How does the Affordable Care Act affect Medicare?

Medicare and the Affordable Care Act 1 Preventative Services. The Affordable Care Act also affected Medicare by adding coverage for a "Wellness Visit" and a “Welcome to Medicare” preventative visit. 2 Wellness Visits. ... 3 Welcome to Medicare Visits. ... 4 Preventative Services. ...

How does the health insurance marketplace affect Medicare?

The Health Insurance Marketplace (or “Marketplace”), which was created under the Affordable Care Act, is designed to provide health insurance to people who don’t have coverage. The Marketplace does not affect Medicare choices or benefits. This is because Medicare is not part of the Marketplace.

How would repealing Obamacare affect Medicare spending?

It included the elimination of the tax penalty required for those who did not maintain health insurance, otherwise known as the individual mandate that served as the foundation of Obamacare. The Congressional Budget Office (CBO) estimated that a full repeal of the ACA would increase Medicare spending by $802 billion between 2016 and 2025. 1

How does Trumpcare affect Medicare spending?

Trumpcare and Medicare The Congressional Budget Office (CBO) estimated that a full repeal of the ACA would increase Medicare spending by $802 billion between 2016 and 2025. 1 The increased spending would center mostly around higher payments to health care providers and Medicare Advantage plans. Trumpcare in 2020

How does the ACA impact Medicare?

Medicare Premiums and Prescription Drug Costs The ACA closed the Medicare Part D coverage gap, or “doughnut hole,” helping to reduce prescription drug spending. It also increased Part B and D premiums for higher-income beneficiaries. The Bipartisan Budget Act (BBA) of 2018 modified both of these policies.

Is Medicare considered under the Affordable Care Act?

Obamacare's expanded Medicare preventive coverage applies to all Medicare beneficiaries, whether they have Original Medicare or a Medicare Advantage plan.

How will repealing Obamacare affect Medicare?

Dismantling the ACA could thus eliminate those savings and increase Medicare spending by approximately $350 billion over the ten years of 2016- 2025. This would accelerate the insolvency of the Medicare Trust Fund.

What is the difference between Obamacare and Medicare?

Main Differences Between Medicare and the ACA (Obamacare) In the simplest terms, the main difference between understanding Medicare and Obamacare is that Obamacare refers to private health plans available through the Health Insurance Marketplace while Original Medicare is provided through the federal government.

What would happen if Medicare ended?

Payroll taxes would fall 10 percent, wages would go up 11 percent and output per capita would jump 14.5 percent. Capital per capita would soar nearly 38 percent as consumers accumulated more assets, an almost ninefold increase compared to eliminating Medicare alone.

What is wrong with the ACA?

The ACA set standards for “affordability,” but millions remain uninsured or underinsured due to high costs, even with subsidies potentially available. High deductibles and increases in consumer cost sharing have chipped away at the affordability of ACA-compliant plans.

What would happen if the ACA was repealed?

The health insurance industry would be upended by the elimination of A.C.A. requirements. Insurers in many markets could again deny coverage or charge higher premiums to people with pre-existing medical conditions, and they could charge women higher rates.

How does a cap on medicaid affect Medicare?

A cap on Medicaid funding not only would affect low-income Medicare beneficiaries, it also could affect the Medicare program because of the close connections between Medicaid and Medicare. For example, reducing the availability of Medicaid-financed home care services that help people manage their complex health conditions could mean that more dually eligible individuals wind up in the hospital more often. Those costs would be borne by Medicare.

What was the average age for Medicaid spending in 2011?

In 2011, Medicaid spending for seniors over age 85 was, on average, more than double program spending for those ages 65 to 74. 5. Pressure to constrain care for low-income Medicare beneficiaries also would arise because the AHCA would let states cross-subsidize funding streams across populations. This means that states could use ...

What would the AHCA per capita cap do?

The AHCA’s Per Capita Caps Would Strain State Medicaid Spending. The AHCA’s Medicaid per capita caps would decouple the amount of federal financial support for Medicaid from actual costs, and provide up to a pre-set capped payment for the individuals enrolled.

Do not touch my Medicare?

While the bill that would repeal and replace the ACA—the American Health Care Act (AHCA)—does not include explicit changes to Medicare , the legislation could have a profound impact on the 11 million Medicare beneficiaries who also rely on Medicaid for key components of their care. Here’s a look at how the AHCA’s major changes in federal funding for Medicaid would affect low-income older adults and the Medicare program.

Does AHCA hurt Medicare?

Counsel, Manatt Health. Toplines. The AHCA could hurt 11 million Medicare enrollees and the Medicare program itself. The AHCA’s per capita Medicaid caps could lead to cuts in services for low-income Medicare enrollees. “Don’t touch my Medicare” has been a rallying cry in recent years, first as Congress considered health reform ...

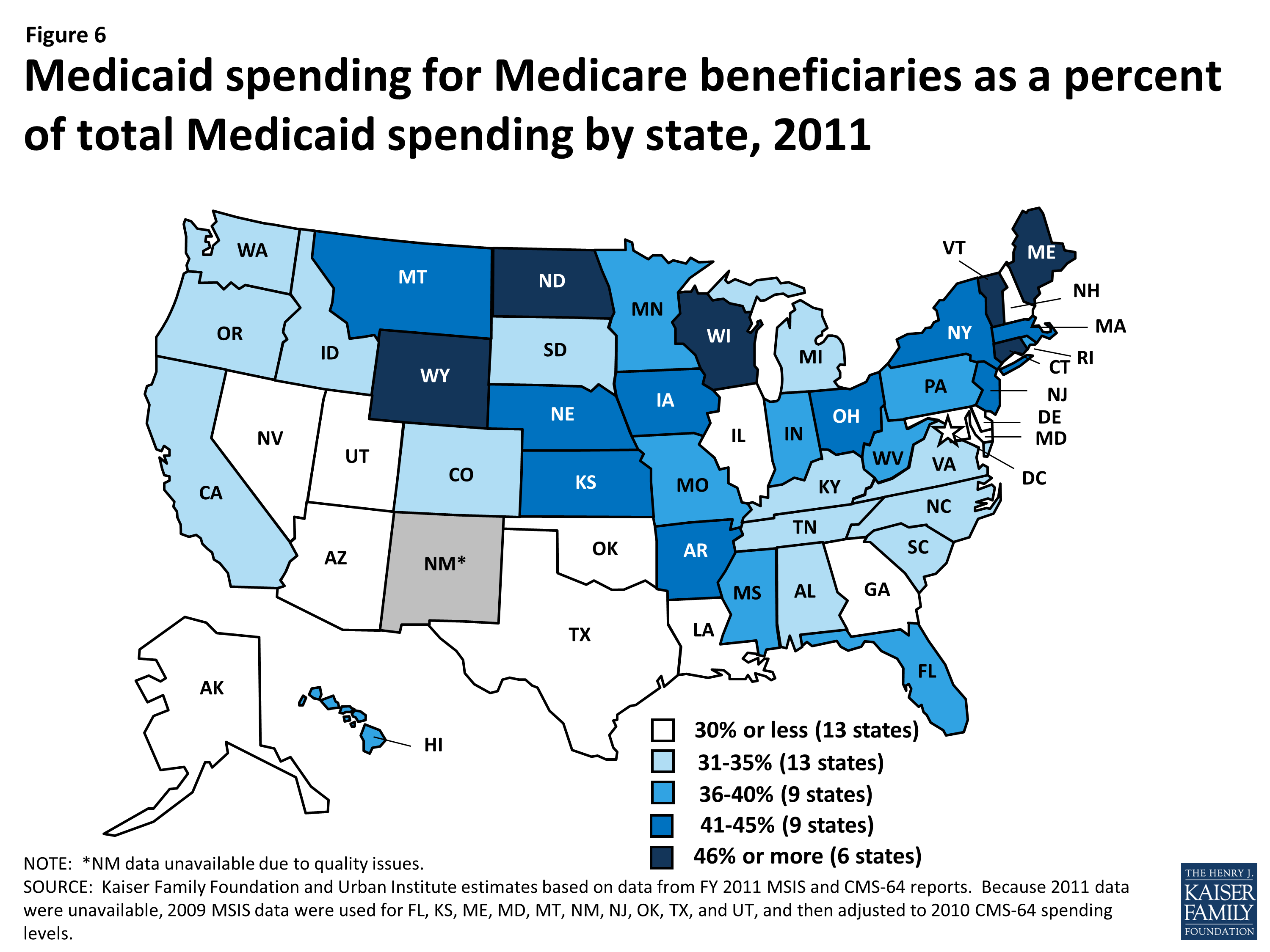

Is Medicaid a third of Medicare?

One-Third of All Medicaid Spending Is for People Covered by Medicare. Low-income Medicare beneficiaries who also are enrolled in Medicaid—often referred to as “dual eligibles”—could be disproportionately affected by congressional efforts to cut and cap federal Medicaid financing.

Tara O'Neill Hayes

Tara O'Neill Hayes is the Director of Human Welfare Policy at the American Action Forum.

Tara O'Neill Hayes

Tara O'Neill Hayes is the Director of Human Welfare Policy at the American Action Forum.

How much will the AHCA reduce the deficit?

The Congressional Budget Office (CBO) has released official estimates showing that the AHCA would reduce the deficit by $150 billion over ten years. The CBO further estimates that elimination of the individual and employer mandates under the AHCA will result in 14 million fewer people having health care coverage in 2018.

What is the AHCA tax credit?

The AHCA repeals the individual premium tax credits based on income and replaces them with tax credits based primarily on age. However, this new premium tax credit is phased out based on income (above $75,000 for individuals and above $150,000 for joint filers).

Can you purchase a wider variety of health plans?

Individuals could purchase a wider variety of plans but could unwittingly enroll in plans that lack the consumer protections in the qualified health plans, such as mandatory coverage for EHBs, maximum out-of-pocket limits, and prohibitions on annual and lifetime limits.

Is the House of Representatives moving forward with the AHCA?

At this time, the House is not moving forward with a vote on the AHCA.

Does the AHCA change Medicare?

● Medicare provisions.The AHCA does not change Medicare, but is estimated to cause the Medicare Trust Fund to become insolvent sooner than current law.

How did the Affordable Care Act affect Medicare?

The Affordable Care Act also affected Medicare by adding coverage for a "Wellness Visit" and a “Welcome to Medicare” preventative visit. It also eliminated cost-sharing for almost all of the preventive services covered by Medicare.

When does Medicare enrollment end?

In most cases, the initial enrollment period begins three months before your 65th birthday and ends three months afterward. For most people, it’s beneficial to sign up for Medicare during this time. This is because those who sign up for Medicare after the initial enrollment period ends, face some negative consequences.

What is the Affordable Care Act?

The Affordable Care Act provides ways for hospitals, doctors and other health care providers to coordinate their care for Medicare beneficiaries. As a result, health care quality is improved and unnecessary spending is reduced.

How long will the Medicare Trust fund be extended?

The Affordable Care Act Ensures the Protection of Medicare for Future Years. Under the Affordable Care Act, the Medicare Trust fund will be extended to at least the year 2029. This is a 12-year extension that is primarily the result of a reduction in waste, fraud, and abuse, as well as Medicare costs.

What are the initiatives under the Affordable Care Act?

Under these initiatives, your doctor may get additional resources that will help ensure that your treatment is consistent. The Affordable Care Act provides ways for hospitals, doctors and other health care providers to coordinate their care for Medicare beneficiaries. As a result, health care quality is improved and unnecessary spending is reduced.

How much does Medicare pay for generic drugs?

In 2016, people with Medicare paid 45% for brand-name drugs and 58% for generic drugs while in the coverage gap. These percentages have shrunk over the last few years. Starting in 2020, however, you’ll pay only 25% for covered brand-name and generic drugs during the coverage gap.

How long does Medicare cover preventive visits?

This is a one-time visit. During the visit, your health care provider will review your health, as well as provide education and counseling about preventive services and other care.

How did the ACA reduce Medicare costs?

Cost savings through Medicare Advantage. The ACA gradually reduced costs by restructuring payments to Medicare Advantage, based on the fact that the government was spending more money per enrollee for Medicare Advantage than for Original Medicare. But implementing the cuts has been a bit of an uphill battle.

Why did Medicare enrollment drop?

When the ACA was enacted, there were expectations that Medicare Advantage enrollment would drop because the payment cuts would trigger benefit reductions and premium increases that would drive enrollees away from Medicare Advantage plans.

How much does Medicare Part B cost in 2020?

Medicare D premiums are also higher for enrollees with higher incomes .

What is Medicare D subsidy?

When Medicare D was created, it included a provision to provide a subsidy to employers who continued to offer prescription drug coverage to their retirees, as long as the drug covered was at least as good as Medicare D. The subsidy amounts to 28 percent of what the employer spends on retiree drug costs.

What percentage of Medicare donut holes are paid?

The issue was addressed immediately by the ACA, which began phasing in coverage adjustments to ensure that enrollees will pay only 25 percent of “donut hole” expenses by 2020, compared to 100 percent in 2010 and before.

How many Medicare Advantage enrollees are there in 2019?

However, those concerns have turned out to be unfounded. In 2019, there were 22 million Medicare Advantage enrollees, and enrollment in Advantage plans had been steadily growing since 2004.; Medicare Advantage now accounts for well over a third of all Medicare beneficiaries.

How many Medicare Advantage plans will be available in 2021?

For 2021, there are 21 Medicare Advantage and/or Part D plans with five stars. CMS noted that more than three-quarters of all Medicare beneficiaries enrolled in Medicare Advantage plans with integrated Part D prescription coverage would be in plans with at least four stars as of 2021.

What are the features of the American Health Care Act?

Below is a brief summary of some of the American Health Care Act’s features. Elimination of the individual mandate. The individual mandate was the cornerstone of the ACA. Obamacare’s individual mandate required people to maintain at least a minimum level of health insurance or else face a tax penalty from the IRS.

How much will Medicare increase with repeal of the ACA?

Trumpcare and Medicare. The Congressional Budget Office (CBO) estimated that a full repeal of the ACA would increase Medicare spending by $802 billion between 2016 and 2025. 1. The increased spending would center mostly around higher payments to health care providers and Medicare Advantage plans.

What did Trumpcare do to prevent pre-existing conditions?

Remove protections for pre-existing conditions. The ACA prevented health insurers from charging higher premiums to people with pre-existing conditions. Trumpcare would have allowed states to obtain waivers for private insurance companies to charge people more for pre-existing conditions according to risk pools.

What is Trumpcare repeal?

May 10, 2019. Trumpcare is another name for the American Health Care Act, which aimed to repeal some aspects of Obamacare (Affordable Care Act, or ACA). Learn where it stands in 2019. When the subject of health care comes up, terms like “ Trumpcare ” and “ Obamacare ” often do too.

What is Trumpcare and Obamacare?

When the subject of health care comes up, terms like “ Trumpcare ” and “ Obamacare ” often do too. These names refer to enacted or attempted health care legislation under President Donald Trump and President Barack Obama, respectively. Trumpcare is most often associated with the American Health Care Act (AHCA), ...

Why was the Health Care Freedom Act dubbed the skinny repeal?

The Health Care Freedom Act (HCFA) was dubbed the “skinny repeal” because it aimed to only eliminate the individual and employer mandates included in Obamacare , as opposed to a complete repeal of the ACA. The HCFA was rejected in the Senate after three Republican senators (along with all Senate Democrats) voted against it.

What is BCRA in healthcare?

The Better Care Reconciliation Act (BCRA) was a revised edition of the AHCA and represented the second attempt at installing Trumpcare. This bill was similar to the AHCA but kept some of the features of Obamacare, such as tax provisions to help pay for low-income insurance premiums.

What is the AHCA bill?

The AHCA, referred to in this paper as “the bill,” replaces portions of the Affordable Care Act (ACA) through budget reconcilia tion. Some of the key provisions include an age adjusted tax credit available to consumers in the individual market, federal funds to help with consumer cost sharing on the individual market, and per capita caps for Medicaid or a state option to block grant Medicaid. [i], [ii] This report details the findings of the Center for Health and Economy (H&E) analysis – relying heavily on its Under-65 Microsimulation Model – of the proposal’s impact on health insurance coverage, provider access, medical productivity, and the federal budget. All impacts projected in this report are relative to H&E’s April 2017 baseline. [iii] As with all projections, the estimates are associated with some degree of uncertainty. The summary of our findings is as follows.

What are H&E premiums?

H&E health insurance premium estimates are based on five plan design categories offered in the Individual Market: Platinum, Gold, Silver, Bronze, and catastrophic. Under current law, the cost-sharing designs of the four metallic categories correspond to approximate actuarial values: 90 percent, 80 percent, 70 percent, and 60 percent, respectively. Catastrophic coverage plans refer to health insurance plans that reimburse medical expenses only after members meet a high deductible—a maximum of $7,150 for an individual under current law. When analyzing the impact of policy proposals on health insurance premiums, the particular plan designs for each category are not held constant. For example, a proposal to repeal the out-of-pocket maximum would allow insurance companies to offer catastrophic coverage plans with much higher deductibles. The bill categories are meant to roughly demarcate the range of plan options available. All premium estimates reflect health insurance prices without any financial assistance.

Does H&E have a budget analysis?

H&E does not attempt a comprehensive budgetary analysis. In its analysis of the bill’s impact on the federal budget, H&E looks only at provisions directly related to health insurance coverage. For plans that repeal the ACA—such as the AHCA—there are a number of tax policy changes that are not directly related to health insurance coverage and are thus not included in our budget impact analysis. Taxes like the medical device tax and the health insurers fee are examples of these types of tax policies that would be repealed along with the ACA, but are not directly related to health insurance coverage and for which, therefore, budgetary impact is not addressed.

How does the AHCA affect the economy?

In later years, reductions in support for health insurance cause negative economic effects.

What are the induced effects of health care?

In addition, there are induced effects that occur as health care employees or other businesses (and eventually their workers) use their income to purchase consumer goods like housing, transportation, or food, producing sales for a diverse range of businesses.

What is the purpose of the AHCA?

The AHCA is designed so that tax cuts take effect sooner than reductions in health insurance subsidies.

What is the effect of eliminating the tax penalty for individuals without health insurance?

Eliminating the tax penalty for individuals without health insurance reduces incentives to purchase insurance, raising the number of uninsured people.

How will health insurance affect the economy in 2026?

In later years, reductions in support for health insurance cause negative economic effects. By 2026, 924,000 jobs would be lost, gross state products would be $93 billion lower, and business output would be $148 billion less. About three-quarters of jobs lost (725,000) would be in the health care sector. States which expanded Medicaid would ...

How does the net effect affect the federal deficit?

The net effect initially raises the federal deficit. In 2018, the number of jobs would rise by 864,000 and state economies would grow. Health sector employment begins to fall immediately in 2018, with a loss of 24,000 jobs, and continues dropping to 725,000 health jobs lost by 2026 (Exhibit 3).

What states are losing jobs in health care?

Most job losses are in health care. In six states (Florida, Kentucky, Maine, Michigan, Ohio, and West Virginia) health care job losses begin in 2018, but all nine states have significant reductions in health employment by 2026.