Medicare Advantage covers some of the gaps of Original Medicare (Part A and Part B) and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or in need of intense medical care. If a patient's situation worsens, it might be difficult or expensive to switch plans.

Full Answer

How much does Medicare pay Advantage plans?

Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. These "bundled" plans include.

How do I choose the best Medicare Advantage plan?

Dec 01, 2021 · Medicare Advantage plan costs. Medicare Advantage plans can charge a monthly premium that’s separate from the Part B premium. Other Advantage plans may be premium …

How do you find top rated Medicare Advantage plans?

How do Medicare Advantage Plans work? When you join a Medicare Advantage Plan, Medicare pays a fixed amount for your coverage each month to the company offering your Medicare …

How do Medicare Advantage plans make money?

Dec 10, 2019 · As for the half that does pay a Medicare Advantage plan premium, the average estimate premium in 2020 is $23 (down from $26.87 in 2019). 2 These numbers relate …

What are the disadvantages of a Medicare Advantage plan?

- Restrictive plans can limit covered services and medical providers.

- May have higher copays, deductibles and other out-of-pocket costs.

- Beneficiaries required to pay the Part B deductible.

- Costs of health care are not always apparent up front.

- Type of plan availability varies by region.

What determines the cost of a Medicare Advantage plan?

Do Medicare Advantage plans pay the 20 %?

Are Medicare Advantage plans less expensive than Medicare?

Do you still pay Medicare Part B with an Advantage plan?

What is the most popular Medicare Advantage plan?

Can you switch back and forth between Medicare and Medicare Advantage?

What are 4 types of Medicare Advantage plans?

- Health Maintenance Organization (HMO) Plans.

- Preferred Provider Organization (PPO) Plans.

- Private Fee-for-Service (PFFS) Plans.

- Special Needs Plans (SNPs)

What is the maximum out-of-pocket for Medicare Advantage plans?

What is the difference between Medicare and Senior Advantage?

Does getting a Medicare Advantage plan make you lose original Medicare?

Who is the largest Medicare Advantage provider?

How does Medicare Advantage plan work?

Aside from the benefits offered and where you live, there are several additional factors that can influence the cost of a Medicare Advantage plan, such as: 1 Whether or not the plan pays any of your Medicare Part B premium#N#When enrolled in a Medicare Advantage plan, you must also continue to pay your premium for Medicare Part B. Some Medicare Advantage plans can cover a portion of the Part B premium for you and may account for that by charging a higher premium for the plan. 2 The amount (if any) of the yearly deductible#N#Many Medicare Advantage plans include annual deductibles. The amount of the deductible can have an effect on the cost of plan premiums. 3 The amount you are required to pay for each health care visit or service#N#Medicare Advantage plans typically include cost-sharing measures such as copayments and coinsurance, and the amounts of these costs can correlate with that of the premium. 4 The type of plan#N#There are several types of Medicare Advantage plans, such as HMO, PPO and Private Fee-For-Service (PFFS) plans, as well as Medicare Savings Accounts (MSA). The type of Medicare Advantage plan you enroll in can affect which health care providers you can see and at what cost, and it can also affect the amount you might pay in premiums. 5 Whether or not you receive any cost assistance#N#There are a few ways (detailed below) in which you may be able to receive some help paying for a Medicare Advantage plan.

What is Medicare Advantage?

The amount you are required to pay for each health care visit or service. Medicare Advantage plans typically include cost-sharing measures such as copayments and coinsurance, and the amounts of these costs can correlate with that of the premium. The type of plan.

What to look for when shopping for Medicare Advantage?

When you are shopping for a Medicare Advantage plan, you may consider features such as a plan’s range of benefits and possible network rules. But above all else, perhaps the biggest thing you might consider is the cost of a plan. When it comes to Original Medicare (Medicare Part A and Part B), the cost of premiums is standardized across the board.

Is Medicare Advantage privatized?

But because Medicare Advantage is privatized, costs can vary from one plan or coverage area to another.

Which state has the lowest Medicare premium?

A closer look at 2021 data also reveals: Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug (MAPD) plans at $11.58 per month. The highest average MAPD monthly premium is in North Dakota, at $76.33 per month.

Does Alaska have Medicare Advantage?

All states except for Alaska offer at least one $0 monthly premium Medicare Advantage plan. $0 premium plans may not be available in all locations within each state. In addition to premiums, many Medicare Advantage plans typically include some out-of-pocket expenses.

Do you have to pay Medicare Part B premium?

When enrolled in a Medicare Advantage plan, you must also continue to pay your premium for Medicare Part B. Some Medicare Advantage plans can cover a portion of the Part B premium for you and may account for that by charging a higher premium for the plan. Many Medicare Advantage plans include annual deductibles.

Does Medicare Advantage charge a premium?

Medicare Advantage plan costs. Medicare Advantage plans can charge a monthly premium that’s separate from the Part B premium. Other Advantage plans may be premium-free.

Why is Medicare Advantage so popular?

Medicare Advantage is a popular health insurance option because it works like private health insurance for Medicare beneficiaries. In fact, according to the Centers for Medicare & Medicaid Services, more than 60 million Americans enrolled in Medicare in 2019. Of these Medicare enrollees, more than 37 percent were enrolled in a Medicare Advantage ...

Does Medicare Advantage cover hospital services?

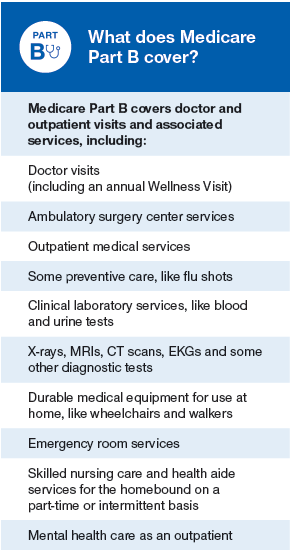

This includes any hospital services covered under Medicare Part A and any medical services covered under Medicare Part B. Some Medicare Advantage plans also cover additional healthcare needs, including: However, this coverage varies by plan, and each Medicare Advantage plan can choose what additional coverage to offer.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage plans include this coverage, which helps pay for the cost of your medications. Only certain types of prescription drugs are required to be covered under Part D, however — so you’ll want to make sure to check for coverage of your medications before enrolling in an Advantage plan.

Does Medicare Advantage have coinsurance?

Most Medicare Advantage plans charge a copayment or coinsurance amount for services rendered. These services could include a doctor’s office visit, specialist’s office visit, or even a prescription drug refill. Specific coinsurance and copayment amounts are set by the plan you’re enrolled in.

How long does it take to sign up for Medicare?

Initial enrollment period. This is a 7-month window around your 65th birthday when you can sign up for Medicare. It begins 3 months before your birth month, includes the month of your birthday, and then extends 3 months after your birthday. During this time, you can enroll for all parts of Medicare without a penalty.

When is the open enrollment period for Medicare?

Open enrollment period (October 15–December 7). During this time, you can switch from original Medicare (parts A and B) to Part C (Medicare Advantage), or from Part C back to original Medicare. You can also switch Part C plans or add, remove, or change a Part D plan. General enrollment period (January 1–March 31).

What is Medicare Advantage?

Medicare Advantage is the counterpart to Original Medicare.

What are the benefits of Medicare?

However, many MA plans go even further, offering additional coverage Original Medicare won’t provide. Some of these benefits may resemble what you were used to through employer coverage, and there may be even more: 1 Dental coverage 2 Vision coverage 3 Prescription drug coverage (like the add-on Part D for Original Medicare) 4 Hearing aid coverage 5 Health Programs (such as Silver&Fit or SilverSneakers)

Is Medicare Advantage the same as Medigap?

Medicare Advantage is the counterpart to Original Medicare.

How much does Medicare Advantage cost in 2020?

As for the half that does pay a Medicare Advantage plan premium, the average estimate premium in 2020 is $23 ...

How long does Medicare enrollment last?

This period lasts for seven months —three months before your 65th birthday month and three after. If you’ve delayed signing up for Medicare because you still have coverage from your current employer, you can sign up during a Special Enrollment Period.

When is the open enrollment period for Medicare?

There’s also a Fall Open Enrollment Period (October 15 through December 7) during which you may sign up.

What is HMO health plan?

In this type of plan, you choose a primary care physician and visit only hospitals, doctors, or specialists in a set network.

What is Medicare Advantage?

A Medicare Advantage private fee-for-service (PFFS) plan is private insurance. These plans are different from PPO and HMO plans in that the plan rules vary greatly from plan to plan. Each plan has its own reimbursement rates and copays. Some important things to consider include:

What is Medicare Advantage Health Maintenance Organization?

A Medicare Advantage health maintenance organization (HMO) offers care within a network of providers. Except in certain emergency situations, you must seek care from one of the network's preferred providers. Some important things to know about these plans include:

What is Medicare Advantage Special Needs Plan?

A Medicare Advantage special needs plan (SNP) caters to a group of people with specific needs. These plans often work with people who have similar or related disabilities, such as dementia, autoimmune disease, or diabetes. You must seek care from in-network providers unless there is an emergency, you have end-stage renal disease and need dialysis outside of the coverage area, or you travel outside of the area the plan covers and need urgent care. Some other considerations include:

What is a PPO plan?

A Medicare Advantage preferred provider organization (PPO) offers discounts for choosing providers within the plan's preferred provider network. In some cases, there may not be coverage for other providers until you reach your deductible. In other cases, the copay for choosing an out-of-network provider may be significantly higher. Some other important facts about PPO plans include:

How The Plans Work

All health insurance companies that offer “Medicare Advantage plans” must accept Medicare-eligible enrollees. In this regard, the plans are advantageous because they cannot deny anyone coverage. Additionally, MA Plan customers can simply switch back to “Original Medicare” during an annual enrollment period.

Costs and Premiums

The premiums paid and costs associated with MA plans can also be more expensive than they first appear. Copays, for example, can cost as much as $300 for an ambulance or $175 per day for a hospital stay. Lab service fees can cost up to $100. Out-of-pocket costs can quickly add up if you become sick (or an existing condition worsens).

Why Medicare Advantage Plans Are Bad

Other problematic issue with MA plans is the fact that care can actually end up costing more than it would under original Medicare. This is particularly true if you suffer from a very serious medical condition. Additionally, some private health insurance companies are not very financially stable. They may suddenly cease coverage without warning.

The Bottom Line

Medicare Advantage plans are not always as wonderful as they are made out to be. While the $0 premium may be enticing, the reality is that the out-of-pocket expenses and restrictions end up making them expensive over time. These plans are best for those who are relatively healthy.

What is Medicare Advantage Plan?

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

What are the problems with Medicare Advantage?

In 2012, Dr. Brent Schillinger, former president of the Palm Beach County Medical Society, pointed out a host of potential problems he encountered with Medicare Advantage Plans as a physician. Here's how he describes them: 1 Care can actually end up costing more, to the patient and the federal budget, than it would under original Medicare, particularly if one suffers from a very serious medical problem. 2 Some private plans are not financially stable and may suddenly cease coverage. This happened in Florida in 2014 when a popular MA plan called Physicians United Plan was declared insolvent, and doctors canceled appointments. 3 3 One may have difficulty getting emergency or urgent care due to rationing. 4 The plans only cover certain doctors, and often drop providers without cause, breaking the continuity of care. 5 Members have to follow plan rules to get covered care. 6 There are always restrictions when choosing doctors, hospitals, and other providers, which is another form of rationing that keeps profits up for the insurance company but limits patient choice. 7 It can be difficult to get care away from home. 8 The extra benefits offered can turn out to be less than promised. 9 Plans that include coverage for Part D prescription drug costs may ration certain high-cost medications. 4

Does Medicare automatically apply to Social Security?

It doesn't happen automatically. However, if you already get Social Security benefits, you'll get Medicare Part A and Part B automatically when you first become eligible (you don't need to sign up). 4. There are two main ways to get Medicare coverage: Original Medicare. A Medicare Advantage Plan.

What is Medicare Supplement?

Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, such as copayments, deductibles, and healthcare when you travel abroad.

Does Medicare cover dental?

Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, and dental. You have to sign up for Medicare Part A and Part B before you can enroll in Medicare ...

What are the benefits of Medicare Advantage?

Benefits of Medicare Advantage Plans 1 You may get extra coverage. Medicare Advantage plans typically include coverage that Original Medicare doesn’t. Your plan may include additional benefits like dental, vision, hearing, and prescription drug coverage. 2 Health equipment may be covered. Your plan may also offer discounts or coverage for health and fitness equipment and services, such as gym memberships, meal subscriptions, and telehealth access. 3 You may pay less out of pocket. Your out-of-pocket costs — how much you pay on your own for health and prescription expenses because they aren’t covered by health insurance — may be less with a Medicare Advantage plan, helping you save money. 4 You have simplified care. If you have Original Medicare, you may have to add on Medigap coverage and Medicare Part D coverage to pay for all your health expenses. With a Medicare Advantage plan, you’ll have just one insurer for all of your health coverage instead of several, streamlining your healthcare. 5 Your care can be coordinated. With a Medicare Advantage plan, you can have coordinated care. With in-network providers, all your healthcare providers can work together and collaborate on your care, minimizing unnecessary tests and lab work.

How does Medicare pay for a plan?

Medicare pays a set amount toward your Medicare Advantage plan each month. But you may have to pay a fee for your plan, depending on the options you choose. There are typically four types to choose from: 1 Health maintenance organization (HMO) When you’re in an HMO plan, you usually have to stay in network, meaning you can only go to doctors and healthcare providers who have agreements with your insurance company. The only exceptions are if you’re facing a serious emergency, need out-of-area urgent care, or out-of-area dialysis. If you need to see a specialist, you’ll need to get a referral for one from your primary care doctor. 2 Preferred provider organization (PPO) With a PPO, you pay less if you see doctors and healthcare providers that are within your network. You can opt to see doctors outside of your network, but insurance will cover less of the cost. In most cases, you don’t need a referral before you see a specialist. 3 Private fee-for-service (PFFS) Under a PFFS, you can go to a healthcare provider who has agreed to accept the plan’s payment terms and treat you. Some PFFS plans have in-network providers, but you can also choose to see out-of-network providers. 4 Special needs plans (SNPs) SNPs are plans for people with specific diseases or characteristics. You can usually get care only from healthcare providers within the plan network, except for emergency situations.

Is Medicare Advantage for everyone?

Medicare Advantage plans are popular, but they’re not for everyone. Everyday Health. If you’re approaching 65, qualifying for Medicare can give you much-needed coverage for your healthcare needs. But dealing with the different aspects of Medicare — including Medicare Part A, Part B, stand-alone prescription drug coverage, ...

What are the benefits of a health insurance plan?

Your plan may include additional benefits like dental, vision, hearing, and prescription drug coverage. Health equipment may be covered. Your plan may also offer discounts or coverage for health and fitness equipment and services, such as gym memberships, meal subscriptions, and telehealth access.

Can you get Medicare if you have end stage renal disease?

If you have end-stage renal disease (ESRD), you don’t qualify. While people with preexisting conditions can qualify for Medicare Advantage plans, that’s not the case if you have ESRD. If you have ESRD, you have to enroll in Original Medicare. You may not be able to see a provider of your choice.

Does Medicare Advantage cover prescriptions?

Many Medicare Advantage plans also include prescription drug coverage, as well, so you can use your policy to get access to branded and generic medications. Medicare pays a set amount toward your Medicare Advantage plan each month. But you may have to pay a fee for your plan, depending on the options you choose.

Can you cancel a Medigap plan?

You’ll have to cancel your Medigap policy, or return to Original Medicare. If you have end-stage renal disease (ESRD), you don’t qualify. While people with preexisting conditions can qualify for Medicare Advantage plans, that’s not the case if you have ESRD. If you have ESRD, you have to enroll in Original Medicare.

Does Medicare Advantage cover Part A?

Medicare Advantage plans cover the same Part A and B services that are offered by Medicare. Some plans have deductibles for medical services or drugs before your benefits begin. Check the plan’s Summary of Benefits to see what expenses you’ll be responsible for upfront.

Does Medicare Advantage have deductibles?

Deductibles. Medicare Advantage plans cover the same Part A and B services that are offered by Medicare. Some plans have deductibles for medical services or drugs before your benefits begin. Check the plan’s Summary of Benefits to see what expenses you’ll be responsible for upfront.

Is Medicare Advantage out of network?

Out-Of-Network Costs. Medicare Advantage HMO plans usually require you to use the plan’s network, except in emergencies. PPO plans are a bit more flexible and will allow out-of-network treatment. However, your share of those costs is often much higher than what you would pay in-network.