The ACA’s Impact on Medicare Among other benefits, the Affordable Care Act (ACA) helps individuals on Medicare to save money with preventative care and brand-name drugs. Starting in January 2014, Medicare began covering many preventative services with no out-of-pocket expense.

How does ACA affect Medicare?

- “Keep your hands off my Medicare.”. There is perhaps no quote more memorable – nor more contentious – from the battle over the Affordable Care Act (aka Obamacare ).

- Cost savings through Medicare Advantage. ...

- Focus on prescription drugs. ...

- Higher premiums for higher-income enrollees. ...

- Free preventive services. ...

- New funding for Medicare. ...

- Cost containment. ...

How did ACA affect Medicare?

- Payments to Health Care Providers. ...

- Payments to Medicare Advantage Plans. ...

- Medicare Benefit Improvements. ...

- Revenues to the Medicare Trust Funds. ...

- Medicare Part B and Part D Premiums for Higher-Income Beneficiaries. ...

- Payment and Delivery System Reforms and New Quality Incentives. ...

- Independent Payment Advisory Board. ...

How will ACA repeal affect Medicare?

Here are three key effects that a repeal of the ACA would have: Higher spending on Medicare Part A and Part B, leading to higher premiums, deductibles and copayments for beneficiaries. The Congressional Budget Office estimates that the ACA reduced Medicare spending by $350 billion over 10 years just by changing how providers are paid.

What are the pros and cons of ACA?

The ACA Has 10 Sections in All, and Most Do More Than Provide Insurance

- It created the National Prevention Council that coordinates all federal health efforts to promote active, drug-free lifestyles.

- It funds scholarships and loans to double the number of healthcare providers in five years.

- It cuts down on fraudulent doctor/supplier relationships.

How will ACA repeal affect Medicare?

Dismantling the ACA could thus eliminate those savings and increase Medicare spending by approximately $350 billion over the ten years of 2016- 2025. This would accelerate the insolvency of the Medicare Trust Fund.

How does the Affordable Care Act Impact Medicare?

Medicare Premiums and Prescription Drug Costs The ACA closed the Medicare Part D coverage gap, or “doughnut hole,” helping to reduce prescription drug spending. It also increased Part B and D premiums for higher-income beneficiaries. The Bipartisan Budget Act (BBA) of 2018 modified both of these policies.

Is Medicare considered under the Affordable Care Act?

Obamacare's expanded Medicare preventive coverage applies to all Medicare beneficiaries, whether they have Original Medicare or a Medicare Advantage plan.

Is Medicare included in the ACA?

Medicare Benefit Improvements The ACA included provisions to improve Medicare benefits by providing free coverage for some preventive benefits, such as screenings for breast and colorectal cancer, cardiovascular disease, and diabetes, and closing the coverage gap (or “doughnut hole”) in the Part D drug benefit by 2020.

What is the Medicare donut hole?

This refers to a temporary limit on prescription drug coverage, where the policy holder needs to pay a higher percentage of his or her medications after reaching this limit.

What is the impact of the Affordable Care Act on Medicare?

Among other benefits, the Affordable Care Act (ACA) helps individuals on Medicare to save money with preventative care and brand-name drugs. Starting in January 2014, Medicare began covering many preventative services with no out-of-pocket expense. This coverage includes an annual wellness visit ...

When will Medicare Part D donut hole close?

Medicare recipients will see some changes in their out-of-pocket expenses as the Medicare Part D donut hole is incrementally lowered to finally “close” in the year 2020. At that time, Medicare recipients will pay 25 percent of the drug cost.

Is Medicare considered a dual insurance?

If you are “Dual Eligible,” generally Medicare would be billed first or considered your primary insurance, and then Medicaid would be billed for the balance acting as a secondary insurance. Please contact your local Department of Human Resources to determine if you qualify.

What is the donut hole?

The donut hole (also called the Part D coverage gap) was the coverage phase you'd enter when you and your Medicare Part D prescription drug plan paid a specific amount during the year for covered prescription drugs. After you'd reached this amount ($4,020 in 2020), 1 you'd pay more out of pocket for drugs.

What is the Affordable Care Act?

The Affordable Care Act provides ways for hospitals, doctors and other health care providers to coordinate their care for Medicare beneficiaries. As a result, health care quality is improved and unnecessary spending is reduced.

How long will the Medicare Trust fund be extended?

The Affordable Care Act Ensures the Protection of Medicare for Future Years. Under the Affordable Care Act, the Medicare Trust fund will be extended to at least the year 2029. This is a 12-year extension that is primarily the result of a reduction in waste, fraud, and abuse, as well as Medicare costs.

How did the Affordable Care Act affect Medicare?

The Affordable Care Act also affected Medicare by adding coverage for a "Wellness Visit" and a “Welcome to Medicare” preventative visit. It also eliminated cost-sharing for almost all of the preventive services covered by Medicare.

What are the initiatives under the Affordable Care Act?

Under these initiatives, your doctor may get additional resources that will help ensure that your treatment is consistent. The Affordable Care Act provides ways for hospitals, doctors and other health care providers to coordinate their care for Medicare beneficiaries. As a result, health care quality is improved and unnecessary spending is reduced.

How much does Medicare pay for generic drugs?

In 2016, people with Medicare paid 45% for brand-name drugs and 58% for generic drugs while in the coverage gap. These percentages have shrunk over the last few years. Starting in 2020, however, you’ll pay only 25% for covered brand-name and generic drugs during the coverage gap.

How long does Medicare cover preventive visits?

This is a one-time visit. During the visit, your health care provider will review your health, as well as provide education and counseling about preventive services and other care.

How does the Medicare law affect hospitals?

It also penalizes hospitals with too many readmissions of Medicare patients who have heart attacks , heart failure or pneumonia within 30 days of a hospital stay.

How many states have Medicare cut doctors?

The American Medical Association says that in at least 11 states, Medicare Advantage plans have cut thousands of physicians. Critics worry that more doctors may stop taking Medicare patients or that patients will face lengthy waits for appointments or other changes.

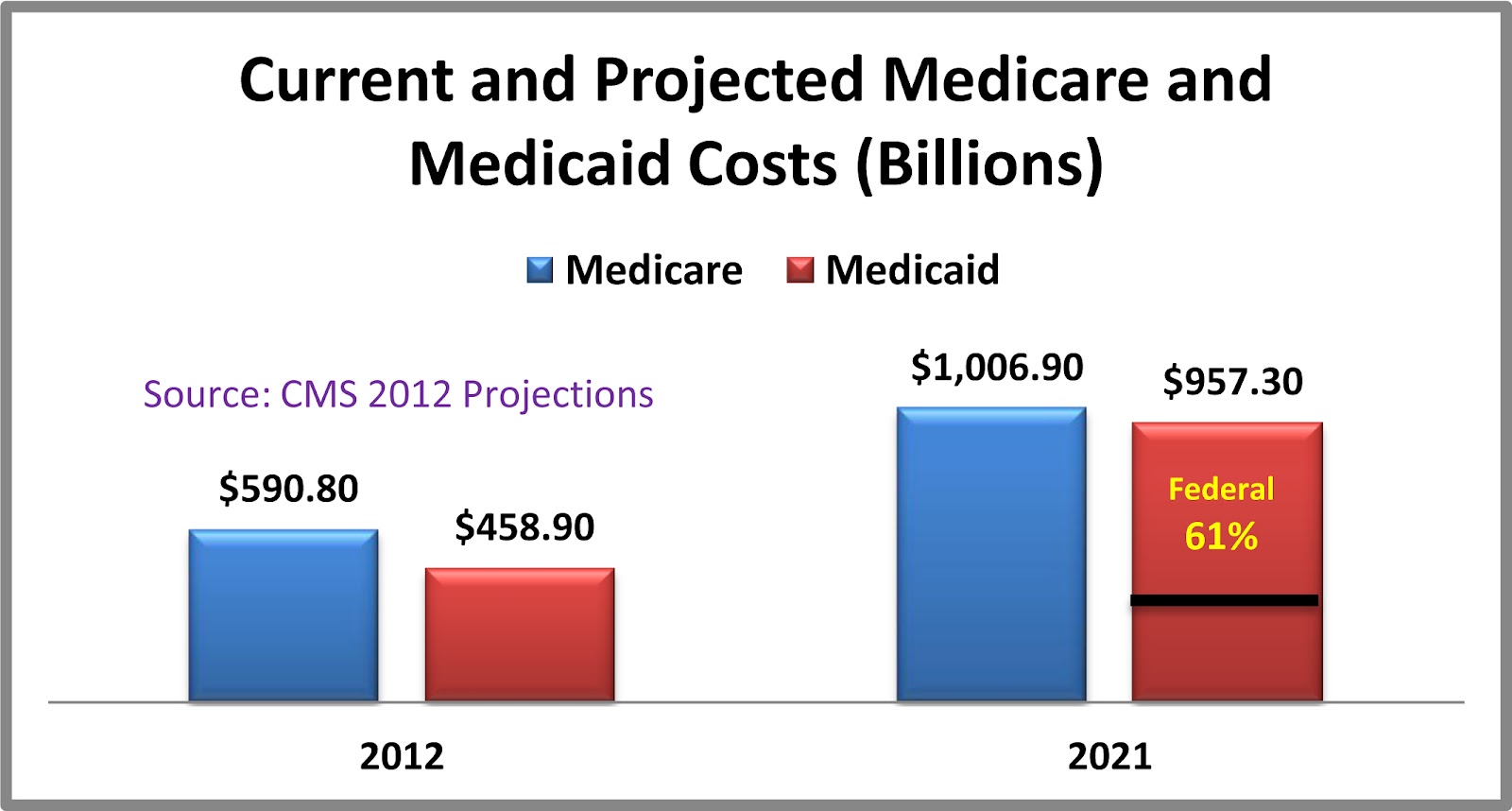

How much less will Medicare get in 2022?

Other cuts include $66 billion less for home health, $39 billion less for skilled nursing services and $17 billion less for hospice care — all by 2022. Medicare costs will still grow, just more slowly than they would without the ACA. But some experts predict that beneficiaries will feel ...

How much will Medicare be reduced?

The nonpartisan Congressional Budget Office estimated that Medicare spending would be reduced by $716 billion over 10 years, mainly because the law puts the brakes on annual increases in Medicare reimbursement for Medicare Advantage, hospital costs, home health services, hospices and skilled nursing services.

What is Medicare Advantage?

About three in 10 Medicare beneficiaries are enrolled in Medicare Advantage options, which are premium insurance plans that often include dental, vision and drug insurance. These plans have been subsidized by the federal government for years. The ACA is simply aiming to equalize costs, according to its proponents.

Will Medicare increase in 2026?

Medicare costs continue to grow more rapidly than Medicare income, though, and that makes the ACA's goal of controlling the rate of growth in health care spending critical, he says. The health law has extended the life of the Part A hospital insurance trust fund to 2026, the Medicare trustees reported in May.

Can Medicare Advantage plan reduce dental insurance?

There are only a few ways Medicare Advantage plans can cope with reductions in payments, says Wilensky, the former Medicare chief. "They can reduce some of the optional benefits, such as vision or dental coverage. They can raise premiums. And they can also tighten their physician networks," she says.

Why is BRFSS important?

The BRFSS is a commonly used data source in the ACA literature because it includes a number of questions related to health care access and self-assessed health. In addition, it is large enough to precisely estimate the effects of state policy interventions, with over 300 000 observations per year.

How long did the Affordable Care Act last?

While the Affordable Care Act (ACA) increased insurance coverage and access to care after 1 (2014) or 2 (2014-2015) postreform years, the existing causally interpretable evidence suggests that effects on self-assessed health outcomes were not as clear after 2 years.

What happened in the third year of the Affordable Care Act?

Second, an improvement in the probability of reporting excellent health emerged in the third year, with the effect being largely driven by the non-Medicaid expansions components of the policy.

Which states have expanded Medicaid?

Pennsylvania, Indiana, and Alaska expanded Medicaid in January, February, and September of 2015, respectively. Montana and Louisiana expanded Medicaid in January and July of 2016, respectively. States are classified as part of the Medicaid expansion treatment group beginning the month/year of their expansion.

What happens if you don't enroll in Medicare at 65?

Even worse, if you fail to enroll in Medicare at age 65 because you choose to keep your Obamacare plan instead, you will later owe a Part B late enrollment penalty that will stay with you for as long as you remain enrolled in Medicare. It’s a 10% penalty per year for every year that you could have been enrolled in Medicare (at 65).

How long do you have to wait to cancel ACA?

Don’t be tempted to gamble with your health by cancelling your ACA plan early. If you have more than a 63-day window between when your ACA plan ends and your Medicare begins, then when you enroll in a Medigap plan, they can impose a waiting period for pre-existing conditions.

How much is the penalty for Medicare if you wait two years?

It’s a 10% penalty per year for every year that you could have been enrolled in Medicare (at 65). So if you waited two years, your would pay a 20% higher monthly premium for Part B for the rest of your life. This can be disappointing news if you’ve been getting your ACA plan very inexpensively due to a subsidy.

What happens if you miss your window to switch to Medicare?

If you miss your window to switch to Medicare, the federal government will catch up to you soon enough. When it finds that you should have moved to Medicare at age 65, it will assess you a fine to make you pay back any subsidy dollars that you have received toward your ACA coverage since you turn 65.

Can you lose your Social Security if you are already on ACA?

Second, if you are already taking Social Security and you dis-enroll from Part A, you could forfeit your Social Security benefits. Finally, the ACA plans are quite expensive compared to Medicare when you can no longer take advantage of the subsidy that has been reducing the price. In many cases, paying for Medicare Part A can still provide you ...

Does ACA cover Medicare?

Your ACA coverage was never meant to replace Medicare. If you do not sign up for Medicare during your Initial Enrollment Period, you will be subject to substantial penalties when you later enroll in Medicare.

Can you cancel ACA coverage once you join Medicare?

So if you are enrolled in either an ACA plan or a short term medical plan, you’ll likely want to cancel that coverage once you join Medicare. Many people use short-term health insurance plans to bridge the gap between when their employer coverage ends and when they turn 65 and become eligible for Medicare.