in either an ACA plan or a short term medical plan, you’ll likely want to cancel that coverage once you join Medicare. Many people use short-term health insurance plans to bridge the gap between when their employer coverage ends and when they turn 65 and become eligible for Medicare.

What is Medicare Advantage?

Medicare Advantage, also called Part C, is another way to get your Original Medicare (Part A and Part B) benefits through a private insurance company approved by Medicare. Medicare Advantage plans got their name in 2003 with the passage of the Medicare Modernization Act (MMA).

How many people will be enrolled in Medicare Advantage in 2020?

Since 2014, Medicare Advantage enrollments have increased, while premiums have decreased. In 2020, about 39% of Medicare beneficiaries (24.4 million) were enrolled in Medicare Advantage plans, according to the Centers for Medicare & Medicaid Services (CMS). This is a marked increase since 2009, pre-Obamacare, when Medicare Advantage enrollment was about 23% of Medicare beneficiaries (10.5 million) according to the Kaiser Family Foundation.

How long do you have to enroll in Medicare Advantage?

You can enroll in Medicare Advantage during your 7-month Medicare Initial Enrollment Period. This enrollment period: 1 Begins three months before you turn 65 2 Includes the month of your 65th birthday 3 Lasts for three months after your turn 65.

How much is the average health insurance premium in 2020?

The average premium overall (all ages) for a health insurance plan under the Affordable Care Act was $484 in 2020, eHealth reported. The average Medicare Advantage premium in an eHealth survey was $5 per month.

How to contact Medicare by phone?

You can enter your zip code on this page to get started. Call Medicare at 1-800-MEDICARE (1-800-633-4227) . TTY users should call 1-877-486-2048. Medicare representatives are available 24 hours a day, seven days a week.

When does Medicare disability end?

Includes the 25th month of getting disability benefits. Ends three months after your 25th month of getting disability benefits. Learn about the other time periods when you may be able to sign up for a Medicare Advantage plan.

Is Medicare Advantage still affordable?

Medicare Advantage plans may still be affordable despite Obamacare cuts. According to the Centers for Medicare & Medicaid Services (CMS), the estimated average premium for a Medicare Advantage plan is $21 a month in 2021. In fact, Medicare Advantage premiums have been going down year by year, CMS reports.

What are the benefits of the ACA?

Medicare Benefit Improvements. The ACA included provisions to improve Medicare benefits by providing free coverage for some preventive benefits , such as screenings for breast and colorectal cancer, cardiovascular disease, and diabetes, and closing the coverage gap (or “doughnut hole”) in the Part D drug benefit by 2020.

Why is the ACA important?

The Medicare provisions of the ACA have played an important role in strengthening Medicare’s financial status for the future, while offsetting some of the cost of the coverage expansions of the ACA and also providing some additional benefits to people with Medicare.

What would happen if Medicare spending increased?

The increase in Medicare spending would likely lead to higher Medicare premiums, deductibles, and cost sharing for beneficiaries, and accelerate the insolvency of the Medicare Part A trust fund. Policymakers will confront decisions about the Medicare provisions in the ACA in their efforts to repeal and replace the law.

How much will Medicare increase over 10 years?

Increase Part A and Part B spending. CBO has estimated that roughly $350 billion 3 of the total $802 billion in higher Medicare spending over 10 years could result from repealing ACA provisions that changed provider payment rates in traditional Medicare.

What is CMS in Medicare?

Through a new Center for Medicare & Medicaid Innovation (CMMI, or Innovation Center) within the Centers for Medicare & Medicaid Services (CMS), the ACA directed CMS to test and implement new approaches for Medicare to pay doctors, hospitals, and other providers to bring about changes in how providers organize and deliver care. The ACA authorized the Secretary of Health and Human Services to expand CMMI models into Medicare if evaluation results showed that they either reduced spending without harming the quality of care or improved the quality of care without increasing spending. CMMI received an initial appropriation of $10 billion in 2010 for payment and delivery system reform model development and evaluation, and the ACA called for additional appropriations of $10 billion in each decade beginning in 2020.

How much will Medicare save in 2026?

Increase Medicare spending over time, in the absence of the Board’s cost-reducing actions. CBO projects Medicare savings of $8 billion as a result of the IPAB process between 2019 and 2026. 12

What would be expected from repealing the ACA?

Repealing the ACA’s Medicare benefit improvements would be expected to: Reduce Medicare Part B spending for preventive services and reduce Part D spending on costs in the coverage gap. Increase beneficiary cost sharing for Part B preventive benefits.

Why were people over 64 excluded from the ACA?

Individuals older than 64 years were excluded because the ACA was not intended to affect their health care coverage. Our sample starts in 2011 because this is the first year in which the BRFSS included cell phones in its sampling frame. A 2011-2016 sample period gives us 3 years of pretreatment data and 3 years of posttreatment data.

What effect did the third year of the health insurance policy have on the health insurance coverage?

We find that gains in health insurance coverage and access to care from the policy continued to increase, while an improvement in the probability of reporting excellent health emerged in the third year, with the effect being largely driven by the non-Medicaid expansions components of the policy .

How long did the Affordable Care Act last?

While the Affordable Care Act (ACA) increased insurance coverage and access to care after 1 (2014) or 2 (2014-2015) postreform years, the existing causally interpretable evidence suggests that effects on self-assessed health outcomes were not as clear after 2 years.

How many variables are used in the outcome of a health care study?

We utilize 9 outcome variables. The first 3 relate to access to care: indicators for any health insurance coverage, having a primary care doctor, and having any care needed but foregone because of cost in the past 12 months. The remaining outcomes relate to self-assessed health status. These include dummy variables for whether overall health is good or better (ie good, very good, or excellent), very good or excellent, and excellent, as well as days of the last 30 not in good mental health, not in good physical health, and with health-related functional limitations. Subjective self-assessed health variables such as these have been shown to be correlated with objective measures of health, including mortality.31-33

Which states have expanded Medicaid?

Pennsylvania, Indiana, and Alaska expanded Medicaid in January, February, and September of 2015, respectively. Montana and Louisiana expanded Medicaid in January and July of 2016, respectively. States are classified as part of the Medicaid expansion treatment group beginning the month/year of their expansion.

Does the ACA affect mental health?

With respect to self-assessed health, we find that the ACA increased the probability of reporting excellent health and reduced days in poor mental health. In contrast, a recent article with only 2 posttreatment years found no evidence of gains in these outcomes despite also using BRFSS data and the same identification strategy.18The emergence of an impact on the probability of having excellent self-assessed health appears particularly gradual, as the effect of the full ACA was small and insignificant in 2014, 1.9 percentage points in 2015, and 2.7 percentage points in 2016. Improvements in self-assessed health at lower points of the distribution also emerge in 2016. Most of these gains appear to come from the non-Medicaid-expansion components of the law.

How did the ACA help Medicare?

The ACA provided a regulatory framework for containing costs in Medicare by setting a per capita target for spending growth and creating a 15-member Independent Payment Advisory Board (IPAB) to develop a plan to reduce spending if that target is exceeded. What the board can recommend is constrained: by law, it cannot raise premiums, reduce benefits, or increase cost sharing, meaning that their recommendations are mostly confined to cuts in provider payments. The board’s proposals become law unless Congress explicitly overrides them. Spending did not exceed per capita targets in the ACA’s first three years, and therefore IPAB was not triggered. The IPAB currently has no members, which reflects a congressional majority strongly opposed to its existence. IPAB has been targeted for repeal on a bipartisan basis and is not likely to survive as a cost containment mechanism.

How did the ACA affect healthcare?

The ACA’s coverage expansion in 2014 spurred a spike in spending, as would be expected. These provisions allowed millions of people to get health insurance through the exchanges and through Medicaid expansion. Health care costs increased by 5.3 percent in 2014, from a low of 2.9 percent in 2013. The Office of the CMS Actuary estimated that increased use of health care services accounted for nearly 40 percent of the increase in per-capita health spending. Health costs grew by 5.8 percent in 2015, and preliminary estimates by the Altarum Institute indicate a steady growth rate of 5.4 percent over 2015.

How does the Affordable Care Act affect health care costs?

While the Affordable Care Act (ACA) has been largely defined by its coverage expansions, its authors recognized the need to include mechanisms to slow the growth of health care costs. The law’s provisions took aim at Medicare spending and to a lesser extent, factors that affect costs in the individual and group private market. To understand the law’s impact and potential to “bend the cost curve,” it is important to isolate the effects of the ACA from those attributable to the economic recession and recovery. Although the ACA’s future is in doubt, cost containment will remain a key ingredient of any health reform effort. In this brief, we discuss key ACA provisions and their effects on containing overall cost growth and the cost of ACA-related gains in coverage.

How did the ACA save money?

One of the most immediate and direct ways that the ACA produced savings was through reductions in provider payment updates and Medicare Advantage (MA) payments. Prior to the ACA, payments to MA plans were 14 percent higher than the cost of covering similar beneficiaries under the traditional Medicare program, according to the Medicare Payment Advisory Commission. The ACA reduced payments to MA plans over six years, and by 2016, payments to MA plans were just two percent higher than costs in the traditional Medicare program. Although critics were concerned that these cuts would mean that plans withdrew from the program, according to Kaiser Family Foundation, enrollment actually increased from 24 percent in 2009 to 31 percent in 2016. The payment reductions produced short-term federal savings of $68 billion between 2011 and 2016.

What is the ACA regulation?

These include a prohibition on lifetime and annual caps on coverage, a mandate to cover “essential health benefits,” premium rate review, and the Medical Loss Ratio (MLR) provision, which required insurers to provide a customer rebate if they spend too high a percentage of premium dollars on non-medical expenditures . It is difficult to tease out the countervailing effects of these regulations on health care costs, especially because the provisions affect the individual, small group, and large group markets differently.

What are some examples of ACA?

Some of the most prominent examples include the Hospital Readmissions Reduction Program (HRRP); Accountable Care Organizations (ACOs) through the Medicare Shared Savings Program and Pioneer Program; primary care medical homes; and bundled payment models. This emphasis on moving to value-based reimbursement dovetails with changes in the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), which mandated that Medicare move from fee-for-service to alternative payment models, such as those with risk-sharing arrangements or reimbursement tied to quality measures.

How did rate review affect health care?

In the individual market, premium rate reviews were an explicit mechanism to restrain premium increases and keep costs down. An early analysis by Kaiser Family Foundation of the rate review provision found that 20 percent of filings resulted in lower premium increases due to the rate review process. On average, premium rate increases were 1.4 percentage points lower than originally requested. Another analysis by the Department of Health and Human Services found that in 2013, rate review reduced premiums in the individual and small-group markets by almost $1 billion. The actual effects on health care costs, however, is unknown, given that insurers could have inflated premium increase requests above what would have been present in the absence of the provision.

When does Medicare coverage take effect?

If you complete the enrollment process during the three months prior to your 65th birthday, your Medicare coverage takes effect the first of the month you turn 65 ( unless your birthday is the first of the month ). Your premium subsidy eligibility continues through the last day of the month prior to the month you turn 65.

What happens if you don't sign up for Medicare?

And if you keep your individual market exchange plan and don’t sign up for Medicare when you first become eligible, you’ll have to pay higher Medicare Part B premiums for the rest of your life, once you do enroll in Medicare, due to the late enrollment penalty.

How long does it take to get Medicare if you are not receiving Social Security?

If you’re not yet receiving Social Security or Railroad Retirement benefits, you’ll have a seven-month window during which you can enroll in Medicare, which you’ll do through the Social Security Administration. Your Medicare card will be sent to you after you enroll. Your enrollment window starts three months before the month you turn 65, ...

When does Medicare subsidy end?

The short story is that if you enroll in Medicare during the first four months of your initial enrollment window, your transition to Medicare will be seamless, with subsidy eligibility continuing through the last day of the month prior to the month that your Medicare coverage begins. If you enroll in Medicare during the final three months of your initial enrollment period, your premium subsidy will likely end before your Part B coverage begins, although your Part A coverage should be backdated to the month you turned 65. And if you don’t enroll in Medicare at all during your initial enrollment window, your premium subsidies will end a few months after you turn 65. Here are the details:

When will Medicare be enrolled in Social Security?

Here are the details: If you’re already receiving retirement benefits from Social Security or the Railroad Retirement Board, you’ll automatically be enrolled in Medicare with an effective date of the first of the month that you turn 65. As is the case for people who enroll prior to the month they turn 65, premium subsidy eligibility ends on ...

When will Medicare be sent to you?

Your Medicare card will be sent to you after you enroll. Your enrollment window starts three months before the month you turn 65, includes the month you turn 65, and then continues for another three months. (Note that you’ll need to enroll during the months prior to your birth month in order to have coverage that takes effect the month you turn 65.

When will Medicare be sent out to my 65 year old?

If you’re already receiving Social Security or Railroad Retirement benefits, the government will automatically enroll you in Medicare Part A the month you turn 65, with your Medicare card arriving in the mail about three months before you turn 65. If you’re not yet receiving Social Security or Railroad Retirement benefits, ...