You will pay the first $480 yourself (as the Medicare Part D

Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

Full Answer

How does a Medicare Part D plan work?

Medicare recipients who have a Medicare Part D Prescription Drug Plan, whether it’s standalone or within a Medicare Part C Medicare Advantage bundle, should consult their plan’s formulary for specific coverage information when it comes to blood pressure medication. Medicare Part D plans may charge copays according to the cost tier assigned to that medication.

What is Medicare Part D prescription drug coverage?

What Medicare Part D drug plans cover. Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site. Costs for Medicare drug coverage. Learn about the types of costs you’ll pay in a Medicare drug plan. How Part D works with other insurance. Learn about how ...

What is extra help Medicare Part D?

You will pay the first $480 yourself (as the Medicare Part D Plan deductible). After your deductible, you will pay 25% co-insurance towards all your prescription drug costs up to a total of $4,430. For example, let us assume that your total yearly prescription drug expenses are $4,680. (plus your monthly premiums for the Medicare Part D plan).

Why do I need Medicare Part B coverage?

May 16, 2022 · How Does Medicare Part D Work - Understanding how your Part D plan works will help you get the best rates on your prescription medications. ... Medigap Plan G; Medigap Plan N; About Us. The Medicare Minute TV Segment; The Medicare Help Desk Radio Show & Podcast; Contact; Medicare Explained. Medigap Plan G; Menu. Articles. Original Medicare ...

How Does Medicare Plan D work?

How does Medicare Part D reimbursement work?

What does plan d pay for?

What exactly does Medicare Part D cover?

What are the 4 phases of Part D coverage?

What is the max out of pocket for Medicare Part D?

Which Medicare Part D plan is best?

| Rank | Medicare Part D provider | Medicare star rating for Part D plans |

|---|---|---|

| 1 | Kaiser Permanente | 4.9 |

| 2 | UnitedHealthcare (AARP) | 3.9 |

| 3 | BlueCross BlueShield (Anthem) | 3.9 |

| 4 | Humana | 3.8 |

Are you automatically enrolled in Medicare Part D?

Do you have to pay for Medicare Part D?

What drugs are not covered by Medicare Part D?

- Drugs used to treat anorexia, weight loss, or weight gain. ...

- Fertility drugs.

- Drugs used for cosmetic purposes or hair growth. ...

- Drugs that are only for the relief of cold or cough symptoms.

- Drugs used to treat erectile dysfunction.

Why do Medicare Part D plans have different premiums?

What does Medicare D cost?

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is Medicare Part D?

Medicare Part D plans are like any insurance that provides lower-costing coverage for your prescription drugs. And like any other insurance coverage, you usually pay the plan a monthly premium, you may have an initial deductible that you must pay first before your insurance coverage begins to pay a portion of your drug costs, ...

How many parts of Medicare Part D 2022?

The following information describes how the basic or model 2022 Medicare Part D prescription drug plan is separated into four main parts. Depending on your prescription drug needs, you may only go into one or two parts of your Part D coverage (and if you spend over $7,050 in prescription drugs you might go into all four parts of your Part D coverage):

What happens when you meet your initial coverage limit?

Once you meet your plan's Initial Coverage Limit, you will exit the Initial Coverage Phase and enter the Coverage Gap. (As a note, most people never leave their Medicare drug plan's Initial Coverage Phase). Part 3 - The Coverage Gap or Donut Hole - In this phase of coverage, you will receive a 75% discount on all formulary drugs ...

How much is a Part 1 deductible?

Part 1 - The Initial $480 Deductible - Some Medicare Part D prescription drug plans (PDP) and Medicare Advantage plans that provide drug coverage (MAPD) have an initial deductible that you must pay out-of-pocket before the start of your plan coverage (or before the start of your plan's cost-sharing). Many Medicare Part D plans (both PDPs and MAPDs) have a $0 deductible and provide "first dollar coverage" for your formulary prescriptions. You can see our Medicare Part D Plan Finder for examples of Medicare plans with different deductibles (just choose your state to see plans in your area). You may notice that some Medicare Part D plans have a "standard" Initial deductible, but the plans exempt low-costing drugs from the deductible, meaning your inexpensive generic drugs may be covered before you pay any of your deductible.

What is Part 2 of Medicare?

Part 2 - The Initial Coverage Phase - Once you meet your plans Initial Deductible (if any), your drug plan then provides cost-sharing coverage for formulary drugs. Cost-sharing is where you and your Medicare Part D plan share in the retail cost of covered drugs with co-insurance (a percentage of retail, such as 25%) or co-payment ...

What is the catastrophic coverage phase?

Part 4 - The Catastrophic Coverage Phase - When a person has spent more than $7,050 for prescription medications, they will be protected by Catastrophic Coverage - here the cost of medications is substantially reduced to about 5% of the retail drug price. When a person reaches Catastrophic Coverage, they will remain in this coverage area through the end of the year (December 31st).

Does Medicare Part D have a deductible?

Many Medicare Part D plans (both PDPs and MAPDs) have a $0 deduct ible and provide "first dollar coverage" for your formulary prescriptions. You can see our Medicare Part D Plan Finder for examples of Medicare plans with different deductibles (just choose your state to see plans in your area).

What is Medicare program?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs , like premiums, deductibles, and coinsurance. with your prescription drug costs. If you don't join a plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What is a copayment for Medicare?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. for each drug. If you don't join a drug plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

Can you keep a Medigap policy?

Medigap policies can no longer be sold with prescription drug coverage, but if you have drug coverage under a current Medigap policy, you can keep it . If you join a Medicare drug plan, your Medigap insurance company must remove the prescription drug coverage under your Medigap policy and adjust your premiums. Call your Medigap insurance company for more information.

Is Medicare a creditable drug?

It may be to your advantage to join a Medicare drug plan because most Medigap drug coverage isn't creditable. You may pay more if you join a drug plan later.

Can you join Medicare with meds by mail?

This is a comprehensive health care program in which the Department of Veterans Affairs shares the cost of covered health care services and supplies with eligible beneficiaries. You may join a Medicare drug plan, but if you do, you won’t be able to use the Meds by Mail program which can give your maintenance drugs to you at no charge (no premiums, deductibles, and copayments). For more information, visit va.gov/communitycare/programs/dependents/champva/ or call CHAMPVA at 800-733-8387.

Does Medicare help with housing?

, you won't lose your housing assistance. However, your housing assistance may be reduced as your prescription drug spending decreases.

Does Medicare cover drug costs?

Your drug costs are covered by Medicare. You'll need to join a Medicare drug plan for Medicare to pay for your drugs.

What are the stages of Part D?

Part D prescription drug coverage has three stages: Initial coverage stage. Coverage gap (also known as the gap or the donut hole) Catastrophic coverage stage. Not everyone will have all the stages. For example, you might not have a coverage gap because you get Extra Help paying for your prescription drugs. So how do you know which stage you're in?

What is the initial coverage stage of a pharmacy plan?

Initial coverage stage. If your plan has a pharmacy deductible, you'll start the year paying the full cost of your prescription drugs until you meet it. After you meet your deductible, you enter the initial coverage stage. During the initial coverage stage, your plan helps cover the costs of your prescription drugs.

What does a monthly prescription drug benefit statement tell you?

They tell you what stage you're in and how much you've spent on prescription drugs to date.

What is the gap in insurance?

In the coverage gap, you're responsible for a higher percentage of the cost than you were in the initial coverage stage . That's why it's called a "gap.".

How long do you stay in the coverage gap?

You stay in the coverage gap until your total out-of-pocket drug spending reaches $5,000. If you get any discounts on brand-name drugs, we count it as though you paid the full price. This helps you move through the coverage gap a little faster.

How much does a prescription cover in 2018?

Where and how you fill the prescription. In 2018, you'll stay in the initial coverage stage until you and your plan spend a total of $3,750 on prescription drugs. If you don't take a lot of medications, it's possible you could stay in the initial coverage stage for the whole plan year. Coverage gap.

When do you leave the coverage gap?

In 2018, you'll leave the coverage gap when your total out-of-pocket spending reaches $5,000. From that point until the end of your plan year, you'll be in the catastrophic stage. You'll have lower out-of-pocket drug costs than you did in the coverage gap.

What is Medicare Part D coverage?

Medicare Part D prescription coverage has something called the coverage gap , or donut hole. The coverage gap is a stage in which you pay much more out of pocket for your prescription drugs. It's not based on a time period.

Why are Medicare Advantage plans so popular?

Medicare Advantage plans are popular because of their convenience. Most plans combine medical and prescription coverage on one card. Some offer dental and vision coverage, too. And you're able to predict your out-of-pocket costs better than you can with Original Medicare.

How much does Medicare pay for coinsurance?

When you have Original Medicare, you pay 20 percent of the cost, or 20 percent coinsurance, for most medical services covered under Part B. Medicare Advantage plans use copays more than coinsurance. Which means you pay a fixed cost. You might have a $15 copay for doctor office visits, for example.

What is Medicare Advantage?

You buy Medicare Advantage plans from private health insurance companies that contract with the government. They work with Original Medicare coverage. Part D covers prescription drugs. Many Medicare Advantage plans combine Parts A, B and D in one plan. And each Medicare plan only covers one person.

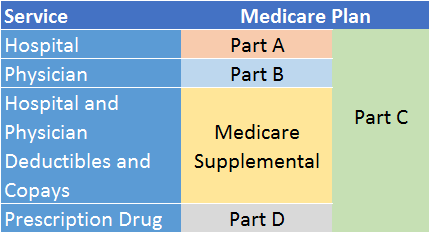

What is the difference between Medicare Supplement and Medicare Advantage?

Medicare supplement, or Medigap, plans are another option. In a way, Medicare Advantage replaces Original Medicare and connects all the pieces together on one plan. Supplement plans don't replace Original Medicare. It's more like an extra you can add on top of Original Medicare.

Does Medicare have a cap?

That means once you spend a certain amount of money on health care each year, your plan pays 100 percent of the cost of services it covers. Original Medicare doesn't have this cap. So if you get really sick, you'll end up paying a lot.

Do Medicare supplement plans come with dental?

And supplement plans don't come with the extra benefits you often get with Medicare Advantage, like dental and vision coverage. The triangles to the right show how supplement plans sit on top of Medicare Parts A, B and D. You can get complete coverage, but you still have to coordinate all those pieces on your own.

What is Medicare?

More and more people are signing up to Medicare each year, with enrollment reaching a twenty-year high in 2021. But there’s still much confusion around what the program is and how it can benefit Americans.

How does Medicare work?

When you enroll, you’ll receive a Medicare card linked to your Social Security number. This card will allow you to receive medical treatment and services at discounted rates in public hospitals and other approved medical facilities.

What does Medicare cover?

If you’re asking yourself the question, “What does medicare pay for?” the short answer is that it will cover some of the costs for most legitimate medical expenses.

Making sense of the different types of Medicare

The government’s Medicare program aims to offer eligible people affordable healthcare options as they get older.

Types of coverage plans for Medicare

As an eligible Medicare recipient, two broad basic Medicare options are available to you — Original Medicare and Medicare Advantage.

How do I enroll for Original Medicare and Medicare Advantage?

If you’re thinking about signing up for Medicare or just want to know more about the enrollment process, we’ve laid out the steps for you here.

Should I get health insurance on top of Medicare?

If you are in good health and have a Medicare-approved hospital or facility nearby, you will benefit from signing up for the federal government’s health insurance program.

What is Medicare Part B?

Medicare Part B is medical insurance. Along with Medicare Part A (hospital insurance), it makes up Original Medicare, the federal health insurance program. Here’s something important to know about Medicare Part B: you need this coverage if you decide to sign up for a Medicare Advantage plan, or buy a Medicare Supplement insurance plan.

What happens if you don't sign up for Medicare Part B?

However, when that coverage ends, be aware that if you don’t sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty. Here’s one reason you might want to sign up for Medicare Part B. Suppose you decide you’d like to buy a Medicare Supplement insurance plan.

How much is Medicare Part B 2021?

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services.

How much is the Part B deductible for 2021?

A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021. After you pay your deductible, you generally pay a 20% coinsurance (as mentioned above) for most covered services.

Does Medicare cover prescription drugs?

Most prescription drugs you take at home. Medicare Part B may cover certain medications ad ministered to you in an outpatient setting.

Does Medicare cover custodial care?

If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesn’t generally cover it. Some of these services, such as routine dental and vision care, might be covered under a Medicare Advantage plan.

Is a hospital inpatient covered by Medicare?

Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B. Some tests and services that your doctor might order or recommend for you.

What is the Medicare Part D coverage gap?

The Medicare Part D Coverage Gap (“Donut Hole ”) Made Simple. Summary: When it comes to Medicare prescription drug coverage, you might have questions surrounding the Medicare Part D coverage gap, also known as the “donut hole.”. The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug Plans or Medicare Advantage ...

What is the deductible phase of Medicare?

Deductible phase: For most stand-alone Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans, you’ll pay 100% for medication costs until you reach the yearly deductible amount (if your plan has one). After you reach the deductible, the Medicare plan begins to cover its share of prescription drug costs. The deductible amount may vary by plan, and some plans may not have a deductible. If your Medicare plan doesn’t have a deductible, then you’ll start your coverage in the initial coverage phase (see below).

What is the coverage gap in Medicare?

Typically, each new coverage phase begins once your spending has reached a certain amount. The coverage gap is one of the coverage phases under Medicare Part D.

Why won't Medicare pay the $4,020 coverage gap?

Now that you know about the coverage gap (“donut hole”), here is some good news: Many Medicare beneficiaries won’t have to pay the increased prices during the coverage gap because their prescription drug costs won’t reach the initial coverage limit of $4,020 in 2020.

What happens if you spend $6,350 on prescriptions in 2020?

Remember, if your prescription drug spending reaches $6,350 in 2020, you’ll have catastrophic coverage for the rest of the year. The following costs count towards your out-of-pocket spending and getting you out of the coverage gap: Your prescription drug plan’s yearly deductible.

How much is the coverage gap for 2020?

While in the coverage gap, you’ll typically pay up to 25% of the plan’s cost for both covered brand-name drugs and generic drugs in 2020. You’re out of the coverage gap once your yearly out-of-pocket drug costs reach $ 6,350 in 2020. Once you have spent this amount, you’ve entered the catastrophic coverage phase.

When will the Medicare coverage gap end?

This gap will officially close in 2020 , but you can still reach this out-of-pocket threshold where your medication costs may change. Find affordable Medicare plans in your area.