Full Answer

What to consider when comparing Medicare plans?

What to Ask When Comparing Medicare Advantage Plans

- How much are monthly premiums?

- What portion of costs do you have to pay before the plan begins coverage (also known as the deductible)?

- How much of the cost of a doctor’s visit or hospital stay are you required to pay?

- What is the plan’s cap on annual out-of-pocket costs? ...

- Does your current doctor accept the plan? ...

What is the best way to compare Medicare plans?

- How many states in which they provide coverage

- Lowest costs available in terms of monthly premiums and copays (though they vary from plan to plan)

- The types of benefits they can offer (though it varies from plan to plan)

- How the Centers for Medicare and Medicaid Services (CMS) ranked their plans, using an average to represent the company as a whole

How to choose the perfect Medicare plan?

Your Ultimate Guide to Choosing the Perfect Medicare Plan

- Importance of Medicare Advantage Plans. ...

- Enrol early. ...

- You can evaluate your coverage each year. ...

- Select a plan with an extensive network. ...

- Check out what’s NOT covered. ...

- Don’t miss the deadline for enrolment. ...

- Choose the Right Medicare Plan. ...

What are the best Medicare plans?

... Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers. Sign up today for a FREE virtual event and let Silver Supplements Solutions help you understand your best option for your own peace of mind!

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the advantages and disadvantages of Medicare Advantage plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

What will Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

What is the benefit of choosing Medicare Advantage rather than the original Medicare plan?

Under Medicare Advantage, you will get all the services you are eligible for under original Medicare. In addition, some MA plans offer care not covered by the original option. These include some dental, vision and hearing care. Some MA plans also provide coverage for gym memberships.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Does Medicare pay 100 percent of hospital bills?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

Are shingle shots covered by Medicare?

Shingles shots cover the shingles shot. Medicare prescription drug plans (Part D) usually cover all commercially available vaccines needed to prevent illness, like the shingles shot.

Is there a Medicare supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

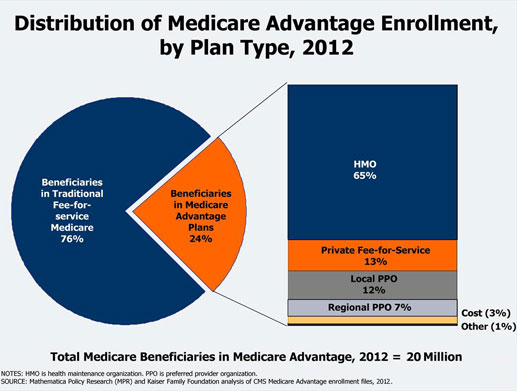

What percent of seniors choose Medicare Advantage?

A team of economists who analyzed Medicare Advantage plan selections found that only about 10 percent of seniors chose the optimal Medicare Advantage plan. People were overspending by more than $1,000 per year on average, and more than 10 percent of people were overspending by more than $2,000 per year!

Is Original Medicare more expensive than Medicare Advantage?

The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county.

Is Medicare Advantage more expensive than Medicare?

Slightly more than half of all Medicare Advantage enrollees would incur higher costs than beneficiaries in traditional Medicare with no supplemental coverage for a 6-day hospital stay, though cost are generally lower in Medicare Advantage for shorter stays.

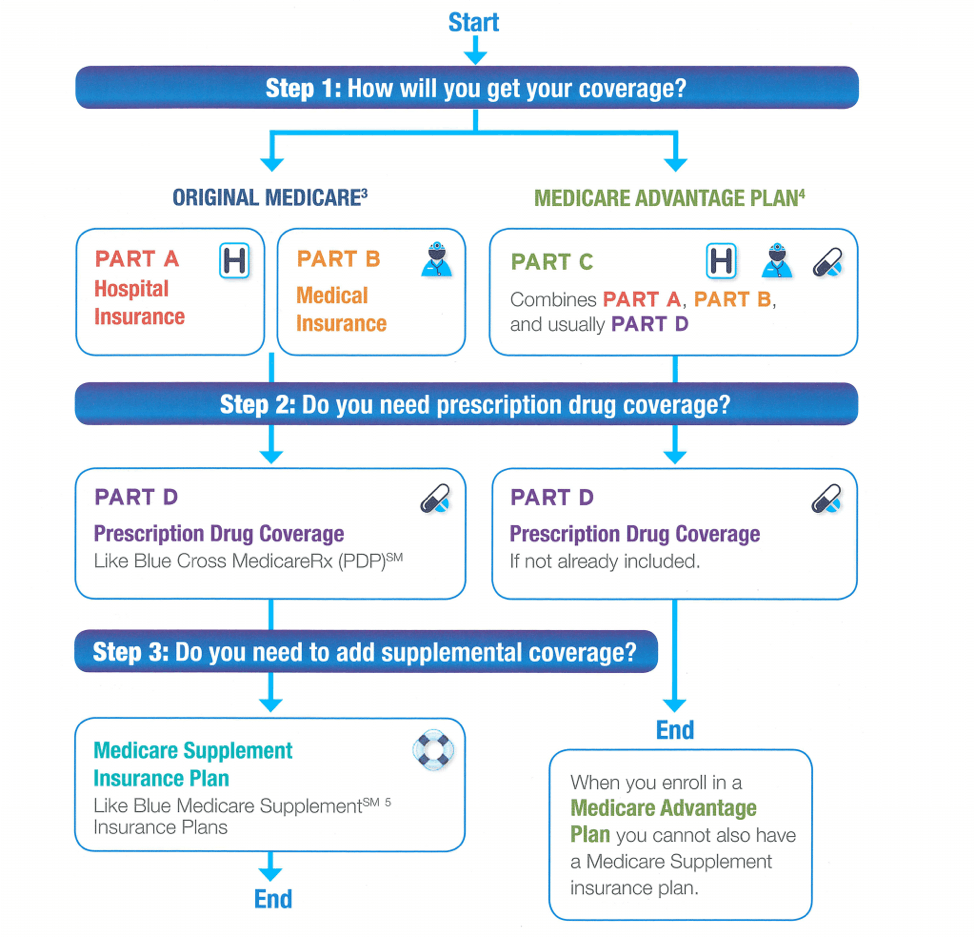

Original Medicare vs Medicare Advantage Plans, Aka Medicare Part C

Commonly known as “straight” Medicare by the medical community, Original Medicare (OM) comprises two parts. Medicare Part A provides services for h...

What Is Medicare Advantage?

Medicare Advantage or “Medicare Part-C” was introduced with the specific purpose of driving down costs as it provided more options for consumers. T...

Myths About Original Medicare and Medicare Advantage

There are a few misconceptions floating around about Medicare and Medicare Advantage since changes from Affordable Care Act. Some of these myths in...

Two Basic Medicare Advantage Plans: HMO and Non-Hmo

Medicare Part C plans break down into different types that you can most commonly refer to as HMO and non-HMO. While some people prefer HMO because...

Choosing Original Medicare Or Medicare Advantage

Since Medicare isn’t just for individuals over the age of 65, there are a lot of people who have questions about how to get Medicare Advantage or P...

What’S Covered in Medicare Part A and Part B?

Original Medicare is known as Part A and Part B. Part A covers expenses from hospitalization. Part B covers bills from doctors and other expenses s...

What’S Covered in Medicare Advantage Or Part C Plans?

Many individuals interested in Medicare actually find that Medicare Advantage plans are better because of the flexibility and choices when it comes...

Comparing The Costs of Original Medicare and MA Plans

Most Medicare Advantage plans cost the same or much less than Original Medicare with supplemental coverage extras. Then there are some Medicare Adv...

What Is Included in Original Medicare Plans?

These plans are for Part A and B. They do not include Part C or Part D. Original Medicare is completely offered through the federal government. You...

What Is Included in Medicare Advantage Plans?

Plans are sold by private companies approved by Medicare. Plans include Part A, Part B and typically, Part D or prescription drug coverage. However...

What are the different types of Medicare Advantage plans?

Plans vary by type with Medicare Advantage. Popular plans include HMOs, PPOs and PFFS.

How does Medicare cost vary?

Medicare costs vary based on your income and what plan you choose.

What is Medicare Advantage?

Medicare Advantage or “Medicare Part C” was introduced with the specific purpose of driving down costs as it provided more options for consumers. These plans are managed and administered by private insurance companies, but they also still operate under Medicare and must be approved before being made available to the public. Medicare Advantage Plans must include the same benefits as Original Medicare. Any basic services available under Part A and Part B must also be included in a Medicare Advantage Plan offered by a private company. You can purchase Medicare Advantage plans during open enrollment periods or special enrollment periods. You can enroll, switch or change your plan only during these times of the year. You can find and compare Medicare Advantage Plans on Medical.net or you can also use Medicare.gov. It’s important when looking at Medicare Advantage plans that you read through the benefits and understand the costs. Confusion is one of the biggest challenges facing Medicare providers as they attempt to educate people regarding Medicare Advantage. Misinformation and poor understanding often increase stress, consumer costs and may delay treatment. There are three vital principles that must be understood to help eliminate unwelcomed surprises as you receive care appropriate to your need.

How to find out what Medicare plan is right for you?

If you think you need a little extra help, finding a licensed sales agent, who can help you determine what plan is right for you, is as simple as calling our toll free number and speaking to a licensed, Medicare professional. Or, if you would prefer to obtain some additional information from a government resource, you can always visit Medicare.gov for more details.

How much is Medicare Advantage 2019?

Medicare Advantage payments were increased by 3.4% for 2019, which is more than the anticipated 1.84% that was projected. Thankfully, the premiums for 2020 are decreasing for many carriers. The Affordable Care Act made more than $200 billion in cuts to Medicare Advantage payments that will be phased in each year.

How many stars are Medicare Advantage plans?

Medicare Advantage plans are offered through private health insurance companies and must be approved by Medicare. They are also rated from one to five stars with five stars being an excellent plan. For all of Your Tomorrows FIND THE RIGHT MEDICARE PLAN TODAY. Compare Plans ›.

When does Medicare open enrollment end?

You can only switch Medicare Advantage plans and Original Medicare Plans during the fall Open Enrollment that starts October 15th and ends December 7th. New coverage starts January 1st.

Find Out the Plans Available in Your Area

One place to start is to find the Medicare health plans available in your area. Original Medicare ( Parts A and B) is a federal program and it’s available everywhere in the U.S.

Ask for Advice and Opinions

One way you can make Medicare decisions easier is to talk to people you trust. If you have friends or family with a Medicare plan, ask them about their experience. They might help steer you to a plan that could work for you.

Other Questions to Ask Yourself About Medicare Health Plans

As you compare all Medicare plans, take these different questions into account.

What if I Want to Change My Medicare Plan?

As your health needs change, so should your Medicare plan. You might need a Medicare plan with more coverage or more affordable costs. Certain times of the year allow you to change your Medicare plan, such as the Annual Enrollment Period. Learn more about the different enrollment periods for Medicare.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is a Medicare company?

The company that acts on behalf of Medicare to collect and manage information on other types of insurance or coverage that a person with Medicare may have, and determine whether the coverage pays before or after Medicare. This company also acts on behalf of Medicare to obtain repayment when Medicare makes a conditional payment, and the other payer is determined to be primary.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

Which pays first, Medicare or group health insurance?

If you have group health plan coverage through an employer who has 20 or more employees, the group health plan pays first, and Medicare pays second.

What is Medicare Part A?

Inpatient hospital services ( Medicare Part A ). These benefits include coverage for hospital visits, hospice care, and limited skilled nursing facility care and at-home health care.

Who manages Medicare Advantage?

Medicare Advantage is managed and sold by private insurance companies . These companies set the prices, but Medicare regulates the coverage options. Original Medicare and Medicare Advantage are two insurance options for people age 65 and older living in the United States.

How much is Medicare 2021?

You’ll have certain set costs associated with your coverage under parts A and B. Here are some of the costs associated with original Medicare in 2021: Cost. Original Medicare amount. Part A monthly premium. $0, $259, or $471 (depending on how long you’ve worked) Part A deductible. $1,484 each benefit period.

What takes the place of original Medicare add-ons?

Medicare Advantage takes the place of original Medicare add-ons, such as Part D and Medigap.

How long before you can apply for medicare?

You can also apply for Medicare 3 months before your 65th birthday and up to 3 months after you turn age 65. If you decide to wait to enroll until after that period, you may face late enrollment penalties.

How long do you have to have prescriptions for Medicare?

No matter what option you choose, you’re required to have some form of prescription drug coverage within 63 days of enrolling in Medicare, or you’ll be required to pay a permanent late enrollment penalty.

Does Medicare Advantage cover dental exams?

However, if you’re someone who wants coverage for yearly dental, vision, or hearing exams, many Medicare Advantage plans offer this type of coverage.

Which is better, private or Medicare?

Typically, private insurance is a better option for people with dependents. While Medicare plans offer coverage only to individuals, private insurers usually allow people to extend health coverage to dependents, including children and spouses.

Why does Medicare cost more?

However, Medicare plans may cost more because they do not have an out-of-pocket limit, which is a requirement of all Medicare Advantage plans.

What is Medicare approved private insurance?

The health insurance that Medicare-approved private companies provide varies among plan providers, but it may include coverage for the following: assistance with Medicare costs, such as deductible, copays, and coinsurance. prescription drug coverage through Medicare Part D plans.

How much is the deductible for Medicare Part A?

Medicare Part A: $1,484. Medicare Part B: $203. As this shows, the deductible for Medicare Part A is lower than the average deductible for private insurance plans.

What is Medicare Advantage?

Medicare Advantage plans, which replace original Medicare , may offer coverage that more closely resembles that of a private insurance plan. Many Medicare Advantage plans offer dental, vision, and hearing care and prescription drug coverage.

How many employees does Medicare have?

For example, Medicare is the primary payer when a person has private insurance through an employer with fewer than 20 employees. To determine their primary payer, a person should call their private insurer directly.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What is Medicare Advantage?

Medicare Advantage plans are a popular option for Medicare beneficiaries because they offer all-in-one Medicare coverage. This includes original Medicare, and most plans also cover prescription drugs, dental, vision, hearing, and other health perks.

How much does Medicare Advantage cost in 2021?

The most a Medicare Advantage plan can charge in out-of-pocket costs is $7,550 in 2021.

How to talk to an unbiased Medicare expert?

If you’d like to discuss your specific situation with an unbiased Medicare expert, contact your local State Health Insurance Assistance Program (SHIP) office.

What is the difference between bronze and silver?

Bronze plans have the highest deductible of all the plans but the lowest monthly premium. Silver plans cover 70 percent of your healthcare costs . Silver plans generally have a lower deductible than bronze plans but with a moderate monthly premium.

What to do if you need additional coverage?

If you need additional coverage under your plan, you must choose one that offers all-in-one coverage or add on additional insurance plans. For example, you might have a plan that covers your healthcare services but requires additional plans for dental, vision, and life insurance benefits.

How many tiers of insurance are there?

Another option is purchasing insurance through the federal Healthcare Marketplace. There are four tiers of private insurance plans within the insurance exchange markets. These tiers differ based on the percentage of services you are responsible for paying.

What age do you have to be to get medicare?

Anyone age 65 or older qualifies for Medicare, which is a federal program that offers affordable healthcare coverage. However, some people may prefer to compare this coverage with private insurance options.

How do Medicare's costs compare to employer-sponsored insurance?

In 2020, the average employee premium cost for employer-sponsored health insurance was $1,243, or about $104 per month. (This is far lower than the actual cost of coverage, but employers pay an average of more than 80% of their employees’ premiums.) In addition to the premiums, the average employer-sponsored plan had an annual deductible of $1,644 in 2020 (among plans that have deductibles, which is the majority of employer-sponsored plans).

How would having Original Medicare, Medigap and a Part D plan compare with my employer-sponsored insurance?

Depending on which Medigap supplement and Part D Prescription drug plan you choose, your out-of-pocket expenses could end up being very minimal.

What percentage of Medicare beneficiaries have supplemental coverage?

But here’s the thing: most Medicare enrollees don’t go with the barebones coverage. Of Original Medicare beneficiaries, 18 percent have some sort of supplemental coverage (generally Medigap, employer-sponsored insurance, or Medicaid), according to a Kaiser Family Foundation analysis.

How much does Medicare cost in 2020?

If you want to add supplemental coverage, the average Part D Prescription Drug Plan costs about $42 per month in 2020.

Does Medicare Advantage have a premium?

Medicare Advantage plans are often relatively inexpensive – some have no premium at all other than the cost of Medicare Part B. And Medicare Advantage plans come with built-in caps on out-of-pocket exposure, limited to $7,550 for in-network care in 2021 – although that does not include the cost of prescription drugs. (Although Medicare Advantage plans have caps on out-of-pocket costs, Original Medicare does not. This is why Medigap supplements are so important if you enroll in Original Medicare.)

Does Medicare cover out of pocket?

There are Medigap supplements that cover all or nearly all of Original Medicare’s out-of-pocket charges, with the exception of prescriptions, which are covered by Part D plans.

Is Medicare supplemental coverage good?

The good news is that Medicare beneficiaries who have supplemental Medicare coverage will generally find that their resulting coverage is quite comprehensive. And depending on the cost of the employer-sponsored plan (including premiums and out-of-pocket costs), some people also end up with lower overall healthcare costs once they switch to Medicare.