Medicare Part A may be used if you are formally admitted to a hospital for a procedure and you will be required to spend a few days in the hospital afterwards for recovery. In addition to the procedure and the stay, Part A will also cover any other costs you incur while you are at the hospital, including medications, therapy, any medical equipment you use, and meals.

When does Medicare coinsurance kick in?

Medicare coinsurance kicks in after you’ve paid your Medicare deductible for the year. The amount for Medicare Part A hospital insurance is a set dollar amount while coinsurance for other Medicare parts are a percentage of the cost of the medical or hospital service you receive.

How much does Medicare pay for coinsurance?

For most services covered by Part B, for example, you pay 20% and Medicare pays 80%. How Does Coinsurance Work? To understand how coinsurance works, let’s look at an example.

What is the difference between Original Medicare and coinsurance?

Although original Medicare (part A and part B) covers most of your medical costs, it doesn’t cover everything. Medicare pays a portion of your medical costs, and you’re responsible for the remaining amount. With coinsurance, you pay a fixed percentage of the cost of every medical service you receive.

What is coinsurance and how does it work?

Coinsurance is when you and your health care plan share the cost of a service you receive based on a percentage. For most services covered by Part B, for example, you pay 20% and Medicare pays 80%. How Does Coinsurance Work?

How is Medicare coinsurance calculated?

Medicare coinsurance is typically 20 percent of the Medicare-approved amount for goods or services covered by Medicare Part B. So once you have met your Part B deductible for the year, you will then typically be responsible for 20 percent of the remaining cost for covered services and items.

What is the Medicare Part A coinsurance for 2022?

Daily Coinsurance Costs for Medicare Part A in 2022 You pay $0 coinsurance for first 20 days and $194.50 for days 21 to 100. You are responsible for all costs from day 101 and beyond.

How does the Medicare Part A deductible work?

Part A Deductible: The deductible is an amount paid before Medicare begins to pay its share. The Part A deductible for an inpatient hospital stay is $1,556 in 2022. The Part A deductible is not an annual deductible; it applies for each benefit period.

Does Medicare Part A cover copays?

Copayments and Medicare Original Medicare comprises parts A and B, but only Part A has a copayment. People enrolled in Medicare Advantage or Medicare Part D prescription drug plans may pay copayments, but the amount will depend on the plan provider's rules.

Does Medicare Part A have co?

Medicare Part A coinsurance If you have Medicare Part A and are admitted to a hospital as an inpatient, this is how much you'll pay for coinsurance in 2021: Days 1 to 60: $0 daily coinsurance. Days 61 to 90: $371 daily coinsurance.

What is Part A deductible for 2022?

$1,556The 2022 Medicare deductible for Part A (inpatient hospital) is $1,556, which reflects an increase of $72 from the annual deductible of $1,484 in 2021. This is the amount you'd pay if you were admitted to the hospital. The Part A deductible is not an annual deductible; it applies for each benefit period.

Does Medicare Part A cover 100%?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What is the deductible for Part A?

Part A Deductible and Coinsurance Amounts for Calendar Years 2021 and 2022 by Type of Cost Sharing20212022Inpatient hospital deductible$1,484$1,556Daily coinsurance for 61st-90th Day$371$389Daily coinsurance for lifetime reserve days$742$7781 more row•Nov 12, 2021

Does Medicare Part A carry a deductible?

Summary: Medicare Part A and Part B have deductibles you may have to pay. Medicare Part C and Part D may or may not have deductibles, depending on the plan.

What is not covered by Medicare Part A?

A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care. A television or telephone in your room, and personal items like razors or slipper socks, unless the hospital or skilled nursing facility provides these to all patients at no additional charge.

Which of the following does Medicare Part A not provide coverage for?

Medicare Part A does not cover 24-hour home care, meals, or homemaker services if they are unrelated to your treatment. It also does not cover personal care services, such as help with bathing and dressing, if this is the only care that you need.

Does Medicare Part A cover emergency room visits?

Does Medicare Part A Cover Emergency Room Visits? Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

How much is Medicare Part B coinsurance?

With Medicare Part B, after you meet your deductible ( $203 in 2021), you typically pay 20 percent coinsurance of the Medicare-approved amount for most outpatient services and durable medical equipment.

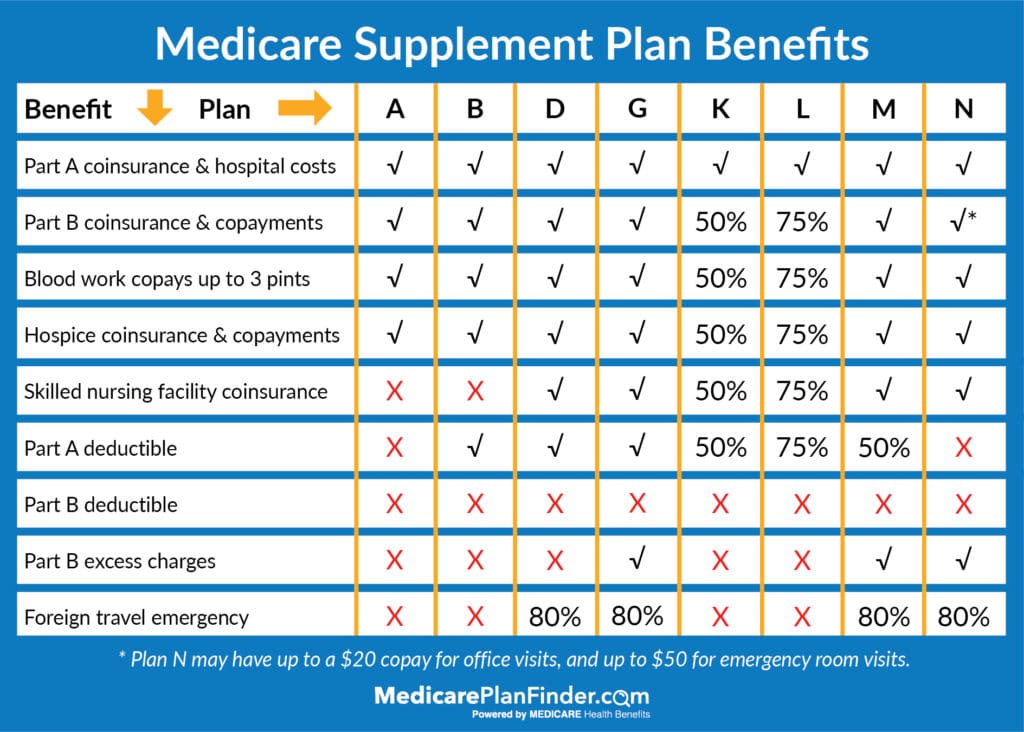

What is Medicare supplement?

Medicare supplement or Medigap plans cover various types of Medicare coinsurance costs. Here’s a breakdown of what Medigap plans cover in terms of Part A and Part B coinsurance. Plan A and Plan B cover: Part A coinsurance and hospital costs up to 365 days after you’ve used up your Medicare benefits. Part A hospice coinsurance.

How much will Medicare pay in 2021?

If you have Medicare Part A and are admitted to a hospital as an inpatient, this is how much you’ll pay for coinsurance in 2021: Days 1 to 60: $0 daily coinsurance. Days 61 to 90: $371 daily coinsurance. Day 91 and beyond: $742 daily coinsurance per each lifetime reserve day (up to 60 days over your lifetime)

What is Medicare Part B?

Medicare Part B. Medigap. Takeaway. Medicare coinsurance is the share of the medical costs that you pay after you’ve reached your deductibles. Although original Medicare (part A and part B) covers most of your medical costs, it doesn’t cover everything. Medicare pays a portion of your medical costs, and you’re responsible for the remaining amount.

What is Medicare Part A?

Medicare Part A is also known as hospital insurance. It’s one of the two pillars of the original Medicare program that President Lyndon B. Johnson signed into law in 1965.

How do Medicare Part A premiums work?

Once you turn 65, you’ll either be eligible for premium-free Part A, or you can choose to pay Part A premiums if you haven’t worked long enough to earn premium-free coverage.

What deductible can you expect to pay with Medicare Part A coverage?

The Medicare Part A deductible for 2021 is $1,484 for each benefit period. A benefit period starts the day you’re admitted to a hospital or skilled nursing facility and ends when you haven’t had inpatient treatment at either place for 60 days in a row.

What medical services does Medicare Part A cover?

Inpatient hospital care: Includes a semi-private hospital room, hospital meals, general nursing, drugs used to treat you during an inpatient stay, supplies, and hospital services that are part of your hospital treatment.

How to find out what your Medicare covers

You can search for whether an item, service, or test is covered here. You also can ask your doctor’s office, call Medicare at 1-800-MEDICARE ( 1-800-633-4227 / TTY 1-877-486-2048 ), or contact your Medicare plan for help with more specific needs.

How does coinsurance work with Medicare Part A?

If you’re admitted to a hospital, you will have to pay your Medicare Part A deductible ($1,484 for 2021). Your admission starts the clock on your cost-sharing, because your out-of-pocket costs are based on benefit periods.

Do you need supplemental insurance to go with Medicare Part A coverage?

Hospitalization can be expensive, even with Medicare coverage. If you don’t have employer or retiree coverage, or have Medicaid to fill in the gaps from original Medicare, you might consider buying Medicare supplement insurance, known as Medigap. Some Medigap plans also cover emergency healthcare when traveling outside of the U.S.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is coinsurance in Medicare?

Coinsurance is when you and your health care plan share the cost of a service you receive based on a percentage. For most services covered by Part B, for example, you pay 20% and Medicare pays 80%.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What would happen if Joe had a Medicare Advantage plan?

So, if Joe had a Medicare Advantage plan rather than Original Medicare in the example above, he might pay a $30 copay when he visited the doctor. Medicare Advantage is an alternative to Original Medicare (Parts A & B). It’s another way to get your Medicare benefits.

How much does Medicare pay for Joe?

Medicare pays 80% of the cost, which is $176. Joe pays 20% of the cost, which is $44. If Joe has a Medicare supplement insurance plan, his share of the cost might be covered by the plan.

Does Medicare Advantage have an out-of-pocket limit?

Medicare Advantage plans are required to set an out-of-pocket limit for plan members. There’s no out-of-pocket limit with Original Medicare. It’s your money, and it’s important to understand your Medicare costs and how they are calculated.

Does Joe have Medicare?

Joe has Original Medicare (Parts A & B), and he has already met his Part B deductible for the year. Joe’s doctor “accepts assignment,” meaning that she agrees to take the Medicare-approved amount—what Medicare says is appropriate—as full payment for her services.