When you have Medicare and other health insurance, such as a Medicare Supplement insurance plan, each type of coverage is called a “payer.” The primary payer will pay what it owes on your health-care bills first and then send the balance to the secondary payer. Coordination of benefit rules decide who pays first.

Full Answer

What are the top 5 Medicare supplement plans?

Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance. For many people, Medicare Supplement, also known as Medigap, insurance helps them economically by paying some of the out-of-pocket costs associated with Original Medicare. If you are considering a Medicare Supplement plan and would like to know how it works, what …

How can you tell if someone has Medicare?

Buy a Medicare Supplement Insurance (Medigap) policy to help lower your share of costs for services you get. If you have other insurance, learn how Original Medicare works with your other coverage. If you're not lawfully present in the U.S., Medicare won't pay for your Part A and Part B claims, and you can't enroll in a Medicare Advantage Plan or a Medicare drug plan.

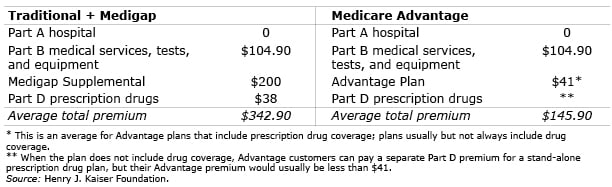

Is Medicare better than Advantage plans?

The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) to pay. In some rare cases, there may also be a third payer. What it means to pay primary/secondary The insurance that pays first (primary payer) pays up to the limits of its coverage.

Who really pays for Medicaid?

Aug 14, 2018 · Medicare Advantage and Medicare supplement plans do not work together – you have to choose one or the other. If you choose the original Medicare option, Medicare supplement plans are important because these plans add an extra element, or boost, to your main coverage by paying for gaps for stand-alone prescription drug plans, employer group health …

How are Medicare and supplemental policies billed?

When you have Medicare and other health insurance, such as a Medicare Supplement insurance plan, each type of coverage is called a “payer.” The primary payer will pay what it owes on your health-care bills first and then send the balance to the secondary payer.

Is Medicare supplemental insurance based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is the difference between Medicare and Medicare Supplement?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

What is the purpose of Medicare supplemental insurance?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance.

Does Medicare look at your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

How much does Medicare take out of Social Security?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What are the 4 phases of Medicare Part D coverage?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.Oct 1, 2021

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

Do I need to renew my Medicare Supplement every year?

The plain and simple answer to this question is no, you don't have to renew your Medigap plan each year. All Medicare Supplement plans are guaranteed renewable for life as long as you're paying your premium, either monthly, quarterly, semi-annually, or annually.Aug 7, 2019

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Is Medigap and supplemental insurance the same?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

How does Original Medicare work?

Original Medicare covers most, but not all of the costs for approved health care services and supplies. After you meet your deductible, you pay your share of costs for services and supplies as you get them.

How does Medicare Advantage work?

Medicare Advantage bundles your Part A, Part B, and usually Part D coverage into one plan. Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What happens if a group health plan doesn't pay?

If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment. Medicare may pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. or a. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.

Why is Medicare Supplement important?

If you choose the original Medicare option, Medicare supplement plans are important because these plans add an extra element, or boost, to your main coverage by paying for gaps for stand-alone prescription drug plans, employer group health coverage and other retiree benefits. Original Medicare will pay first, followed by the payment by ...

How many Medicare supplement plans are there?

How Medicare supplement insurance plans work with Medicare plans. There are up to 10 standardized plans available – labeled A, B, C, D, F, G, K, L, M and N – that cover anywhere from four to nine of these benefits:

What are the benefits of Medicare?

There are up to 10 standardized plans available – labeled A, B, C, D, F, G, K, L, M and N – that cover anywhere from four to nine of these benefits: 1 Medicare Part A coinsurance for hospital costs (up to an additional 365 days after Medicare benefits are used) 2 Medicare Part B coinsurance, copayment 3 First three pints of blood for a medical procedure 4 Part A hospice care coinsurance or copayment 5 Skilled nursing facility care coinsurance 6 Part A deductible 7 Part B deductible 8 Part B excess charges 9 Foreign travel emergencies

What to do when you turn 65?

However, when you turn 65, you have other choices to consider when it comes to health care coverage. You will need to decide on signing up for a Medicare Advantage plan or decide on Medicare with a Medicare supplement plan (Medigap) to fill in the gaps associated with Medicare. Medicare Advantage and Medicare supplement plans do not work together – ...

How long does Medicare cover hospital coinsurance?

Medicare Part A coinsurance for hospital costs (up to an additional 365 days after Medicare benefits are used) Keep in mind, all 10 Medicare supplement plans cover the coinsurance and 100 percent of hospital costs for Medicare Part A, but after that, plans differ in what they cover. For example, only Medicare supplement plans C and F cover ...

Does Medicare cover prescription drugs?

In the past, some Medigap policies covered prescription drugs; however, this is not possible today. For prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D), which is a stand-alone policy. You can also look into prescription drug discount cards.

Is Medigap available in Minnesota?

If you live in Minnesota, Massachusetts or Wisconsin, Medigap policies are standardized differently. Medigap policies are not always available to disabled beneficiaries under the age of 65. Don’t just consider the price per month of a Medicare supplement insurance policy plan.