The insurance cost of Medicare is usually significantly lower than private insurance plans. The premiums for Medicare are usually less expensive than private insurance. Still, there is no deductible or co-pays with this plan, which means you will be responsible for all charges until you reach your out-of-pocket maximum (OOM).

Full Answer

Is Medicare better than private insurance?

May 06, 2021 · Medicare vs. private insurance costs Almost all health insurance plans, private or otherwise, have costs such a premium, deductible, copayments, and coinsurance. We’ll take a look at what these are...

Does Medicare cost less than private insurance?

Medicare vs. private insurance: dependents. Private health insurance often allows you to extend coverage to dependents, such as your spouse and children. Medicare, on the other hand, is individual insurance. Most people with Medicare coverage have to qualify on their own through age or disability.

How does Medicare compare to private insurance?

Feb 22, 2022 · The difference between private health insurance and Medicare is that Medicare is mostly for individual Americans 65 and older and surpasses private health insurance in the number of coverage choices, while private health insurance allows coverage for dependents.

How is Medicare different from private insurance?

When comparing Medicare and private insurance costs, you should consider the premiums, deductibles, and co-pays. The insurance cost of Medicare is usually significantly lower than private insurance plans. The premiums for Medicare are usually less expensive than private insurance. Still, there is no deductible or co-pays with this plan, which means you will be …

What is the difference between Medicare and individual health insurance?

The difference between private health insurance and Medicare is that Medicare is mostly for individual Americans 65 and older and surpasses private health insurance in the number of coverage choices, while private health insurance allows coverage for dependents.Feb 22, 2022

Do Medicare patients get treated differently?

Outpatient services are charged differently, with the patient typically paying 20% of the Medicare-approved amount for each service.Mar 23, 2021

How does Medicare differ from other types of health plans?

Another major difference is that Original Medicare doesn't have an out-of-pocket maximum. That means there's no annual cap on how much you pay for your health care. Almost all other health insurance plans have this feature. Before Medicare, you and your spouse may have been on the same health plan.May 16, 2019

What is the difference between Medicare and insurance?

Medicare is a federal program that provides health coverage if you are 65+ or under 65 and have a disability, no matter your income. Medicaid is a state and federal program that provides health coverage if you have a very low income.

Do doctors lose money on Medicare patients?

Summarizing, we do find corroborative evidence (admittedly based on physician self-reports) that both Medicare and Medicaid pay significantly less (e.g., 30-50 percent) than the physician's usual fee for office and inpatient visits as well as for surgical and diagnostic procedures.

What percentage of doctors do not accept Medicare?

Past analyses have found that few (less than 1%) physicians have chosen to opt-out of Medicare.Oct 22, 2020

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Is Medicare free for seniors?

Medicare is a federal insurance program for people aged 65 years and over and those with certain health conditions. The program aims to help older adults fund healthcare costs, but it is not completely free. Each part of Medicare has different costs, which can include coinsurances, deductibles, and monthly premiums.

Is it illegal to have two health insurance policies?

Policyholders can have any number of health insurance plans. However, they cannot claim reimbursement for the same expense from multiple insurers. If one cover is not sufficient, the other cover can be used to cover the expenses. Health Insurance is of utmost importance for every individual.

What is private insurance?

Private insurance plans are responsible for covering at least your preventative healthcare visits. If you need additional coverage under your plan, you must choose one that offers all-in-one coverage or add on additional insurance plans.

How many tiers of private insurance are there?

There are four tiers of private insurance plans within the insurance exchange markets. These tiers differ based on the percentage of services you are responsible for paying. Bronze plans cover 60 percent of your healthcare costs. Bronze plans have the highest deductible of all the plans but the lowest monthly premium.

What is deductible insurance?

Deductible. A deductible is the amount that you must pay out of pocket before your insurance company begins paying its share. Generally, as your deductible goes down, your premium goes up. Plans with lower deductibles tend to pay out much faster than plans with high deductibles.

What is the difference between silver and gold?

Silver plans cover 70 percent of your healthcare costs. Silver plans generally have a lower deductible than bronze plans but with a moderate monthly premium. Gold plans cover 80 percent of your healthcare costs. Gold plans have a much lower deductible than bronze or silver plans but with a high monthly premium.

How much does Medicare Advantage cost in 2021?

The most a Medicare Advantage plan can charge in out-of-pocket costs is $7,550 in 2021.

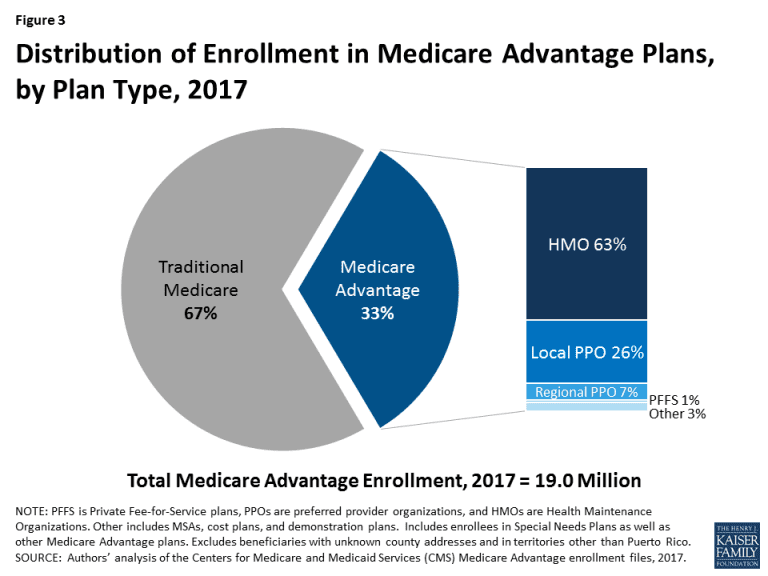

What is Medicare Advantage?

Medicare Advantage plans are a popular option for Medicare beneficiaries because they offer all-in-one Medicare coverage. This includes original Medicare, and most plans also cover prescription drugs, dental, vision, hearing, and other health perks.

Which has the lowest deductible?

Platinum plans cover 90 percent of your healthcare costs. Platinum plans have the lowest deductible, so your insurance often pays out very quickly, but they have the highest monthly premium.

What type of insurance is Medicare?

The types of Medicare coverage you can get from Medicare-approved private insurance companies include: Medicare Supplement (Medigap) insurance to help cover out-of-pocket Medicare costs, such as deductibles, copayments, and coinsurance. Medicare Advantage plans, which include your Part A (hospital) and Part B ...

What is Medicare Advantage?

Medicare Advantage plans, which include your Part A (hospital) and Part B (medical) insurance in one convenient plan. Medicare Advantage plans also might include added benefits, like prescription drugs, routine vision, routine hearing, and routine dental coverage. No matter which coverage option you may choose, you’re still in the Medicare program.

Is Medicare Part A the same as Medicare Part B?

The Medicare Part A and Medicare Part B premiums are the same regardless of your location in the USA. If you get any type of Medicare coverage from a private insurance company, such as Medicare prescription drug coverage, a Medicare Supplement plan, or a Medicare Advantage plan, these premiums may vary from location to location.

Do you pay premiums for Medicare if you are older?

On the other hand, most people who qualify for Medicare don’t pay a premium for hospital insurance (Part A).

Does Medicare Supplement Plan K have out-of-pocket limits?

Two Medicare Supplement plans, Medicare Supplement Plan K and Plan L, have out-of-pocket limits. Other Medicare Supplement plans may still help you cover Medicare’s out-of-pocket costs. All Medicare Advantage plans are required to have an out-of-pocket limit, protecting you from devastating financial responsibility if you have a serious health ...

Is Medicare a private insurance?

Private health insurance often allows you to extend coverage to dependents, such as your spouse and children. Medicare, on the other hand, is individual insurance. Most people with Medicare coverage have to qualify on their own through age or disability.

Does smoking increase Medicare premiums?

Premiums and other costs may also be different among insurance companies. Tobacco use: igarette use will not increase your Original Medicare (Part A and Part B) premiums. However, according to Medicare.gov, Medicare Supplement plans may offer discounts to non-smokers.

What is the difference between Medicare and private insurance?

The difference between private health insurance and Medicare is that Medicare is mostly for individual Americans 65 and older and surpasses private health insurance in the number of coverage choices, while private health insurance allows coverage for dependents. Not only does Medicare provide many coverage combinations to choose from, ...

How much higher is Medicare compared to private insurance?

However, according to a 2020 KFF study, private insurance payment rates were 1.6-2.5 times higher than Medicare rates for inpatient hospital services. 5.

What is Medicare Supplement?

Medicare Supplement plans are designed to cover the out-of-pocket costs left over from Original Medicare. For example, these plans can cover coinsurance amounts, copays, or deductibles. Original Medicare + Medicare Supplement + Prescription Drug.

What happens if you delay Medicare for four years?

For example, if you delayed enrolling in Medicare for four years, you’ll have to pay a higher premium for eight years. Medicare Part B. The Part B penalty is a lifelong consequence to delaying your Medicare coverage. This late-enrollment penalty can increase your premiums by 10% for each year you delayed coverage. 10.

How much is Medicare Part A deductible?

The Medicare Part A deductible is $1,484. The Medicare Part B deductible is $203. 4. On average, an employer insurance plan will have an annual deductible of $1,400. 6. This is a national average and may not reflect what you actually pay in premiums. It is best to use your plan information to make comparisons.

How much is the deductible for bronze health insurance?

It is best to use your plan information to make comparisons. On average, a bronze-level health insurance plan will have an annual medical deductible of $1,730. 7. This is a national average and may not reflect what you actually pay in premiums. It is best to use your plan information to make comparisons.

How many people over 65 are still working in 2021?

Print June 16, 2021. If you are turning 65 but not ready to retire, you aren’t alone. Around 20% of Americans over 65 are still working. 1 And since you aren’t ready to leave the workforce just yet, you may have a new option to consider for your medical coverage: Medicare. This article compares Medicare vs. private health insurance ...

What is Medicare approved private insurance?

The health insurance that Medicare-approved private companies provide varies among plan providers, but it may include coverage for the following: assistance with Medicare costs, such as deductible, copays, and coinsurance. prescription drug coverage through Medicare Part D plans.

Why does Medicare cost more?

However, Medicare plans may cost more because they do not have an out-of-pocket limit, which is a requirement of all Medicare Advantage plans.

How much is the deductible for Medicare Part A?

Medicare Part A: $1,484. Medicare Part B: $203. As this shows, the deductible for Medicare Part A is lower than the average deductible for private insurance plans.

What is Medicare Advantage?

Medicare Advantage plans, which replace original Medicare , may offer coverage that more closely resembles that of a private insurance plan. Many Medicare Advantage plans offer dental, vision, and hearing care and prescription drug coverage.

How many employees does Medicare have?

For example, Medicare is the primary payer when a person has private insurance through an employer with fewer than 20 employees. To determine their primary payer, a person should call their private insurer directly.

What is the limit on out of pocket costs?

For example, health plans that private insurance companies administer usually put a limit on out-of-pocket costs, which means that after a person pays a certain amount in coinsurance fees, the insurance covers 100% of the costs for that benefit until the next membership period.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.