Does Medicare look at income every year?

The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

What is considered yearly income for Medicare premiums?

| Yearly income in 2020: single | Yearly income in 2020: married, joint filing | 2022 Medicare Part B monthly premium |

|---|---|---|

| > $114,000–$142,000 | > $228,000–$284,000 | $340.20 |

| > $142,000–$170,000 | > $284,000–$340,000 | $442.30 |

| > $170,000– < $500,000 | > $340,000– < $750,000 | $544.30 |

| ≥ $500,000 | ≥ $750,000 | $578.30 |

How much money can you make before it affects your Medicare?

Do Medicare premiums increase with income?

If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the “income-related monthly adjustment amount.” Here's how it works: Part B helps pay for your doctors' services and outpatient care.

How is modified adjusted gross income calculated for Medicare?

Does Medicare look at your bank account?

What income is used to determine Medicare premiums 2021?

What is the income limit for Medicare in 2020?

How Are Medicare Premiums calculated?

Many individuals are wondering how medicare premiums are calculated. Medicare Part A is free to most beneficiaries and covers hospital stays, care...

How Is A Beneficiary’S Premium determined?

The Social Security Administration reviews a beneficiary’s most recent federal tax information in order to determine what their premium will be. Ba...

Beneficiary Premium Rates

Beneficiaries filing an individual tax return must pay a monthly premium of: 1. $146.90 with an income of $85,001-$107,000, 2. $209.80 with an inco...

How much is Medicare Part A 2020?

For those who have paid Medicare taxes for under 40 quarters, a monthly premium is charged. In 2020, the premium may be as low as $252 for those who paid Medicare taxes for 30 to 39 quarters or as high as $458 if taxes were paid for under 30 quarters. It is not tied to income level. Conversely, income is taken into account to assess each beneficiary’s monthly premium for Part B.

How many years prior to the effective date of the new Medicare rate?

The basis for where you fall within these ranges is your tax return two years prior to the effective date of the new rate. As an example, the IRS provides Social Security with 2018 tax return data on which to evaluate individual premiums due for Medicare coverage in 2020.

Is Medicare Part B tied to income?

It is not tied to income level. Conversely, income is taken into account to assess each beneficiary’s monthly premium for Part B. Premiums for Medicare Part B insurance. At the end of each calendar year, Medicare announces the Part B standard premium amount to be effective the first of the following year.

How Are Medicare Part D Premiums Calculated

Medicare Part D prescription drug plans are also sold by private insurance companies, so premiums will vary from one plan to the next.

Medicare Part B Part D Irmaa Premium Brackets

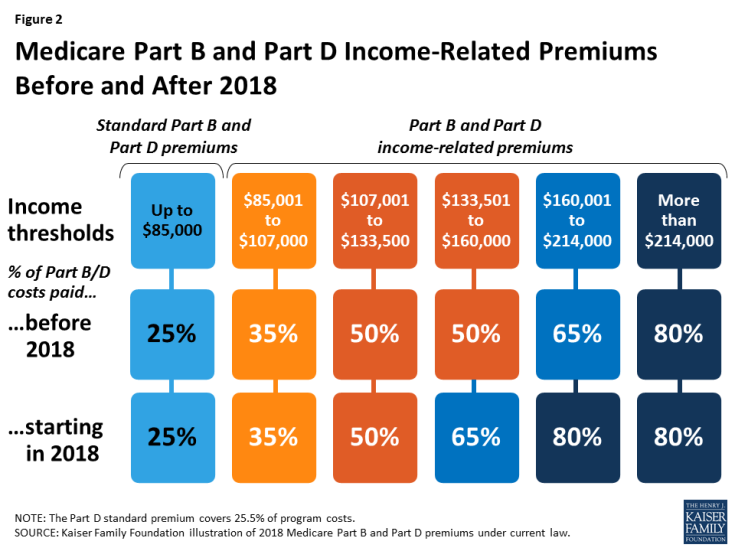

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors services and Medicare Part D that covers prescription drugs.

What Income Is Used To Determine Medicare Premiums

Did you know that not everyone pays the same amount for Medicare premiums? As you are planning for retirement or if you are already in retirement, it is important to understand the effects that your financial decisions can have on your Medicare premiums. It could be the difference of hundreds of dollars a month.

Medicare Part B Premium Appeals

OMHA handles appeals of the Medicare programs determination of a beneficiarys Income Related Monthly Adjustment Amount , which determines a Medicare beneficiarys total monthly Part B insurance premium.

How Record Social Security Cost

News that inflation rose to a historic high in November probably comes as no surprise to retirees.

How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

How To Calculate Medicare Premiums

As you hit the retirement milestone, one of the items you’ll likely need to address is enrolling in Medicare. Medicare has many complexities and the calculation of premiums that you will pay is one of them. The questions and confusion can be endless.

What percentage of Medicare beneficiaries pay higher premiums?

In other words, beneficiaries with higher incomes pay higher premiums. It’s important to note that this affects less than five percent of Medicare beneficiaries. For 2020, if a beneficiary has a MAGI (Modified Adjusted Gross Income) above $85,000 per year (for a single person) and above $170,000 per year (for a married couple), they will pay higher premiums for Part B (medical insurance) and Part D (if you elect for Part D).

What is covered by Medicare?

Each part of Medicare covers specific services that range from inpatient hospital stays to prescription drug coverage to Medicare Medical Savings Account Plans for care in a skilled nursing facility.

How much is Medicare Part B 2020?

Most beneficiaries enrolled in Part B in 2020 will have a premium of $144.60/month. Medicare Part B premiums are calculated as a share of Part B program costs.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant). Medicare coverage is broken down into different parts.

When is Medicare 2020?

October 16, 2020 at 8:07 AM. If you’re currently on Medicare or reaching the age where you are considering Medicare, it’s important to understand the basics. Furthermore, you should consider how premiums are calculated in order to have an idea of what kind of premium you’ll be looking at. Here is a quick guide showing you what Medicare is, ...

Does Medicare cover hospice?

Medicare Part A is free to most beneficiaries and covers hospital stays, care in a skilled nursing facility, hospice care, and some health care. However, premiums for Part B and Part D depend on a beneficiary’s income. In other words, beneficiaries with higher incomes pay higher premiums.

How often does Medicare adjust income?

This amount and the income limits Medicare set can both change every year.

What is the maximum amount you can pay for Medicare in 2021?

In 2021, people with tax-reported incomes over $88,000 (single) and $176,000 (joint) must pay an income-related monthly adjustment amount for Medicare Part B and Part D premiums. Below are the set income limits and extra monthly costs you could pay for Medicare Part B and Part D based on your tax-reported income.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is Part B insurance in 2021?

The IRMAA is based on your reported adjusted gross income from two years ago. For 2021, your Part B premium may be as low as $148.50 or as high as $504.90.

Do you have to factor in Medicare tax?

When you become eligible for Medicare and look at how much to budget for your annual health care costs, you’ll need to also factor in your tax-reported income.

How are Medicare Part B premiums calculated?

Medicare Part B premiums are calculated based on your income. More specifically, they’re based on the modified adjusted gross income (MAGI) reported on your taxes from two years prior.

How much will Medicare pay in 2021?

If you paid Medicare taxes for fewer than 30 quarters, you will pay $471 per month for Part A in 2021.

How often is IRMAA calculated?

Because IRMAA is based on your reported income from two years prior, the amount you have to pay for a Medicare IRMAA will be calculated again each year.

How does Medicare Advantage work?

A Medicare Advantage plan could potentially help you save money on costs such as dental care, prescription drugs and other costs. A licensed insurance agent can help you compare the Medicare Advantage plans that are available where you live. You can compare benefits, coverage and the costs of each plan and then choose the right fit for your needs.

What is the late enrollment penalty for Medicare?

The Part A late enrollment penalty is 10 percent of the Part A premium, which you must pay for twice the number of years for which you were eligible for Part A but didn’t sign up. Medicare Part B. Medicare Part B is optional coverage, but if you don’t sign up when you’re first eligible, your late enrollment penalty will be calculated based on how ...

What happens if you don't sign up for Medicare?

If you do not sign up for certain parts of Medicare when you first become eligible but choose to add one of these coverage options at a later date, you may have to pay a late enrollment penalty that will be added to your monthly premium.

Does Medicare Advantage have a monthly premium?

Some Medicare Advantage plans offer $0 monthly premiums and $0 deductibles, and all Medicare Advantage plans must include an annual out-of-pocket cost limit. $0 premium plans may not be available in all locations.

How much of Medicare Part B is paid?

But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income. If your income level exceeds a certain threshold, you will have to pay more.

How much will Medicare premiums be in 2021?

There are six income tiers for Medicare premiums in 2021. As stated earlier, the standard Part B premium amount that most people are expected to pay is $148.50 month. But, if your MAGI exceeds an income bracket — even by just $1 — you are moved to the next tier and will have to pay the higher premium.

Why did Medicare Part B premiums increase in 2021?

That’s because 2021 Medicare Part B premiums increased across the board due to rising healthcare costs. Exactly how much your premiums increased though, isn’t based on your current health or Medicare plan or your income. Rather, it’s the soaring prices of overall healthcare.

What is Medicare Advantage?

Essentially: Medicare Advantage – Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A.

How is MAGI calculated?

Your MAGI is calculated by taking your adjusted gross income plus any of the following that applies to you: untaxed foreign income, non-taxable Social Security benefits, tax-exempt interest, and income from within the US territories that was not already included in AGI. For most people, your MAGI will be the same as your AGI but read this report by the Congressional Research Service here for further details.

Why are Social Security beneficiaries paying less than the full amount?

In 2016, 2017, and 2018, the Social Security COLA amount for most beneficiaries wasn’t enough to cover the full cost of the Part B premium increases, so most enrollees were paying less than the full amount, because they were protected by the hold harmless rule.

How much is Part B 2021?

So most beneficiaries are paying the standard $148.50/month for Part B in 2021. The hold harmless provision does NOT protect you if you are new to Medicare and/or Social Security, not receiving Social Security benefits, or are in a high-income bracket.

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

Does Medicare Part D increase with income?

Premiums for Medicare Part D (prescription-drug coverage), if you have it , also rise with higher incomes .

Can you ask Social Security to adjust your premium?

You can ask Social Security to adjust your premium if a “life-changing event” caused significant income reduction or financial disruption in the intervening tax year — for example, if your marital status changed , or you lost a job , pension or income-producing property. You’ll find detailed information on the Social Security web page “Medicare ...

Do you pay Medicare Part B if you are a high income beneficiary?

If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare. (Most enrollees don’t pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income ...

What is the Medicare surcharge for 2021?

This means that for your 2021 Medicare premiums, your 2019 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2021 premiums if your 2019 income was over $88,000 (or $176,000 if you’re married), but as discussed below, there’s an appeals process if your financial situation has changed.

How is IRMAA determined?

IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are added to you Part D premiums. You can appeal your IRMAA determination if you believe the calculation was erroneous. The SECURE Act of 2019 could further affect your premiums.

Will MAGI income be adjusted for inflation in 2020?

The year 2020 was the first year that these MAGI income requirements were adjusted for inflation. Going forward, the Modified Adjusted Income requirements will continue to be adjusted by inflation (CPI). Back to top.

Do Medicare Advantage plans include IRMAAs?

Note that if you are a Medicare Advantage policy member – and that plan includes prescription drug benefits – then both Part B and Part D IRMAAs are added to the plan premium (Medicare Advantage enrollees always pay the Part B premium in addition to any premium charged by their Advantage plan).

Does Medicare distribution increase adjusted gross income?

The amount distributed is added to your taxable income, so exercise caution when you’re receiving distributions from qualified funds. This additional income will increase your Modified Adjusted Gross Income, and may subject you to higher Medicare Part B and Medicare Part D premiums.

Can realized capital losses reduce Medicare premiums?

As a result, people can unknowingly earn more income as a result of investments, and the results can be higher Medicare premiums. The inverse is also true and now may be more applicable to you: realized capital losses can reduce your MAGI, and could potentially reduce your Medicare Part B and Part D premiums.

Does Medicare base premiums on income?

Understanding how this works – including what counts as income as far as Medicare is concerned – is a key part of your financial planning. And since the government will base your premiums on your income from two years ago, you’ll also want to have a good understanding of how to appeal an IRMAA determination, in case you experience a life change that reduces your income.